Published on September 3, 2024 by Guojiao Li

Background: Japan’s interest in developing AI

As the world witnesses the rapid progression in artificial intelligence (AI) and generative AI (GenAI), attention is often directed towards advancements in the US, China and India. Japan's contributions, despite being important, are often less discussed. It may surprise many that Japan has been focusing on AI for a while. The Japanese government devised AI Strategy 2019, a vision statement to make Japan an "AI-ready society", with a wide range of policies, from cultivating talent and research development to practical applications and entrepreneurial support.

Why AI for Japan? With a unique set of challenges such as an ageing population and a constant shortage of labour, Japan recognises the necessary role of robotic assistance and AI technology. This was underlined by Prime Minister Kishida Fumio's recent meeting with Mark Zuckerberg in February, indicating the government's strong vested interest in AI and future tech.

Identifying the roadblocks

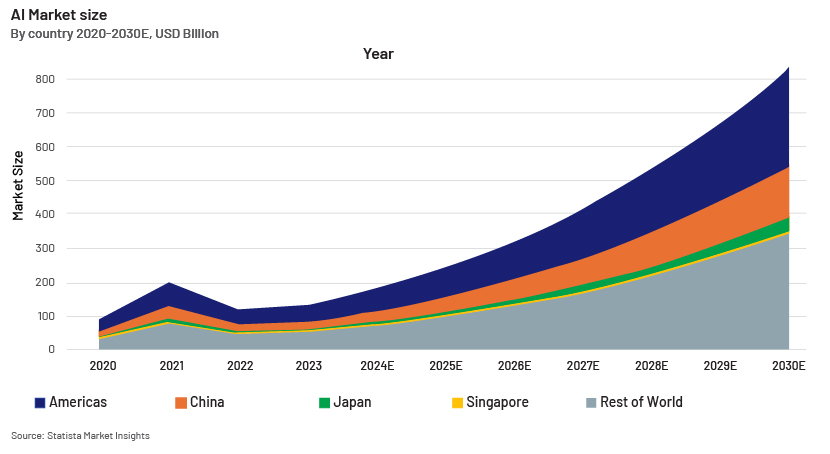

Japan has historically advanced significantly in technological innovation, but its progress in AI development is widely recognised as lagging behind that of most of the G7 nations. Japan’s AI market was worth USD6bn in 2023, according to Statista Market Insights, in contrast to China's equivalent AI market worth USD25.1bn and the US AI market worth a staggering USD47.4bn. At the current pace of development, the gap between Japan and other countries is likely to widen, as the following graph shows.

The challenges in both development and application are many:

-

Shortage of AI talent: With the evolution of the IT industry and the prospects of the AI sector, the Japanese authorities are intensifying the education and training of digital workers, increasing the IT workforce. However, there is still a gap in digital talent, causing staffing difficulties for AI-related companies. Japan is projected to face a deficit of 789,000 software engineers by 2030, according to data from Japan's Ministry of Economy, Trade and Industry.

-

Lack of computing power: The key to GenAI is large language models (LLMs), capable of being trained on large amounts of text and code datasets. Japan is far behind in the computing power required to support LLMs. Only around 3,000 firms in Japan can use a supercomputer housed in the government's National Institute of Advanced Industrial Science and Technology (AIST), which delivers 0.8 exaflops of computing power, according to Japan's Ministry of Economy, Trade and Industry. This is less than 10% of the computing capacity that OpenAI had at its disposal in the development of ChatGPT.

-

Challenges of adopting GenAI in the workplace: In a survey conducted by Nomura Research Institute in November 2023 on the challenges of using GenAI, the most common response was "a lack of related abilities and skills" (64.6%). The second most popular answer was "difficult to manage and mitigate risks of AI" (61.4%). The adoption of new technologies such as GenAI may also be impacted by Japan's traditional work environments and hierarchical systems.

Local efforts and AI development

Local tech companies have been participating more in GenAI development, showing their willingness to overcome the current problems. NEC has now developed GenAI for commercial use. The initial internal trial revealed that the system cut the time needed to generate source code for internal development by 80% and the time consumed in documenting by 50%.

A weakness in Japan’s case for developing AI is that if the LLM is fed with Japanese-language-only information, sources for data learning would be very limited. Companies are working on the language barriers. Local digital advertising company CyberAgent launched an LLM in May 2023, stating that it was one of the few models that "specialised in the nuances of Japanese linguistics and culture".

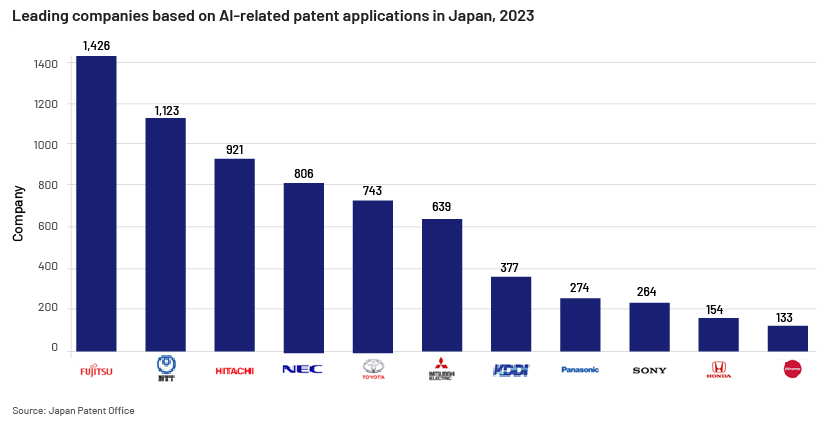

Fujitsu and NTT take the lead in AI patents, demonstrating their ambitions.

Solutions

Recognising these bottlenecks is the first step towards overcoming them. To effectively tackle these challenges, key organisations in Japan’s public and private sectors could take the following steps to strengthen its presence in AI:

-

Invest in education and cultivating talent: Make strategic investments in the education system to develop talent in software development. This could involve revamping school and university curricula, with a strong emphasis on AI, data science and machine learning.

-

Attract global talent: Look at easing immigration restrictions for top global talent in the AI sector, satisfying growing demand for AI professionals.

-

Strengthen public-private partnerships: Consider, for example, collaborative research between industry-leading companies and universities to encourage the development of advanced technologies related to AI.

-

Invest in computing power: The government and companies could invest in infrastructure to increase computing power crucial for LLM development. Investing in high-power computing capacities also provides ample opportunities for hardware companies, data centres and tech maintenance enterprises in AI technologies.

-

Provide AI education: Educational institutions could implement initiatives to provide AI training to all interested, regardless of educational background or professional expertise.

-

Simplify AI adoption: Companies need tools and platforms that can simplify the process of AI adoption, so that even organisations with limited IT abilities or personnel can take advantage of these powerful tools.

Outlook

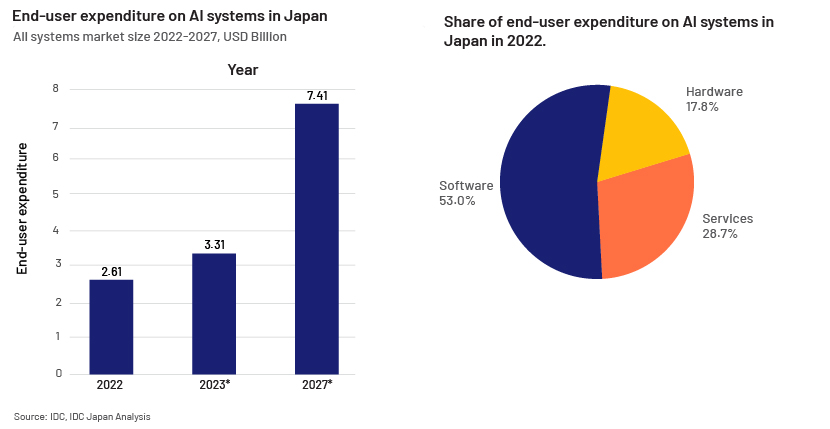

Japanese businesses are increasingly adopting GenAI for a range of applications, including to enhance work efficiency, to automate text analysis and for drafting. The AI market has significant growth potential. End-user expenditure on AI systems in Japan reached USD2.6bn in 2022, of which 53% was spent on software systems. With projections suggesting a substantial increase, the market is likely to grow to USD7.4bn by end-2027.

The business landscape will soon be shaped by growth in AI, and Japan is uniquely placed to leverage the opportunities. Despite the headwinds, Japan's strong resolve, backed by national strategies and a keen interest in embracing AI, is promising.

How Acuity Knowledge Partners can help

Our research experience covers Japan, helping us understand the landscape of its AI market. Our extensive research in the past included

-

in-depth case studies of AI-driven supply-chain management in Japan’s retail sector

-

exploration of business model innovations with AI applications in Japanese companies

-

benchmarking Japan’s data-centre capacities

-

sector analysis of GPU suppliers

-

a comprehensive review of the regulatory environment for AI in Japan, etc.

We already advise over 600 financial institutions around the world and would be happy to work with you to help define and accelerate your journey with AI.

Sources:

-

https://asia.nikkei.com/Politics/Japan-to-ease-regulations-on-medical-AI-software

-

https://asia.nikkei.com/Business/Companies/SoftBank-s-Son-slams-Japan-as-underdeveloped-on-AI

-

https://www.nec.com/en/global/insights/article/ChatGPT-for-Japanese-governments/index.html

-

https://japannews.yomiuri.co.jp/society/general-news/20230618-116944/

-

Statista Market Insights

-

https://www.statista.com/statistics/1244620/japan-artificial-intelligence-systems-market-size/

Tags:

What's your view?

About the Author

Guojiao Li joins as an analyst at Acuity Knowledge Partners. Her role involves in-depth research, data analysis, and monitoring industry trends to support decision-making processes for global clients. In consulting team, she provides valuable insights with a focus on Japanese topics. Guojiao holds a Master of Science degree from the University of Tokyo, where she developed a strong analytical background.

Like the way we think?

Next time we post something new, we'll send it to your inbox