Published on September 16, 2024 by Rony Chacko

The global financial system is an amalgamation of trading strategies and methods that fuel the global economy. Often neglected, although a key investment strategy in the financial world, is the carry trade.

This investment strategy serves as the primary foundation of Japan’s low interest rates. However, in July 2024, Japan made the unexpected decision to hike its interest rate, leading to serious repercussions for both domestic and international markets. This blog examines what carry trades are, how they work and why Japan’s interest rate hike in particular had such an impact on global markets.

What is a carry trade?

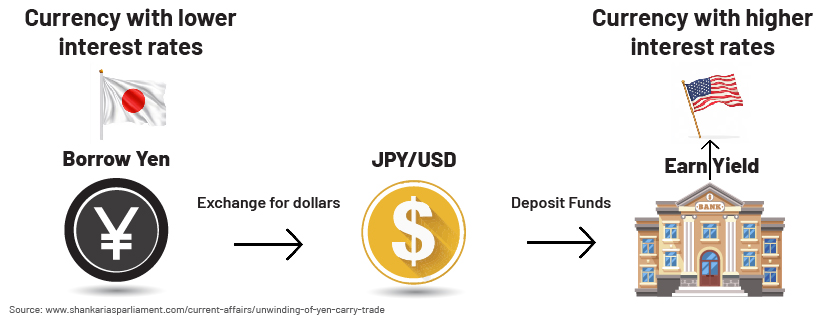

A carry trade is an investment strategy where investors borrow money in a currency with low interest rates and re-invest it in assets denominated in a currency with high interest rates. The key factor here is to profit from the difference in interest rates between two currencies.

For example, if an investor borrows in Japanese yen (JPY), which has an extremely low interest rate, and re-invests in a currency such as the USD that typically offers higher return, the difference in the interest rates can be earned as a profit.

The 2024 interest rate hike – a significant moment for Japan

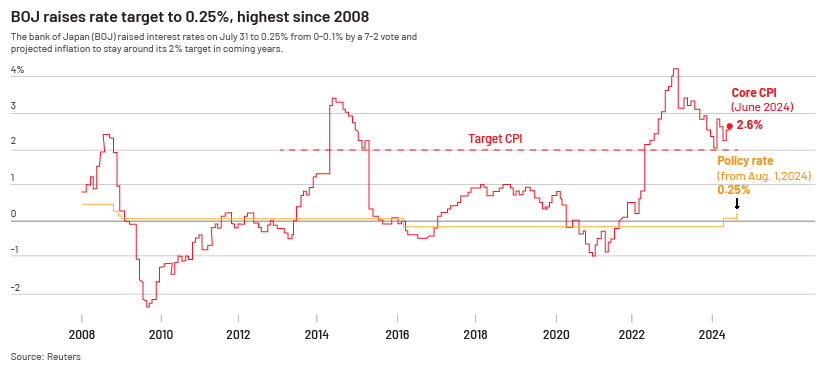

In 2024, the Bank of Japan (BoJ) announced its decision to raise the interest rate from 0.1% to 0.25% due to increasing inflationary pressure. The interest rate had been steady for decades, and this sudden change surprised investors across the globe.

The increase in interest rate, however trivial, diminished the attractiveness of borrowing in JPY as the cost associated with the carry trade increased. The rate hike substantially affected potential profits/risk-reward of investors who had borrowed extensively in JPY and re-invested in high-yielding sources of income.

Impact on Japan’s stock market

The reaction of Japan’s stock market was immediate. The Nikkei 225, Japan’s benchmark index, showed significant volatility after the announcement. Investors, who for decades had been accustomed to the BoJ’s low interest rates, suddenly faced a new challenge with the cost of borrowing in JPY set to increase.

Segments that depended heavily on low-cost financing experienced a significant selloff in the stock market. Companies that used to benefit from low-cost borrowing faced the challenge of eroding profits as interest rates increased, and foreign institutional investors (FIIs) saw a steep decline in the value of their portfolios as bond yields increased.

Global repercussions due to Japan’s interest rate hike

The impact of Japan’s interest rate hike was not limited to the domestic market; the shockwaves spread to global financial markets, causing widespread panic and price volatility.

Stock markets in Asia were among the first to feel the heat. As the JPY strengthened, other Asian currencies felt the strain. South Korea’s KOSPI Index and Hong Kong’s Hang Seng Index saw sharp declines as investors feared an economic slowdown.

Although small, the interest rate hike raised many questions on the possibility of re-evaluating the prospects of European and US markets for the future as JPY carry trades became less attractive, leading to reduced risk-reward for investors. European markets experienced declines on rising concern that a stronger JPY would impact global trading. The US benchmark indices (S&P 500 and Dow Jones) faced heavy selloffs, especially in sectors with substantial involvement in the Japanese market.

Long-term implications for global stock markets

Japan’s recent interest rate hike indicates a possible change in the foreign exchange environment. It may influence the relationships between financial markets and how they trade across the globe. This suggests that even the BoJ, whose monetary policy is inclined towards lower interest rates, is switching to tighten economic policy in response to rising inflationary pressures.

Japan’s higher interest rate would contribute to an increase in international bonds and their respective coupon rates, ultimately putting pressure on stock market valuations. The rate hike could induce a shift in investors’ future investment strategies too.

Conclusion

Japan’s 2024 interest rate hike was not just an adjustment in domestic policy; it was a global event with wide-ranging effects. The shockwaves that spread to global stock markets were intense, making investors realise the impact of even a small change in one country’s economic policy on global markets.

The key lesson for investors is that the carry trade, while profitable, does not refrain from any risks. Japan’s interest rate hike is a reminder of the importance of staying vigilant in a dynamic global market. The future of carry trades would depend largely on the actions of central banks, not only Japan’s but around the world. Investors would need to diligently navigate this new outlook, recognising that the era of low interest rates may be coming to an end.

How Acuity Knowledge Partners can help

We are a leading provider of bespoke research, analytics and technology solutions to the financial services sector, including asset managers, corporate and investment banks, private equity and venture capital firms, hedge funds and consulting firms.

We help clients track their FX exposure across currencies and flag breaches of exposure thresholds. Client teams can also use our expertise in sourcing FX rates and tracking FX rate volatility. We also support the cash management and reporting processes of asset and investment management firms.

Sources:

-

https://www.jhinvestments.com/viewpoints/investing-basics/what-is-a-carry-trade-

-

https://www.weforum.org/agenda/2024/08/explainer-carry-trades-and-how-they-impact-global-markets/

Tags:

What's your view?

About the Author

Rony has 3+ years of experience in investment banking operations, trade settlement, custodian operations and equity and fixed income securities operations. At Acuity, Rony is a part of trade settlements team. He resolves settlement issues and queries on behalf of investment managers and assists in resolving queries with several brokers and custodians. He was working as a Senior securities operations representative with Wells Fargo before joining Acuity. He holds a Master of Commerce degree from CMS College of Science and Commerce, Tamil Nadu and a Bachelor of Commerce degree from St. Thomas College, Kerala.

Like the way we think?

Next time we post something new, we'll send it to your inbox