Published on May 15, 2024 by Ma. Daniela Barrantes

Introduction

In today’s dynamic business landscape, organisations recognise that harnessing insight on individual differences and diverse backgrounds can improve overall performance. Navigating the complexities of managing people would be simpler if everyone were identical; unfortunately, that is not the case.

As Sev, J. T. (2019) espouse, variability exists in personal characteristics, shaped by factors such as social background (including cultural upbringing), gender, race, disabilities, cognitive abilities, intelligence, personality traits and the environment in which the individual was raised. These multifaceted influences significantly impact employee behaviour in the workplace, resulting in diverse outcomes: from low performance trends and inefficiencies to high productivity, effective work completion, satisfied customers, innovative work methods and even fluctuations in job satisfaction and mood.

The big five and business leverage

Businesses increasingly recognise the significance of understanding and leveraging customers’ Big Five personality traits to inform their decisions and strategies. According to Fripp, G. (24 November 2023), these traits impact business decisions as follows:

| Personality trait | How to leverage |

| Extraversion | Extraverted individuals tend to be outgoing, sociable, and energetic. Businesses can tailor marketing efforts to engage extraverted customers through social events, community involvement and interactive campaigns. For instance, hosting lively product launch events or creating vibrant online communities can resonate with this personality trait. |

| Agreeableness | Agreeable individuals are cooperative, empathetic, and compassionate. Companies can focus on building strong customer relationships by emphasising excellent customer service, personalised interactions and collaborative problem-solving. Brands that prioritise social responsibility and ethical practices also appeal to agreeable consumers. |

| Conscientiousness | Conscientious people are organised, responsible and detail-oriented. Businesses can benefit from this trait by ensuring reliability, consistency and quality in their products and services. Implementing efficient processes, clear communication and transparent policies aligns well with conscientious customers’ preferences. |

| Neuroticism (emotional stability) | Neurotic individuals experience higher emotional fluctuations and stress. Companies can address this by providing stress-relief solutions, promoting wellness, and offering reliable customer support. Brands that create a sense of security and stability can attract and retain neurotic customers. |

| Openness to experience | Open individuals are curious, imaginative, and open-minded.

Businesses can appeal to this trait by offering innovative products, unique experiences, and creative marketing campaigns. Brands that celebrate diversity, experimentation and intellectual growth resonate with open-minded consumers. |

Source: Fripp, G. (24 November 2023), adapted to table format

Predicting investment decisions

Investment decisions are crucial for business, as they directly impact a company's growth, profitability, and long-term sustainability. After years of extensive research into the Big Five personality traits, businesses have become increasingly intrigued by the profound impact that these traits can have on investment decisions within the realm of behavioural finance.

To achieve this, Hamza, N., & Arif, I. (2019) discussed three psychological theories regarding individual behaviour, blending first the theory of planned behaviour, which asserts that behaviour is shaped by intentions influenced by internal and external factors, and second, the prospect theory, which suggests that individuals lean towards risk aversion in decision-making, providing insight on how people think and choose. This emphasises minimising risk to attain specific objectives. Third, the Big Five personality traits that play a significant role in shaping behaviour.

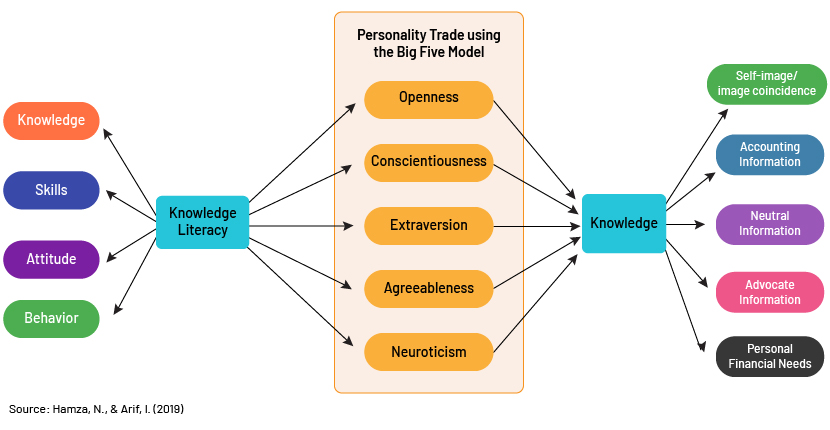

Figure 1: Conceptual framework

Figure 1 illustrates the correlation between financial literacy and the Big Five personality traits and the association between the Big Five traits and investment decisions.

The findings of the study are as follows:

| Predictability | % | Explanation |

| Financial literacy Openness | 6.5% | Financial literacy can explain openness by 6.5% |

| Financial literacy Conscientiousness | 1.2% | Financial literacy can explain conscientiousness by 1.2% |

| Financial literacy Extraversion | 15.2% | Financial literacy can explain extraversion by 15.2% |

| Financial literacy Agreeableness | 0.8% | Financial literacy can explain agreeableness by 0.8% |

| Financial literacy Neuroticism | 18.2% | Financial literacy can explain neuroticism by 18.2% |

| Financial literacy + Big Five Investment decisions | 89.5% | Financial literacy and all five mediators can predict investment decisions by 89.5% |

Source: Results from Hamza, N., & Arif, I. (2019), adapted to table format

The results indicate that both financial literacy and the Big Five personality traits play significant roles in facilitating investors' ability to make informed and rational investment decisions.

They also suggest that policymakers and managers should prioritise profiling investors according to their personality traits. This tailored approach to profiling is expected not only to attract new investors but also to contribute to the overall increase in financial investment in the market.

The role of the big five in social media

Studies have also revealed why people use social media differently, based on their personality traits. Knowing the motives behind social media use, businesses could tailor their strategies to better connect with their target audience, create more engaging content and ultimately increase their reach and impact.

This understanding also allows businesses to adapt their marketing efforts to different personality traits and behaviours, maximising their effectiveness in engaging and retaining customers.

For the following results, Kircaburun, K., Alhabash, S., Tosuntaş, Ş. B. and Griffiths, M. D. (2018), used The Social Media Usage Aims Scale (SMUAS) developed by Horzum (2017) adapted for social media. The SMUAS comprises 30 items on a five-point Likert-type scale examining seven subfactors:

-

Maintaining existing relationships (e.g., “I use social media to stay in touch with friends or people I know”)

-

Meeting new people and socialising (e.g., “I use social media to meet new friends”)

-

Making, expressing, or presenting a more popular oneself (e.g., “I use social media to be cool”)

-

Passing time (e.g., “I use social media to occupy my time”)

-

As a task management tool (e.g., “I use social media to store and organise photographs”)

-

For entertainment (e.g., “I use social media to listen music”)

-

For informational and educational (e.g., “I use social media to keep abreast of current events”)

By the conclusion of the study, the identified motivations encompassed the following:

| Personality trait | Motive for using social media |

| Extraverted | · Maintaining existing relationships · Passing time · Managing their tasks |

| Agreeableness | · Maintaining their existing relationships · Informational and educational purposes |

| Conscientiousness | · Expressing or presenting themselves as being more popular |

| Neuroticism (emotional stability) | · Passing time |

| Openness to experience | · Maintaining their existing relationships · Informational and educational purposes |

Source: Kircaburun, K., Alhabash, S., Tosuntaş, Ş. B. and Griffiths, M. D. (2018), adapted to table format

Understanding these underlying reasons provides valuable insights for tailoring strategies and interventions to better meet the needs and preferences of social media users.

Moreover, it offers businesses and organisations an opportunity to align their approaches with these motives, enabling enhancing engagement, building stronger relationships, and achieving their desired outcomes in the digital landscape.

Conclusion

In addition to understanding these traits, organisations can use the Big Five model to

-

Optimise talent management processes

-

Improve job performance

-

Foster a positive work environment

-

Tailor marketing strategies to different personality profiles

By recognising and leveraging these key personality traits, businesses can create more meaningful connections with their customers, enhance loyalty and drive growth.

How Acuity Knowledge Partners can help

We can assemble a proficient team of data scientists and data engineers to develop a sophisticated platform tailored to monitoring consumer behaviour across social media platforms. As part of our financial services technology solutions, our data scientists undertake the pivotal task of analysing data derived from social media channels to uncover valuable insight on consumer behaviour, identifying preferences, sentiment, and emerging trends. They also specialise in crafting bespoke personality traits models tailored to the specific needs and objectives of our clients.

Our data engineers can construct the technological infrastructure necessary to operationalise the generation of insights. With expertise in software development and system architecture, they can build a robust framework able to run sophisticated analytical models and design a user-friendly platform interface to cater to the needs of investment analysts by providing comprehensive visualisations of the insights from social media data and presenting them in a clear and intuitive manner, enabling effective analysis of insights and strategic decision-making.

By harnessing the power of data analysis, model development and technological innovation such as artificial intelligence and machine learning, we empower investment analysts to stay ahead of market trends and capitalise on emerging opportunities in today’s dynamic business landscape.

Frequently Asked Questions

1. How can businesses use personality traits in marketing?

Businesses can use personality traits to personalize their marketing strategies. They can do this by aligning products and services with customer’s behaviours and preferences.

2. How do personality traits influence investment decisions?

Personality traits affect how individuals approach investments. The data shows that both financial literacy and personality traits play significant roles in facilitating investors' ability to make informed and rational investment decisions. These insights help institutions craft customized investment strategies to align with client’s psychological profiles.

3. How can Acuity Knowledge Partners assist businesses in leveraging personality traits?

Acuity Knowledge Partners can analyse consumer data to identify personality-driven trends, enabling businesses to refine their marketing and product strategies. By integrating this information with advanced analytics, we can help optimize customer engagement, improve retention, and achieve higher ROI on marketing efforts.

Bibliography:

-

Fripp, G. (24 November 2023). Big five model in Organizational Behavior – Organizational Behavior. My Organizational Behaviour Notes. https://www.myorganisationalbehaviour.com/big-five-model-in-organizational-behavior/

-

Sev, J. T. (2019). The big five personality traits as determinants of job performance behavior in business organisations. Journal of Entrepreneurship Studies Benue State University, Makurdi, 89

-

Kircaburun, K., Alhabash, S., Tosuntaş, Ş. B. and Griffiths, M. D. (2018). Uses and gratifications of problematic social media use among university students: A Simultaneous Examination of the big five of personality traits, social media platforms, and social media use motives. International Journal of Mental Health and Addiction, 18(3), 525–547. https://doi.org/10.1007/s11469-018-9940-6

-

Horzum, M. B. and Demirhan, E. (2017). The role of chronotype on Facebook usage aims and attitudes towards Facebook and its features. Computers in Human Behavior, 73, 125–131

-

Hamza, N. and Arif, I. (2019). Impact of financial literacy on investment decisions: The mediating effect of big-five personality traits model. Market Forces, 14(1)

Tags:

What's your view?

About the Author

Daniela Barrantes holds the position of Senior Associate Data Analyst within the Specialized Solutions division. Her professional expertise encompasses investment research, marketing, and data analysis, reflecting her diverse skillset and background.

Like the way we think?

Next time we post something new, we'll send it to your inbox