Published on July 30, 2024 by Prasanna Kumar

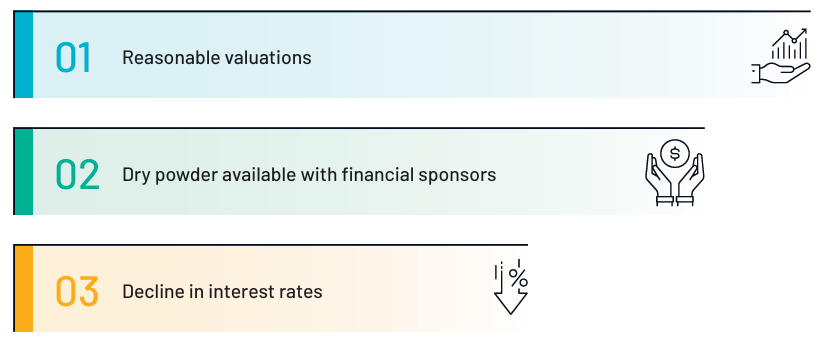

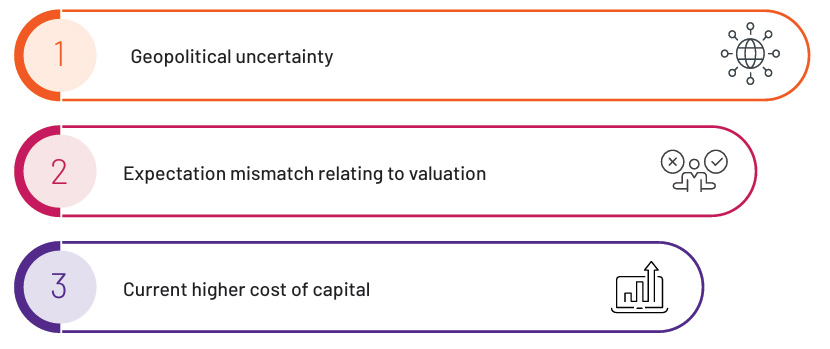

Reasonable valuations and dry powder available with financial sponsors are seen among the top drivers of deal activity in 2024. Geopolitical uncertainty is viewed as the #1 headwind for the industry this year, followed by valuation mismatch and a higher cost of capital.

The ongoing geopolitical headwinds would be offset mainly by the expected decline in interest rates, availability of dry powder, demand for growth capital and cross border transactions.

Ranking of factors driving M&A, according to the survey respondents:

The survey results also highlight factors that could act as headwinds to the industry’s growth and performance:

A “healthy sell-side M&A pipeline” should unlock as conditions improve further. Companies do accept the new pricing reality, which will be helped by a rebound in equity markets - Jane Fraser, CEO, Citigroup

Strategic priorities and focus areas for C-suite executives

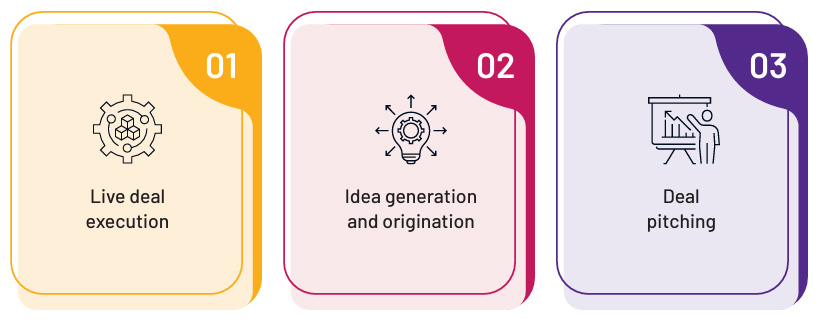

While expanding/augmenting products and services for revenue growth, investment banks and advisory firms are keen to continue focusing on idea generation and origination despite these being the most time consuming tasks.

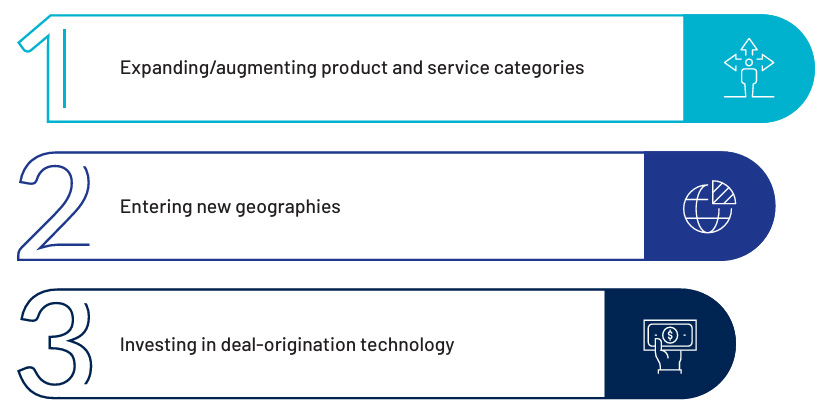

Investment banks and advisory firms are considering the following ideas in order to be more competitive and drive revenues…

…to this end, top management lists the following operational priorities for their bankers in 2024:

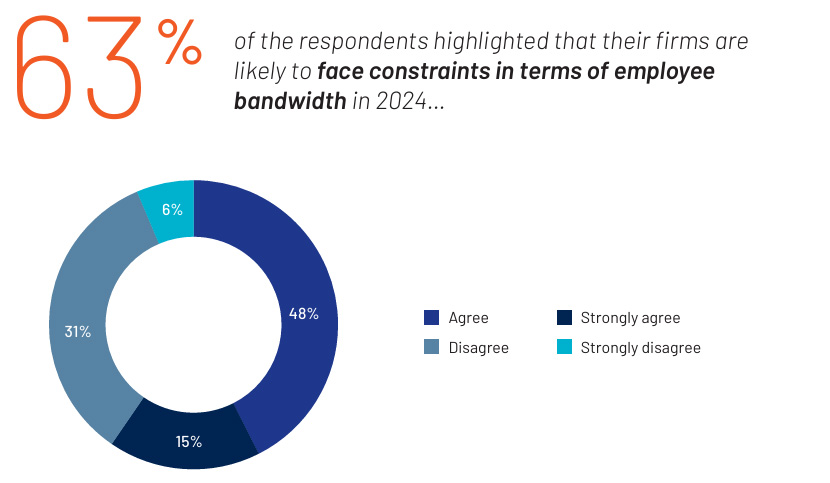

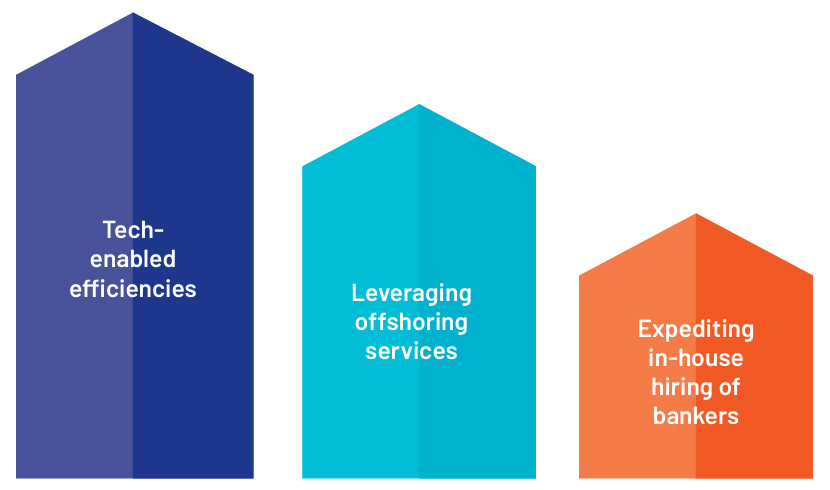

…to bridge this potential gap and/or achieve goals, investment banks and advisory firms are considering the following strategies:

Tags:

What's your view?

About the Author

Prasanna Kumar has over 16 years of experience in global capital markets –Investment Banking and Investment Research. His responsibilities include managing one of the IB engagements and relationship, coordinating with staffers and bankers on new initiatives and services, soliciting feedback, working with teams to identify and improve efficiencies and productivity, training team members on complex and value-added analysis, and implementing industry best practices in the Acuity team for IB Analytics.

Prior to taking up the dedicated role with the account in 2014, Prasanna was working as part of Projects and Transition team gained experience in business development and equity research (financial modeling, report writing, relative..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox