Published on January 27, 2021 by M Amarnath Rao and Kavita Kumar

Introduction

Investment compliance includes complete investment restriction monitoring and administration is a particularly complex and tactful process with investment business.

Why Investment Compliance?

Regulatory rules are becoming more complex and paramount for investment managers dairy, by day but the need of compliance will help portfolio managers not only to fortify their presence in market but to effectively manage their portfolio. Investment compliance can be defined in many ways as per the prevalent rules in the industry, in general the compliance within the asset management industry or investment banking adhering to the regulatory guidelines to trade in the market and by following both internal standards set by internal management and external compliance set forth by legal or regulatory authorities.

Investment Compliance, in this parlance, involves

-

Adherence to comprehensive investment restriction

-

Investment Administration

Why is Investment Compliance necessary to manage portfolios effectively?

Post the 2008 Global Financial Crisis, Investment Compliance assumes more significance for regulators as well as all the other parties involved in direct or indirect portfolio management of Investment, such as fund administrators, portfolio managers, traders and so on.

Investment Compliance ensures strict adherence to rules and regulates mandated by the concerned regulatory authorities, which in turn, ensures the investments are safe.

Adequate investment compliance also ensures there is sufficient liquidity in the corpus pertaining to a particular portfolio.

Investment compliance maintains and restores the confidence/trust of the investors and the public in the capital markets and the overall financial system.

Investment compliance ensures the stable functioning of the economy, to maintain sufficient cash inflow and outflow.

Examples of Regulatory Authorities in certain countries

-

SEBI – Securities and Exchange Board of India – India

-

SEC – Securities and Exchange Commission – United States

-

PRA – Prudential Regulatory Authority – United Kingdom

-

Bank of England – United Kingdom

-

Financial Policy Committee – United Kingdom

-

FINMA – The Swiss Financial Market Supervisory Authority

Consequences of non-compliance to Investment Compliance:

-

Financial loss

-

Penalties/Fines

-

Reputational loss

-

Suspension of License

-

Potential Seizure/closure of the company

Examples of Non-compliance to Investment Compliance Financial Frauds:

-

Enron – 2001 – fooled regulators with fake holdings and off-the-book accounting practices

-

WorldCom – 2002 – massive accounting fraud

-

Lehman Brothers – 2008 – repurchase agreements to disguise ‘at risk’ assets

-

Volkswagen – 2015 – installed emission-cheating devices in its vehicles, mostly in US

-

Equifax – 2017 – major security breach

-

Examples of Non-compliance to Investment Compliance. Financial US 64 scam

-

Harshad Mehta – 1992 securities scam

-

Satyam Scam – 2008

-

PNB scam

Risks which Investment Compliance helps managers to manage

Investment compliance helps a company detect and prevent violations of rules, which protects an organizations from fines and lawsuits. This process should be ongoing.

With the consequences of not adhering with laws and regulations having such a high potential cost, and compliance would create a very big issue for businesses. Investment Compliance helps managers to plan, organize, control and lead activities within required laws and standards.

Investment compliance acts as a second line of defines for an organization’s Risk and Compliance Management functions, while providing an independent challenge and review of risk. A Compliance officer, makers sure that an organization is conducting its business operations within the Compliance requirements adhering with all national and international regulations and laws that pertain to its particular nature of industry and also accept business practices and internal standards.

Compliance officers have an intuitive knowledge of the company’s goals and culture and also of the greater industry and business law.

Investment compliance typically has five areas of responsibility:

-

-

Identification – Investment Compliance identifies risks that an organization faces and advises on how to address and avoid the risks. While it’s difficult to eliminate all of an organization’s risk exposure, the risk methodology and framework laid by Investment Compliance help the organization prioritize which risks it wants to more actively manage. Developing a methodology & framework helps organizations determine the extent to which an organization’s/company’s existing risk diminution activities are able to reduce risk.

-

Prevention – In order to prevent risks, firstly we need to understand what the risks which are associated with an organization, a scientific justification of risk assessment that make up compliance program like policies due diligence etc. will accomplish little if they do not address the right risks. Investment Compliance will always start with risk assessment. Investment Compliance ensures that a business adheres to internal controls and external rules. Investment Compliance work to meet key regulatory objectives in order to protect investors and ensure that markets are fair, efficient and transparent.

-

Monitoring and detection – Investment Compliance ensures an organization to initiate system of internal control systems that adequately detect and monitor the risk that it faces. A compliance officer with the help of Investment Compliance effectively support business areas in their duty to comply with relevant laws and regulations and internal procedures. Integrated compliance management (ICM) calls for rich data support.

-

Resolution – ICM helps in correctly portraying the capabilities by introducing RFP process which can help companies avoid or address any issue. Introduction of RFPs by ICM would help Institutional investors who require greater visibility into organization’s ICM capabilities and they tend to ask direct questions about those capabilities in their RFPs. With the help of RFPs, ICM may disclose the process followed in initiating the controls, types of restrictions involved which can be monitored and also the structure of the ICM team. ICM though RFPs, help manager to correctly portray client requirements.

-

Advisory – In the current world ICM has a major role though the investment management and banking has recovered to pre-crisis levels and the outlook is positive there are still many challenges to overcome. New regulations and laws are regularly introduced and in parallel the organizations need to ensure effective advisory to be in compliant with increasingly complex and varied requirements.

-

Major challenges for industry professionals are dealing with the change in regulatory changes, transforming their business models, improving governance etc. ICM provides an advisory framework in order to copy up with these challenges.

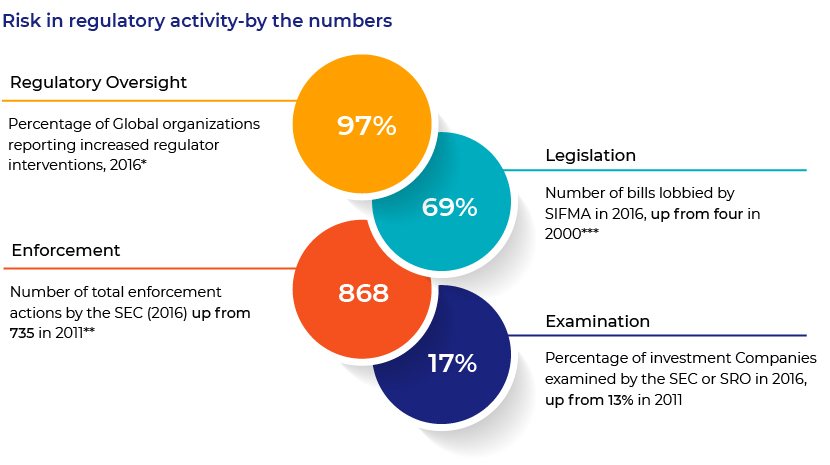

The above diagram clearly shows that the regulator interventions has been increasing exponentially in the coming years.

The investment industry’s Agency activity has increased comparably. In the year 2016, SEC reported 868 enforcement actions arising from assessment of 17% of investment companies.

Acuity Knowledge Partners’ solution:

We create tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery.We have a very experienced tool-agnostic team able to provide support in investment compliance, trade surveillance, and corporate compliance services. We are experienced in providing unique solutions with the help of our state-of-the-art technology.

We have a pool of subject-matter experts for process delivery, training, projects and automation to mitigate costs. Our established compliance capabilities help clients identify problems and opportunities to navigate through a challenging business environment.

Sources:

What's your view?

About the Authors

Amarnath carries a total work experience of 14 years and is currently working as an investment compliance specialist in pre-trade & post-trade monitoring. He has worked for various firms including Thomson Reuters & Capgemini. At Acuity Knowledge Partners, he is working as a Delivery Manager supporting both post & pre-trade compliance services. He is a BBM graduate in Finance from Garden City college, Bangalore.

Kavita has over 2 years of experience in investment compliance at Acuity Knowledge Partners. Currently working in post trade monitoring. She has done her Masters in Ramaiah College, Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox