Published on June 17, 2019 by Aradhna Chaudhry

The global financial industry is seeing steady growth in Islamic finance as an alternative source of lending. Islamic finance offerings differ from their conventional counterparts due to their compliance with Sharia law, i.e., Islamic jurisprudence facilitating asset-backed transactions and risk-sharing investments instead of interest-bearing transactions. Islamic finance has emerged as a more ethical form of financing than the conventional ones and has become a popular source of lending for followers of Islam across the world. Interestingly, Islamic finance has started to expand into non-Muslim populations as well. Recent trends show that Islamic financial products such as sukuk (Islamic bonds), takaful (Islamic insurance), and waqf (Islamic endowment) continue to carve a niche for themselves in global financial markets.

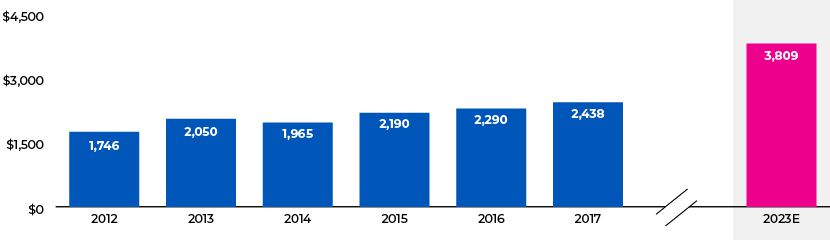

Global Islamic Finance Assets Growth

Source: IFDI 2018, Thomson Reuters

An emerging financing channel

Although the Islamic finance industry is much smaller than the traditional financial industry, we believe its strong growth within a short period of time proves its success. The global Islamic finance market stood at USD2.4tn as of end-2017, having grown at a CAGR of c.6% in five years. In contrast, the traditional industry (including global central banks, financial institutions, other financial intermediaries, and public financial institutions) stood at USD314.5tn, having grown at a c.4% CAGR over the same period. In addition to these positive historical trends, the outlook for Islamic finance remains positive. The industry is expected to reach USD3.8tn by 2020, according to a Thomson Reuters report in mid-2018. The large and widening global funding gap and growth in the global Muslim population are major drivers of the growing popularity of Islamic finance products even outside the Gulf countries.

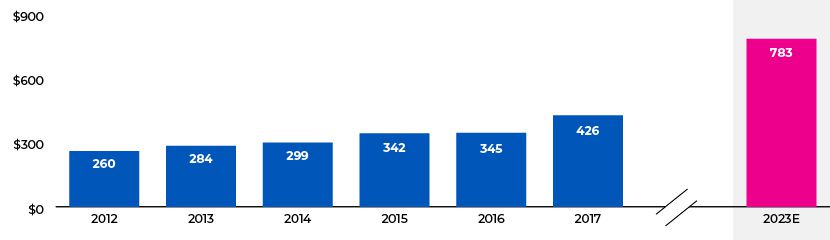

Sukuk Assets Growth

Source: IFDI 2018, Thomson Reuters

Narrowing the global funding gap

Asia is considered to be a thriving market for infrastructure development. The Asian Development Bank estimates that c.USD1.7tn of funds are required annually to cater to the region’s development needs until 2030. This creates a significant requirement for credit. It is believed that the asset-backed nature of Islamic finance can bridge the infrastructure-linked funding gap. Infrastructure projects provide stable cash flow through long-term concessions. Cash flow derived from clear asset sources makes infrastructure-related financing more attractive for Sharia-compliant products. Similarly, we believe the existing credit funding gap in other sectors, such as the micro, small and medium-size enterprises (MSME) sector, could be narrowed by introducing Islamic finance. Currently, in developing economies alone, the MSME credit gap is estimated at USD4.5tn, more than 1.3 times the current level of funding available to the sector. Considering the significance of MSMEs in driving economic growth and the importance of infrastructure development in emerging markets, we believe Islamic finance could bridge the funding gap.

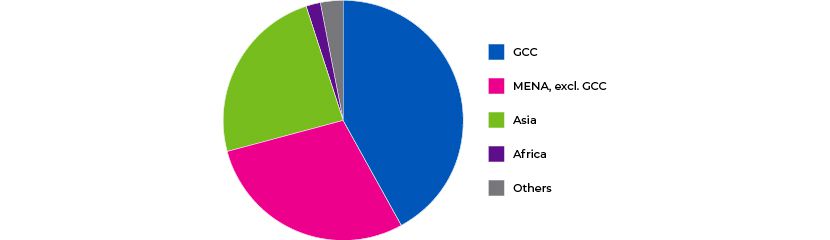

Breakdown of Islamic Financial Services by region, 2017

Source: Islamic Financial Services Industry Stability Report 2018, IFSB

Tapping a large potential market

The growing global Muslim population affords significant opportunities. Recent studies show that the Asia-Pacific region and Africa are home to over 60% of the world’s Muslims, making them lucrative markets for distributing Islamic finance products. Some Asian and African countries have already started to build inclusive environments for Islamic finance. For example, South Africa, Nigeria, and Kenya have introduced legal and regulatory frameworks focusing on the development of Islamic finance products. Indonesia, one of the most mature Islamic finance markets among non-Islamic countries, has already started to capitalize on unmet capital demand there with the use of fintech. Many Sharia-compliant fintech providers are planning to increase lending in the country, where more than 40% of the population lacks access to financial services.

The Islamic finance industry is still in a nascent stage. We believe continued effort by governments and financial agencies globally to build a more inclusive financial environment and to strengthen legal and regulatory frameworks will help elevate it in the coming years.

At Acuity Knowledge Partners, our investment research team helps buy-side clients to stay abreast of new investment frontiers, validate long-term theses and deal with the complex areas of evolving business models. This includes deep-dive analyses, thematic research, and competitive landscape analyses. Our team of fundamental research experts and data experts can provide optimal solutions by combining alternative data and technology expertise to produce differentiated research insights.

Sources:

-

https://www.statista.com/statistics/421221/global-financial-institutions-assets-by-institution-type/

-

https://www.whitecase.com/publications/insight/islamic-finance-africa-opportunities-and-challenges

What's your view?

About the Author

A Level II CFA candidate, Aradhna Chaudhry is a member of the Investment Research team at Acuity Knowledge Partners. She has nearly five years of work experience and currently supports buy-side clients on financial models, recommendation reports, earnings reports, and thematic notes. Aradhna also holds a Bachelor in Science (Chemistry) degree from St. Stephen’s College, Delhi.

Comments

18-Jun-2019 06:02:08 am

It is good to introduce sharia(ethical) banking in India for an unbanked fraction of people in which no interest is charged. But We don\'t have prior experience in sharia banking and may not aware of a lot of complexities involved in lending as per sharia law coupled with a lot of regulatory and supervisory headwinds. To be sharia-compliant India has to possible overhaul its banking system, a pretty much herculean task for anyone. But I think we can gradually shift to this banking system under our current banking infrastructure and leverage this potential funds as a growth driver so to propel ourselves in the path of sustainable economic developments

Like the way we think?

Next time we post something new, we'll send it to your inbox