Published on November 13, 2020 by Charanjit Singh and Ramesh Dharanipathy

Among the key challenges of ESG analysis are data gaps and information quality. Artificial intelligence (AI) is now being used increasingly to mitigate these challenges, while reducing information processing time, to enable ESG analysts and investors to focus more effectively on deep-dive ESG research and engagement activities. We expect financial institutions to outsource most of these AI-driven ESG analytics to third-party service providers with expertise in the AI and ESG domains and well positioned to develop cost-effective, customised solutions.

ESG analysis faces data-/information-related challenges

With ESG-related elements now becoming mainstream in investment-decision making, there is an increasing need for quality and real-time ESG analysis. However, data limitations in the form of

(1) unstructured or incomplete data,

(2) the availability of more qualitative and ambiguous information,

(3) delayed information flow,

(4) changes in reporting patterns of companies, and

(5) different reporting templates/structures are making it difficult for investors/analysts to carry out meaningful, accurate and timely analysis.

AI/NLP enabling resolution; a range of use cases

To effectively resolve some of these data-/information-related challenges, a number of ESG solution providers and customers are now relying on natural language processing (NLP), a field of AI. This helps investors scan and analyse large quantities of unstructured ESG data. The algorithms can scan many years of sustainability reports and millions of articles in real time, sift through the information, and classify it at a much faster pace than analyst teams can, making the process more time- and resource-efficient. An AI company TruValue Labs claims that its analysis of the automotive sector over a year using AI would have taken a human analyst almost six years . Some of the NLP applications in ESG investing are summarised in Figure 1.

AI investments for ESG analysis are set to grow

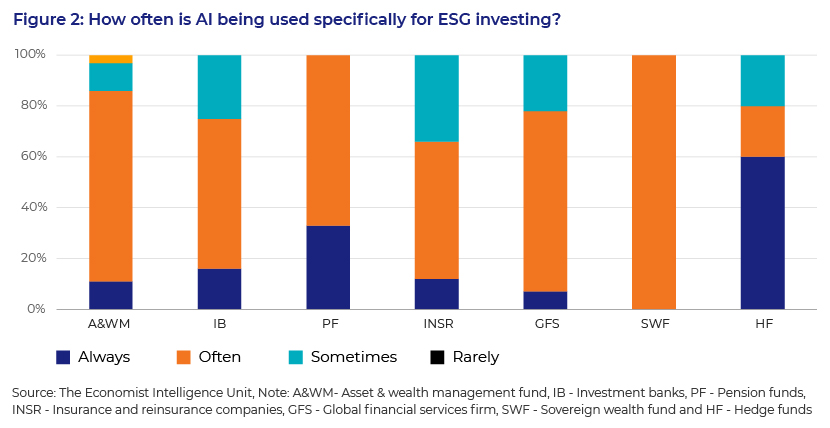

The Economist Intelligence Unit asked investors in 2019 how often AI was used specifically for ESG investing. The responses varied by investor type. Pension funds and sovereign wealth funds had the largest share of cumulative responses in the “always” and “often” categories, whereas insurance and reinsurance companies appeared to have the lowest share (refer to Figure 2 for details) . More such surveys/engagements with stakeholders from financial institutions reflect a growing focus on AI-/NLP-driven ESG investment decision making.

In 2018, an S&P subsidiary Greenwich Associates interviewed 30 CIOs, portfolio managers and investment analysts across North America, Europe and Asia to get their views on the evolution of investment research over the next 5-10 years. It concluded that many investors expect to increase their use of research from independent providers, and to integrate alternative data sources in their investment process. Around 40% of the respondents expected to increase their budget allocation for AI .

A US-based AI company Databricks held an online technical workshop in September 2020 titled “Data + AI in the World of ESG” that included attendees from large global financial institutions. When asked about whether their ESG strategies leverage data and AI, around 30% of them responded in the affirmative .

With ESG analysis now a focus area of investors and with many investors not fully satisfied with the ESG data/information quality, the segment share of AI budget allocation is likely to grow, in our view. Most of these investors are likely to outsource the development of these AI-/NLP-driven ESG analytics to third-party vendors providing cost-effective and quality output, combined with their expertise in the AI and ESG domains. The available output would enable ESG analysts and investors to focus on higher-value activities such as deep-dive ESG research and company engagement.

How Acuity Knowledge Partners helps its ESG clients

Acuity Knowledge Partners is a private-equity-backed organisation, recently spun out of Moody’s Analytics. Our 3,000+ experts work with blue-chip asset managers, hedge funds and private wealth and banking organisations. Our ESG team has been servicing clients across the value chain, with deep-dive research on subjects including climate change-related opportunities and risks, SDG performance analysis, and ESG research and analytics. The team is now expanding its offerings using AI- and NLP-based solutions that are likely to yield significant cost and time savings in the analysis process.

Sources:

https://www.spglobal.com/marketintelligence/en/news-insights/trending/b6b49keq7ysfg9uxnk3_xw2

https://eiuperspectives.economist.com/sites/default/files/green_intelligence_eiu_e_fund.pdf

https://www.greenwich.com/press-release/could-ai-displace-investment-bank-research

https://databricks.com/blog/2020/09/09/its-an-esg-world-and-were-just-living-in-it.html

Tags:

What's your view?

About the Authors

Charanjit Singh joined Acuity Knowledge Partners in October 2019 as the head of ESG Research. He has more than 20 years of experience in investment research and advisory, with a focus on ESG, climate change and clean energy. Previously, he was a Senior ESG Strategist with HSBC and the co-head of its India Onshore Research Centre. During his tenure of over 11 years at the bank, Charanjit was instrumental in building and leading three sector teams for the bank’s global research business in India.

Charanjit has been rated in the Asia Money survey amongst the top five analysts in India/ Asia during 2012-15, for his sector coverage. He..Show More

Ramesh Dharanipathy has been with Acuity Knowledge Partners for 13 years working in the areas of ESG, Sustainability, climate change and investment research. He has acquired extensive experience in various aspects of ESG, sustainability, and climate change, including conducting climate-related risk and opportunity assessments, performing ESG and climate maturity evaluations, and mapping Sustainable Development Goals (SDGs) alongside impact assessments for investee companies. His expertise also encompasses comprehensive support for SFDR reporting, EU Taxonomy assessments, double-maturity evaluations, ESG benchmarking and analysis, and developed ESG – related methodology documents. Additionally, he is involved in assessing the impact of green, social, and sustainable bonds while quantifying the financial implications of climate risks...Show More

Comments

08-Jan-2021 08:29:04 am

I think the idea is genius the process how ESG is implemented is infact so effective, the will totally revolutionize business industry. Possibilities are amazing on how to prevent potential risk ahead of time and how fast and early they can avoid or resolve certain possible risk. Although tools are not that user friendly yet can improve overtime. The only thing that limits you is your own imagination on how to assess situations and how will you use the tools. New process or system like this without imagination of people o new issues may arise every now and then, things unforseen how people and AI would be affected. I just hope you select wisely and apply nice approaches to ind to potential individual. Power like this comes with great responsibilities thay may or can be use unlawfully. Create a system checklist on hpw to pick them.

Like the way we think?

Next time we post something new, we'll send it to your inbox