Published on December 3, 2024 by Anusha Vuyyuru

Fintech has redefined the financial services landscape over the past decade with its applications across payments, banking, lending, wealth management, insurance and regulatory compliance. Fintech innovation, enabled by the internet and smartphone usage, has increasingly attracted investments to the sector, especially in the US market. This shift highlights significant fintech market trends and opportunities.

Investment trends in fintech

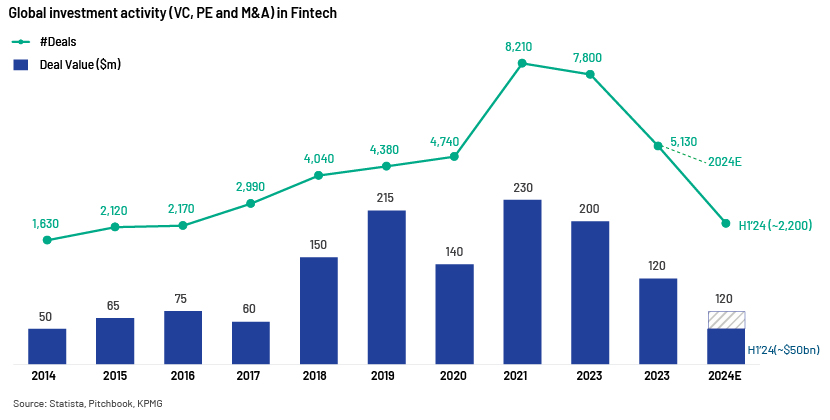

The fintech sector attracted large investments from venture capital (VC) and private equity (PE) firms over 2019-21, enabled by high cash reserves, low interest rates and pandemic-driven digitisation. Surplus liquidity in the market led to high valuation multiples (20x revenue in 2021) and the proliferation of startups in the sector. These fintech investment trends underline the growing interest in technology-driven financial solutions.

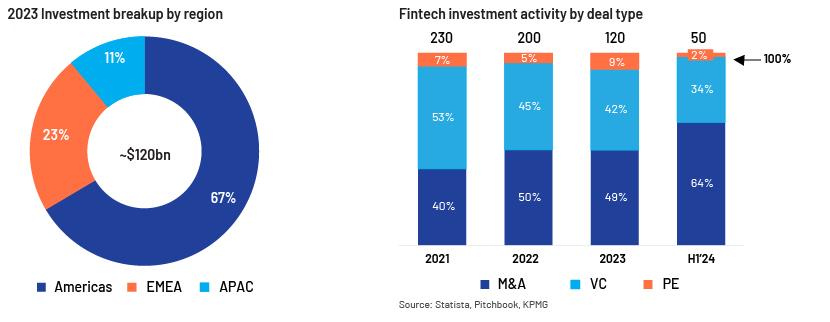

Investments in fintech have declined since 2H 2022 due to unfavourable macroeconomic factors, geopolitical tensions and high interest rates. Total investments in 1H 2024, amounting to USD52bn through c.2.2k deals across PE, VC and M&A, indicate the weakest funding activity since 2017. In addition to the decline in funding from PE/VC firms and lower deal valuations (6x revenue in 2023), the latest fintech trends reveal that the market has reached temporary saturation in product innovation. Companies have shifted focus from “rapid growth” to “profitability and cost discipline.” This has led to the consolidation of players across product offerings and regions, resulting in higher M&A deals relative to PE/VC funding.

Fintech market – growth projections

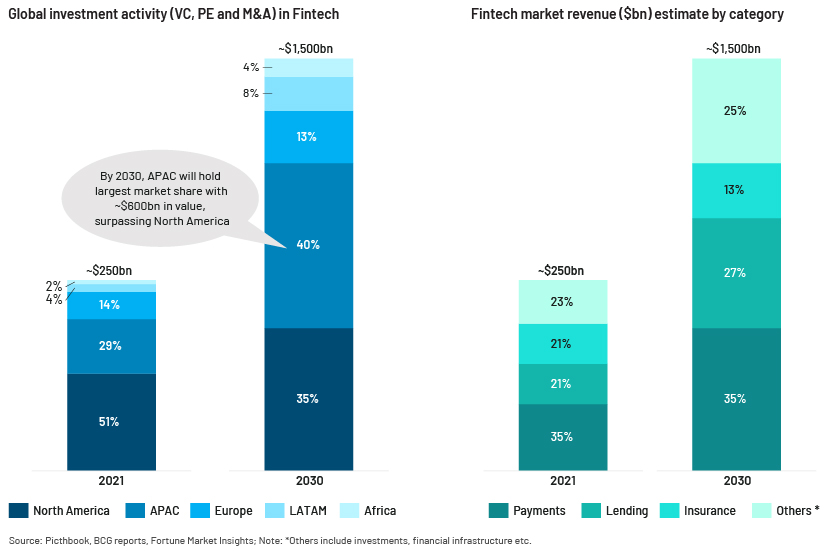

Despite the ongoing decline in investments, the global fintech market is estimated to be worth c.USD340bn in revenue in 2024, having grown at a CAGR of c.14% in the past four years. Revenue growth is primarily due to sustained demand in e-commerce and contactless payments. The market is estimated to reach USD1.2tn in revenue by 2032, growing at a 16.5% CAGR. Some predict it will cross c.USD1.5tn by 2030. Fintech has significant potential for growth, as it is still a nascent market, covering only c.2% of financial services. Growth is expected to be driven by emerging markets such as APAC, with large consumer populations and SMEs underserved by traditional banking systems.

Growth drivers in the payments segment

The payments segment accounts for the largest share of fintech in deal value and market revenue and is expected to remain a central focus of fintech. The following are key drivers enabling growth in the sector.

-

Account-to-account (A2A) payments are instant/real-time payments enabled by open-banking APIs. The European Union's recent change in payment rules (PSD2) enables real-time checks on customer data, leading to growth in opening banking/A2A transfers. The US Federal Reserve’s FedNow and The Clearing House’s (TCH’s) RTP system have started enabling instant payments in the US. Meanwhile, Asian countries such as India have adopted UPI technologies to make A2A payments.

-

B2B real-time payments, especially in SMEs, are gaining momentum, as they are quick and cost-effective. These also enable fintech companies to provide value-added services such as automated matching of purchase orders to invoices, instant e-invoices and cashflow improvements

-

Digital wallets such as Amazon Pay, Apple Pay and Google Pay enable 50% of global e-commerce payments (70% in APAC). They are expected to reach 61% of e-commerce transactions globally (77% in APAC) by 2027. The number of users is expected to grow from 42% of the world's population, with 3.4bn digital wallets in 2023, to 60% of the world's population, with c.5.2bn digital wallets by 2026.

-

Biometric authentication while making payments is becoming more mainstream as demand for digital identity management and payment security increases. Visa and Mastercard have started offering biometric cards.

Blockchain technology to further enable payments

Blockchain technology/cryptocurrency is gaining prominence in the financial ecosystem, enabling cross-border payments for businesses and consumers, and digital asset tokenisation of financial infrastructure.

-

Although still subject to regulatory scrutiny, cryptocurrencies are slowly becoming mainstream. The SEC approved Bitcoin ETFs in 1H 2024 and is expected to approve Ethereum ETFs in 2H 2024

-

Companies such as Microsoft, AT&T, Adidas, IKEA, and Amazon have started accepting crypto payments. Visa and Mastercard are integrating blockchain in payments into their cards, especially for cross-border payment.

-

Central Bank Digital Currencies (CBDCs) are being explored by 130+ countries, representing 98% of global GDP. Asia and Europe are seeing the emergence of non-USD stablecoins. CBDCs and stablecoins seem to be efficient alternative methods in trade financing and cross-border transactions

-

Asset tokenisation is gaining popularity across regions. The US tokenised c.USD1bn assets in Treasury bonds in 1H 2024,, integrating digital infrastructure into traditional financial systems

Emergence of Embedded Finance

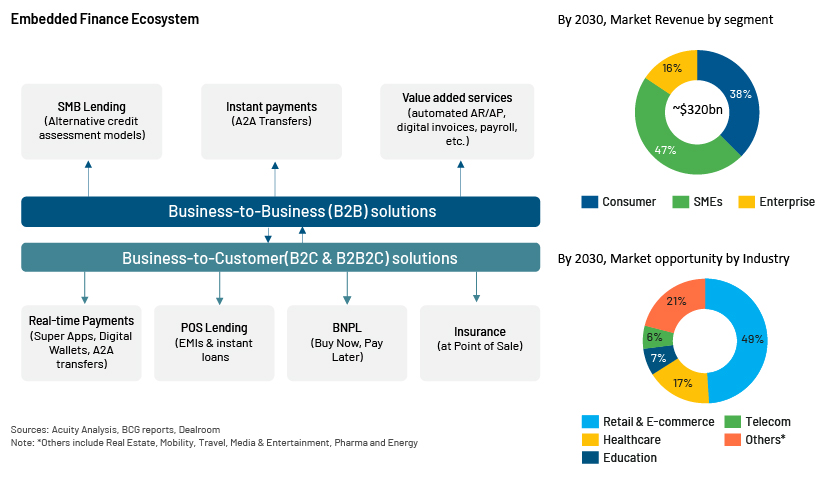

Embedded Finance integrates fintech and banking into non-financial platforms to deliver a seamless customer experience. For example, consumers can access digital wallets, loan options, and product insurance on e-commerce platforms. Embedded finance solutions are estimated to be worth USD320bn by 2030, encompassing 30-40% of the fintech market.

The market predominantly comprises consumer-facing (B2C) use cases in e-commerce and retail POS. Although B2C currently generates c.70% of revenue, the B2B SME segment is projected to account for the largest share by 2030. The following are key trends likely to drive growth in embedded finance:

-

Buy Now, Pay Later (BNPL) payments soared in Europe during the pandemic. While countries such as Sweden, Germany and Norway are leaders in BNPL adoption, the US and APAC are expected to witness a steep rise in BNPL transactions in the future.

-

Super apps, popular in China and South Korea, are expanding their presence in other emerging markets. These apps enable consumers to access social media and ride-hailing, make digital payments, engage in quick commerce, and more, all on one single platform.

-

B2B lending in the SME space would play a crucial role in the growth of embedded finance. Fintech companies would extend banks’ credit access to SMEs by providing alternative credit assessment models and customised lending solutions.

-

There is increasing demand from both large enterprises and SMEs for end-to-end solutions such as A2A payments, e-invoicing, accounting, payables/receivables and payroll.

How Acuity Knowledge Partners can help

We have the expertise to support PE and VC firms in investing in fintech firms. Our strong understanding of the fintech space enables us to collaborate with their sales and marketing teams to track the development of infrastructure, technologies, regulations, and portfolio monitoring strategies in the sector.

Sources:

-

https://www.mckinsey.com/industries/fintechs-a-new-paradigm-of-growth

-

https://softjourn.com/insights/top-payments-Buy-Now-Pay-Later--BNPL-Continues

-

https://www.fintechfutures.com/2024/05/state-of-play-the-future-of-credit/

-

https://www.fortunebusinessinsights.com/fintech-market-108641

-

https://kpmg.com/xx/en/home/insights/2023/07/pulse-of-fintech-h1-2023-fintech-segments.html

-

https://kpmg.com/xx/en/home/insights/2024/02/top-fintech-trends-in-h1-2024.html

-

https://cointelegraph.com/news/visa-crypto-withdrawals-cards-145-countries

-

https://www.statista.com/statistics/719385/investments-into-fintech-companies-globally/

-

https://dealroom.co/uploaded/2022/03/Dealroom-embedded-finance-v2-.pdf

-

https://www.bcg.com/publications/2024/global-fintech-prudence-profits-and-growth

-

https://www.bcg.com/press/3may2023-fintech-1-5-trillion-industry-by-2030

Tags:

What's your view?

About the Author

Anusha has more than five years of experience in Investment Research and Consulting. She has been associated with the Acuity Private Markets team for over two years in supporting private equity investment professionals across the deal lifecycle. Previously, she worked as a manager in Private Equity Business Development at Genpact

Like the way we think?

Next time we post something new, we'll send it to your inbox