Published on July 26, 2024 by Siddhartha Chabria, CFA®

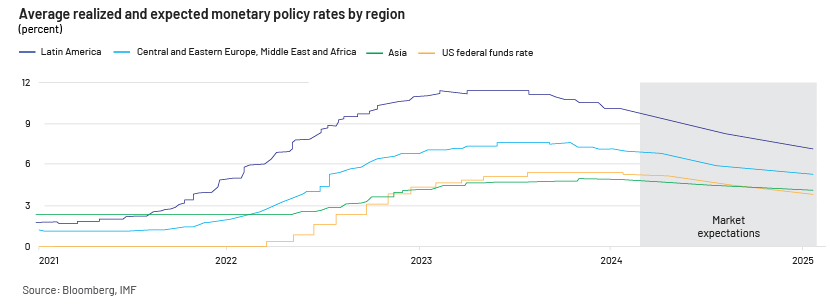

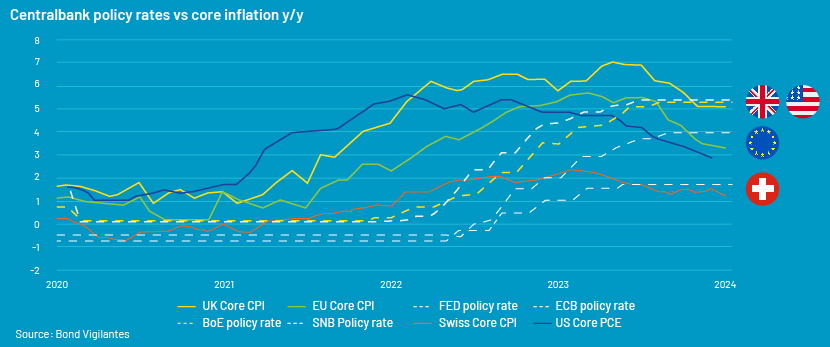

Interest rates are diverging sharply in major economies, most notably in the US and the Eurozone, raising concerns about global financial stability and the effectiveness of coordinated monetary policy responses.

The world’s two largest and most closely connected economies are the US and the Eurozone, and they have a notable influence on global financial markets and trade. In normal circumstances, their central banks aim to maintain stable inflation rates by adjusting monetary policy. In recent years, however, inflation has been heading in different directions –the US has been registering an increase while the Eurozone has been experiencing a decrease.

Central banks and iInflation

The US Federal Reserve (Fed) is currently following a “higher for longer” stance to curb inflationary pressure and prevent the economy from overheating. On the other hand, the European Central Bank (ECB) has started to move towards a dovish stance, with a 25bps rate cut at the June meeting, with inflation in the Eurozone recently falling toward the ECB's target of 2%.

Interest- rate cuts

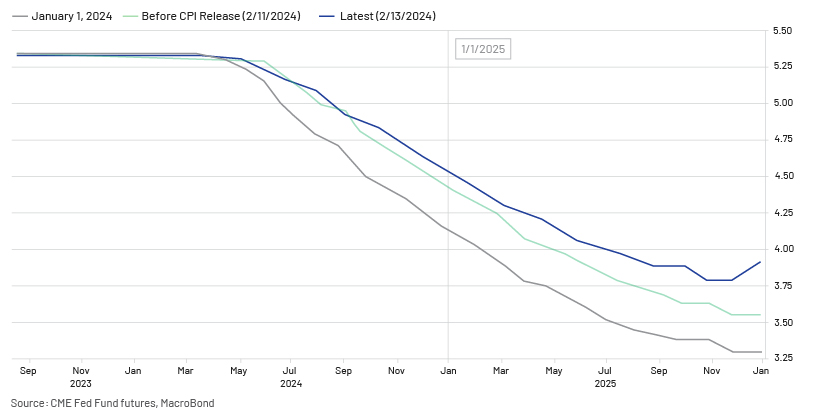

The Federal Open Market Committee (FOMC) has not reduced interest rates in 2024, despite market forecasts. The market is now pricing in one or two cuts at most at the end of the year, down from four to five expected at the beginning of the year, due to slower-than-anticipated progress towards lower inflation and the robust US jobs market resulting in higher wage inflation.

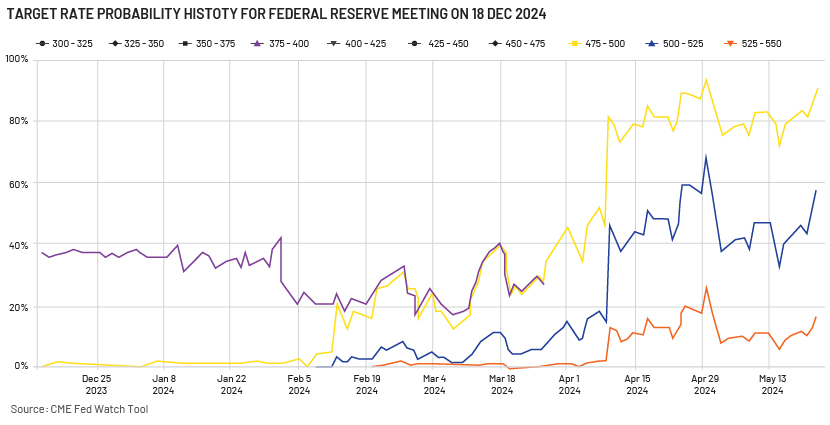

CME Fed Fund futures show how the surge in unexpected inflation is reshaping rate-cut expectations. After the bearish news, the futures curve has been reshaping upwards, signalling higher rates for longer.

The CME Fed Watch Tool follows the same narration, showing that the probability of a 375-400bps cut has fallen to less than 1% currently from around 40% since the beginning of the year and that the probability of a 475-500bps cut has risen less than 1% to more than 80% over the period.

Causes of divergence

A number of key factors have contributed to this divergence in interest rates in 2024:

-

Differences in the Fed’s and the ECB’s approach to monetary policy and economic conditions. The Fed has been gradually tightening policy to curb inflation, while the ECB has moved to a more neutral stance as Eurozone inflation has fallen closer to the target.

-

Progress in reducing inflation in the US has been slower than anticipated, while the labour market has remained strong, leading to the Fed postponing interest-rate cuts, although the market has factored in such cuts. The Fed is pausing cuts to ensure that a tightening policy has the full effect.

-

Geopolitical tensions and risks of commodity-price volatility are leading to restrictive central-bank policy. The World Bank warns that a major energy shock could undermine progress towards disinflation.

-

Increased fiscal support, geopolitical fragmentation and shifts in supply chain lead to slightly structurally higher inflation and interest rates in the post-pandemic era.

In conclusion, the divergence in stance stems from differences in inflation dynamics, labour markets and policy responses in the major economies and global geopolitical and commodity price risks. Central banks remain vigilant and data-dependent in their policy decisions.

This divergence between US and Eurozone monetary policies could have a significant effect on exchange-rate fluctuations between the USD and the EUR, leading to changes in interest rates, inflation expectations and economic conditions affecting currency valuation.

Long-term interest rates

The FOMC's anticipated moves also influence long-term interest rates, such as mortgage rates. If the FOMC cuts rates earlier and deeper than expected, mortgage costs could fall. If, conversely, the FOMC holds off for longer, mortgage rates could rise even further.

Central banks must remain vigilant

Central banks need to focus on reducing inflation to keep the financial system healthy in the long run. Maintaining stability in the long run would require a multi-pronged approach, and regulators would need to ensure banks and other financial institutions are strong enough to handle any uncertainty.

Additional context

The Bank of Japan (BoJ) hit a turning point in March 2024. In a major policy shift, it ended 17 years of ultra-loose monetary policy by raising interest rates to around 0% from a negative 0.1% and halting its quantitative and qualitative easing (QQE) programmes. This signalled a return to normalcy for Japanese monetary policy, even though the BoJ has remained more cautious than the central banks of the US and Eurozone.

Outlook

Policymakers in both regions must closely monitor inflation trends and coordinate their monetary policy responses to prevent further inflation-related divergence. This may require greater communication and collaboration between the Fed, the ECB and other major central banks. Addressing this divergence would be critical for maintaining financial stability and promoting sustainable growth of the global economy.

Implications for capital markets

Diverging interest rates in the US and Eurozone (2024) present investors with new opportunities and risks:

-

Growing market divergence and increasing volatility may provide active fixed-income investors with new opportunities because credit markets are repricing.

-

The increasing divergence of central-bank policy is likely to lead to growing differences between regions and impact interest rate-sensitive sectors, which active investors may see as a window of opportunity.

-

The stock-market correction could be a good opportunity to add to positions as improving fundamentals highlight the need to keep portfolio risk and equity exposure at strategic levels.

-

Concerns remain about the repercussions of previous increases in interest rates, as they would have a delayed impact on those enterprises looking to extend their credits and on those whose mortgages have variable interest rates; these would be reset only after a few years. Such concerns may have a negative impact on inflation and development and, therefore, would need to be monitored closely by those owning assets in their portfolios.

-

Given increased fiscal support, geopolitical fragmentation and shifts in supply chain, investors could expect a period of moderately higher inflation and interest rates than in the pre-pandemic era.

In summary, while the divergence presents risks, it also creates opportunities for active investors to navigate the shifting landscape. Monitoring labour markets, wage growth, inflation and the impact of past rate hikes on refinancing would be key.

Disruptions observed within the market environment

Frontier emerging markets, characterised by developing economies with relatively small yet investable financial markets, face significant obstacles, the main one being the scarcity of external financing. Costs associated with borrowing remain high, making it difficult for these economies to secure new financing or refinance existing debt with foreign investors.

Such elevated borrowing costs indicate the inherent risks associated with assets in emerging markets. In fact, returns on these assets have fallen short of those in similar advanced economies during periods of high interest rates. For example, bonds issued by emerging-market entities with lower credit ratings have yielded an average of 0% in net returns over the past four years, in stark contrast to US high-yield bonds, which have averaged a return of 10%. Loans provided by non-bank entities in the form of “private credit” to lower-rated US companies have yielded even higher returns. These substantial differences in returns could cast doubt on the prospects for external financing for emerging markets, as foreign investors with mandates that permit investment across asset classes may seek more lucrative opportunities in advanced economies.

Conclusion

The widening gap between US and Eurozone interest rates threatens global financial stability and coordinated central-bank actions. To prevent this, policymakers need to keep a close eye on inflation and adjust their interest-rate strategies together. This would require improved communication and collaboration between the central banks.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence services to TMT-, industrial-, consumer-, real estate-, utilities- and healthcare-focused investment banks.

We also support sell-side research firms in research, publishing and operations. Global investment banks and other research firms leverage our experience to rapidly increase internal analyst bandwidth and expand coverage of equities and credit. We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients on a wide range of activities including idea generation, building financial models, financial analysis, thematic research, building databases and providing regular sector coverage.

Sources:

-

https://www.ft.com/content/f76884e9-bc66-4a5d-8445-4f842af5ef68

-

https://www.forbes.com/sites/simonmoore/2024/05/14/what-to-expect-from-interest-rates-in-2024/

-

https://www.imf.org/en/Blogs/Articles/2024/04/16/central-banks-must-remain-vigilant-along

-

https://bondvigilantes.com/blog/2024/02/the-interest-rate-cutting-race-ready-set-go/

-

https://www.linkedin.com/pulse/data-update-3-2024-rule-breaking-year-interest-rates-aswath

-

https://www.fitchratings.com/research/sovereigns/global-interest-rate-moves-becoming-more-

-

https://www.cnbc.com/2024/04/26/bank-of-japan-keeps-monetary-policy-unchanged.html

What's your view?

About the Author

Siddhartha is an Investing Banking Senior Associate at Acuity Knowledge Partners, having around 2.5 years of experience working with one of the leading credit-rating agencies in India and around 7 years of capital market experience. He is skilled in investment research, financial modelling, report writing, investment recommendations. His areas of interest are equity, fixed income, derivatives, portfolio-management along with keeping a track of the global-macro scenario. He has also made notable submissions in CFA Asia Pacific Research Exchange. He is currently a CFA Charter holder and has completed his Masters from the University of Calcutta, he is also certified by NSE as a Capital Market Professional.

Like the way we think?

Next time we post something new, we'll send it to your inbox