Published on February 26, 2025 by Ziying Wang

Cold chain logistics developing rapidly in China

Cold chain logistics is an indispensable part of the modern logistics system that ensures that temperature-sensitive goods such as food, drugs and biological products are always kept in a low-temperature environment across the supply chain, maintaining their quality and safety.

China's cold chain logistics sector has developed rapidly in recent years, supported by national policies and continued growth in consumer demand.

A growing market in China

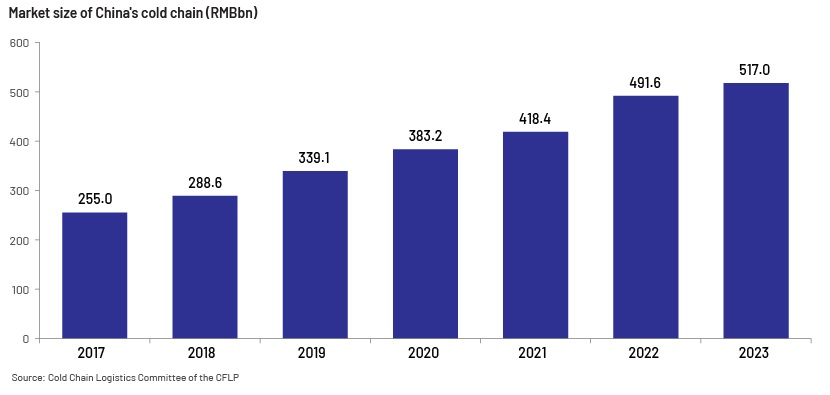

China's cold chain logistics market grew at a CAGR of 14.87% – to RMB517bn in 2023 from RMB255bn in 2017, according to statistics from the Cold Chain Logistics Committee of the China Federation of Logistics & Purchasing (CFLP).

Growth drivers

The government has issued multiple policies to support the sector

The State Council issued the 14th Five-Year Plan for Cold Chain Logistics Development in November 2021, aiming to do the following:

To accelerate implementation of this cold chain logistics construction plan, multiple government departments have since 2022 issued supporting development policies, deployed specific measures for the construction of the cold chain system and provided the sector with multi-faceted support such as project approval and priority credit.

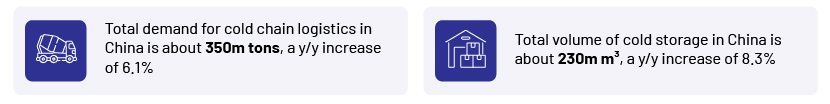

Increasing market demand promotes steady growth of the cold chain logistics sector

China's domestic consumer market is dynamic, and sectors such as fresh food and pharmaceuticals are developing rapidly. Its cold chain logistics sector is growing steadily, with less-than-truckload (LTL) distribution becoming a key factor in the transformation of cold chain logistics companies.

New trends on the demand side of the cold chain logistics sector promote LTL delivery

Customers of traditional cold chain logistics companies are mainly regional brand dealers that require full truckload (FTL) services and pure warehousing services. However, the traditional model is declining, and the demand side of the cold chain logistics sector is developing towards multi-channel retailing, chain branding and delayed ordering.

New trends on the demand side

Multi-channel retailing becomes the norm

The proportion of online channels for delivery on the current demand side has increased, breaking up order batches and quantities, turning FTL delivery into high-frequency, small-batch orders.

strong>Demand-side customers are moving towards chain brands

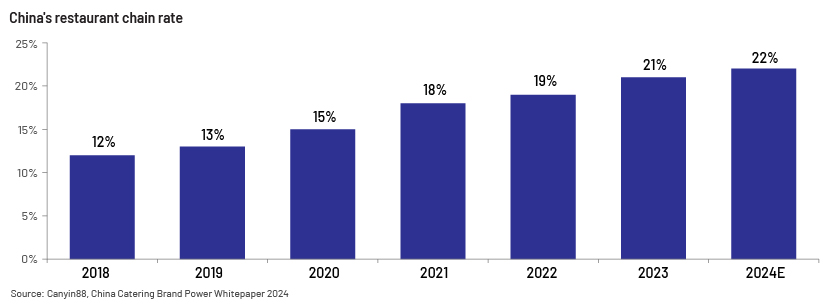

The trend of demand-side customers moving towards chain brands is becoming more and more obvious.

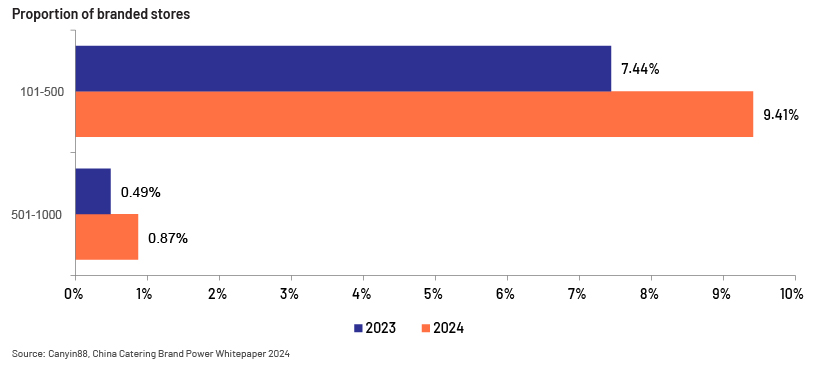

Taking the catering sector as an example, the China Catering Brand Power White Paper 2024 shows that the chain rate of China’s catering sector increased to 21% in 2023 from 12% in 2018; this is expected to have reached 22% in 2024.

The number of chain catering brands with more than 100-500 stores increased by 1.97 percentage points in 2024 compared with 2023. In line with this trend, cold chain companies with capabilities to meet high-frequency and small-batch order demand are gaining popularity, especially cold chain LTL and cold chain warehouse and distribution companies.

Delaying orders: product flow coverage is moving from sales locations to production locations

Customer groups are also moving upward – from the C end to the B end.

The market was previously more focused on sales locations, using the "FTL + warehouse distribution" model under a multi-level distribution model, which often resulted in a significant amount of warehousing redundancy. Based on the need to destock, logistics orders are now being broken up by flattened channels, and the business model has changed to direct shipment from the production location.

At the same time, the retail and catering sectors, as the two core customer sources of the cold chain sector, have begun to penetrate third- and fourth-tier cities, and even county towns, increasing demands on the depth of network of the related logistics service providers.

Traditional model (FTL) vs new trend (LTL): LTL distribution is more appropriate for current demand

Traditional model: FTL distribution refers to an entire vehicle (such as a truck or container) being used to transport goods to the customer. This model is suitable for a large number of goods, as it ensures direct and fast delivery, but the cost is high.

New trend: LTL distribution is usually used when goods are small and delivery is dispersed. It makes full use of space and reduces cost, with more flexible service features. LTL distribution companies also usually provide a variety of services such as cargo tracking and customer service to meet the different needs of customers.

LTL distribution has, therefore, triggered the transformation of cold chain logistics companies.

Conclusion

China's cold chain logistics market is vast, and we are optimistic about its growth prospects.

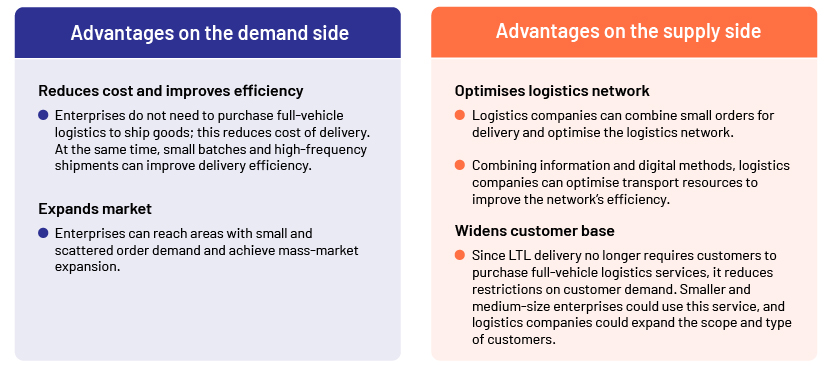

LTL delivery has diverse advantages on both the demand and supply sides of cold chain logistics:

How Acuity Knowledge Partners can help

We help clients stay ahead of the curve by adopting innovative and sustainable business models and taking first-mover advantage of market opportunities available in China’s logistics sector. Sector experts at our Beijing office work with our clients’ strategy, business development, market intelligence and M&A teams, supporting them with critical insights.

Sources:

-

https://baijiahao.baidu.com/s?id=1811399626683483507&wfr=spider&for=pc

-

https://baijiahao.baidu.com/s?id=1746371393461083559&wfr=spider&for=pc

-

https://baijiahao.baidu.com/s?id=1768666589541443847&wfr=spider&for=pc

What's your view?

About the Author

Ziying Wang has over 3 years of experience in consulting and works as an associate in Acuity’s Beijing office. Her role involves in-depth research, data analysis, and monitoring industry trends to support decision-making processes for global clients. In the Consulting & Corporates team, she provides valuable insights through multiple industries.

Like the way we think?

Next time we post something new, we'll send it to your inbox