Published on July 31, 2024 by Nitin Ram

Demand and investment in the leisure sector have rebounded from pandemic-induced lows, but elevated microeconomic/macroeconomic pressures (sluggish inventory, higher financing costs and weak consumer spending[1]) are likely to weigh on big-ticket consumer discretionary spending. Amid this backdrop, select pockets of the leisure sector such as recreational vehicles (RVs) and golf facilities/equipment manufacturers stand out, showing signs of a durable recovery, and are well positioned to generate healthy free cashflow and profits on the back of robust dealer sentiment, customer stickiness and improving inventory conditions. Within RVs, we expect original equipment manufacturers (OEMs) to perform better than downstream players, likely benefiting from improving demand conditions, while among golf facilities/equipment manufacturers, we like well-established players from the limited number of publicly listed companies.

RV manufacturer sentiment boosted by improving inventory conditions:

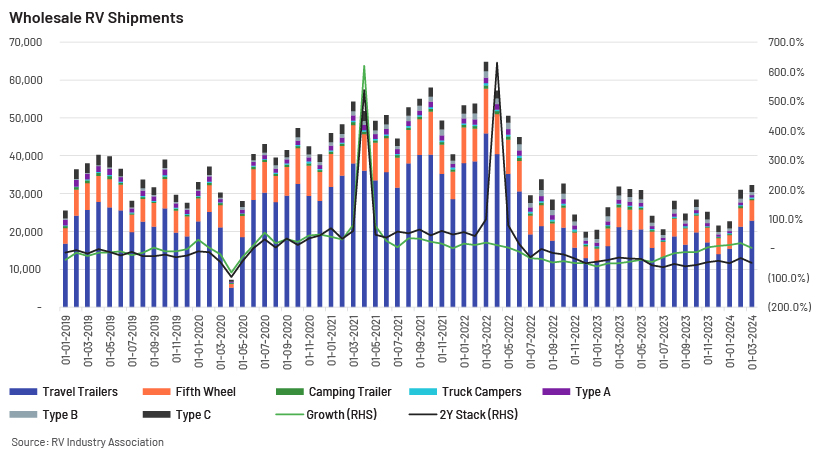

Demand for RV continues to recover after receding from the all-time high in March 2022. A wide range of choices in the market and end-market diversification augur well for the subsector, partially offset by concerns about affordability and cost pressures. OEMs [such as Winnebago (WGO) and Thor Industries (THO)] are likely to benefit from the demand recovery cycle earlier than RV retailers [such as Camping World (CWH)] and component manufacturers [such as Patrick Industries (PATK)].

Although manufacturers are exposed to demand challenges such as those faced by retailers, OEMs enjoy a cushion from working capital gains. OEMs are also expected to generate higher free cashflow this year as the supply-demand gap continues to narrow. Dealers have signalled optimism about a recovery in sales, driven by prudent promotions of latest models.

Retailers use floorplan financing, typically a line of credit with flexible terms provided to retailers to fund new inventory. The loan is repaid upon sale of the vehicle[2]. Hence, the increase in cashflow from operations resulting from lower inventory is offset by the cash outflow for floorplan finance repayment. Higher interest rates present a bigger challenge for RV dealers than for OEMs. CWH’s floorplan interest rate stood at 8.0% in 1Q24 compared to 7.0% in 1Q23 and 2.2% in 1Q22. While retailers lack the benefits of working capital enjoyed by manufacturers, cost rationalisation and a better product mix could result in margin expansion when retail sales stabilise.

The RV Industry Association[3] estimates that shipments in 1Q24 increased by 9% y/y. Shipments of 85,941 units recorded in 1Q24 represent about a quarter of the total 350,000 units projected to be shipped in 2024, about 12% more than the 312,200 units shipped in 2023[4].

The golf subsector – benefiting from a keen customer base and affordable offerings:

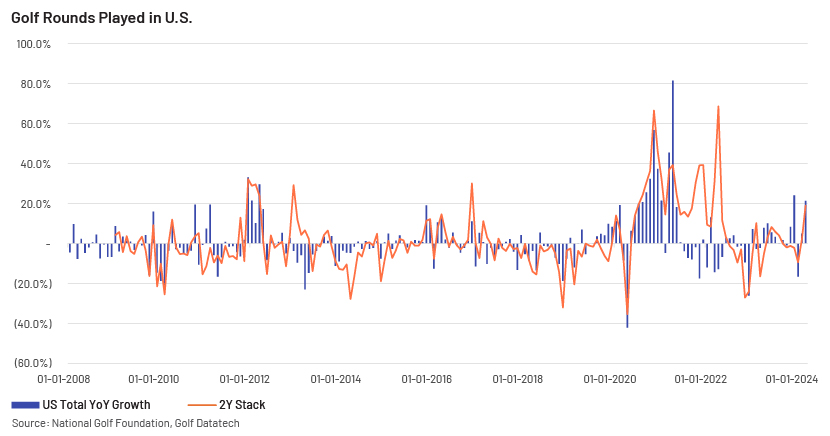

Golf is one of the most favoured subsectors, resilient against macro challenges as it faces tailwinds from the expansion of the total addressable market and higher engagement levels. About 26.6m Americans played a record number of 531m rounds in the US in 2023, topping the previous record of 529m rounds played in 2021[5]. The fact that Americans are spending more time and money on golf courses than in 2019 suggests an optimistic outlook for the subsector that has found enhanced appeal among higher-income consumers. Golf also benefits from its allure as a leisure product less expensive than options such as cruises, boating and powersports.

While publicly listed pure-play golf companies remain limited, players such as TopGolf Callaway (MODG) and Acushnet Holdings (GOLF) offer strong product portfolios and cater to well-diversified end markets. Both companies benefit from a pandemic-driven secular trend that has resulted in a high level of stickiness among loyal customers and strong untapped latent demand from potential golfers. Total retail market data for March 2024 shows that the on-/off-course retail dollar value was 31.5% higher than in 2019[6]. The current retail trend indicates sustained upward sales momentum for equipment and consumables such as clubs, wedges, balls and gloves, helped by conducive weather and increased focus on core golfers. Overall, golf equipment manufacturers and course operators stand to gain from increased participation and durable demand, affording the golf subsector a buffer against cautious consumerism.

Takeaways

The ongoing recovery in the leisure sector, although nascent, is robust. High market penetration and an ability to offer value propositions to a large and sticky customer base are the characteristics of a successful playbook for winners in the leisure sector amid macro headwinds. RVs and golf remain the strongest pockets of growth in the leisure space as other subsectors, including marine, toys, powersports, amusement parks and cruises, are mired by weak retail demand, macro uncertainty and a struggle to recover pre-pandemic demand.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, building databases and regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Source

-

[1] The Leisure and Hospitality Industry: Short-Term Growth, Long-Term Challenges – The Leisure and Hospitality Industry: Short-Term Growth, Long-Term Challenges – United States Joint Economic Committee (senate.gov)

-

[2] Cash Flow Management and Floor Plan Financing for RV Dealers (mossadams.com)

-

[5] Golf Research and Industry Data | National Golf Foundation (ngf.org)

Tags:

What's your view?

About the Author

Nitin Ram has about a decade of experience in equity research. He is part of the Investment Research team at Acuity Knowledge Partners. In his current role covering the US leisure sector, he supports sell-side clients with research assignments including initiation and thematic reports, economic updates, data research and earnings reviews. His previous experience includes tenure with a boutique investment research firm, where he headed the Special Situations Equity Research Desk. He holds a bachelor’s degree in Business Administration and is a CFA charterholder.

Like the way we think?

Next time we post something new, we'll send it to your inbox