Published on November 21, 2024 by Maruti Patnaik and Anamika Deshwal

The fintech sector is growing exponentially, holding the attention of many investors over the years. The lucrative sector has attracted many traditional players to enter and offer services around payments, banking-as-a-service, embedded finance and digital lending, among others. Its growth has been driven primarily by technological advancements and customer demand. Increasing government focus on financial regulation, compliance and ESG considerations is expected to attract additional investments to the regtech domain, taking these startups from the seed stage to the next level.

Global investment

-

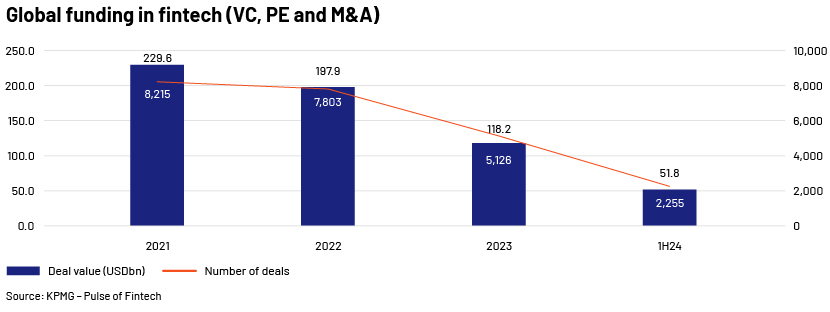

1H24 witnessed a decline in global fintech investment amid the high-interest-rate environment and significant global geopolitical uncertainty. The decline in deal value was partly due to the decline in large deals as fintech investors became cautious with their investments. Total global investment declined to USD51.8bn in 1H24 from USD62.3bn in 2H23.

Regional investments

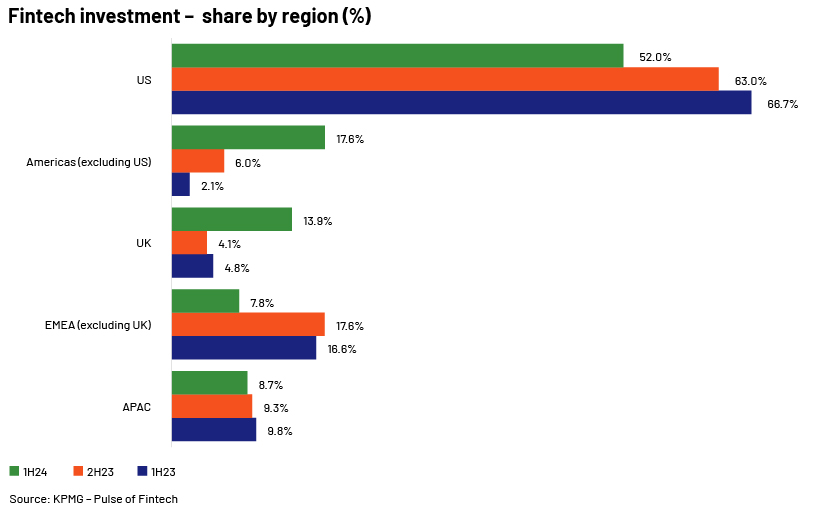

All regions experienced a noticeable drop in fintech investment in 1H24, with EMEA experiencing the sharpest drop.

-

Americas – This region attracted the largest share of fintech (69.6%) investment in 1H24 of around USD36bn.

-

EMEA – This region witnessed a 40% decline in fintech funding in 1H24 compared with 2H23, primarily due to continued geopolitical uncertainty, including elections in the EU, the UK and France, combined with the high-interest-rate environment. Within EMEA, the UK accounted for the largest share (64%, USD7.3bn) of fintech investment in 1H24.

-

APAC – This region has witnessed quarters of sluggish investment since 3Q17.

Reasons for the decline in fintech funding and valuations

Fintech funding has declined significantly, due to factors such as rising interest rates, market volatility and a more cautious approach from investors.

-

Squeezed margins: Margins are being squeezed across most consumer debt products, particularly in home lending. Mortgage rates have increased with the prime lending rate. Economic headwinds such as high interest rates and continued inflation are forcing fintechs, specifically consumer lenders and digital lenders, to seek new revenue streams or cheaper capital sources. Fintechs unable to maintain steady cash flow from their operations are facing a decline in margins, and this pressure also leads to a decline in valuations.

-

Oversaturation: The fintech sector has become increasingly crowded, with a proliferation of startups offering comparable or overlapping services. This competition is putting downward pressure on valuations as investors seek to identify distinguished players.

-

Valuation reset: Fintech startups are facing a valuation reset primarily due to the lack of IPO exits, deteriorating macroeconomic conditions and a slower path to profitability exerting pressure. The market correction caused fintech valuations to fall, and a number of firms faced down rounds in market capitalisation.

Banks are increasingly participating in fintech investment

-

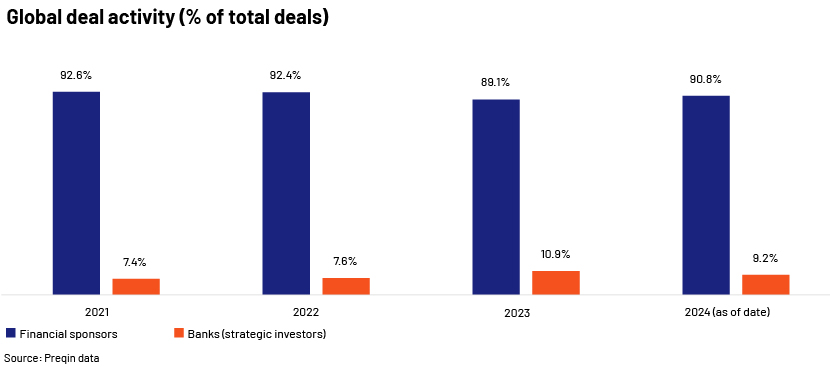

The most active investors in fintech are venture capital (VC) and private equity (PE) firms such as Coinbase Ventures, Tiger Global, 500 Global, Blackstone and Carlyle. However, bank investments in fintech have increased in recent years. Banks’ share of global funding deal activities increased to 10.9% in 2023 from 7.4% in 2021.

-

Banks are progressively investing in fintech to stay competitive, focusing on strategic deployment for efficiency and an enhanced customer experience. Big banks such as Citigroup, Goldman and JPMorgan Chase & Co. have increased their investments in fintech startups over the years.

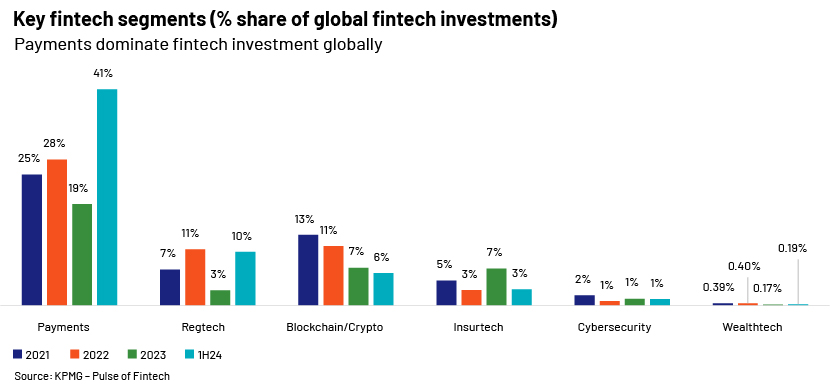

Sector investments – Payments dominate fintech investments globally

Large fintech and payment buyouts will continue: The presence of large PE firms such as Blackstone and Carlyle in the space makes the payments and software sectors ideal for investment due to their strong revenue growth and healthy margins. There have been many buyouts in the fintech and payments space in recent quarters, including the acquisition of Nuvei for USD6.2bn by Advent, Coupa for USD8.0bn by Thoma Bravo, and Worldpay for USD12.5bn by GTCR.

| Global |

|

| Europe (UK) |

|

| Americas (US) |

|

| APAC |

|

Fintech trends to watch

-

Embedded finance

-

The embedded finance solutions market is expected to reach USD7.2tn by 2030, according to analysis by Dealroom, surpassing the combined value of fintech startups and the top 30 global banks and insurance companies. Growth of embedded finance solutions is reducing the silos in finance and other sectors, offering users convenient access to financial services.

-

-

Regtech

-

Regtech is set to attract increasing interest and investment, driven by the frequent changes to regulatory regimes and the growing complexity of reporting requirements.

-

-

Open banking

-

The development of open banking, catalysed mainly by the increased penetration of smartphones and the evolution of technology, has enabled digital banks to take advantage of interconnected IT architectures. More than 130m individuals globally are expected to use open-banking services by 2024, indicating growth of more than five times in just four years. GlobeNewswire predicts that the open-banking market will be worth USD43bn in 2026 versus USD7bn in 2018. The UK is currently the leader in open banking, followed by Germany, the Netherlands, Spain and France. After Europe, China is reported as having the largest open-banking market.

-

-

Decentralised finance (DeFi)

-

DeFi would introduce a paradigm shift in the financial landscape, leveraging blockchain technology to enable peer-to-peer financial services without intermediaries. It enables cryptocurrency-based transactions, exchanges and financial services.

-

-

Sustainable finance and climate fintech

-

ESG fintech remains an attractive area of investment, particularly carbon measurement and tracking. Certain fintech entities and banks are already forging ahead in sustainability, with a number of neobanks and payment providers committing to disclosure. These firms are actively developing environmentally friendly financial products and services.

-

Fintechs are also creating digital solutions that aim to tackle global environmental issues. Industry pioneers are fast allocating resources to green initiatives such as sustainable power. Capital is likely to continue flowing towards sustainable projects in 2024. Investors’ links to green bonds and renewable-energy projects are likely to increase through fintech platforms. Additionally, technologically advanced tools such as AI-powered tools would be used to a greater extent to analyse ESG data to empower investors to make informed decisions aligned with climate goals.

-

-

Generative AI and ML

-

There is growing investor focus on AI-powered fintech offerings, including in emerging areas such as behavioural intelligence. Generative AI (GenAI) has catalysed a new wave of innovation in financial technology – Finastra’s State of the Nation survey found that the number of decision-makers at financial institutions who had improved or deployed AI capabilities over the past 12 months had increased globally to 37% in 2023 from 30% in 2022. With additional information, GenAI can be used to produce financial solutions; for example, it can recommend significant instalment strategies or notices, aid in fraud detection and assist with further developing client reliability and fulfilment. GenAI-powered chatbots can also provide real-time customer assistance, answering queries and resolving issues promptly.

-

Fintech firms, along with traditional banks, will continue to invest heavily in GenAI in 2024 to keep up with market demand to significantly enhance efficiency and personalised customer service. GenAI adoption would reshape fintech operations and aid in strategic decision-making.

-

How Acuity Knowledge Partners can help

We keep abreast of developments and enhancements in the financial services and fintech space. We offer a wide range of tailored solutions and capabilities, including market assessment, competitive landscape and positioning, competitive benchmarking, competitor tracking, opportunity assessment and market-entry strategy. Our unique approach, combining processes, people and technology, helps deliver faster results and drives excellence for our clients. Several industry leaders leverage our proprietary suite of business excellence tools and offerings to unlock new levers of business growth and unmatched returns on investment. We currently support the world’s top financial services and fintech firms with our team that offers coverage across geographies.

Sources:

Tags:

What's your view?

About the Authors

Maruti has more than 10 years of experience in technology research and consulting. He currently works with the marketing and research teams of a leading fintech supporting them execute their go-to-market strategies. Prior to joining Acuity Knowledge Partners, Maruti worked for GlobalData where he worked on areas around emerging themes such as AI, business intelligence, cloud, 5G, payments, and retail.

Anamika Deshwal is a part of Acuity Knowledge Partners – PE & Consulting team, wherein she has worked on projects for numerous clients across sectors including technology, financial services,and payments.Her functional expertise includes strategic research, company profiling, competitor analysis & benchmarking, besides GTM market studies.Anamika holds a PGDM in Business Analytics from IMT Ghaziabad and BE in Electronics and Communication from Chitkara University, Himachal Pradesh

Like the way we think?

Next time we post something new, we'll send it to your inbox