Published on December 5, 2023 by Sudhir Shetty

In their efforts to ease inflation, almost all central banks have reached the upper end of their rate-hiking cycles. China, the world’s second-largest economy, is the only exception, as it battles deflation, unemployment and the stress of debt default in its real estate and construction sectors. The US, the world’s largest economy, could witness one more rate hike by the Fed before the end of 2023, in its effort to keep a close eye on inflation, unemployment rates and the consumer spending trajectory. The current Fed rate range is 5.25-5.50%, and the rate could peak at 5.50-5.75% by year-end. It would be interesting to see whether the US would face a recession by 1H24, with all likelihood of a soft landing.

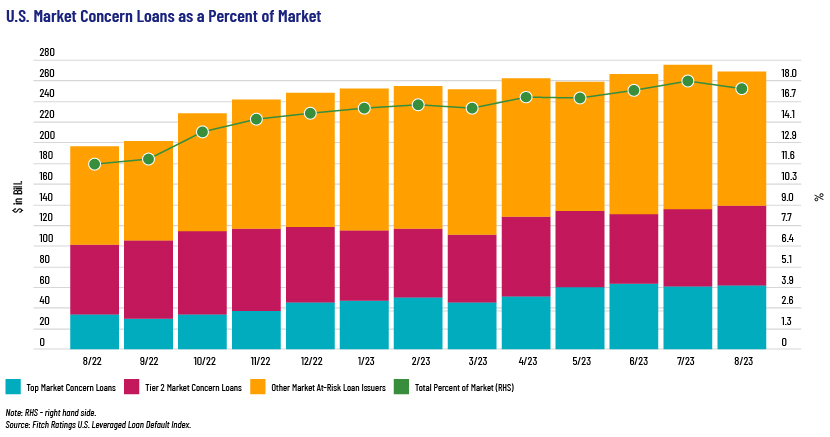

The leveraged lending market is witnessing significant volatility in the current macro-environment scenario. Liquidity pressures, combined with a high percentage of near-term debt maturities (one to two years) and unique challenges (opioid litigation), remain a key threat to leveraged finance issuers in Fitch’s Top Market Concern Loan list filing for bankruptcy or opting for distressed debt exchanges (DDEs).

The U.S. Top Market Concern Loan list grew by USD8.5bn in August 2023 alone, due to the addition of borrowers with weak operating metrics, resulting in refinancing risk (Radiology Partners and Trinseo). USD5.7bn of loan volume was removed from the list on account of DDEs (US Renal Care, Juice Plus and Dawn Acquisitions).

On 31 August 2023, Mallinckrodt Pharmaceuticals filed for Chapter 11 due to operational liquidity arising from macroeconomic pressures (resulting in missed interest payments in June and July 2023), coupled with issues related to opioid litigation payment obligations (USD250m).

Healthcare and pharmaceuticals are the largest sector in the U.S. Top Market Concern Loan list by volume and issuer account (30% and 22%, respectively), with the three largest loans issued by healthcare companies Global Medical (USD3.8bn), Team Health Holdings (USD3.6bn) and Bausch Health Companies (USD2.4bn). Leisure and entertainment, and technology are the next largest sectors by volume (11%).

YTD default volume as of August 2023 totalled USD42.3bn (52 issuers), with some defaulting twice, compared with USD17.6bn (17 issuers) over the same period last year. Fitch expects loan defaults to rise 4.0-4.5% over the remainder of 2023 due to refinancing challenges, weak liquidity, stricter lending norms and the high cost of debt. It forecasts a leveraged loan default rate of 3.5-4.5% in 2024.

Middle-market loan trends

-

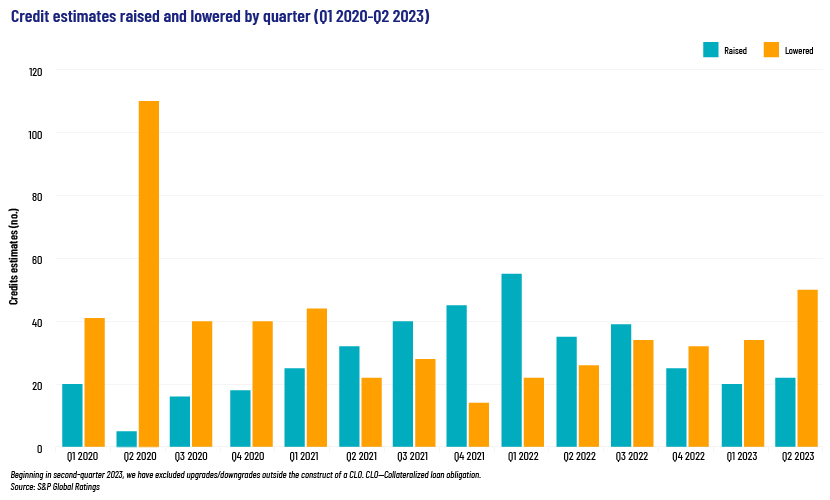

S&P’s US credit estimate downgrades outpaced upgrades for three consecutive quarters to June 2023 as the burden of high interest due to the increase in benchmark rates and inflationary pressures strained companies’ financial and operational performance.

-

Companies are opting to pay-in-kind (PIK) upcoming interest payments, deferring loan maturities or rescheduling interest or principal payments.

-

The trailing 12-month Morningstar Loan Syndication and Trading Association (LSTA) US Leveraged Loan Index default rate trended upwards to 1.7% at the end of June 2023 from 1.4% in March 2023. Among rated loan issuers, S&P expects the trailing-12-month Morningstar LSTA US Leveraged Loan Index default rate to increase to 2.5% by March 2024 in the base case (in line with the long-term historical average of 2.5%). In the downside case, S&P believes defaults could increase to 4.5% by then.

-

S&P expects downgrades to dominate upgrades for the rest of 2023 and selective defaults to rise as more companies look to restructure outside of the bankruptcy process.

-

The higher interest rate regime would be negative on the free operating cash flow (FOCF) of small growth companies with high debt levels.

-

Cost inflation, supply constraints and labour issues could lead to margin compression, resulting in further downgrades.

Middle-market (MM) CLO trends

-

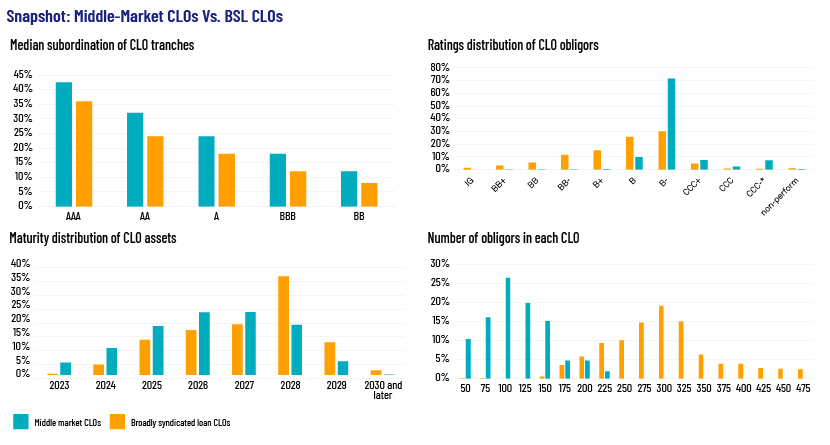

MM CLOs have continued to see significant volumes in 2023, even as the overall corporate credit landscape experiences higher interest rates and deteriorating operating conditions

-

Through July 2023, year-to-date broadly syndicated loan (BSL) CLO issuance was down 37%, while MM CLO issuance was up 103% over the same period last year

-

MM CLO new issuance amounted to USD11.4bn in 1H23 and is expected to close 2023 at USD23bn, according to Deutsche Bank

-

Average exposure to speculative-grade loans in the CCC category increased to 10.6% in June 2023 from 9.6% in March 2023

-

Defaulted assets in MM CLO grew marginally, to 0.35% in June 2023 from 0.28% in March 2023

-

Software and healthcare providers and services are the two major sectors in both MM and BSL CLOs. The average MM CLO has 15.7% of its assets in software companies versus 11.5% for the average BSL CLO, and 9.2% of its assets in healthcare providers and services versus 6.6% for the average BSL CLO

-

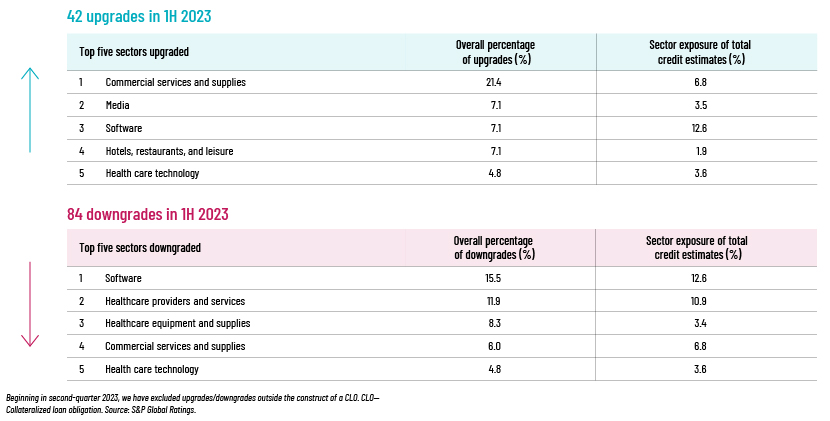

42 credit estimate upgrades were offset by 84 downgrades in 1H23

-

Drivers of credit estimate upgrades were debt pay-down, improved EBITDA and interest cover, increase in market share, better operational performance and ability to pass on increased cost to consumers

-

Drivers of credit estimate downgrades were weak liquidity, negative FCF, high leverage, refinancing risk, inflationary pressures and lower interest coverage

-

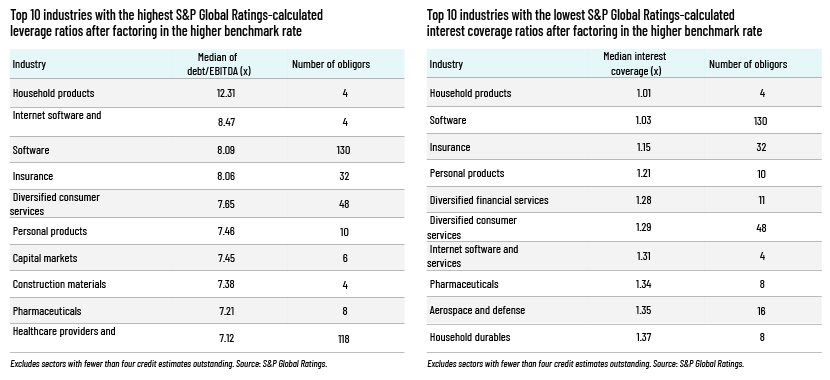

Top 10 industries with leverage and interest cover ratios higher than benchmark rates

“Household products” tops the industries list, with the highest leverage and lowest interest cover relative to benchmark rates, followed by software and insurance, respectively.

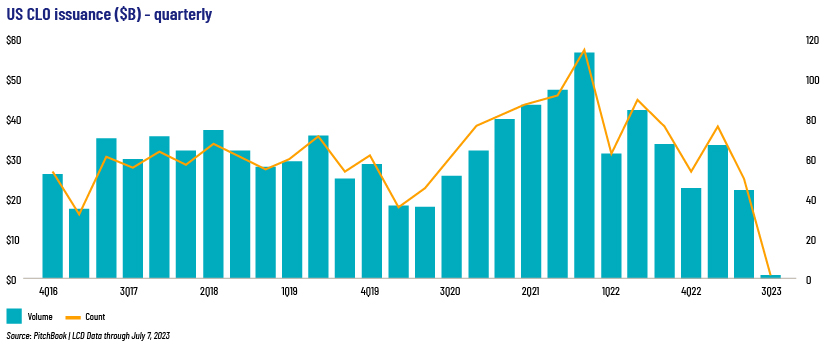

US CLO issuance

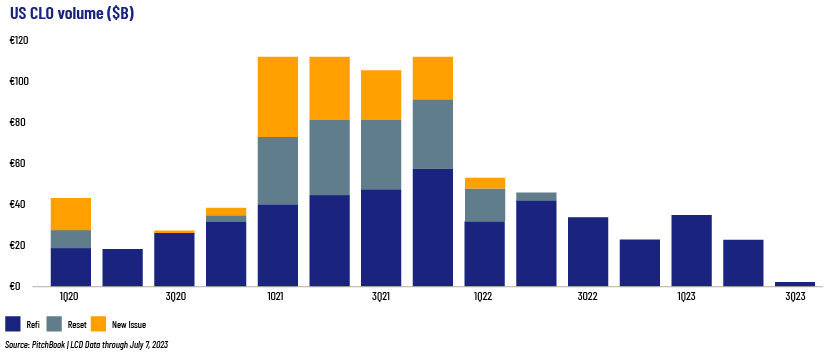

Despite high volumes of issuance in US MM CLO, portfolio managers could find the going tough as the US transitions to a recessionary environment starting in 2024 with the Fed maintaining higher interest rates. The overall US CLO market is an indicator, with full-year issuance for 2023 forecast at USD100bn (USD129bn in 2022) as deal managers find it extremely difficult to break even due to excessive deal costs and high spreads.

CLO managers took advantage of low interest rates in 2021, leading to refinancing and reset transactions of USD250.9bn. Refinancing and reset transactions (since 3Q22) have almost disappeared after the rate-hiking cycle due to deals going out of the money on repricing at high interest rates.

Space for ESG/sustainability-linked loans

Sustainability-linked loan (SLL) issuance in 2022 was 12% lower y/y at USD205.8bn. Compared to the smaller US green loan market, where loan proceeds are used to fund eligible environmental projects, issuance was up 46% y/y at USD25.4bn in 2022. While BSL and MM loan managers in the US are yet to catch up with their European counterparts in terms of including ESG parameters in loan agreements, SLLs and green loans are well positioned to build on the gains in 2023 and beyond as corporations, investors and the US government continue to focus on the migration to green energy. Goldman Sachs expects the Biden administration’s Inflation Reduction Act to be a major boost to ongoing SLL and green loan activity, with investment potential of USD386.0bn in energy and climate-related investment in the next decade.

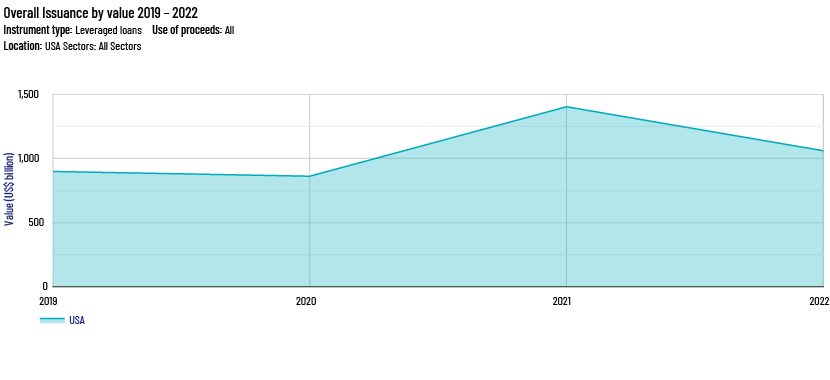

The positive performance of the SLL and green loan markets in the US was offset by overall US loan issuance – leveraged loan issuance was down c.24% y/y in 2022 at USD1.1tn (highlighted in the following graph).

Outlook for 2024

The macro-environment scenario of higher interest rates, unemployment, persistent inflation, supply-side disruptions due to the Ukraine-Russia conflict and trade restrictions on China will likely continue to put operational and financial pressure on borrowers in the leveraged lending space.

Banks’ tighter lending norms, resulting in restrictive primary markets, would lead to reduced access to capital for borrowers with weakened liquidity profiles and, in turn, increased default and refinancing risk.

Borrowers with stronger balance sheets would continue to have access to capital markets. However, especially in the leveraged lending space, with borrower downgrades outpacing upgrades, borrowing appetite will likely be slow to return before the interest rate cycle reverses in 2024. We believe that 2024 could see a muted to downward-sloping curve for new issuance in the US leveraged loan market as corporate borrowers factor in the lagged effect of interest rate hikes. From a US CLO market perspective, despite the MM CLO market maintaining momentum in terms of new issuance in 2023, the BSL CLO market is slowing due to the higher interest rate regime. This could also result in a contagion effect on the US MM CLO market ahead of 2024.

With macroeconomic indicators still above the Fed’s comfort levels, the higher interest rate regime could be prolonged, for the rest of 2023 and well into 1H24. Banks across the globe would have their work cut out with the proportion of weaker balance sheets increasing, which would require closer monitoring of leveraged loans.

How Acuity Knowledge Partners can help

We continue to empower our stakeholders through ongoing monitoring of leveraged debt, delivering innovative solutions to new challenges, timely delivery of alerts on the latest news and detailed projections with quality credit reports to enable them to take action-oriented decisions.

Sources:

-

Liquidity, Refi Risk Were Key U.S. Loan Default Drivers in August (fitchratings.com)

-

Leveraged Finance & CLOs Essentials | S&P Global Ratings (spglobal.com)

-

Middle-Market CLO And Private Credit Quarterly: Calm Amidst The Storm? (spglobal.com)

-

Sustainability-linked and green loans hold ground in volatile market | Debt Explorer (whitecase.com)

-

CLO mid-year outlook: Dry spell remains in forecasts for 2023 issuance | PitchBook

Tags:

What's your view?

About the Author

Sudhir has over 15 years of experience working with leading global organizations in the credit-rating and commercial-lending domains. Currently, he is part of a commercial-lending team that works with a large Canadian Bank supporting their alternate finance team. Prior to this, he supported the commercial-lending teams of a large European banks and was responsible for communicating with the origination teams, writing annual and interim credit reviews, responding to risk queries and performing post-credit-sanction formalities. Prior to joining Acuity, Sudhir worked for a leading rating company and supported the US public-finance domain, both in his individual capacity and in the capacity of a team lead. Sudhir holds a Master in..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox