Published on March 26, 2024 by Saswata Mohanty and Akshata N. Upadhyaya

IPO market: building momentum for a strong upturn

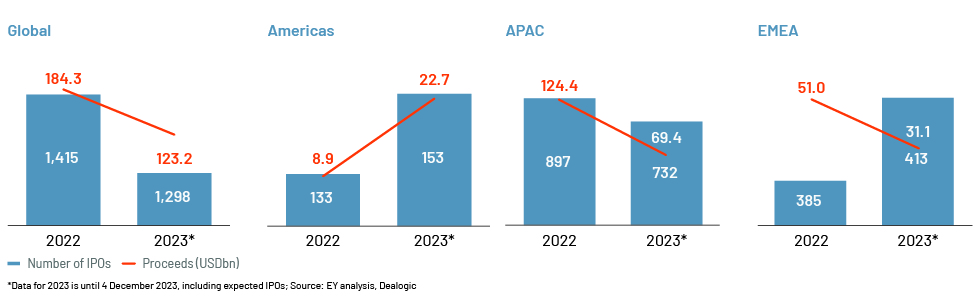

The IPO market saw a shift in sentiment in 2023 and is set to bounce back to pre-2019 levels in 2024. The Americas and Europe, the Middle East, India and Africa (EMEIA) saw a rebound in 2023. Strong economic growth backed by growing capital markets in countries such as Indonesia, India and Japan also resulted in higher yields than benchmark indices.

Improved investor sentiment in Western markets, growing emerging markets (EMs), the large number of private companies backed by venture capital and stabilising inflation are expected to reduce the headwinds and provide opportunities for the IPO market in 2024.

IPO market gaining momentum

The IPO market has been struggling since the boom in 2021, when the largest number of IPO deals in the market (2,388 IPOs) raised USD453.3bn1. This level of activity is unlikely to be repeated in the near future, but market experts forecast that the IPO market will stage a rebound to levels such as seen in 2019 and before.

USD101.2bn in capital was raised globally through IPOs in the first three quarters of 2023, a 32% decrease y/y. Despite the drop, 3Q alone showed a notable improvement, with September seeing the most recovery after the 2021 put.

The global IPO market is showing signs of improvement, with pricing re-aligned between issuers and investors, improving investor sentiment in Western economies and growing EMs.

Trends driving equity capital markets in 2024:

Moderate inflation backed by potential rate cuts paving the way for increased liquidity:

Many central banks expect interest rate cuts in 2024 as inflation remains stable, and investors are becoming more confident in the equity markets. They are looking to invest in companies with strong fundamentals and able to grow despite challenging economic conditions, rather than in companies with high valuations.

Strong IPO backlog in major sectors:

Investors expected the IPO market to reopen after Arm Holdings’ IPO, but the company’s post-IPO performance reiterated the fact that the market was not ready. Many privatemarket companies plan to go public in 2024. Venture capital-backed companies, especially those in the later stages of obtaining venture capital, either need to obtain more funding from the venture capital firm or go for an IPO to stay competitive amid the market uncertainty.

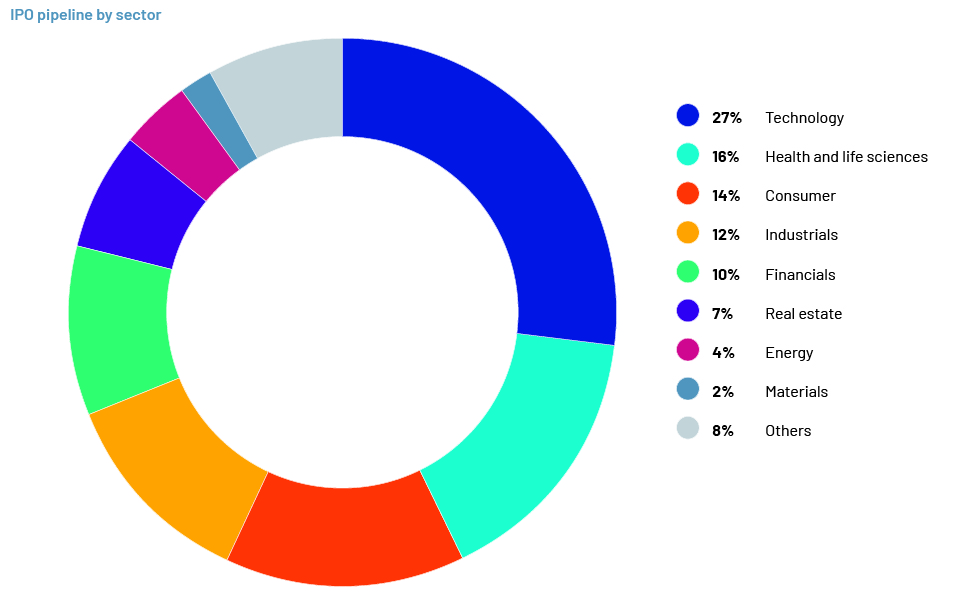

This has resulted in a strong pipeline of IPO companies backed by venture capital –around 257 technology companies for 2024. Around 800 IPOs were withdrawn or postponed due to unstable markets in 2023. The companies concerned are now poised to go public in search of funding.

Positive investor sentiment across the globe:

Expectations that were raised in the latter part of 4Q 2023 due to the increased IPO listings translated into an improvement in US listings. The shift in investor confidence, signs of rate hikes ending and the positivity surrounding an improving economy resulted in enhanced confidence in the market. Europe has also shown signs of the IPO market improving, such as the announcement of Germany’s Schott AG IPO.

Europe is optimistic about a recovery in IPOs in 2024. In the Middle East, Saudi Arabia’s Lumi Rental Co.’s strong post-filing performance has increased investor confidence in market recovery. Asia Pacific is expected to rebound in 2024, with mainland China and Hong Kong at the forefront. Within EMEIA, India, Turkey and Italy are expected to drive the market in 2024, followed by MENA, Romania and Germany.

There is no perfect timing for a company to go public. Each would have its own set of challenges, and aligning these with market conditions would be difficult. Companies around the world are proving that they can report strong earnings despite changes in central-bank policy.

As valuation gaps narrow, investors are reviewing the post-listing performance of the new cohort of IPOs, which, if positive, could renew market confidence” – George Chan, EY Global IPO Leader

Investors are realigning, and the valuation gap between issuers and investors is narrowing. Investors are now looking at new IPO pricing as a benchmark versus valuations of previously priced IPOs. Strong company fundamentals and their avenues to profitability are a major concern for investors due to the tighter liquidity and higher cost of capital in the market. We expect inflation to slow in 2024 and do not consider the possible economic downturn a threat any longer.

What's your view?

About the Authors

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Akshata is a Delivery Lead at Acuity Knowledge Partners, completing a decade of experience since joining the company as a fresh graduate. Akshata is an integral member of a mid-market U.S. Investment Bank’s team based in Bangalore. Throughout her tenure, she has adeptly navigated through various roles, supporting a diverse range of sectors and product teams. She actively engages with onshore bankers and supports across the value chain, from deal origination to execution, for various live pitches. Alongside the service delivery, Akshata takes an active role in delivering training to enhance team competencies and mentoring

Like the way we think?

Next time we post something new, we'll send it to your inbox