Published on January 13, 2022 by Kiran Kumar and Saswata Mohanty

The investment banking industry saw a significant surge in activity after the reopening of global markets and the infusion of stimulus packages by governments to mitigate the adverse effects of the COVID-19 pandemic. Most investment banks have started operating from office premises and meeting clients in person again, albeit on a limited basis. Investment banks have started following the hybrid conference/roadshows strategies and utilising the latest technology to realign and revamp deal origination strategies. The liquidity in the market is expected to further fuel merger and acquisition (M&A) activity in the coming period. Environmental, social and governance (ESG) trends are also worth monitoring as the world transitions towards sustainable investing.

Here are the salient trends to look for in 2022:

Trend 1: Sustainable finance achieving new heights

Sustainable finance is not a new concept, but it has been gaining popularity lately and hitting new milestones. Investors and stakeholders have been showing more interest in it following the COVID-19 pandemic’s impact and events like the COP26 climate conference, where major global economies announced plans to work towards achieving net-zero carbon emissions. These events have also propelled the growth of ESG investments in the market. Corporate stakeholders and investors are increasingly focusing on implementing mandatory ESG policies and regulations in their firms now. Of all the avenues, sustainability-linked bonds (SLB) have been booming thanks to climate change commitments.

The first SLB was issued in 2019, with total global issuances reaching USD8.2bn at the time, as per Refinitiv. Since then, it has grown over 11x to USD92.9bn in 2021. The growth trajectory is expected to continue as the focus is shifting more and more towards sustainability.

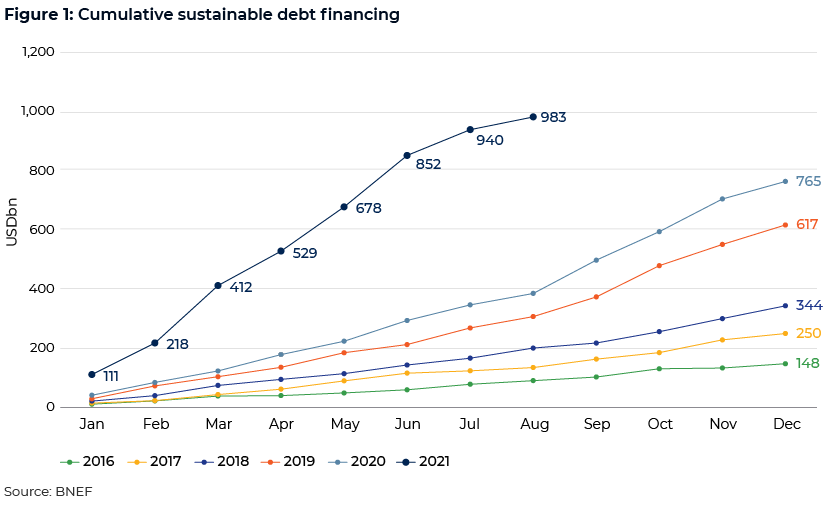

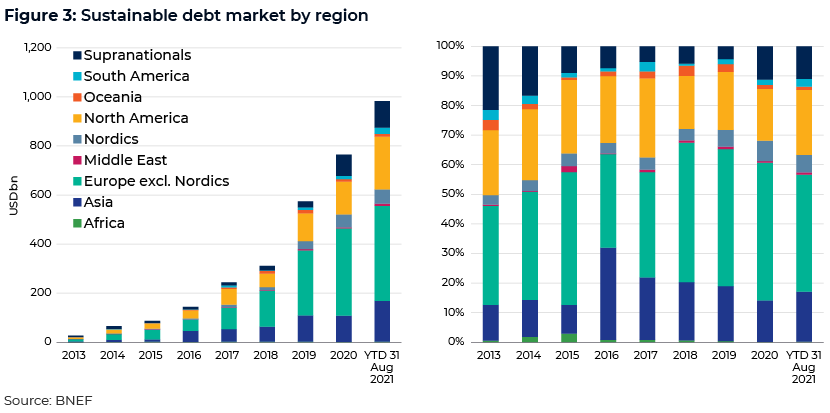

The sustainable debt market achieved a new milestone in August 2021, with new issuances reaching record levels and already crossing total issuances of USD765bn seen in 2020.

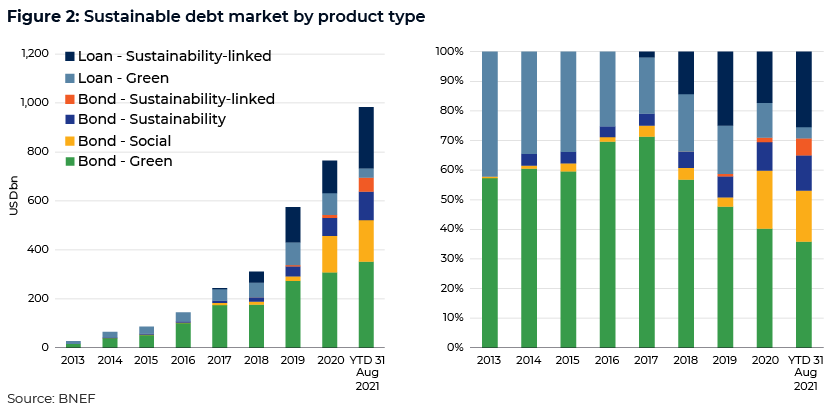

Green bond issuances take the lion’s share of all sustainable investments; however, other avenues, such as social bonds and sustainability-linked loans, have also been gaining prominence lately, giving issuers plenty of options to choose from in the ESG space.

Sustainable market activity thrives in the European, North American and Asian regions, with Europe accounting for the largest share in terms of activity.

Trend 2: Hefty liquidity in the market driving the M&A sphere

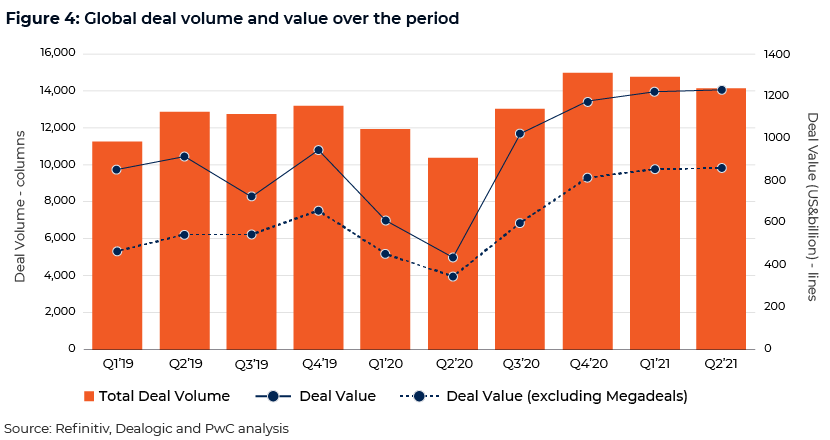

Slowly fading out uncertainties have been lending new confidence to business leaders for a speedy and strong economic recovery, supported by positive GDP growth, better CPI rates and market liquidity, among others. Based on these positive sentiments, the market has been witnessing strong appetite for M&A.

This is further aided by the availability of robust dry powder worth more than USD1.9tn and is expected to be infused in the market in near to medium term. In addition, nearly 400 special purpose acquisition companies (SPACs) are on the lookout for an acquisition target globally, which will provide additional impetus for growth in the M&A landscape. The availability of capital is likely to carry the momentum well into 2022.

Infusion of fresh capital through SPACs, PE investments and corporate acquisitions have led to strong deal making activity, generating total deal values in excess of USD1tn per quarter over the past 12 months.

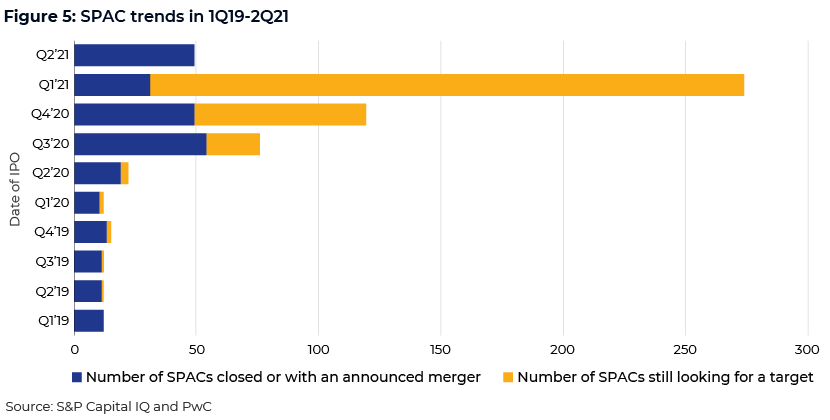

Trend 3: SPACs’ ever-shining buying power

SPACs created a buzz in the market during the pandemic but started witnessing a boom in activity during early 2021, with a record 274 new listings during 1Q21. More than USD80bn was raised by SPACs in 1H21, mostly in February and March, exceeding the total amount raised during full-year 2020. This spike drew the attention of the Securities and Exchange Commission (SEC), who brought in new financial reporting guidelines in April. Though this led to a temporary slowdown in activity, the popularity of SPACs persisted and is not expected to fade away soon.

The available capital, along with a leverage option for the 400 SPACs looking for new target (typically 18-24 months), will carry the deal making momentum forward in 2022. The new SPACs to hit the market next year will further boost deal-making activity.

Trend 4: Capital market activity slowly paving its way back to pre-pandemic levels

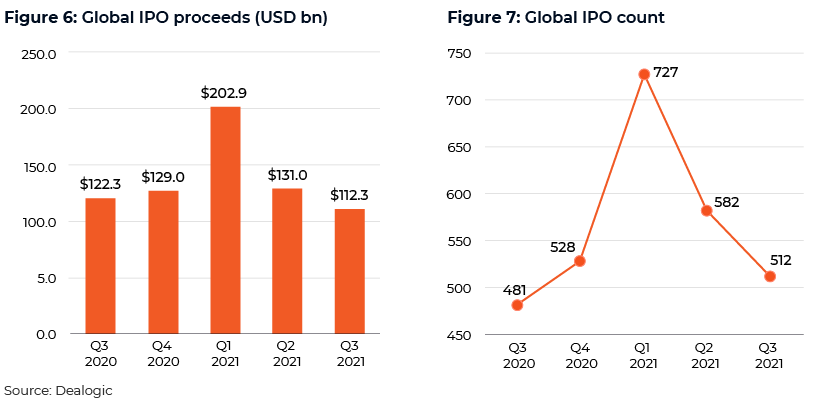

Equities are continuing to provide moderate returns in 2021 unlike in 2020, but they continue to offer an attractive risk premium over bonds.

After a bumper 1Q21 and 2Q21, the global IPO market witnessed a slowdown, bringing activity levels in line with pre-pandemic levels. Global IPO issuance in the 3Q21 totalled USD112.3bn, down 8% from the same period last year. Markets, including the UK and Europe, were more active during 3Q21 compared with other markets across globe.

A similar trend was also observed in the debt capital market (DCM), which achieved a breakthrough in 2020 but was flat in 2Q21. Global corporate bonds were either flat or lower in November, while government bonds rallied on concerns about the Omicron variant of the coronavirus. Moreover, it is expected to remain flat as most central banks are considering interest rate hikes to counter the likely inflation.

Trend 5: Rising momentum in infrastructure spending globally

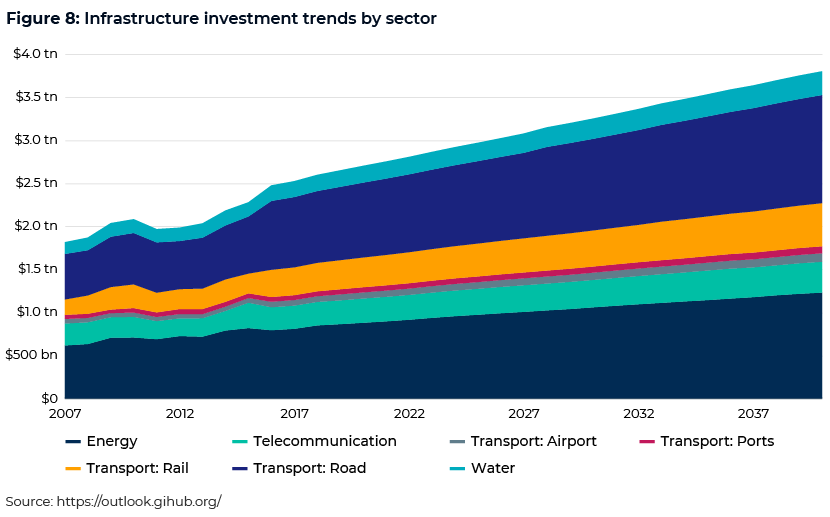

Major economies across the globe are realigning their strategies towards infrastructure spending, especially after COVID-19. Several new initiatives were taken during this time. They include the Build Back Better World initiative (a G7 global infrastructure initiative worth more than USD40tn), a new infrastructure bill worth USD2.3tn passed in the US senate to revamp aged infrastructure in the US, the recent COP26 conference, the implementation of the EUR1.0tn European Green Deal and China turning to infrastructure-led stimulus (much as it did after the Great Recession in 2008). Infrastructure spending would be one of the key pillars to help revive pandemic-ravaged economies even in 2022.

Trend 6: Deal acceleration powered by artificial intelligence and predictive analytics

Investment banks aim to exploit the power of artificial intelligence (AI) and machine leaning to revamp the deal process. These advancements may not be able to replace a human, but they can accelerate the pace of the deal closure process by making information available significantly faster. If quickly and widely adopted, investment banks can greatly benefit in terms of cracking deals in this tough competitive market. These tools also aid in minimising human error in complex documentation, alongside other efficiency benefits. AI and bots offer a plethora of opportunities for investment banks. Many banks have worked to compile and leverage decades worth of data on their CRM platforms, which is used to study predictive bid ranges and spreads to help deal teams make informed decisions, with an eye towards maximising the success rate while also reducing the time taken to close deals. Banks can also get instant updates on the behaviour of clients and sponsors using tools such as Einstein Prediction Builder, Einstein Discovery and Tableau CRM.

Trend 7: Attrition and talent shortage resulting in increased operational costs

With the surge in deal making, investment banks have been struggling with massive workloads and a shortage of trained staff. With seasoned bankers across levels job-hopping in record numbers, banks are forced to keep a lookout to prevent employees from leaving. Banks typically expect around 5% of employees to exit after receiving their annual bonuses. However this year, human resources departments are asking management to start preparing for more resignations, with possibly c.10% of junior employees expected to leave the company after receiving their bonuses. The industry has witnessed significant talent rotation and exits to pursue careers outside the field of investment banking.

The entire industry is going through a major supply and demand disequilibrium issue, which is expected to persist over the coming quarters. In response, banks are working harder to offer more benefits and introduce new measures, including faster promotions, higher bonuses, more hires to reduce workloads, and limited working hours. These measures may yield the expected benefits of retaining or attracting talent, but management should also be cautious of increasing operational costs and impacts to the margins as these might throw a wrench into their expansion plans.

About Acuity Knowledge Partners

Acuity Knowledge Partners (Acuity), formerly part of Moody’s Corporation, is a leading provider of bespoke research, analytics, staffing and technology solutions to the financial services sector. Headquartered in London, Acuity has nearly two decades of transformation experience in servicing over 400 clients with a specialist workforce of more than 4,000 analysts and delivery experts across its global delivery network. We provide our clients with unique assistance not only to innovate, implement transformation programmes and increase operational efficiency, but also to manage costs and improve their top lines. These services are supported by our proprietary suite of Business Excellence and Automation Tools (BEAT), which offer domain-specific contextual technology. We are backed by Equistone Partners Europe, a leading private equity organisation that supports specialist growth businesses and management teams.

Sources:

https://www.pwc.com/gx/en/services/deals/trends.html

https://www.sourcescrub.com/post/5-recent-trends-in-technology-and-investment-banking

https://www.gpwinfostrefa.pl/czym-jest-ico-initial-coin-offering/

https://www.climatebonds.net/2021/11/2021-already-record-year-green-finance-over-350bn-issued

https://www.reuters.com/business/global-markets-ma-2021-08-12/

https://www.spglobal.com/_assets/documents/ratings/research/100772320.pdf

https://www.pwc.com/gx/en/services/audit-assurance/ipo-centre/global-ipo-watch.html

https://www.advisor.ca/investments/market-insights/corporate-bond-outlook-for-2022/

https://www.schwab.com/resource-center/insights/content/2022-corporate-bond-outlook-focus-on-income

Tags:

What's your view?

About the Authors

Kiran plays an active role in onboarding new Investment Banking client with special focus on Public Finance. He has rich experience in transitioning and setting up the dedicated teams for new clients and existing relationships. Actively engages with clients to analyze and understand the client requirements and identify solutions and plan for process transitions or migrations. Alongside onboarding the new clients, he is managing multiple client accounts, where his responsibilities include resource and talent management, delivery quality and client satisfaction management, governance and MIS, regular communication with the senior stakeholders for smooth functioning of the relationship, and implementing industry best practices in the Acuity team for IB Analytics...Show More

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox