Published on February 14, 2023 by Shubha Kamath and Vishal Kashyap

The IPO market almost shut down in 2022, when the market went from boom to bust as the Federal Reserve (Fed) started raising interest rates aggressively. This was one of its most aggressive rate-hiking campaigns in a very long time. The stock market was hit hard at a time when it was focused on large tech companies with high expectations for future earnings.

There are close to 200 companies waiting to be listed on the Nasdaq alone; this is less than the average of 250-300 in past years. These companies are not coming to market because of market volatility or because investors are risk-averse. Investors are now looking for companies driven by both growth and profitability versus those driven primarily by growth previously.

The Americas and Europe, the Middle East and Africa (EMEA) have been facing headwinds in regard to IPOs.

-

Rising interest rates have crushed stock valuations including those of last year’s high-profile IPOs that had declined significantly from the issue price

-

Additionally, Chinese shell companies listed in the Americas are facing scrutiny, slowing IPOs further

Chinese companies led the pack, with USD71.2bn in offerings, although down by c.8% compared to 2021.

-

Chinese markets have been resilient to global volatility, cutting interest rates in an effort to end the real estate crisis

Asia Pacific (APAC) is better placed to avoid recessionary pressures and has continued with the IPO trend.

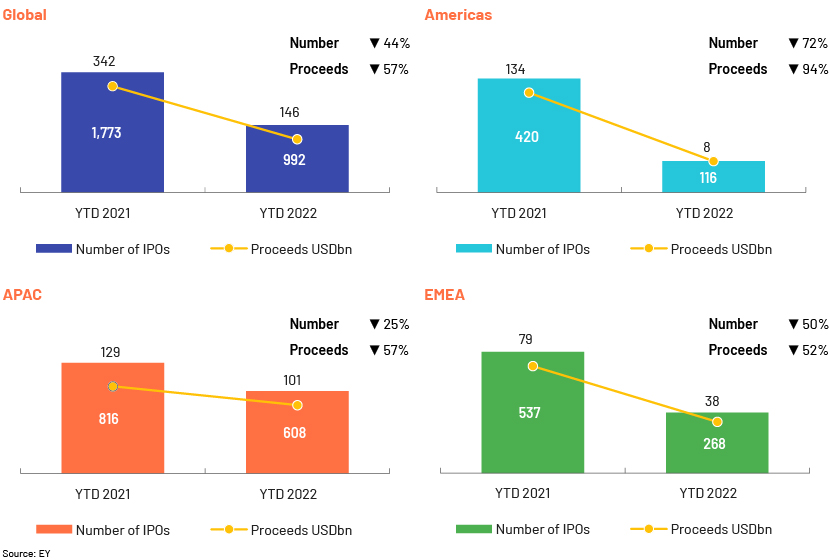

IPO activity declined 44% in terms of number of deals and 57% in terms of proceeds in 9M 2022. In the Americas, the number of deals fell by 72%, followed by a 50% drop in EMEA and a 25% drop in APAC. The Middle East remained a rare winner, with a 209% increase in proceeds, despite a 51% decrease in the number of deals.

In 2021, nearly 400 companies in the Americas raised as much as USD142.4bn through IPOs, the highest since the dot-com boom. In 2022, there were only c.70 IPOs, which raised USD7.7bn.

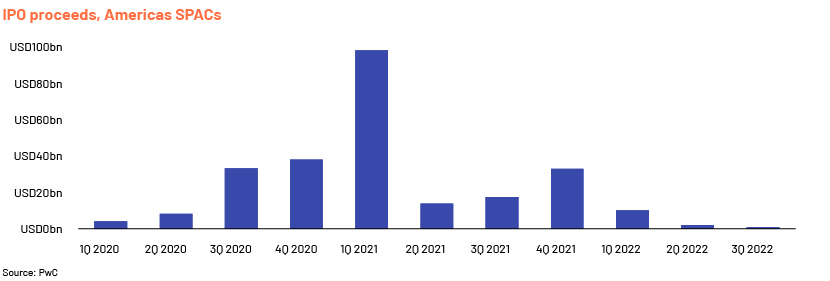

SPACs accounted for most of the IPOs in 2021. However, SPAC-related activity declined in the second half of 2021 as the Securities and Exchange Commission (SEC) stepped up scrutiny. Although an alternative route for private companies looking to gain entry into the public market, SPACs also took a hit.

Factors driving the IPO market’s comeback in 2023:

-

Certainty in the equity markets, along with decent index performance and trading volumes Due to weaker valuations and subpar stock-market performance, the average deal size decreased, and fewer significant IPOs were launched in 2022. Weakened stock markets, valuations and post-IPO performance have further dampened IPO investor sentiment. For the IPO market to become more active again, positive sentiment and an uptick in stock-market performance are key.

-

Companies with sustained profitability and strong cashflow, with competitive differentiation Many companies backed off in 2022 from going public, unprepared for an economic backlash. However, those companies that can satisfy the "rule of 40" (a combined revenue growth rate and profit margin that equal or exceed 40%) would be the best positioned in the current environment.

-

Stabilisation of market volatility (VIX) and valuations Stable to improving multiples and a volatility index in the low 20s will serve as the foundation for the IPO market to reopen no later than 3Q 2023. Additionally, the lead time for IPOs from filing to listing may postpone the listings to 2H 2023. Although the 2021 highs may not be achieved, a normalised level is expected.

-

Stable inflation and visibility on the interest rate hike trajectory Stock-market valuations negatively impacted the IPO market in 2022. High-growth IPO deals were undermined by growing inflation and interest rate hikes intended to control inflation. Markets would advance when there is conviction that inflation has peaked and interest rates are stabilising, providing more clarity, likely in 3Q 2023.

There is no such thing as a perfect IPO window; it is different for every company and sector. However, the timing of an IPO can impact valuations.

Investor sentiment can help assess a good time to enter. Whether or not it is an active IPO year depends on the overall strength of the stock market. When stock prices increase, indices break new records and investors are optimistic about the stock, further driving up stock valuations. Private companies could capture this phase of higher valuations by selling their stocks to the public. In the long run, however, IPO timing and stock performance are independent.

While most private equity firms are busy calculating their exit options and the path to liquidity for their portfolio companies, the current sluggish scenario could also be seen as a good time to assess IPO-readiness. As investors navigate through uncertainty, they are looking for sustainable profits. Private equity firms could build a solid case of growth and profitability to attract them.

This low level of activity will likely continue for a while. However, lower interest rate hikes and visible corrections in inflation rates could provide relief and strengthen the markets. Recent Fed forecasts indicate 2023 will be a year of slower interest rate hikes, suggesting IPO activity will rebound. Although the rebound may not be to the levels seen in 2021, we believe the initial wave of IPOs will mainly be from companies with increasing cashflow and a record of high earnings.

We have no doubt the stock and IPO markets will bounce back. A stable market, along with regulatory reform, could boost the 2023 IPO pipeline with more listings.

How Acuity Knowledge Partners can help

We provide a broad range of equity capital markets (ECM) support to investment banks and advisory firms globally. Our experts provide end-to-end support to ECM advisors, helping onshore teams on live transactions and regular workstreams related to IPOs, FOs, registered direct offerings (RDOs), PIPE transactions, rights, convertibles and other equity-related offerings.

Sources:

-

https://www.pwc.com/gx/en/services/audit-assurance/ipo-centre/global-ipo-watch.html

-

https://wtop.com/news/2022/12/10-best-upcoming-ipos-to-watch-in-2023/

-

https://www.ey.com/en_gl/news/2022/09/global-ipo-market-continues-to-plummet-as-q3-draws-to-a-close

Tags:

What's your view?

About the Authors

Shubha Kamath has over 6+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Consumer and retail team for a U.S. based mid-market Investment Bank, in Bangalore. She has good exposure working through the deal life cycle, including deal origination to deal execution. She has experience working on different pitchbooks, evaluating business dynamics and CIMs. She has extensive knowledge in financial modelling and capital structure analysis. Prior to joining Acuity, she was part of sell side research team of Crisil Ltd. She holds a Master’s degree in Business Administration in Finance.

Vishal Kashyap has over 3+ years of experience working across various stages of the deal making process. Currently, supports M&A group for a U.S. based mid-market Investment Bank, in Bangalore. He carries good experience, working on different products in the IB value chain. He is well versed in making teasers, industry research, SOTP analysis, WACC analysis and valuation model. Previously worked with Verity Knowledge Solution and Deloitte, and holds a Post Graduate Diploma in Management in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox