Published on July 18, 2024 by Biswajit Baruah , Mansi Madan and Himanshu Batta

Leveraged loans continue to offer some of the highest yields among major sub-asset classes in the fixed income space, fulfilling their objective of providing protection during a slow post-pandemic economic recovery. However, given the expectations of interest rate cuts in FY24 (expected in 4Q24), we believe that the income opportunity outweighs the downside risks of default, especially as peak rates revert to normal levels, boosting overall macro prospects. In this report, we cover trends in (1) inflation, (2) performance of the leveraged finance universe, (3) default rates, (4) effective yield and (5) repricing.

FY24 outlook – We expect the US economy to continue to emerge from the pandemic-induced recession, and possible rate cuts in FY24. Should these materialise, they are likely to serve as growth catalysts for companies with leveraged loans, as lower rates make it easier for companies to grow, resulting in long-term value creation.

Inflation reaching the Fed’s 2% target – US inflation fell to 3.0% in June 2024 (vs 3.5% in March 2024). However, core inflation fell further, to its lowest in more than three years – to 3.3% in June 2024 from 3.4% in May 2024 and below market forecasts of 3.4%, indicating that the disinflation process is underway. CPI is projected to increase to 0.1%, after a flat reading in May. Core inflation is projected to remain steady at 3.4%, maintaining the lows in 2021. Monthly core inflation is expected to stay at 0.2% (source: Trading Economics).

US consumer inflation expectations for the coming year declined for a second consecutive month – to 3% in June 2024 from 3.2% in May, led by a broad-based decline in price prospects. Inflation expectations for the coming five years also declined, by 0.2 percentage points to 2.8%, while the median three-year-ahead expectation increased 0.1 percentage point to 2.9% (according to the June Survey of Consumer Expectations). US inflation is expected to decrease to 2.1% by 2028, according to Statista. Inflation was exceptionally high in 2022 at 8% (source: Survey of Economics).

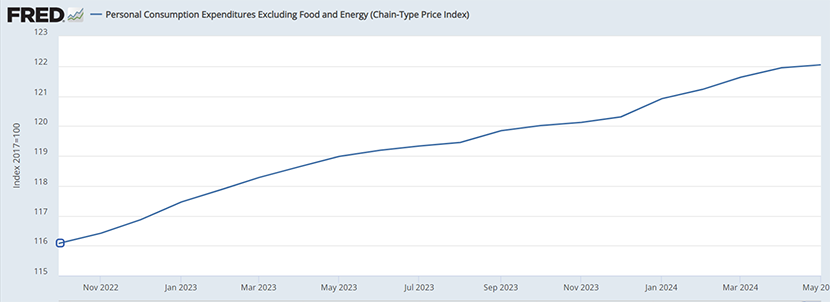

Personal consumption expenditure (as of May 2024)

Source: FRED

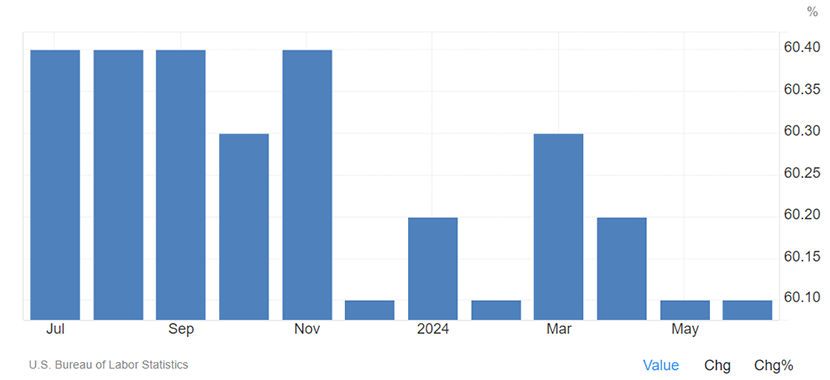

US employment rate

Source: Trading Economics

Performance of leveraged finance – Considering the Leveraged Loan Index’s performance in the past year and the past three years globally and in the US, we believe past performance is not a proxy for future returns. The US leveraged loan market posted strong activity in 1Q24 as sentiment around inflation improved, fears of a recession reduced and expectations of Fed rate cuts in 1Q24 rose. Tighter spreads drove refinancing and repricing activity as issuers sought to reduce interest expenses, while M&A and leveraged-buy-out (LBO) activity remained muted. A more stable interest rate outlook encouraged borrowers and lenders to return to the market. A reduction in the base rate by the Federal Reserve will likely trigger buyout activity among private equity firms and increase the number of LBO deals entering the market in the second half of the year. This would boost investor returns and drive new financing transactions and new-issue premiums to fund these deals.

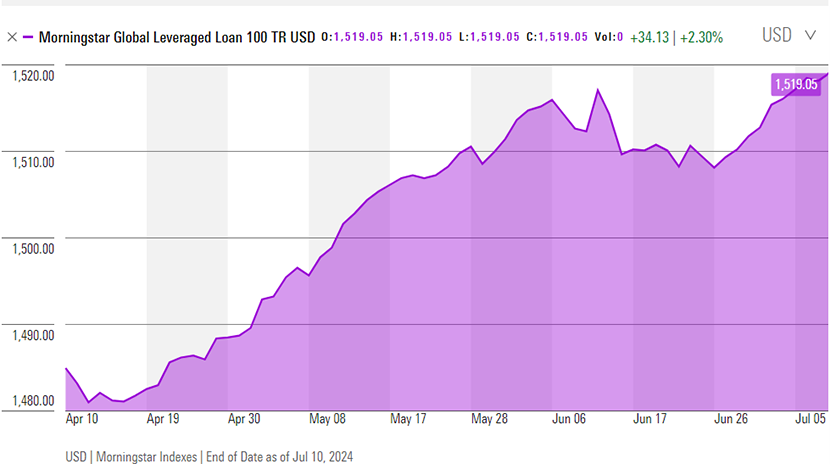

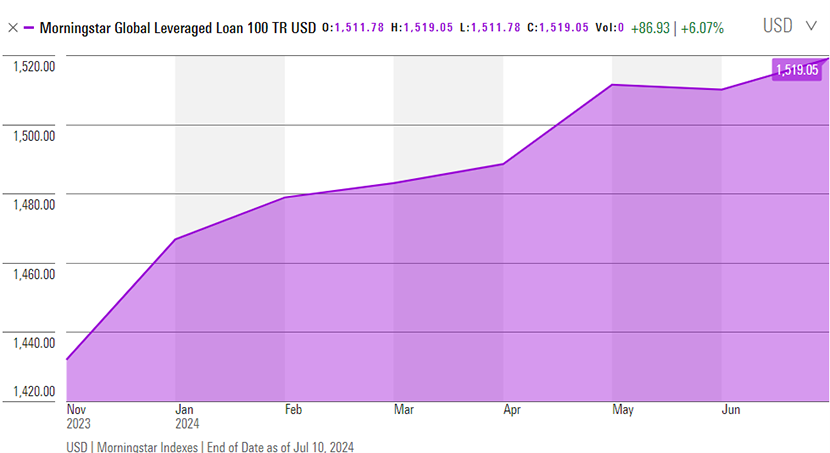

Global leveraged loans – The Morningstar Global Leveraged Loan 100 Index measures the 100 largest facilities’ performance in leveraged loans. It is a fixed-weight composite index, with the Morningstar LSTA US Leveraged Loan Index accounting for 75% of the weight and the Morningstar European Leveraged Loan Index making up 25%, with a cap of 2% on the weight of an individual loan.

Morningstar Global Leveraged Loan 100 Index (3-month returns)

Source: S&P Global

Morningstar Global Leveraged Loan 100 Index (one-year returns)

Source: S&P Global

US – This index assesses the performance of the 100 largest US leveraged loans based on loans outstanding. The following charts provide data on one-year and three-year horizons.

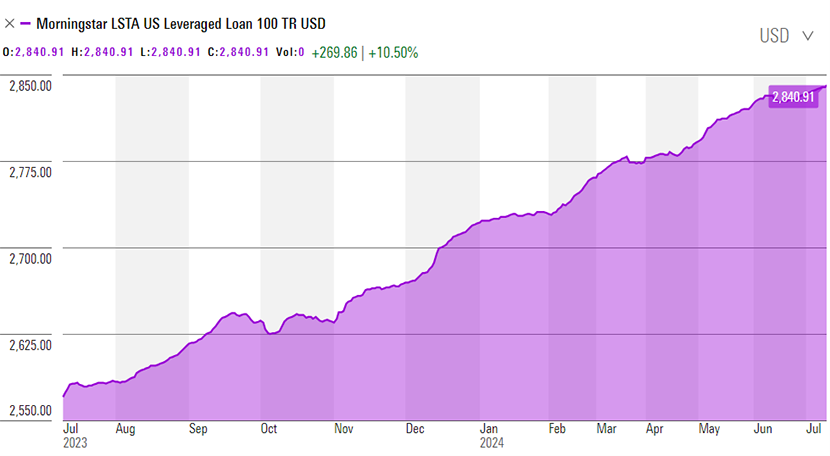

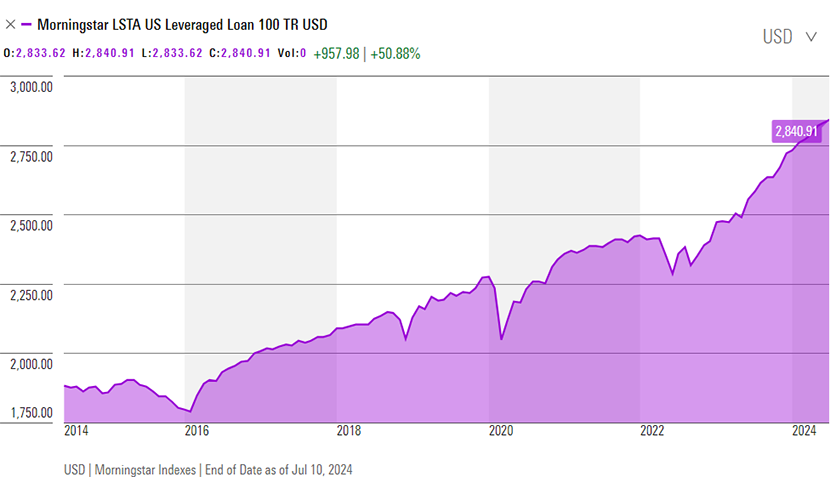

Morningstar LSTA US Leveraged Loan 100 Index (one-year returns)

Source: S&P Global

Morningstar LSTA US Leveraged Loan 100 Index (three-year returns)

Source: S&P Global

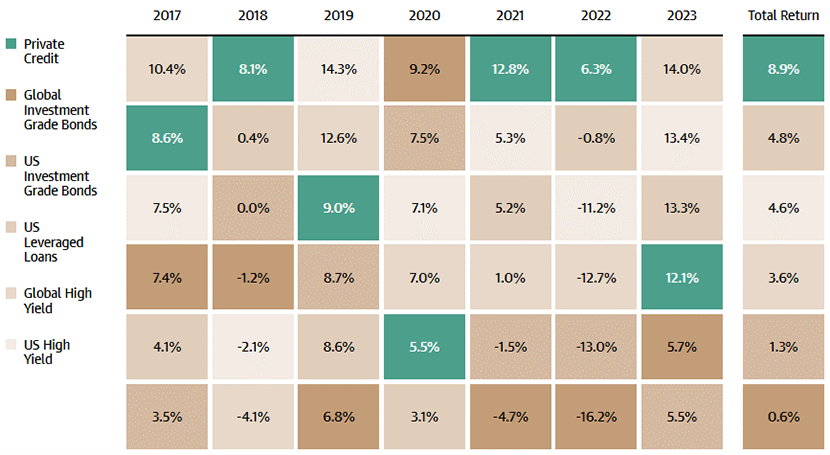

Comparison of performance across fixed income – Based on 2017-23 annual returns (data as of 31 December 2023), the US leveraged loan asset class ranked fourth (3.6% CAGR) of six key fixed income sub-asset classes.

Source: Morningstar, Cliffwater

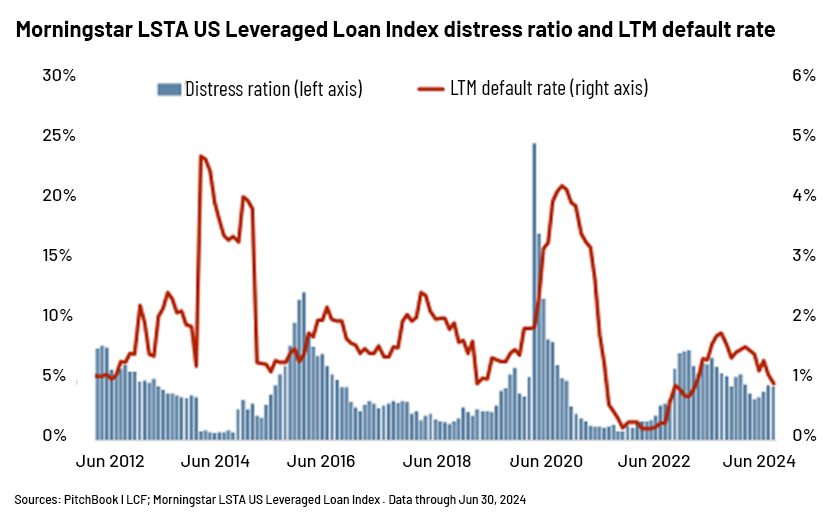

Default rates – With interest rate cuts expected from FY24, we believe default rates will normalise from the pandemic-induced peak rate.

In June, payment defaults in the US Leveraged Loan Index continued to trend lower, while a large number of issuers managed to avoid bankruptcy through out-of-court liability-management transactions in this higher-interest-rate environment. The share of performing loans priced below 80 cents on the dollar – a marker for the loan distress ratio and a demonstrated indicator for heightened default activity – eased slightly to 4.42% in June after rising over the last three months vs 4.47% in May, although above the 2024 lows of 3.35% in February – the lowest level since August 2022. However, the distress ratio remained significantly lower than the 7.36% in December 2022 (source: PitchBook).

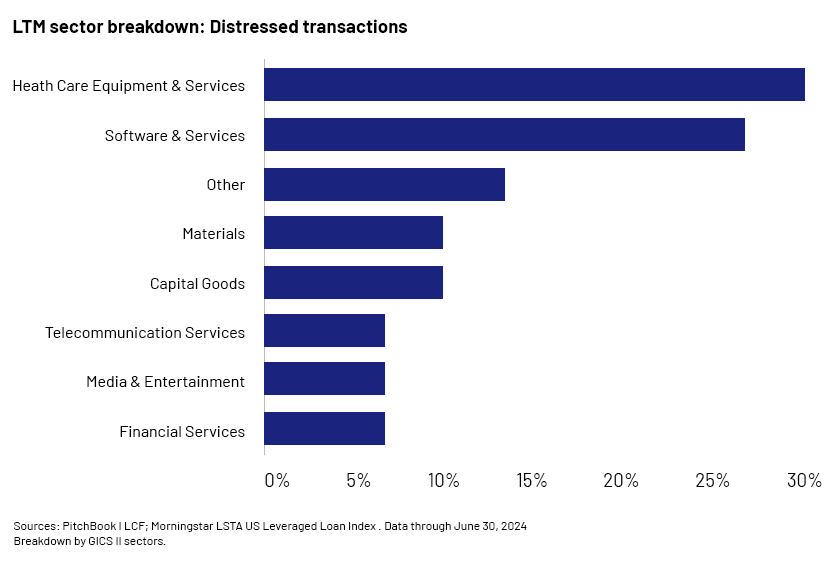

Out-of-court distressed transactions among index companies were dominated by healthcare and software companies; healthcare equipment and services, and software and services accounted for 27% and 24% of distressed transactions, respectively, over the past 12 months.

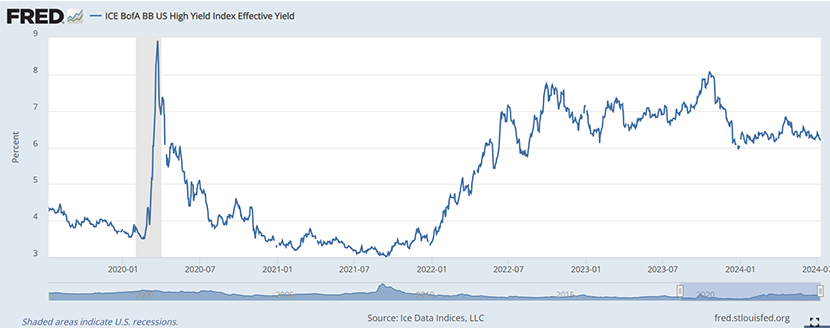

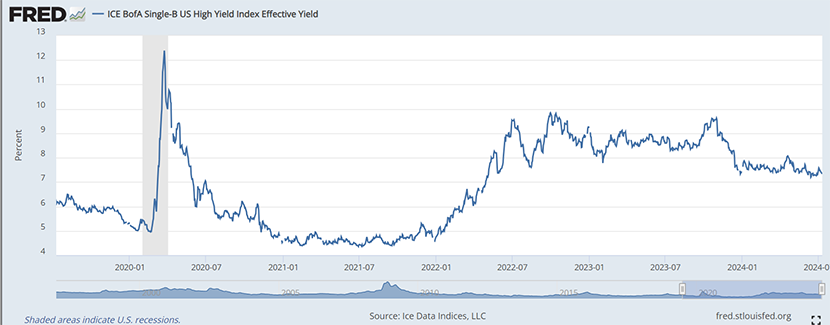

Effective yield trends – We also expect banks’ lending standards to ease amid the reduction in interest rates. Trends in effective yields across BBB, BB and single-B borrowers (source: FRED) are shown in the charts below.

BBB US Corporate Index (effective yield: 5.58%)

BB US Corporate Index (effective yield: 6.41%, c.70bps higher than that of the BBB Index)

Single-B US Corporate Index (effective yield: 7.37%, c.96bps higher than that of the BB Index)

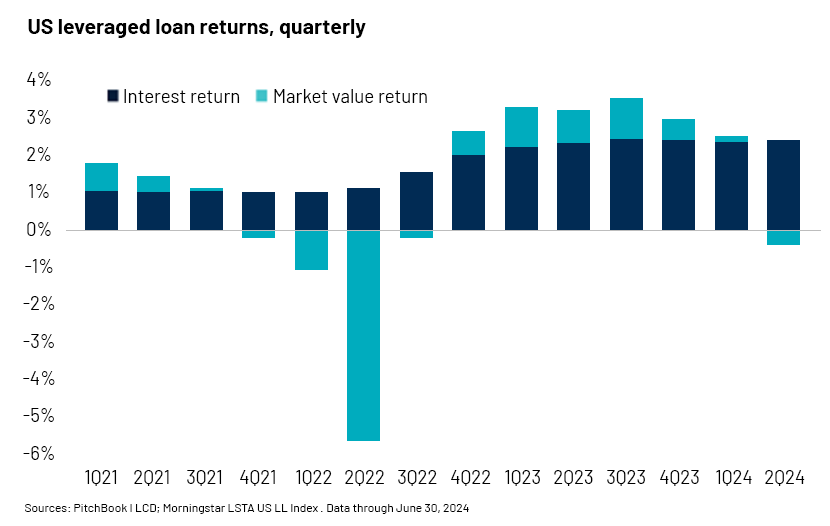

Leveraged loans yield strong interest returns

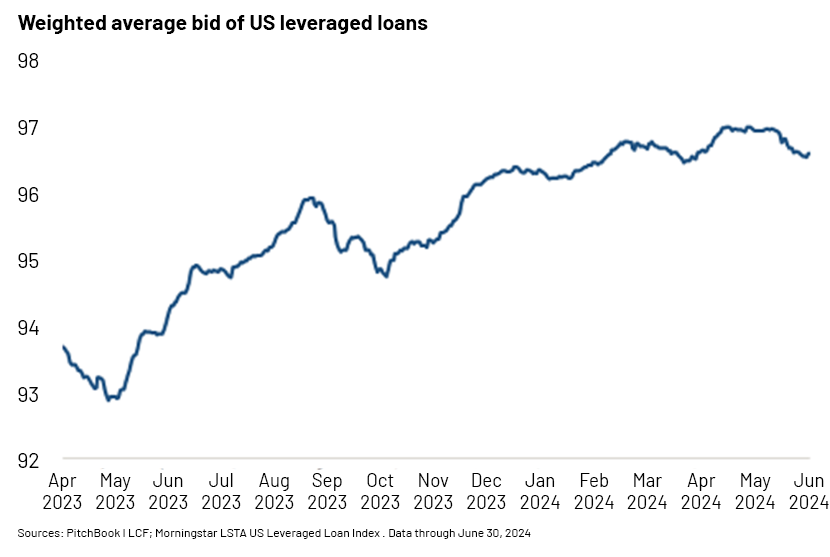

US leveraged loans rallied strongly throughout the year, but demand from loan investors — CLOs and retail mutual funds/ETFs — slipped to 0.35% in June from the multiyear high of 0.94% in May and resulted in the weakest monthly returns so far in 2024. Despite the recent obstacles, loans remain on track for a strong return due to the elevated base rate and continued shortage of net supply.

The US Leveraged Loan Index gained 1.90% overall in 2Q24, marking the weakest performance since 2Q23 and down from 2.46% in 1Q24 due to a decline in market-value return by 40bps versus the 12bps gain in 1Q24; however, leveraged loans benefited from higher base rates. The interest return (the base rate and nominal coupon on the loan) was 4.69% YTD in June 2024, up from 4.58% YTD in June 2023. More than USD400bn of institutional loans, accounting for c.30% of the loan market, have been repriced (source: PitchBook).

The weighted average bid of the loan index withdrew by 34bps last month, to 96.59, the largest m/m decline since October 2023. However, the weighted average bid had gained more than two points over the past 12 months (source: PitchBook).

Sources:

-

Trading Economics

-

PitchBook

-

Morningstar

-

New York Fed

-

Fitch Ratings

-

FRED

What's your view?

About the Authors

With a professional journey spanning 16 years, Biswajit is a seasoned expert in credit analysis, underwriting, and leveraged lending portfolio monitoring activities. His experience encompasses roles in both US and Europe, working with prestigious Global and Regional banks. Since June 2016, he has been an integral part of Acuity, stationed at the Gurgaon Center in India.

His expertise lies in leveraged lending credit research, credit modeling, company valuation, and end-to-end portfolio monitoring processes, while bringing valuable experience in setting up, transitioning, and managing centralized portfolio monitoring teams, handling tasks such as financial spreading, credit modeling, annual and quarterly reviews, Levfin credit reviews, credit surveillance, and system updates, culminating in..Show More

Mansi has over 11 years of experience in Investment Banking and Commercial Lending. She is a part of the Leverage Lending division at Acuity Knowledge Partners and has experience across performing in depth credit reviews on large and mid-sized corporates and building financial models. Her expertise spans across various sectors including TMT, Healthcare, Power, Software and Industrials. Mansi has done her post graduation in Finance and Marketing from ICFAI Hyderabad.

Himanshu Batta is a post-graduate with 13+ years of work experience in commercial lending and lending operations. He is experienced in analyzing leveraged finance credits, preparing credit model, credit reports and closely working with onshore credit approvers and relationship directors. His current profile includes providing credit review and monitoring support to leveraged debt capital market team in one of the leading Commercial banks. A significant aspect of his work involves preparing overall credit review decks and a financial model to assess the credit worthiness and project the future financial health of the borrowers. He is also responsible for regular monitoring of existing bank customers through annual performance updates.

Like the way we think?

Next time we post something new, we'll send it to your inbox