Published on December 18, 2020 by Saswata Mohanty and Kiran Kumar

The investment banking industry has been steadily managing its level of activity, especially during the pandemic in 2020. It has been a principal task to go fully virtual and execute an untested working model in a matter of weeks. Many investment banking operations were executed smoothly, despite some hurdles. Clients were served virtually, employees were productive, and compliance policies were reassured. Investment banks successfully deployed technology and established unparalleled alertness and resilience.

The investment banking domain witnessed low levels of fund raising and advisory activity during early 1H20. Subsequently, investment banks started utilising the opportunity arising from pandemic, mostly towards liquidity assessment assignments, and slowly started getting market traction.

Here are the salient trends to look for in 2021:

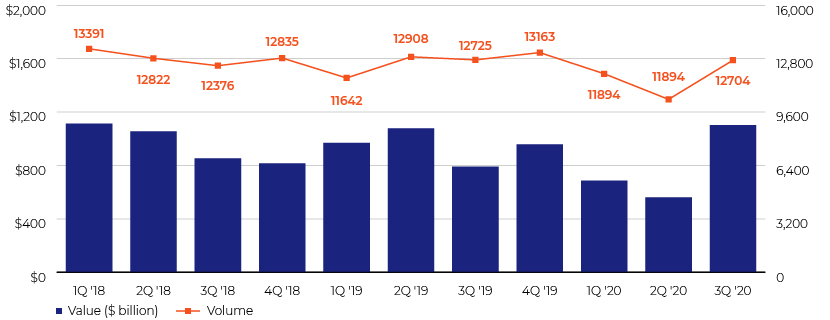

Trend #1: Merger and acquisition (M&A) market showing signs of recovery

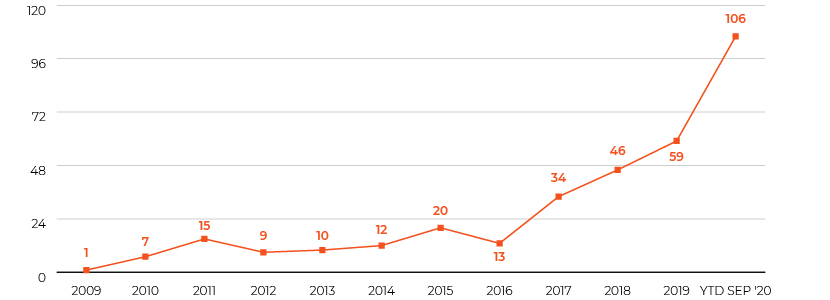

M&A activity, both in terms of volume and value, slowed down during 1H20 due to the pandemic, but the activity level started showing northward movement during 3Q20. Given the signs of recovery in the last quarter, there is a positive outlook towards M&A activity for 4Q20 and beyond. The deals put on hold in 2020 due to the weak market conditions may be realised in 2021. Also, the availability of finance at lower interest rates and a surge in dry powder may push activity further. The roll out of COVID-19 vaccines in the market, and a strong pipeline of new deals and attractive valuations would further accelerate momentum.

Chart 1: M&A activity started showing a rebound

Source: Thomson Reuters

During 3Q20, the technology, media and telecom sector continued to lead the M&A table, followed by the consumer and industrial sectors. In addition, the market saw megadeals making a comeback this quarter, such as NVIDIA agreeing to acquire Softbank’s ARM for c.USD40.0bn and Analog Devices’ acquisition of Maxim Integrated Products for USD20.7bn.

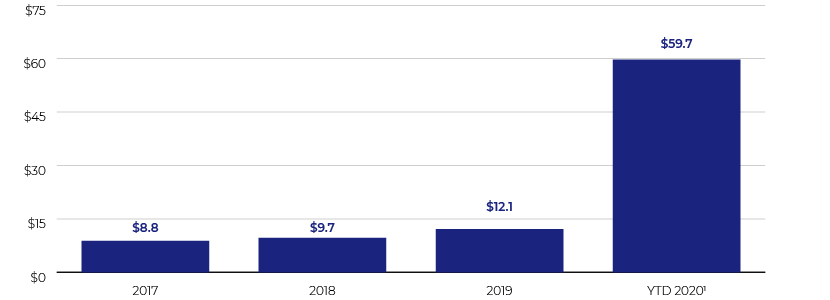

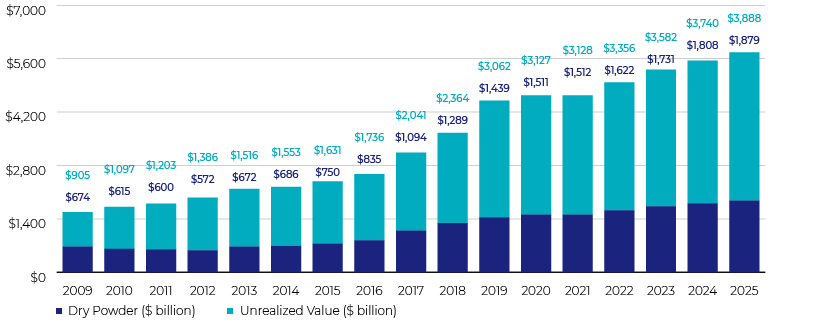

Trend #2: Special purpose acquisition company (SPAC) initial public offerings (IPOs) gaining momentum in the US

There is a steady inflow of capital into SPACs—“blank check” companies that are listed for the sole purpose of raising funds to acquire or merge with unlisted firms. This provides sellers an avenue to expand the investor pool and an option to access new funds. Listing through an SPAC is simpler, quicker and less cumbersome than traditional IPOs.

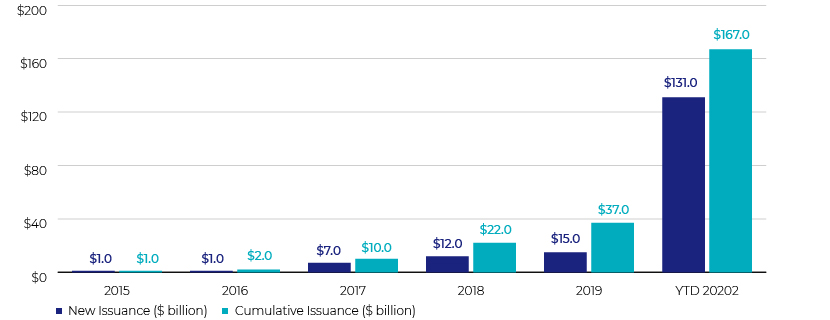

SPACs have become the hottest topic these days as they are gaining momentum: SPACs have shown a high level of traction, as their activity level increased 5.0x during the first 9 months of 2020 compared with the whole of 2019. As stock markets continue to slide during the COVID-19 pandemic, SPACs are emerging as a primary alternate source of raising capital through IPOs. According to market pundits, SPACs provide the opportunity to raise large funds in volatile markets, and would continue to do so going forward.

Chart 2: Surge in SPAC IPO deals ($ bn)

Source: PWC

Note 1: Data for YTD 2020 is as of November 13, 2020

Chart 3: # of SPAC IPOs deals

Source: PWC

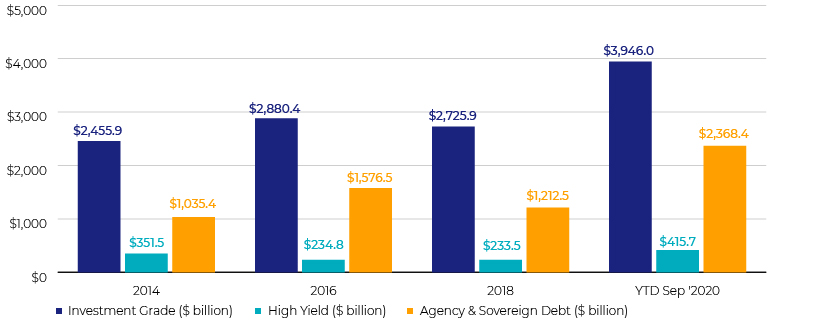

Trend #3: Strong dry powder and attractive valuations bring optimism to the private equity (PE) space

The spread of COVID-19 has caused disruptions to economic activity across the globe. PE firms felt the initial shock from the pandemic as well. After PE activity hit rock bottom in early 1H20, the sector witnessed a remarkable turnaround in 3Q20. The industry's resilience and agility helped it to bounce back rapidly, which, along with the record level of dry powder, gives hope for a solid year ahead.

PE will play a pivotal role in recovery as economic activity returns to normalcy. Unlike other investment vehicles such as mutual funds, exchange-traded funds and hedge funds, PE firms always explore opportunities and the right moment to deploy cash committed by limited partners. PE firms also look for companies at attractive valuations and realise a major chunk of profits when they exit. PE firms are actively involved in management and oversight of portfolio companies and can effectively steer these companies through crises.

Chart 4: PE assets under management shows steady growth

Source: Deloitte

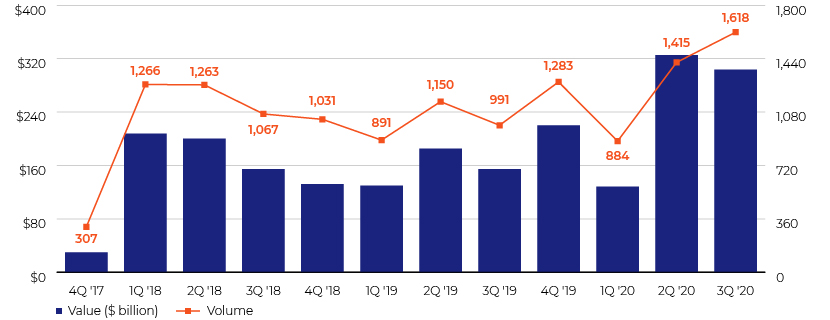

Trend #4: Pandemic-driven liquidity concerns playing catalyst for capital market activity

The pandemic led economic lockdown has caused significant liquidity concerns for companies across the globe and fundamentals appeared to get weaker. With companies tapping the capital markets at record pace and started raising funds through loans, bonds and equity issuances, where the proceeds are expected to be used for liquidity management in case things got poorer, as well as any business opportunities. By 3Q20, debt markets issued c.USD8.0tn in bonds and around USD762bn was issued in equity markets. Particularly, the US investment-grade borrowers were on the forefront, accounting for USD1.2tn, an increase of 68% up to 3Q20, while US high-yield borrowers raised USD276bn, a 79% increase over the same period last year. On the other hand, cost of debt is historically low in the US, but still higher compared to some foreign countries, where yields are lower or negative. This spread, coupled with the new government’s initiatives, is expected to attract foreign allocation of institutional capital into US capital markets. Overall, the equity and debt capital markets’ volumes show how well the industry has adapted since the pandemic has begun. As economies emerge from lockdown and vaccine for the virus becomes widely available, companies’ shall rebuild their strategies to an economic recovery environment and start raising capital for expanding and investing in their growth and development, further leading to a continued healthy capital market activities.

Chart 5: Global debt issuances across grades

Source: Refinitiv

Chart 6: Global IPO market activity

Source: Thomson Reuters

Trend #5: Environmental, social and governance (ESG) investment is set to surge amid COVID-19

ESG investing refers to an investment approach revolving around the philosophy of “sustainable investing”. Companies are now promoting ESG investment to effectively manage adverse business outcomes amid the pandemic. Increasing interest in ethical investment and more governments/agencies using social bonds as their key alternative for increased funding needs to compensate for lost business and constrained finances during the COVID-19 pandemic led to a substantial spike in social bond issuances: social bond issuances increased 8.0x in the 11 months to November 2020 over the same period in 2019. Of the total USD1,280bn in cumulative sustainable fixed-income issuances in the 11 months to November 2020, social bond issuances accounted for c.10% of the total, amounting to USD131bn, dwarfing the green bond market’s and sustainability bond market’s expansions in 2020. Europe has been leading the global social bond issuance, accounting for c.45% of the total issuance volume in the 11 months to November 2020. All these would lead to a green evolution in the coming years.

Chart 6: Social bond issuance jumped manifold

Source: Amundi Asset Management

Note 1: Data for YTD 2020 is as of November 16, 2020

Trend #6: Integration of technology in investment banking operations continues to gain momentum

Corporations around the world have integrated machine learning and artificial intelligence into their operations. The trend has impacted investment banking significantly as well. Automation is fast becoming a strategic business imperative for investment banks seeking to innovate and move fast. Many banks are in the process of elevating the role of junior bankers from just creating profiles, collecting data, formatting and other basic tasks to utilising well-rounded skills, including creative thinking, client facing and deal execution. In every activity that may be automated in investment banking, there will be areas in which investment bankers will continue to apply a significant amount of expertise and judgment. Technology is expected to not only facilitate freeing up a banker’s time, lowering costs and reducing the time to go to market, but also augment the banker’s ability to bring in new ideas. Acuity Knowledge Partners has developed a proprietary toolkit that enhances productivity of investment banking professionals by integrating cutting-edge technology with time-consuming day-to-day investment banking tasks and processes.

About Acuity Knowledge Partners

Acuity Knowledge Partners (Acuity), formerly part of Moody’s Corporation, is a leading provider of bespoke research, analytics, staffing and technology solutions to the financial services sector. Headquartered in London, Acuity has nearly two decades of transformation experience in servicing over 300 clients with a specialist workforce of more than 3,000 analysts and delivery experts across its global delivery network. We provide our clients with unique assistance not only to innovate, implement transformation programmes and increase operational efficiency, but also to manage costs and improve their top lines. These services are supported by our proprietary suite of Business Excellence and Automation Tools (BEAT), which offer domain-specific contextual technology. We are backed by Equistone Partners Europe, a leading private equity organisation that supports specialist growth businesses and management teams.

Tags:

What's your view?

About the Authors

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Kiran plays an active role in onboarding new Investment Banking client with special focus on Public Finance. He has rich experience in transitioning and setting up the dedicated teams for new clients and existing relationships. Actively engages with clients to analyze and understand the client requirements and identify solutions and plan for process transitions or migrations. Alongside onboarding the new clients, he is managing multiple client accounts, where his responsibilities include resource and talent management, delivery quality and client satisfaction management, governance and MIS, regular communication with the senior stakeholders for smooth functioning of the relationship, and implementing industry best practices in the Acuity team for IB Analytics...Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox