Published on March 28, 2018 by Archana Kanojia

Understanding RFPs

In liaising business relationships for procurement of services of products between companies (buyer and bidder), a request for proposal (RFP) is a bidding solicitation document and usually the first mode of engagement. When a company announces that funding is available for a particular project, it usually resorts to using a consultancy or an RFP system to make the process more manageable. An RFP is an information-seeking document that a buyer (or inquirer) – interested in procuring a service or product – floats in the market and elicits responses from potential service providers to gauge the best fit in terms of offerings and strategy. It becomes imperative for bidders (or respondents) to showcase their strengths and differentiating edge in a clear manner.

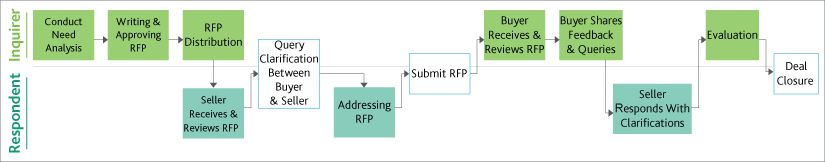

A standard RFP process is depicted below:

Investing in tools to smoothen the RFP response process

A well-drafted RFP can speed up the decision-making process. However, it also has its share of challenges, as the responses are examined and scored individually by a review committee, and the review team faces time and resource constraints. Hence, the greatest challenge before the review team is receiving too much, inaccurate and/or incomplete information. Accordingly, the buyer may have to engage in back and forth collaboration with the responder.

To circumvent these challenges, responders are increasingly investing in proposal management software (such as PMAPS and Qvidian) to quickly turn around RFPs. These softwares are centralized databank repositories that act as a ready reckoner while responding to an RFP. The responses are saved in one central location, thereby saving the time consumed on coordinating with various departments or reviewing older RFPs (for responses).

Adopting industry-leading expertise to enhance RFP submission

Sales organizations face one pertinent question: how do they keep this database up to date as it has become the backbone of an RFP? These databases receive input from past RFPs and companies’ internal communications, such as collecting data from various divisions or meetings. But these centralized databank repositories need to be edited in a timely manner with any new or redundant information to quickly turn around RFPs and keep pace with the competitive climate.

In this age of cut-throat competition, the outsourcing of these database updates to outside vendors is increasing. It is important to note that competition not always is in terms of a financial advantage but also entails having a technical advantages as well as regulatory compliance over peers. According to research, approximately 68% of the firms surveyed outsource the task of updating the databank library to some extent. The outsourcing partner offers a vast scope of services that optimizes clients’ RFP processes. They include (but are not limited to) the following:

-

Addressing RFPs

-

Timely cleansing of RFP databases

-

Reviewing past RFPs to identify new/redundant language

-

Engaging with subject experts for any language updates

-

Reviewing financial reports to identify updated information

-

Managing a list of RFPs addressed

Apart from the cliché that outsourcing enables responders to optimally concentrate their efforts and resources on their core operations and expand to new territories, other advantages are illustrated below:

MA Knowledge Services, which gained this expertise over the years across clients, takes pride in providing quick and effective solutions in this sector, not only toward RFPs but also for Request for Information (RFIs) and quarterly and annual due diligence questionnaires. Not limited to this, we also offer services of periodic cleansing and maintenance of databank libraries (such as PMAPS and Qvidian), including uploading qualitative and quantitative data.

Tags:

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance and Marketing from New Delhi Institute of Management, Delhi. She..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox