Published on February 22, 2023 by Chenran Tian

Executive summary

China’s government announced relaxing all COVID-19-related restrictions in December 2022, after having implemented its Zero-COVID strategy for roughly three years. The number of infections has reduced substantially, and the economy is gradually returning to growth. As the world continues to reel amid conflict, investors seeking additional returns are turning to China. They would, however, still have to be cautious when entering China and may need a reliable local partner to help them benefit from this lucrative but difficult market.

China’s economy is well positioned for growth in 2023

The following indicators shed light on where China’s economy is heading in 2023.

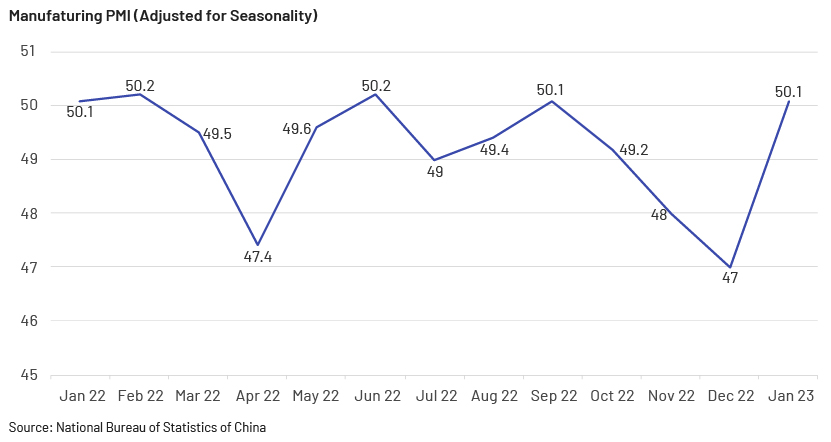

1. Purchasing Managers’ Index (PMI) indicates a return to healthy business activity

The Manufacturing PMI was at 50.1% in January 2023, 3.1% higher than in December 2022. A PMI above the breaking point of 50% indicates an uptrend in domestic business activity. Large-scale companies’ PMI stood at 52.3%, and for small and mid-size companies at 48.6% and 47.2%, respectively.

An expanding PMI is good news for China’s economy in many aspects, especially for the labour market. Since the strict Zero-COVID policy was implemented, the unemployment rate increased to 5% in 2020 from around 4.5% in 2019 and 4.28% in 2018. The resumption in business activity is likely to create more job opportunities and gradually reduce the unemployment rate to normal levels in 2023.

2. Stock market performance shows increasing investor confidence

Resumed business activity led to strong stock-market performance in January 2023. The CSI 300 Index consists of the largest 300 companies listed on the Shanghai and Shenzhen stock markets. On 30 January, the first trading day after the Chinese New Year holiday, the CSI 300 closed at 4,201.35, 19.74% higher than the low on 31 October 2022. Since a bull market is defined as a 20% increase from recent lows, it is appropriate to say that the China A-share was close to entering a bull market in January 2023.

As global investor confidence declined in 2022, there was foreign capital outflow from the mainland China stock market. International investors had withdrawn a net CNY9.6bn in total from Chinese stocks in the 11 months to November 2022, just before the restrictions were relaxed. Starting in 2023, the Zero-COVID policy will no longer restrain economic development, and foreign capital is expected to return to China.

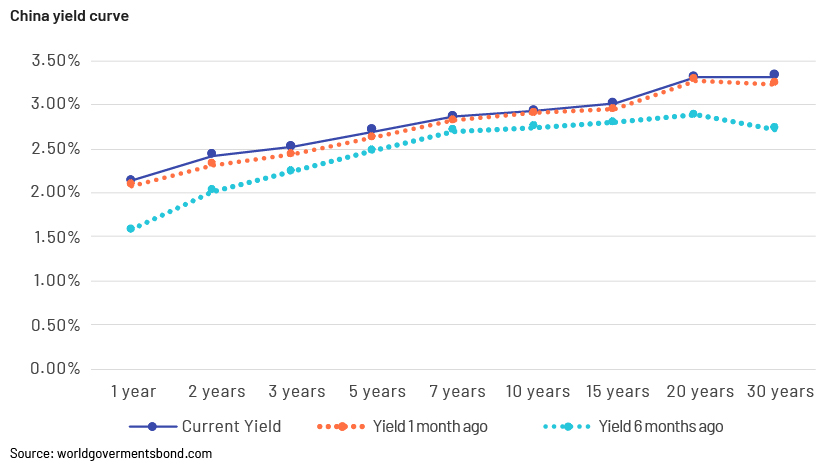

3. A rising yield curve in China indicates the risk of recession is remote

Ultimately, the overall improving economic conditions have translated into a rising confidence level for the broad market, which is manifest in the yield curves. The table above shows the trend in China’s yield curve at three different points of time: current stage, 1 month ago and 6 months ago. The lines indicate a bear-steepening upward trend for maturities from 2 years to 20 years, usually seen prior to market recovery. A closer look at the current yield shows a more evident upward trend than in the other two lines for the same maturities. The yield curve, a critical leading indicator, reflects investor confidence in future economic development. China’s most recent yield curve shows investors are optimistic about the economy. This is especially noteworthy given the fact that the world economy is gloomy and major economies have inverted yield curves, for example, the US (inverted for maturities of 2 to 10 years), the UK (inverted for maturities of 1 to 7 years) and Germany (inverted for maturities of 1 to 7 years).

The inflation rate for 2022 was as low as 2%, below the target inflation rate of 3% set by the central bank of China. Although the easing of COVID-19-related restrictions will likely put upward pressure on prices, demand is forecast to increase, and inflation should remain manageable. Therefore, interest rates are not expected to increase. In fact, the central bank may reduce interest rates to encourage economic recovery, as it still has room to do so.

The January economic indicators suggest a strong economic recovery, prompting the IMF to raise China’s 2023 growth outlook from 4.4% to 5.2% in January 2023 after the Zero-COVID policy was abandoned.

Investors still need to be cautious with the Chinese market

Undoubtedly, abandoning the policy has benefited the economy. However, being the world’s second-largest economy, its situation is complex, and a number of issues remain to be resolved.

The real estate sector has historically accounted for 30% of China’s GDP. However, this started declining in 2021, and the government has taken steps to stem the drop. Property sales dropped by more than 26% and investment in the sector decreased by 9.8% in 2022 compared with 2021. With the economy recovering and the government continuing to stimulate consumption, both commercial and residential real estate sectors may improve but at a slower pace.

Additionally, demand in 2023 is difficult to gauge, because it is influenced by two opposing forces: weakening foreign demand and increasing domestic demand. Exports have accounted for 19-25% of China’s GDP over the past 10 years and created a number of job opportunities. With global economic activity slowing, demand would inevitably drop. Although easing COVID-19-related restrictions mean factories can reopen, they would still face difficulties if orders are insufficient.

On the other hand, domestic demand is recovering strongly. January 2023 saw the first spring festival without COVID-19-related travel restrictions since 2020, and combined revenue of consumption-related sectors increased by 12.2% over 2022, achieving or even surpassing the level in some indicators in the same period in 2019. This was driven especially by the better-than-expected performance in box office sales and travel. It is worth noting that the recovery was registered just a month after the government announced relaxing its Zero-COVID policy.

As the country with the largest population, China’s potential domestic consumption growth is significant. The former Vice Minister of Commerce recently forecast double-digit growth in retail sales of consumer goods. Furthermore, China’s policymakers have pledged to boost the economy by encouraging consumption, as evidenced by the guidelines released in December 2022 that detail plans to build a sound domestic demand system to promote its long-term development. Therefore, investors may expect a shift in the composition of China’s GDP as domestic demand surpasses foreign demand and becomes the main driver of economic growth.

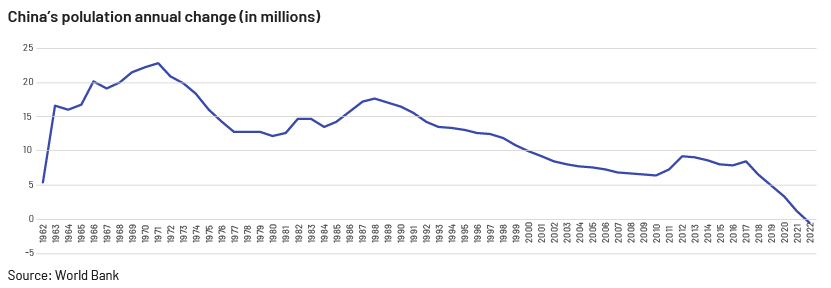

A more worrying issue is that China’s population fell in 2022 for the first time since 1961. China’s past success is largely attributable to its abundant population and cheap labour. As this benefit gradually diminishes, it would be difficult to predict the future of the economy. More importantly, the social problems that come with declining populations include ageing populations, shrinking workforces and increased need for social welfare. The silver lining is that China’s policymakers have been pushing for structural economic changes for years, and growth from new sectors, such as technology, would eventually mitigate the population-related issues and shape a new economy, although this will likely be a bumpy road with fluctuations in the short term.

Conclusion

The long-awaited easing of COVID-19-related restrictions has injected a vitality into China’s economy, and the first month of 2023 saw a number of positive changes. We believe the economy has considerable potential waiting to be unleashed in 2023. However, it may be too optimistic to assume this would be a smooth development. We stand at a crossroads of opportunities and uncertainties. Therefore, investors need an in-depth understanding of the China story if they are to benefit.

How Acuity Knowledge Partners can help

We support global investors. Analysts in our Beijing office have not only witnessed but also experienced the ups and downs of China’s economy for more than a decade. We have a large talent pool that is sensitive to economic, social and demographic changes in China, and expertise in working with international investors.

Sources:

-

China stocks near bull market after return from Lunar New Year holidays (cnbc.com)

-

China Government Bonds – Yield Curves (worldgovernmentbonds.com)

-

https://www.reuters.com/world/china/chinas-population-shrinks-first-time-since-1961-2023-01-17/

-

https://edition.cnn.com/2022/12/29/economy/china-economy-2023-outlook-hnk-intl/index.html

-

https://edition.cnn.com/2023/01/18/china/china-population-drop-explainer-intl-hnk/index.html

-

Economist: Domestic consumption to drive China's 2023 economic rebound – CGTN

-

https://english.www.gov.cn/policies/latestreleases/202212/15/content_WS639a6338c6d0a757729e474b.html

-

https://www.macrotrends.net/countries/CHN/china/unemployment-rate

-

https://www.scmp.com/economy/economic-indicators/article/3206490/china-inflation-

-

https://baijiahao.baidu.com/s?id=1757337848575089446&wfr=spider&for=pc

-

https://baijiahao.baidu.com/s?id=1757338320104360407&wfr=spider&for=pc

Tags:

What's your view?

About the Author

Chenran Tian works as an equity research analyst in Acuity Beijing. She is currently supporting a global asset management firm. She has a master’s degree of Financial Risk Management in University of Toronto. She previously worked as a banking advisor and client advisor in Royal Bank of Canada.

Like the way we think?

Next time we post something new, we'll send it to your inbox