Published on June 17, 2024 by Alankar Ranade, CFA

-

The US Treasury market is in a precarious situation as dwindling demand from traditional buyers is unlikely to be able to absorb the elevated supply, leaving a void that will have to be filled by higher yields.

-

In this scenario, even rate cuts by the US Federal Reserve (Fed) are unlikely to be sufficient to lower yields, which could have severe and widespread effects on valuations of fixed income asset classes.

-

The multiple forces at play would increase market volatility, making deep-dive fundamental research the key to generate alpha and to avoid major losses.

-

Acuity Knowledge Partners, with its team of seasoned analysts, has the experience of supporting market participants to operate and succeed in fast-changing markets.

The inflation “final boss” is not easy

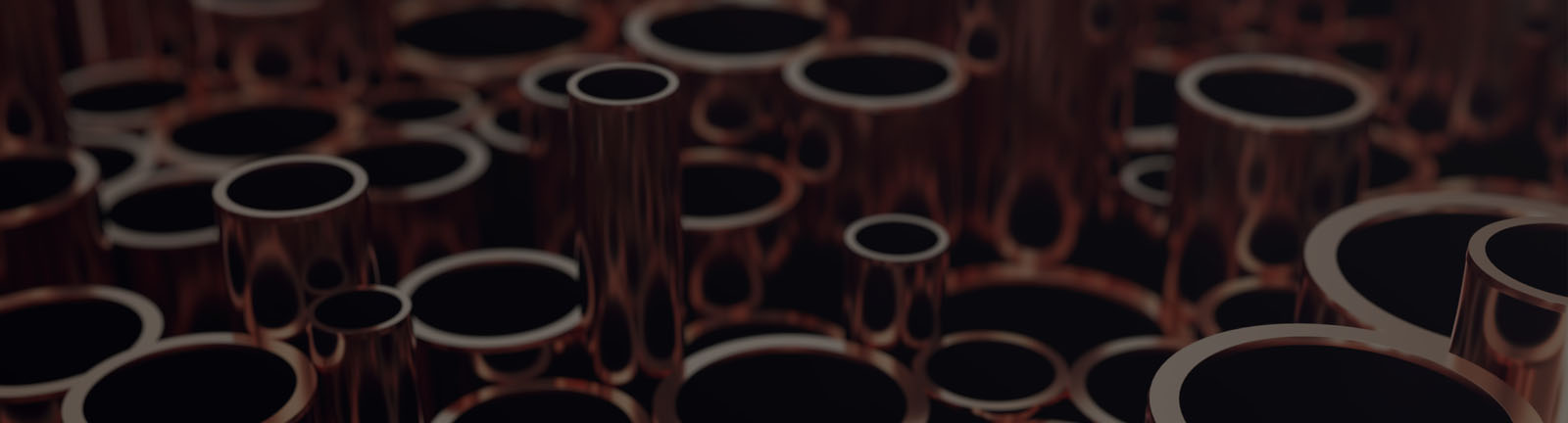

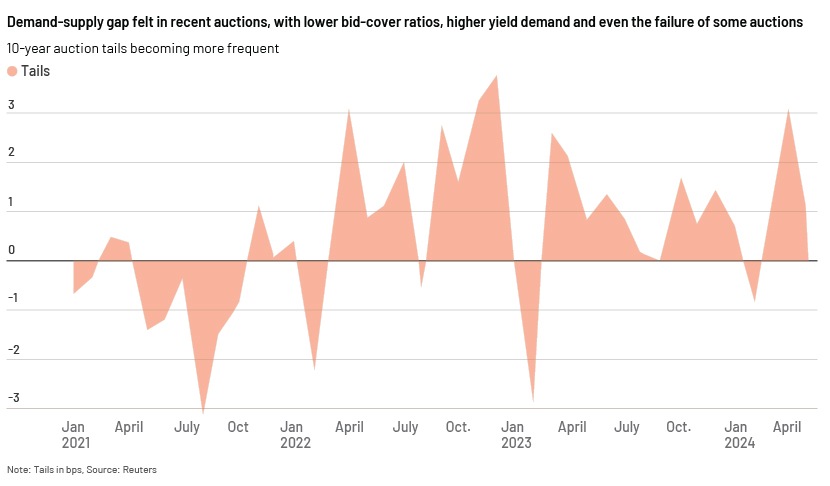

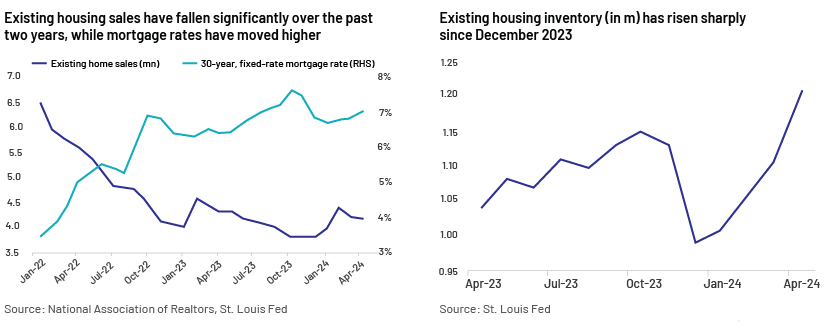

Financial markets have grasped in 2024 that the last mile of inflation (from 3% to 2%) is sticky and difficult to get rid of. Rate cut expectations for the year have been lowered sharply to 1-2 as of May from 6-7 in January 2023. With this, treasury yields have moved higher (2-year and 10-year yields rising 65bps year to date) and market sentiment is firmly in the “higher for even longer” camp. However, even keeping benchmark rate expectations aside, the demand-supply characteristics of the treasury market suggest that treasury yields will stay high over the medium term even after the Fed cuts rates.

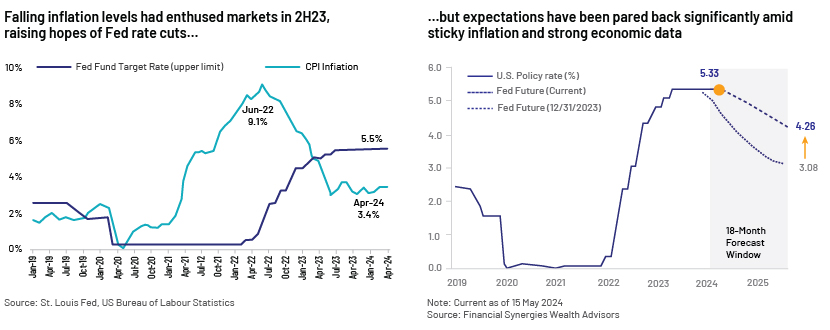

The endless river of treasuries

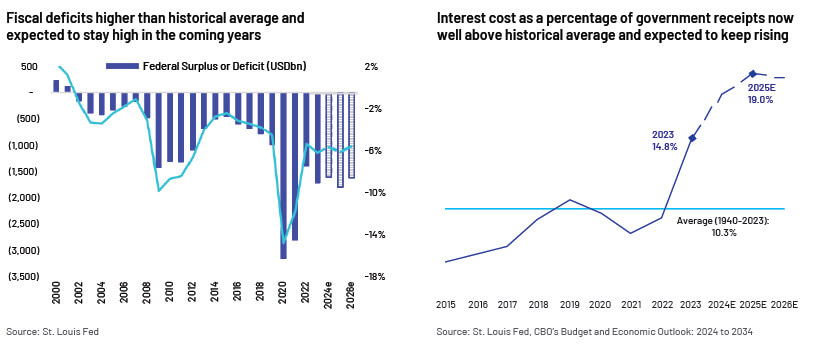

On the supply side, the Congressional Budget Office (CBO) expects the US government to continue running high fiscal deficits (USD1.6tn in 2024; 6.2% of GDP), which are financed by Treasury issuances and will further add to the supply pressure.

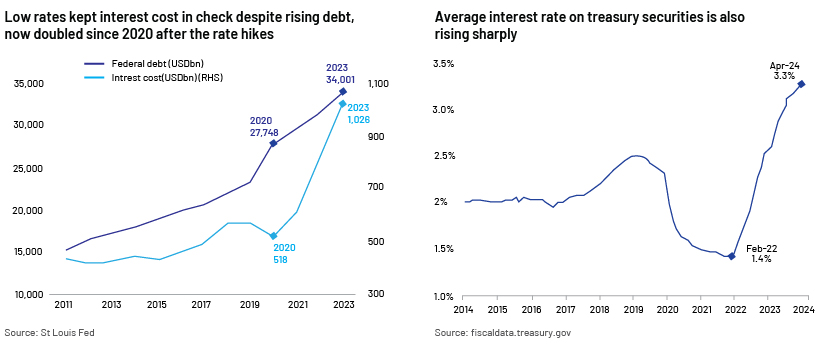

Apart from discretionary spending, interest payments are a key factor pushing up government expenses and the deficit and have crossed USD1tn in 2024 – the highest ever.

Interest cost is expected to continue to rise and more than double to 19% of government receipts in 2025 from 8.7% in 2021, putting additional strain on government budgets. This also creates circularity, where the government needs to borrow more to cover its interest payments, further increasing debt and interest liabilities.

Where art thou, buyers?

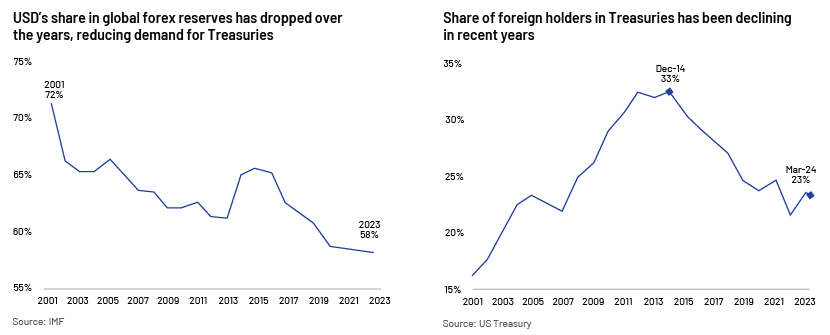

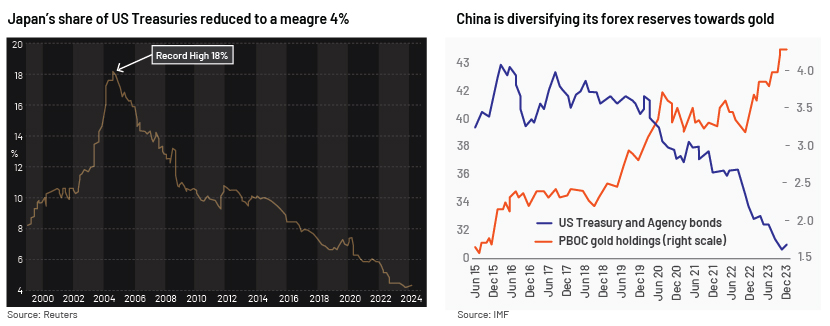

On the demand side, foreign sovereigns have traditionally been key buyers of Treasury securities. Japan and China have been the top two buyers every year over the past 15 years, and at their peak held 18% and 14% of the overall stock of US Treasuries, respectively. However, their share of holdings has reduced significantly over the past 10 years. With Japan exiting the yield curve control policy and China adding gold at the expense of US Treasuries, demand from these countries is likely to contract further. We saw anecdotal evidence recently when China sold USD53bn of Treasuries and agency bonds in 1Q24.

The other major buyer, the Fed, has also been pulling back. Instead of buying Treasuries, the Fed is now in quantitative tightening (QT) mode and is letting maturing Treasury securities roll off its balance sheet, with a focus on reducing the size of its balance sheet, which had ballooned amid the pandemic. Although the Fed will lower the amount that it is reducing its balance sheet by (USD60bn/month from June vs USD95bn now), it is still deep in QT territory.

The gap in demand is being covered partly by domestic and foreign private investors; this new buyer composition also puts upward pressure on yields. While the Fed and foreign sovereigns were largely yield agnostic as they needed to buy Treasuries, the current key buyers are choosing to invest and, therefore, insist on yields that factor in the demand-supply dynamic and some term premium. This will not only keep Treasury yields higher but also steepen the Treasury curve.

The gap in demand is being covered partly by domestic and foreign private investors; this new buyer composition also puts upward pressure on yields. While the Fed and foreign sovereigns were largely yield agnostic as they needed to buy Treasuries, the current key buyers are choosing to invest and, therefore, insist on yields that factor in the demand-supply dynamic and some term premium. This will not only keep Treasury yields higher but also steepen the Treasury curve.

Impact of higher Treasury yields – the entire structure will sway if the foundation moves

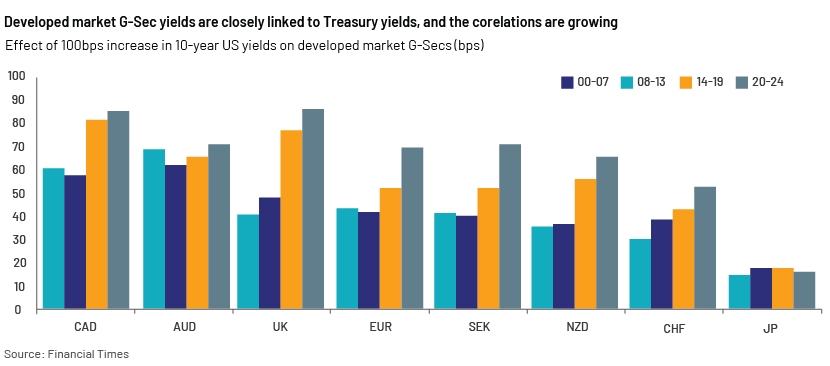

US Treasuries play a unique role in the global economy as the risk-free benchmark against which all assets are priced. As a result, the effect of high Treasury yields will reflect in the values and prices of all asset classes.

US private borrowers are likely to be hit by high borrowing costs due to high benchmark rates and constrained liquidity in the market. This would affect the viability of many investment projects and bring down private capex and, consequently, GDP growth. Interest-rate sensitive sectors such as construction, capital goods, and infrastructure are likely to be impacted the most. Moreover, high interest rates will strengthen the USD, making exports less competitive and further hitting economic growth.

With inflation levels falling around the word, all central banks are looking to cut benchmark rates to boost their respective economies. Europe, the UK, and Canada are seeing lower inflation than the US, and the European Central Bank(ECB) and Bank of Canada have initiated rate cuts this month. However, they need to remain cognisant of US rates and maintain historical deltas to attract foreign portfolio flows. This could deter rate cuts around the world and potentially dampen economic growth. Cristine Lagarde also referenced this in her ECB monetary policy press conference of October 2023. A strong USD combined with weak global growth could also hit global commodity markets.

How Acuity Knowledge Partners can help – a different playbook

Fixed income markets have adapted to rising benchmark rates well after years of near-zero levels. If treasury yields stay higher for longer, the risk-reward dynamics across fixed income asset class would come under scrutiny. This, coupled with tight spreads across fixed income asset classes, election and geopolitical conflicts, will make for a heady cocktail for volatile markets in 2H24. Given the scenario, it becomes increasingly important for financial institutions to focus on deep fundamental bottom-up and top-down research to find the opportunities and avoid the sinkholes.

Acuity Knowledge Partners has two decades of experience in partnering with leading market players across market cycles. Our experience and expertise across various fixed income asset classes help us partner with buy- and sell-side institutions and support their research teams to identify and take advantage of dynamic situations.

Tags:

What's your view?

About the Author

Alankar has 16 years of experience in investment research and has been supporting high-yield analysts (buy side and sell side) and credit rating analysts. He currently supports sell-side analysts of a major trade desk, covering high-yield issuers in EMEA. Alankar holds an MBA in Finance and a bachelor’s degree in engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox