Published on November 29, 2024 by Sanjay Heisanam

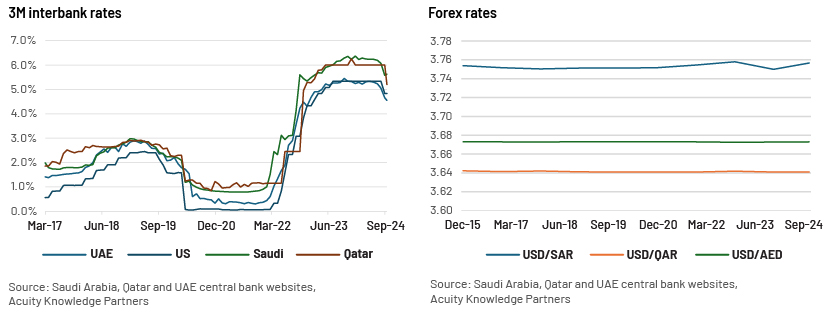

Gulf Cooperation Council (GCC) countries such as Saudi Arabia, the UAE and Qatar have a fixed-rate exchange regime, with their respective currencies pegged to the USD. A key mechanism used by the central banks of these countries to maintain their currency peg is management of the short-term interest rate differentials between their respective local rates and that of the US. This is also one of the key reasons for the close correlation in the movement of policy rates of these countries and subsequently their interbank rates – a key benchmark rate for banks. Now that the Federal Reserve rate has been cut twice – first by 50bps in September 2024 and then by 25bps in October 2024 – it raises an important question as to how the start of this interest-rate downcycle would impact the performance of GCC banks.

Will an interest-rate downcycle drive credit volume?

The Saudi banking sector’s credit volume momentum was slower yet healthy at low double digits in 2023 but weak for the UAE at a mid-single-digit and for Qatar at a low-single-digit run rate. Momentum in all three banking systems is likely to accelerate, led by corporate loans as the interest-rate downcycle progresses. A key factor likely to drive corporate loan momentum is the acceleration in execution of mega projects related to these GCC countries’ economic stimulus programmes, aimed at diversifying their economies away from oil.

A key goal of Saudi Arabia’s Vision 2030 programme is to increase the contribution of the country’s private sector and FDI to GDP. To this end, the Saudi government plans to invest a total of USD7.1tn over 2021-30 to develop its industries such as manufacturing, mining, housing, renewable energy, tourism and export. Retail credit in the GCC banking sector, particularly in Saudi Arabia, should also pick up pace, aided by the country’s ongoing subsidised mortgage programme to drive home ownership to 70% (from 64% in 2023).

Qatar’s 2031 Vision programme aims to double its GDP over 2021-31 via a number of measures with multiple end goals. Notable among them is its goal to raise the contributions from non-oil exports and tourism to GDP.

Qatar’s National Vision 2030 programme aims to make it an advanced country by creating an attractive business environment, drafting investor-friendly policies and developing alternative-energy infrastructure, all by leveraging its oil and gas resources.

Apart from these stimulus measures, the increasing regulatory focus on meeting ESG-related climate goals is also likely to aid in credit uptake. Top banks in this region already have ESG strategies and sustainable financing frameworks in place – the top three UAE banks have committed to financing 75% of the country’s sustainable financing target of USD265bn by 2030, according to McKinsey.

Is there enough liquidity in the system to support credit growth?

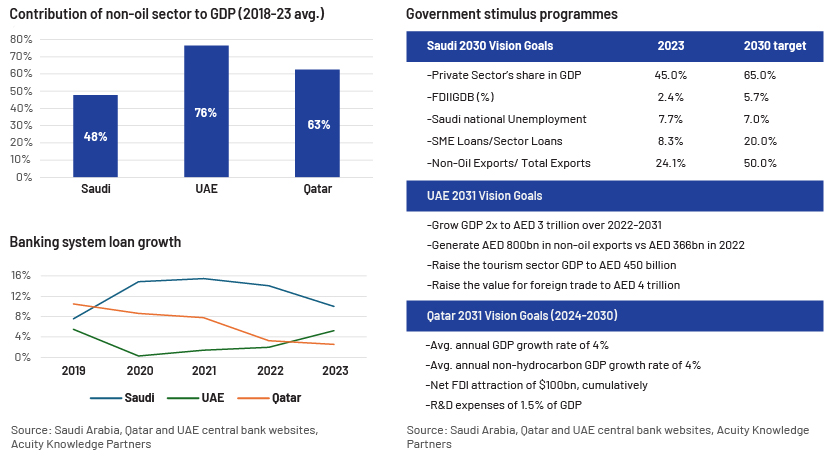

Deposits are the key funding source of GCC banking sector; growth performance has been diverging, with Saudi Arabia’s performance picking up markedly versus the flattish/underperformance of the UAE’s and Qatar’s. A lower run rate of deposits versus loans has resulted in a slight deterioration in the liquidity position, measured by the loans-to-deposits ratio (LDR), for Qatar, but Saudi Arabia’s and the UAE’s saw marginal improvements. The levels, however, give a different picture, with an average LDR of c.70% for the top four UAE banks, indicating a comfortable liquidity position, while Saudi’s LDR of >100% and Qatar’s LDR of >120% indicate a tight liquidity position. Against this backdrop, a lower-interest-rate environment should help ease the funding pressure of Saudi and Qatari banks by raising wholesale funds to meet the anticipated credit uptake.

What about the impact on NIMs?

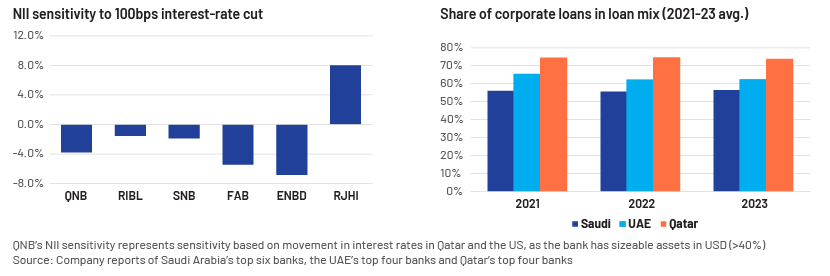

Rate cuts should lead to modest NIM downside for most of the large banks in these three GCC countries. Yield compression in their asset books is likely to outpace the drop in funding costs due to their corporate-heavy loan books – at 55-74% for the three banking systems – and the large share of CASA accounts in their deposit mix (over 40% for the UAE and around 50% for Saudi Arabia). The impact would vary, however, for individual banks depending on their asset mix, repricing gap, strength in deposit franchise and liquidity and capital positions. We see a net interest income contraction of 2-7% in the next 12 months for most large banks in this region for every 100bps drop in local rates, except for Alrajhi Bank (more than a 6% positive impact on NII). For Qatari banks, the negative impact of their large corporate loan books in a downcycle environment also comes with a substantial offset due to the repricing benefit of the sizeable time-deposit book (CASA accounts are c.20% of the system’s deposit mix). For example, QNB’s NII sensitivity is about a 4% contraction for every100bps drop in interest rates in Qatar and the US.

Revenue strength should improve in the medium term

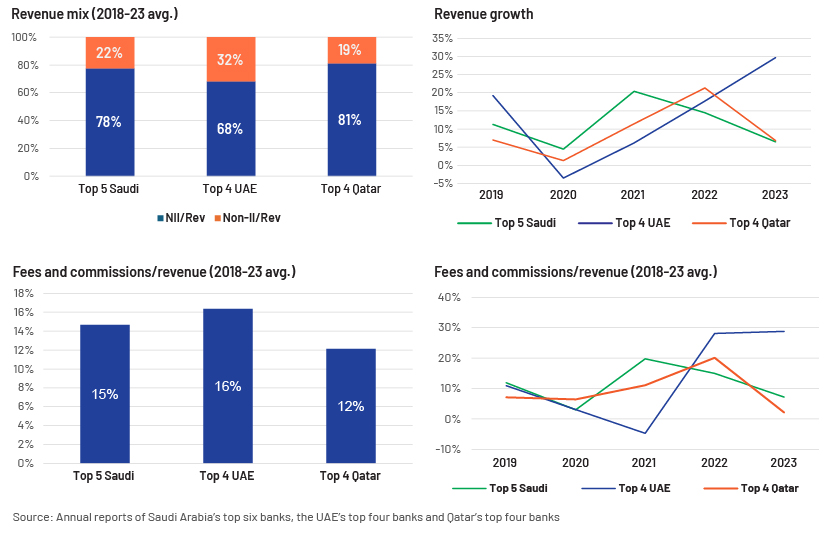

The revenue performance of these three GCC countries’ large banks has been robust post-pandemic, driven by a strong volume recovery in the initial phase and by an interest-rate upcycle in the later phase. Momentum, however, has come off from the highs of a 20-30% run rate in 2021-23, to 5-13% in 9M 2024. The UAE has outperformed peers due to its comfortable liquidity position and higher economic diversification.

NIM weakness, offset by better volume uptake, is likely to keep growth in net interest income moderate in the near/medium term. Revenue momentum, combined with continued strength in the fees and commission component – underpinned by higher business volume – should improve in the medium term.

Fee income franchises such as distribution, private wealth and asset management would also continue to benefit from favourable trends such as those in the past that saw AuM growth in the Middle East in the low teens in 2023 (versus a global average of 12%). Key current trends include the intergenerational wealth transfer, which is expected to reach c.USD1tn by 2030; increasing demand from the next generation of affluent individuals for broader access to international markets and asset classes; and the large influx of millionaires to the region looking to park their fortunes and for new business opportunities and luxurious lifestyle. Other balance sheet-driven fee components such as loan origination fees should also benefit from increased business activity. Treasury income – volatile in nature – should also benefit from the interest downcycle. The share of fee income in banks’ total income in these three GCC countries is sizeable at 16-23% (the annual average over the past five years).

Asset quality to remain benign and support growth

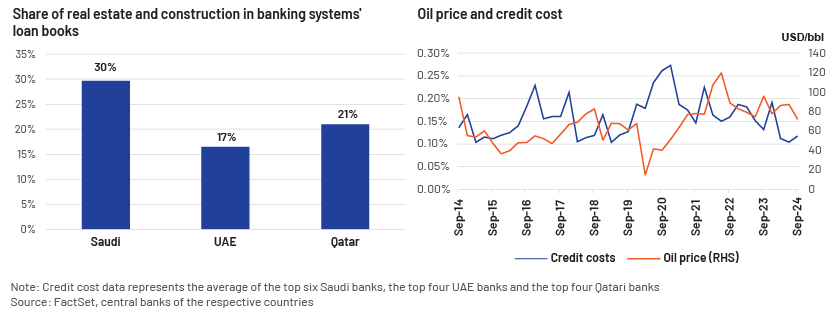

High interest rates and weak oil prices tend to pressure the asset quality of Saudi Arabia’s, the UAE’s and Qatar’s banks. The significant exposure of these banks to highly-interest-rate-sensitive sectors such as real estate and construction (accounting for 17-30% of banking-system loans) places stress on their balance sheets when interest rates are high. Low oil prices (less than USD60/barrel) also lead to an increase in NPL formation and, hence, banks’ credit costs. Resilient oil prices (despite geopolitical turmoil) and the deepening of the interest-rate downcycle should result in benign asset quality in the near to medium term, absent a major shock.

Scope for improving operational efficiency

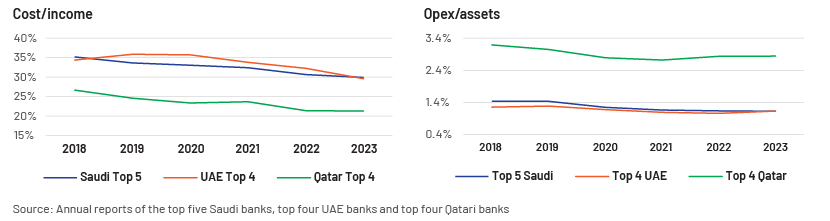

These three GCC countries’ banking systems have seen a remarkable increase in operational efficiency in recent years, with the downtrend in metrics such as the cost-to-income ratio (or the cost-to-assets ratio) supporting an 8-32% net income CAGR over 2020-23. Continued investment in IT technology and platforms by banks in the region to develop full-stack digital technology – mirroring the trend in emerging-market banking systems – has led to operational efficiency. More recently, Saudi and UAE banks have stepped up their investments in newer technology such as machine learning, advanced chatbots and AI applications. Such initiatives have a number of end goals: to enrich the features of the digital platforms, modernise the core, develop a cloud-based business model, collaborate with innovative non-banking players to create a robust ecosystem, achieve granular customer segmentation, improve the underwriting process and optimise marketing and sales efforts. This sets the stage for further improvement in operational efficiency.

Recent share-price performance

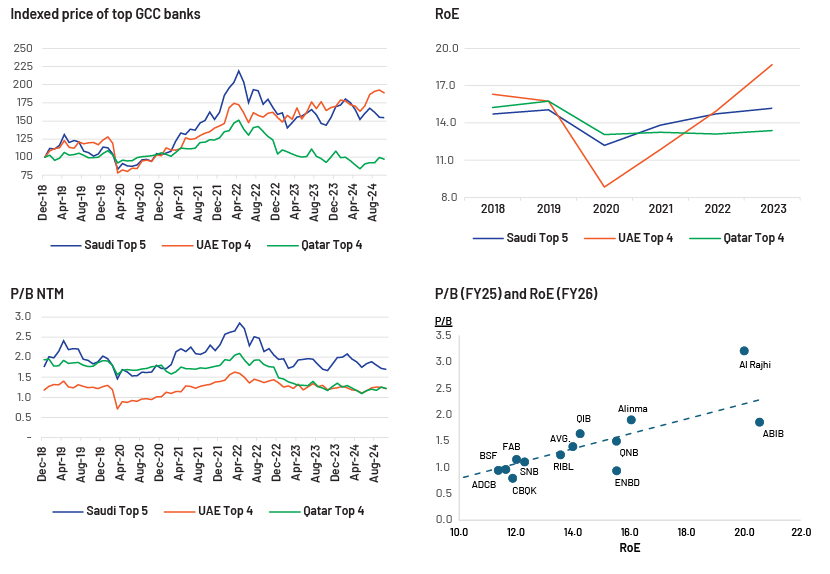

Share-price performance of the top Saudi and Qatari banks has remained weak since mid-2022 after a pandemic-induced surge, while that of the top UAE banks has continued to improve. This has led to the de-rating of NTM P/B multiples to a level below the past-five-year average for Saudi and Qatari banks. For UAE banks, the de-rating is shallower than that of the other two countries’ banks, with the current multiple on par with the past-five-year average. Capital-optimisation initiatives by these large banks – and the consequent higher dividend payout ratios in 2023 – have improved their RoE. Despite this, the momentum in share price was lower than growth in book value, as the higher-for-longer interest-rate environment is beginning to impact performance in the form of lower volume and NIM pressure.

Conclusion

Broadly speaking, GCC banks have enjoyed a strong financial performance post-pandemic, driven by lower impairments, an interest-rate upcycle and controlled expense growth, but with slower momentum recently. The top UAE banks’ RoE has increased significantly, while that of Saudi and Qatari banks has seen only a marginal improvement. The start of an interest-rate downcycle is likely to drive revenue momentum moderately in the near term and at a faster pace in the medium to long term, underpinned by government stimulus programmes and strong economic growth prospects. Combined with our optimism surrounding NPL evolution, benign credit costs and potential for further efficiency gains from the continued digital transformation, earnings momentum should also gather pace. Such a pickup, combined with a decent RoE (one of the best globally), should lead to a rerating of multiples for those banks with sound fundamentals and a sustainable competitive edge.

How Acuity Knowledge Partners can help

We work with asset managers as an extension of their research teams and help build their proprietary research products across equity and credit. Apart from research and advisory, we also provide services in areas such as sales and marketing, fund and management services, private equity portfolio management, investment compliance, and risk management. Our integrated solutions across asset classes and functions help wealth and asset managers improve investment performance, enhance client servicing, attract new client assets, and retain assets in the current complex business environment. Partnering with us, our clients have been able to achieve cost savings of 50-60% versus performing these functions in-house.

Many emerging-market stocks have limited coverage by large and small brokerage houses. Our Investment Research teams located in India, China, Sri Lanka and Costa Rica play a key role in filling the research gap our clients face due to challenges relating to language, cultural differences and niche market dynamics.

Sources:

-

https://gfmag.com/economics-policy-regulation/wealth-management-private-banking-gcc/

-

https://www.bcg.com/press/10june2024-middle-east-continues-its-year-on-year-growth

-

https://gfmag.com/economics-policy-regulation/wealth-management-private-banking-gcc/

Tags:

What's your view?

About the Author

Sanjay Heisanam has around 18 years of experience in investment research. He has been with Acuity Knowledge Partners (Acuity) since 2011 and has supported both buy-side and sell-side engagements. He is currently part of a team that provides research support to a global asset manager, covering more than 700 stocks across sectors and geographies in emerging markets. Prior to joining Acuity, he worked at Infosys and at a debt-brokerage house.

Like the way we think?

Next time we post something new, we'll send it to your inbox