Published on July 9, 2024 by Ambarish Srivastava

Emerging markets offer a distinct landscape for infrastructure investment. These regions are not only catching up in terms of development, but are also leapfrogging into new technologies and innovative practices to address their specific challenges and opportunities.

In this blog, we discuss two key infrastructure investment trends that demonstrate how emerging markets are following the latest trends and addressing inherent challenges.

Emerging markets are leapfrogging into renewable energy

Unlike Western markets, which are grappling with transitioning from legacy energy systems to greener alternatives, many emerging markets are leapfrogging directly into renewable-energy infrastructure. With abundant natural resources, these markets are rapidly adopting solar, wind and other renewable projects that are environmentally friendly and financially sustainable, bypassing traditional energy pathways in the process.

BRICS nations stand out among emerging economies

India launched an ambitious solar energy initiative in January 2010 and aims to have 450GW of solar power by 2030. Many emerging countries such as Brazil are also actively pursuing renewable energy (Brazil is pursuing wind energy, especially in the northeast, with total planned capacity of 234GW as of April 2024).

Africa is aggressively building renewable capacity

African countries are showing significant interest in renewable energy. Ethiopia is investing significantly in the Grand Ethiopian Renaissance Dam (GERD) to generate 5.15GW of hydropower, including focusing on exporting such power, while Morocco aims to have wind and solar accounting for 52% of its energy requirement by 2030. Morocco's Noor Ouarzazate Solar Complex is one of the world's largest solar farms and part of the country's plan to source 52% of its energy from renewables by 2030. Morocco is also integrating wind power with solar, e.g., via projects such as the Tarfaya Wind Farm, to create a diversified renewable energy portfolio.

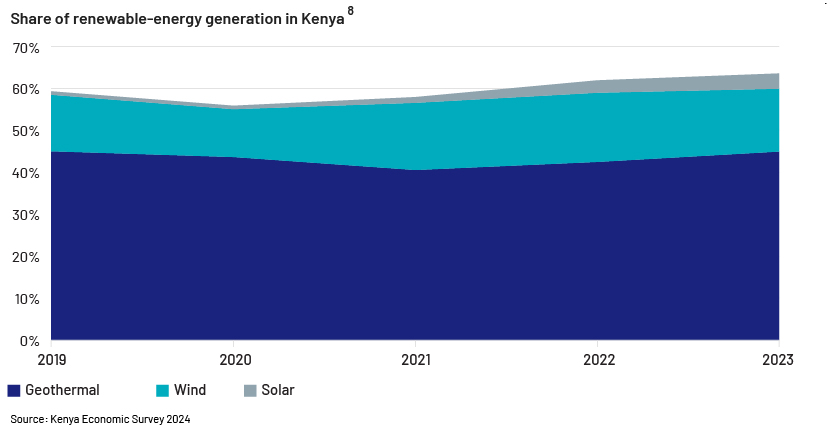

Kenya also has a high and increasing share of renewables and is partnering with data companies such as Microsoft and G42 for data centres to benefit from geothermal energy. Geothermal energy accounts for the bulk of renewable-energy generation due to the region being located in the Great Rift Valley, which has an abundance of geothermal reservoirs. Bitcoin-miner Marathan Partner recently partnered with Kenya on a renewable-energy project.

Besides green energy, emerging countries are also focusing on basic infrastructure

Many emerging markets still require significant investment in basic infrastructure, including clean water supply, sanitation and rural electrification. These foundational projects are critical for inclusive growth and are attracting investors interested in making a social impact in addition to generating financial returns. This focus on basic infrastructure is less common in developed markets, where the emphasis is often on upgrading or replacing existing systems.

Service company Veolia won a contract in Uzbekistan to supply heat and water to its capital city Tashkent. It is widening its footprint in emerging markets, having won a contract for a desalination plant in May 2024 to supply drinking water to the UAE. Global leader in water management and environmental services SUEZ is working to supply drinking water to Mumbai, Delhi and Mangalore in India. Construction company Vinci won a contract to build a water production plant in Cambodia. A joint venture between Spanish water management company Aqualia and Orascom Construction won a contract to design, build and operate the Abu Rawash wastewater treatment plant in Egypt to improve water and sanitation services.

There is private-sector participation on a number of levels globally for ensuring water security, including in emerging countries. The World Bank is also working to ensure water supply, a crucial Sustainable Development Goal (SDG), as it influences the achievement of other SDGs. It has invested USD30bn in water-related projects, highlighting the need for private capital, as government investment is insufficient. To instil confidence in private investors and attract private capital, however, organisations such as water utilities must be financially viable.

Private capital solves infrastructure-related problems such as traffic congestion

The private sector is also participating actively in solving infrastructure bottlenecks, including traffic congestion, in emerging countries. Online ride-booking and ride-sharing global apps such as Uber and local variants such as Ola in India provide mobility and tackle urban traffic congestion.

Chinese ride-hailing company Didi Chuxing uses artificial intelligence to analyse traffic patterns and solve urban traffic congestion. Egypt-based Swvl offers a bus-booking service for mass transit by optimising bus routes and schedules. Siemens Mobility is involved in a USD3bn contract to upgrade the signalling systems of Cairo Metro to improve efficiency and capacity of public transport.

However, still more capital investment is required in emerging markets

The gap between projected investment and capital required for essential infrastructure may widen to USD15tn by 2040, according to an estimate by Global Infrastructure Hub. Middle- and low-income countries may be impacted more, as private capital available there covers only 20% of the investment in infrastructure required.

As a result, these countries’ governments are the largest investors in infrastructure and are looking for private-sector expertise in terms of capital and technology as they strive to build modern infrastructure. Emerging markets also face rapid urbanisation, population growth and economic development, leading to increased demand for infrastructure investment. Fifty-six percent of the world’s population lives in urban areas, according to the World Bank; this is expected to reach c.70% by 2050. The rate of urbanisation is faster in lower- and lower-middle-income countries, requiring more infrastructure investment to accommodate this and promote economic growth.

How Acuity Knowledge Partners can help

We help global infrastructure investing teams identify and assess potential opportunities, supporting them in concluding deals in emerging markets such as Central and Eastern Europe, South Asia and Africa, by providing bespoke research on opportunities, business environment and economic activity, including infrastructure support to private markets.

Source

-

https://en.hespress.com/86561-why-moroccos-ambitious-renewable-energy-plans-face-delays.html

-

SUEZ to handle water distribution service in Mangalore (business-standard.com)

-

VINCI wins a contract to extend a drinking water production plant in Phnom Penh in Cambodia

-

https://www.worldbank.org/en/topic/urbandevelopment/overview

Tags:

What's your view?

About the Author

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox