Published on July 25, 2024 by Ankit Agrawal

-

The government maintains a glide path to fiscal consolidation in the FY25 budget with a continued push for capital spending

-

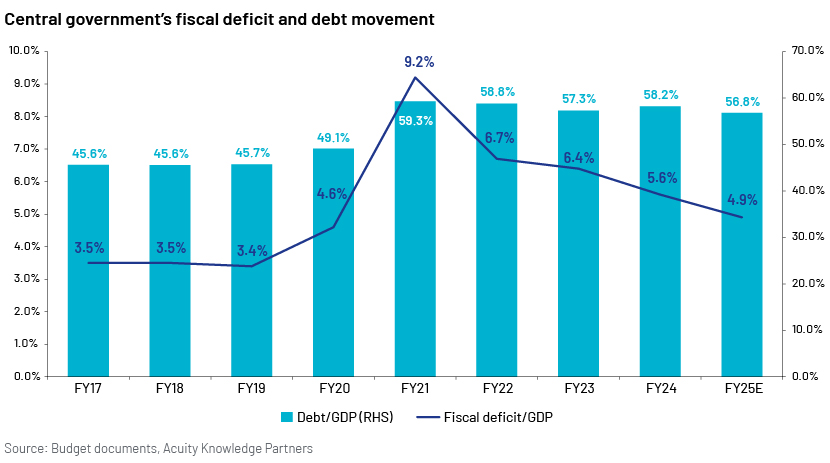

The fiscal deficit to GDP is pegged at 4.9% for FY25 vs a provisional 5.6% in FY24, while affirming the below-4.5%-of GDP target for FY26. The resulting reduced gross market borrowings (INR14.01tn in FY25 vs INR15.4tn in FY24) could be positive for the currency and sovereign bond yields. The improving fiscal profile also paves the way for a sovereign credit rating upgrade in the near to medium term

-

Capital spending growth is to continue, albeit at a moderate pace of 11.1% y/y to INR11.1tn (c.USD133bn), supporting economic growth and generating employment

-

The budget focuses on improving consumption (through job creation, skill development and support to the rural economy), bolstering the start-up ecosystem by removing angel tax and simplifying and rationalising capital gains tax

The first Union Budget of NDA 3.0 is prudent overall, evidenced by the government maintaining its stance on fiscal consolidation. It focuses mainly on generating employment, skill development and boosting micro, small and medium enterprises (MSMEs; through credit guarantee schemes, banks developing in-house credit assessment models and technology support packages). Outlay for education, employment and skill development is estimated at INR1.48tn in FY25 (c.USD18bn) or 4.7% of revenue receipts. New schemes such as skilling and education loan schemes and CSR-funded internships at top corporates will support skill development among youth and make them industry-ready over the medium term.

The government’s allocation of INR2.66tn (c.USD32bn) to the rural sector (also highlighted in the interim budget) is a positive move; this, together with income tax relief for the middle class, would boost consumer discretionary spending.

The finance minister also tweaked customs duties for items such as cancer drugs, medical equipment, mobile phones, solar equipment, the marine food industry, leather and textiles and, more importantly, gold and silver to bolster domestic value-added manufacturing. The new INR1tn (c.USD12bn) allocation aims to provide low-cost long-term funding to the private sector to scale up R&D and innovation to boost the country’s start-up ecosystem.

The proposed amendment to the Insolvency and Bankruptcy Code and the setting up of new National Company Law Tribunal benches bode well for the financial sector and will likely result in faster bankruptcy resolution and free up capital and credit.

For coalition partners, the government announced capex-backed special assistance for Andra Pradesh and Bihar, targeting infrastructure development (e.g., roads, bridges, airports, medical colleges).

Overall, the budget is pragmatic and lays the foundation for generating employment, skill development and increasing manufacturing and rural development for the next five years.

Key economic indicators

| FY20 | FY21 | FY22 | FY23 | FY24 P | FY25 BE | |

| Nominal GDP | 200.7 | 198.3 | 234.7 | 272.4 | 295.4 | 326.4 |

| Real GDP growth rate | 3.7% | -6.6% | 8.7% | 7.0% | 8.2% | 6.8% |

| Fiscal deficit to GDP | 4.6% | 9.2% | 6.7% | 6.4% | 5.6% | 4.9% |

| Central government debt to GDP | 49.1% | 59.3% | 58.8% | 57.3% | 58.2% | 56.8% |

| Interest expenses to revenue receipts | 36.3% | 41.6% | 37.1% | 40.1% | 38.7% | 37.2% |

| State's fiscal deficit to GSDP | 2.6% | 4.1% | 2.8% | 2.8% | 3.1%* | NA |

| State governments’ debt to GSDP | 26.6% | 31.0% | 29.3% | 27.5% | 27.6%* | NA |

BE = Budget estimate; P = Provisional data; NA = Not available

*Estimates

Source: Budget documents, Reserve Bank of India, Acuity Knowledge Partners

The government continues the path of fiscal consolidation

We believe it is commendable that the government did not follow conventional wisdom of announcing major tax cuts or subsidies but rather used the Reserve Bank of India’s (RBI’s) dividend bonanza to prioritise fiscal consolidation. It sets a fiscal deficit-to-GDP target of 4.9% for FY25 vs a provisional 5.6% for FY24. It also remains committed to narrowing the fiscal deficit to below 4.5% of GDP by FY26. Sharp fiscal consolidation generally results in a negative fiscal impulse; however, given that the consolidation is driven by higher revenue and not by lower expenditure, we believe this would have limited impact on economic growth.

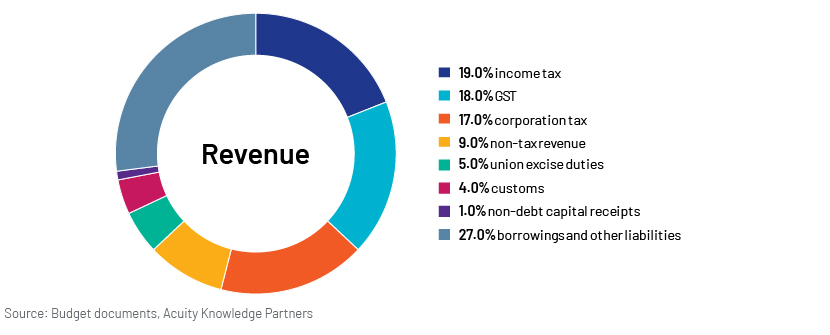

Revenue

The central government’s revenue estimates are on the conservative side given gross tax revenue growth of 10.8% y/y (compared to FY24 provisional data) is largely in line with the nominal GDP growth estimate of 10.5% y/y for FY25. Revenue receipt estimates (+14.7% y/y) are supported by increased revenue from personal income tax (+13.6% y/y), corporate income tax (+12.0% y/y) and goods and services tax (+11.0% y/y). Estimated growth in non-tax revenue is strong at 35.8% y/y, supported by 69.6% y/y growth in dividend receipts following bumper dividend payments by the RBI.

Expenditure

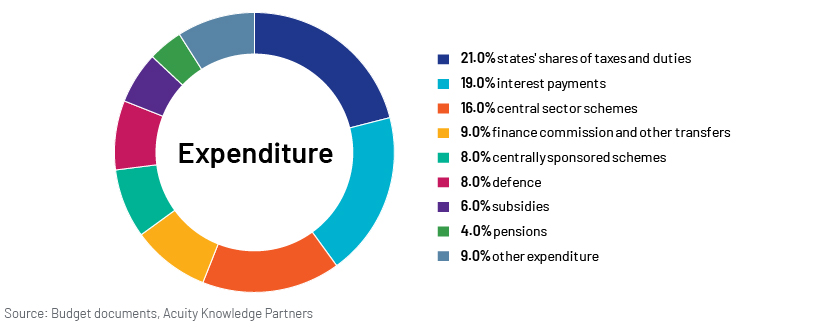

Expenditure

In line with budgets in recent years, this budget’s focus remains on high-quality spending, with capex (INR11.1tn, or USD168bn) accounting for c.23% of total estimated spending for FY25. High capex outlay is positive given its medium- to long-term growth multiplier effect on the economy. Additionally, subsidies are projected to decline (-7.8% y/y) on lower fertilizer (-13.2% y/y) and food (-3.3% y/y) outlay. However, large interest payments of 37.2% of revenue receipts highlight weak debt affordability for the government.

Deficit funding

For FY25, the government projects a fiscal deficit of 4.9% of GDP, which will be funded through net debt assumption of INR16.1tn (c.USD193bn), including gross market borrowings of INR14.01tn (c.USD167bn). Debt to GDP is expected at 56.8% in FY25 (vs 58.2% in FY24 and 57.3% in FY23).

The budget and its impact on asset classes

The bond market reacted positively to the announcements of fiscal consolidation and lower market borrowings. The 10-year bond yield was down 2bps to 6.95% just after the announcements of the fiscal target and net borrowings but rose again immediately, ending the day at 6.97%. Similarly, the currency market was volatile, with the INR strengthening marginally during the speech but weakening later, ending the day at 83.69 per USD vs 83.67 per USD on 22 July 2024. The equity market fell, with both benchmark indices down over 1% during the budget, following the announcement of an increase in long-term and short-term capital gains taxes to 12.5% and 20%, respectively, and a higher securities transaction tax on futures and options (F&O) trades.

Sources:

-

Union Budget document

-

Ministry of Statistics and Programme Implementation

-

Controller General of Accounts

-

Reserve Bank of India

What's your view?

About the Author

Ankit has close to 12 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Like the way we think?

Next time we post something new, we'll send it to your inbox