Published on May 7, 2021 by Mamatha Subbaiah and Venkatesh Krishnamurthy

The London Interbank Offered Rate (LIBOR) is a globally accepted key benchmark interest rate used by the major global banks to lend to each other. LIBOR played a crucial role in global markets, acting as a reference rate for financial contracts and a yardstick for measuring funding costs and investment returns for a wide array of financial products, including adjustable-rate mortgages (ARMs), credit cards, floating-rate loans and swaps.

Due to the element of judgment involved in a bank’s credit risk, coupled with the global financial crisis of 2009 and high-profile rate-rigging cases that were busted in 2012, banks gradually reduced relying on LIBOR. In 2017, the Financial Conduct Authority (FCA) announced that banks need not provide data for the purpose of arriving at LIBOR, with effect from 2021. As a phasing-out process, one-week and two-month USD LIBOR rates will not be available after 31 December 2021.

The Alternative Reference Rates Committee (ARRC) is closing on the Secured Overnight Financing Rate (SOFR) as a benchmarking rate in the US. Federal organisations such as Fannie Mae and Freddie Mac switched from LIBOR to the SOFR in mid-2020.

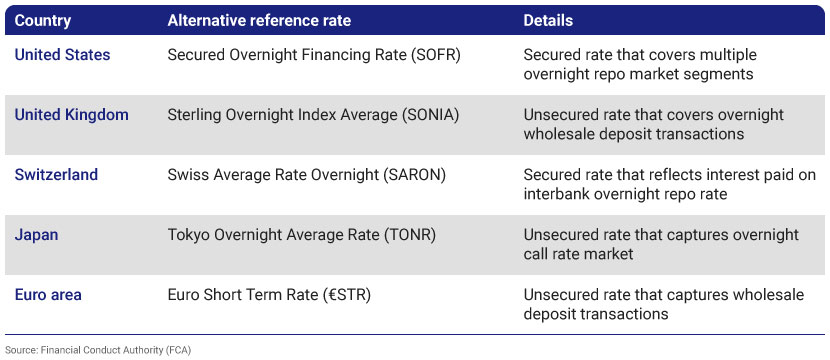

The table below shows the alternative reference rates of different countries.

The end of LIBOR poses significant risks and challenges in terms of complications in the transition to a new benchmark rate:

-

Financial contracts worth several trillions of dollars are based on LIBOR and need to be transitioned to a new rate, highlighting the Libor transition Impact on global financial operations and systems.

-

The number of transactions and specific complex transactions including counterparty and syndicated transactions is large

-

Existing contracts and clauses were framed to cover a temporary unavailability of LIBOR, but not a cessation or replacement

-

Some lending institutions estimate the transition to cost USD200m

Banks and other lending institutions should take the following steps for a smoother transition:

-

Ensure new contracts contain “fallback” clauses and sections that clearly set out what happens when LIBOR is suspended

-

Educate internal/external stakeholders as well as their customers to ensure all relevant business implications are dealt with appropriately

-

Test their internal tools/templates/applications with replacement rates to ensure an effective monitoring mechanism

-

Address the material differences between LIBOR and the proposed alternative rate

-

Develop non-LIBOR products

Private-label commercial mortgage-backed securities (CMBS) issuers started including fallback language in their documents in late 2019 to ensure a smooth transition from LIBOR to the SOFR. Due to the aggressive deadlines set by agency lenders, banks and financial institutions began originating SOFR-linked multifamily mortgages by the end of 3Q 2020. They also reported that no changes or obstacles were observed. However, the Libor Impact is still being felt as institutions continue to adapt to SOFR-linked products and the new benchmark rates. The two leading clearing houses for derivatives – the Chicago Mercantile Exchange and the London Clearing House – began switching to the benchmark and trading in SOFR derivatives in October 2020.

Although banking regulators had announced in 4Q 2020 that financial institutions were free to choose alternatives to the SOFR, small and midsize banks observed that the SOFR did not suit their business and declared that they preferred the American Interbank Offered Rate or AMERIBOR, a rate based on overnight loan transactions on the American Financial Exchange.

Investors and borrowers began declaring breaches of contract due to the shift from LIBOR to the SOFR. Hence, to prevent potential lawsuits, statutory initiatives were designed towards the end of 2020 and the start of 2021.

Given the fast-approaching deadlines, financial institutions started taking the following comprehensive steps:

-

Extracting key contract clauses/conditions along with the associated terms and provisions

-

Bucketing the various types of clauses into key categories

-

Framing the relevant SOFR provisions to replace the existing key clauses/categories

-

Detailed impact analysis for further action/recommendation

How Acuity Knowledge Partners can help

We support financial institutions across the lifecycle of LIBOR transition with a well-defined systematic approach, so they can be prepared for the required remediation process and procedures. We also help them restructure specific clauses relating to existing interest rates within loan agreements.

References:

https://www.financierworldwide.com/libor-no-more#.XovfuPkza00

https://www.brinknews.com/why-libor-will-disappear-and-what-it-means-for-you/

What's your view?

About the Authors

Mamatha Subbaiah has over 10 years of experience in banking and commercial lending domains. Her area of expertise includes writing credit appraisal reports, industry reports, Cash Flow modelling, Slotting and client pitch presentations. At Acuity Knowledge Partners, she is part of sector and product-specialist teams in Commercial Lending, focusing on diverse sectors such as UK Real Estate, UK Agriculture, and US Real Estate. She holds a MBA (Finance) and a bachelor’s degree on Commerce.

Venkatesh Krishnamurthy has been with Acuity for over 10 years and has over 18 years of overall experience in Commercial Real Estate (CRE). At Acuity Knowledge Partners, he leads multiple CRE client engagements based out of US and is actively involved in client management, training, and quality control of deliverables. He holds a MBA (Finance) and a bachelor’s degree on Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox