Published on August 6, 2024 by Puneetkumar Singal

On 21 September 2023, JP Morgan announced that it is planning to include Indian government bonds (IGBs) in its emerging-market indices, namely the Government Bond Index – Emerging Markets (GBI-EM) and the Emerging Markets Bond Index (EMBI).

Twenty-eight IGBs, worth over USD400bn, will be included in the index from 28 June 2024 to 31 March 2025, resulting in increased weightage for India of 1% per month.

What is the JP Morgan GBI-EM Index?

The JP Morgan GBI-EM Index tracks local-currency bonds issued by emerging-market governments.

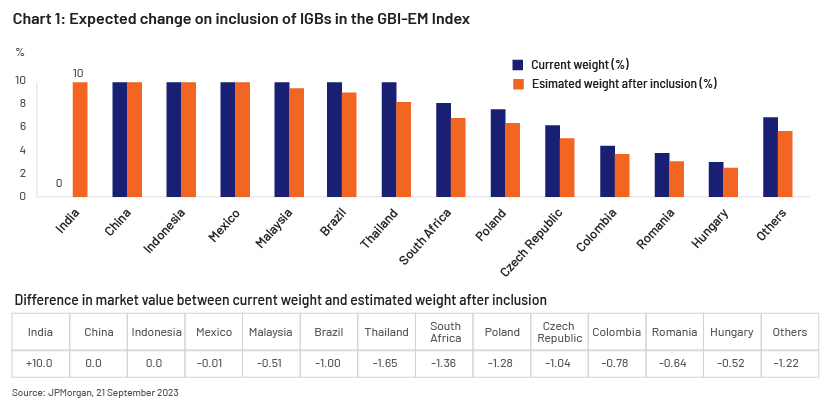

India’s expected weightage after inclusion

After their inclusion on 31 March 2025, IGBs are expected to have a maximum weightage of 10% in the GBI-EM Global Diversified Index, 8.7% in the GBI-EM Global Index and the 14.59% in GBI-EM Global Diversified IG 15% Cap Index.

Why all the hype?

INR appreciation against the USD

-

The JP Morgan GBI-EM Index tracks bond movement in local currency

-

With the inclusion, all the investment (c.10% weightage) will be in INR. Bond exchange-traded funds (ETFs) and mutual funds (MFs) that replicate this bond will passively invest money in these IGBs

-

This would eventually result in more inflow of foreign currency (especially USD), strengthening the INR

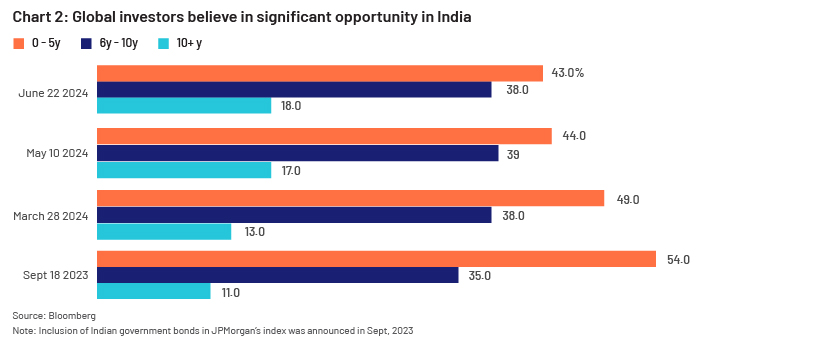

Increased weightage of longer-duration bonds

-

Confidence in India has increased, as the chart below shows

-

Weightage of investment in bonds with maturity of 10+ years through the fully accessible route (FAR) increased to 18% in June 2024 from 11% in September 2023

-

Higher-duration investment signifies a more stable economy

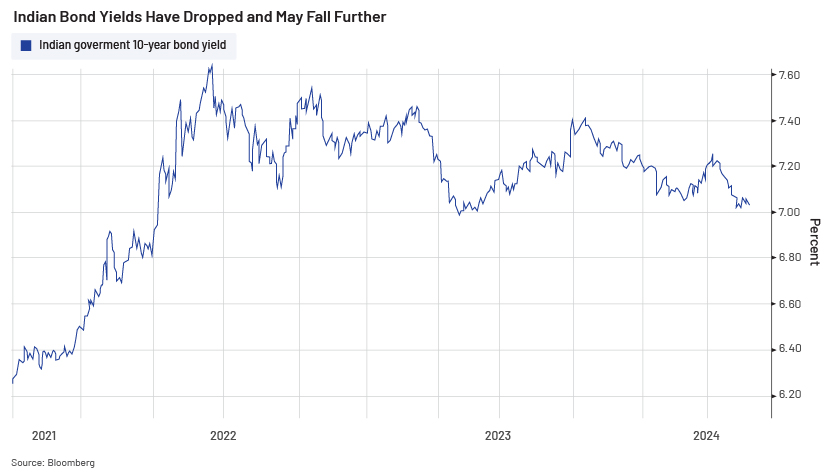

Interest rates

-

Owing to increased investment in IGBs, their prices are increasing

-

This increased pricing would eventually lead to reduced yields (the bond price and yield have an inverse relationship; when one goes up, the other goes down)

-

This would help the Indian government and companies raise money at lower interest rates in global markets

-

This would ultimately result in more spending on infrastructure or other capex requirements at the domestic level

Charts 3 and 4: Declining bond yields

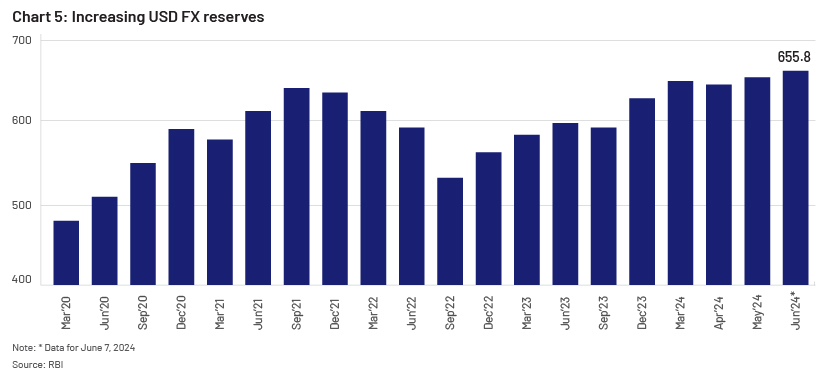

India’s FX reserves

-

India’s USD FX reserves reached a high of USD655.8bn in June 2024

-

India’s bond inflow increased to USD10bn in June 2024; this is expected to increase further, to c.USD30bn in the next 10 months, increasing FX reserves

-

This increased inflow would also help improve USD FX reserves

Conclusion

The inclusion of IGBs in the bond indices is a net positive for India in a number of areas, i.e., it improves sentiment and confidence in the Indian economy; increases FX inflow; reduces yields, benefiting interest rates; enhances liquidity; and reduces risks.

Case study

An improved or strengthening INR is always positive for any foreign investor

A, a US investor, was looking to make a bond investment worth USD10m on 28 June 2024

-

USD1 = INR83.3 (USD1,000,000 = INR83,300,000)

-

10-year bond yield = 7.008% (on 28 June 2024)

-

10-year US Treasury yield = 4.34% (on 28 June 2024)

-

With the IGB inclusion, A has a net profit (excluding exchange fees or commissions) of c.267bps (7.008% - 4.34%) on the yield differential

-

In addition, his liquidity increases owing to India’s increased weightage of 10% in the bond market

With the INR strengthening, his currency risk reduces

Example:

-

At the time of exchange (exit) the INR appreciates; USD1 = INR80

-

The investor will get his initial investment back, i.e., INR83,300,000 (excluding all coupon payments and considering just the bond value); this will fetch him USD1,041,250

-

This is an excess gain of USD0.041m, just owing to the INR strengthening

In conclusion, the US investor benefits in two ways, i.e., better yield and an exchange-rate benefit with reduced risk.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific/macroeconomic experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, model building and regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients gain a unique, sustainable edge.

Sources:

-

Switch to India’s longer-dated bonds extends as index date nears (moneycontrol.com)

-

Foreigners Flocking to India Bonds Make Splash Across Market – Bloomberg

-

Citi Sees Global Investors Staying in India Bonds After JPMorgan Index Inclusion – Bloomberg

-

Flows to Indian Bonds Back to $10 Billion Before Index Inclusion – BNN Bloomberg

-

India set for billions of dollars of inflows as bonds join JPMorgan index (ft.com)

Tags:

What's your view?

About the Author

Puneetkumar has around 10 years of experience in equity research. He has been with Acuity Knowledge Partners (Acuity) since January-2022. He currently manages delivery for a buy-side client in Europe, supporting them with their research needs, and covering multiple sectors. Prior to joining Acuity, he worked with Sutherland global service. Puneetkumar holds an MBA (Finance) from University of Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox