Published on February 27, 2019 by Vipul Gupta and Nipun Mehra

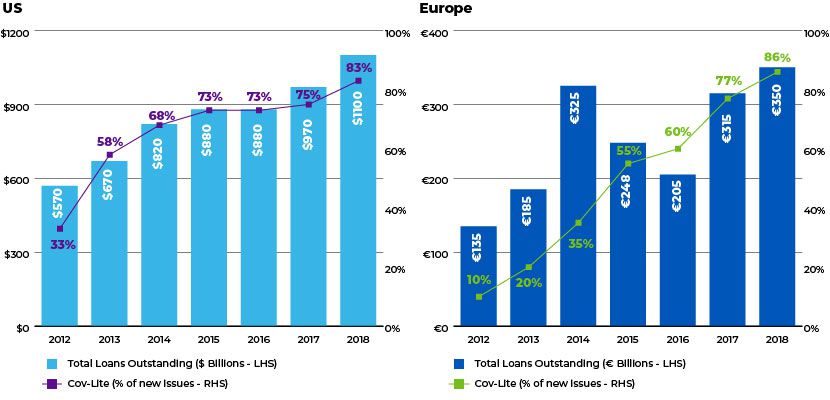

Following the subprime crisis of 2008, banks have been under special scrutiny by regulators in both the US and Europe. Leveraged lending (LL), by definition, is a riskier class of debt financing. This market has grown significantly in recent years and the global market for leveraged loans is estimated to be around $1.5tn now. Leveraged loans outstanding in the US were roughly $1.1tn – nearly double the $554bn outstanding at year-end 2007. Europe’s share was smaller, but is growing. It has crossed the €350bn mark.

The default rate is considered low at around 2.4%. However, it is expected to increase significantly when the credit cycle takes a turn. LL has, therefore, become a full-fledged asset class since its start a few decades ago. The market share for leveraged loans composed of the so-called “covenant-lite” loans (i.e. loans with no maintenance covenants and thus fewer restrictions on the borrower) reached c.80% in 2018 across the US and Europe, compared to less than 20% pre-2008.

Below charts provide a snapshot of the US and EU LL markets:

US and European Regulations

In the US, the board of the Federal Reserve, together with the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency (OCC), issued its guidance on LL (2013 Leveraged Lending Guidelines), that provides high-level principles related to safe and sound LL, in March 2013. These guidelines apply to all the financial institutions supervised by the Federal Reserve that engage in LL activities, replacing the previous guidance issued in 2001. Subsequently, in February 2018, OCC Comptroller Joseph Otting made a public statement, in which he said, “Financial institutions should have the right to do the LL they want, as long as they have the capital and personnel to manage that and it doesn't impact their safety and soundness”. Banks have considered this as a green signal to continue to participate in such transactions, which we believe will introduce more systemic risk to the financial system.

The European Central Bank (ECB) also finalized its own set of guidelines on LL in November 2017. In early 2018, it made a round of visits to banks that fall under its purview.

In terms of comparison, US guidelines have greater reach, encompassing all federally regulated financial institutions including non-banking subsidiaries of bank-holding companies and US branches of non-US banks, while the ECB guidelines apply only to ‘significant’ credit institutions. In terms of Leverage, both ECB and US consider a threshold of post-financing leverage (Total Debt/EBITDA) >4.0x, but the US guidance also adds a clause for senior debt leverage (Senior Debt/EBITDA) to be over 3.0x to be included as a leveraged lending deal. Furthermore, ECB guidance excludes certain transactions from the leverage lending criteria, such as loans to credit institutions, investment firms, public sector entities, investment-grade borrowers, small and medium-sized enterprises if not owned by a financial sponsor, and loans where the own consolidated exposure of the significant credit institution is below €5 million. The US guidance has not specified any such exclusion.

Acuity View

We believe the guidelines are a step in the right direction to prevent the highly leveraged loan market from becoming dysfunctional. However, with banks considering the OCC’s latest announcement as giving them full discretion, that will likely lead to a further lack of oversight and irresponsible conduct. Although, neither set of guidelines is particularly stringent in its approach, market participants view the ECB’s guidelines as being too general and lenient.

In summary, not only are banks at risk when they hold such loans on their balance sheets, but also are a wide array of global investors – such as pension funds, insurance companies, and asset managers – to whom banks transfer risk in the form of collateralized loan obligations (CLOs) that are backed disproportionally by leveraged loans.

We understand from our experience that effective underwriting and management of leveraged lending risk is correlated with the quality of analysis during approval process and ongoing monitoring. This calls for a comprehensive credit analysis framework including:

- Financial modeling (Base, Downside, Stress, Debt Repayment) with Enterprise Valuation (EV) analysis, sensitivity analysis and detailed free cash flow projections

- De-leveraging trajectory

- Stress testing and performance update assessing any material deterioration in the overall health

- Loan portfolio dashboard to monitor sectoral and company-wise exposures

- Covenant monitoring and headroom analysis

- Business and industry analysis

This will help banks in strengthening their credit monitoring, streamlining processes, enhancing quality metrics and ensuring regulatory compliance.

What's your view?

About the Authors

Vipul Gupta has over 16 years of experience in working with leading global organisations in the banking and commercial lending domains. His expertise spans a broad range of credit analysis, financial modelling, portfolio management, leveraged lending, industry coverage and onshore client-facing roles. Vipul holds an MBA in Finance and a bachelor’s in mechanical engineering.

Nipun Mehra has around six years of experience in the financial services sector, particularly in corporate banking, including experience in corporate credit analysis, market research, credit support and sanctions. At Acuity Knowledge Partners, he is part of the Credit Analysis and Research team that has a specialized focus on large corporate leveraged lending customers. Nipun holds a Postgraduate Diploma in Management from Lancaster University, UK.

Like the way we think?

Next time we post something new, we'll send it to your inbox