Published on July 1, 2024 by Jagrut Badani

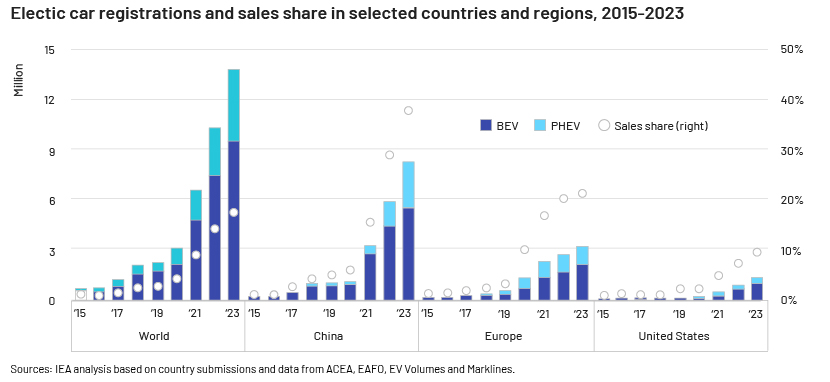

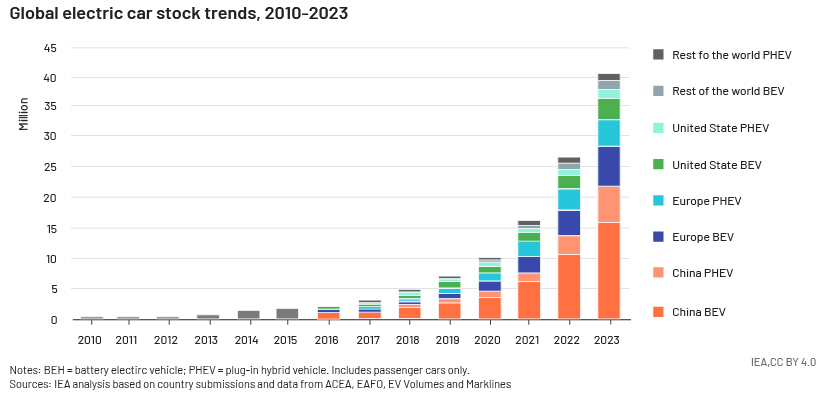

Technological advancements in the electric transport market are crucial for improving battery and electric-motor efficiency, reducing the weight of a car and integrating autonomous driving. Electric-vehicle (EV) sales (14m unites) accounted for ~20% of global vehicle sales in 2023, a 35% increase y/y, with 95% of the sales from China, Europe and the US.

The global EV market is expected to expand at a 13.7% CAGR, to USD952bn by 2030 from USD388bn in 2023. China is the largest EV maker and increased its EV exports by 80% to 1.2m units in 2023.

The market for used electric cars has also expanded – to 800,000 in China, 400,000 in the US and 450,000 in France, Germany, Italy, Spain, the Netherlands and the UK. Installed charging points increased by 40% y/y in 2023.

EV penetration increased to 20% by 2023 from 2% in 2018, with around 40m EVs on the road globally. However, most of the sales are still from China, Europe and the US.

In India, EV penetration, mainly in the two-wheeler and three-wheeler categories, is expected to increase to 40% of total sales by 2030 from 5% as of September 2023.

Growth momentum in EVs is expected to remain driven by long-term cost savings, environmental concerns, expanded offerings by automakers, improved battery capacity and driving range, faster charging and longer battery life, expansion of charging networks and government incentives. Affordability remains the primary concern for EV buyers.

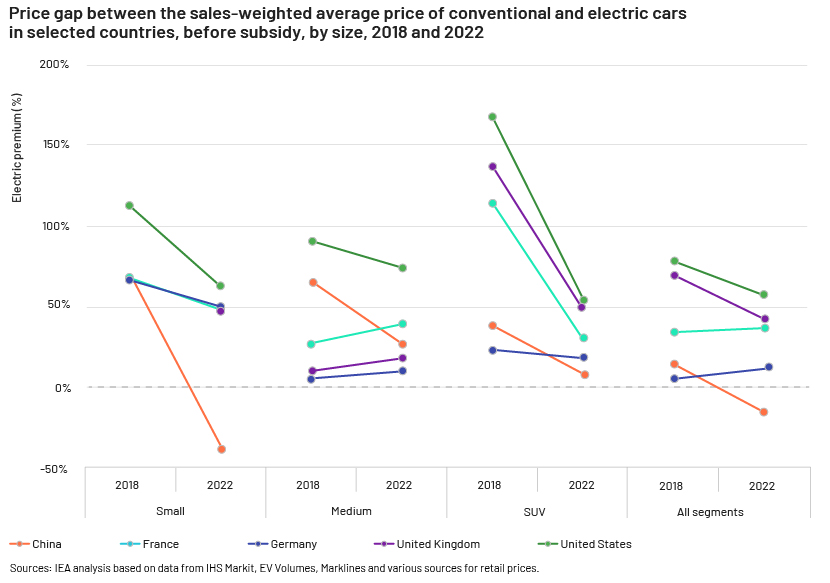

Price parity between electric and internal combustion engine (ICE) SUVs is likely to be reached by 2030 in the US. For certain small-car models in Europe, price parity may be reached by 2025. In China, 55% of EVs sold were cheaper than their ICE equivalents in 2022. Price parity would depend on how market forces such as volatile commodity prices, supply-chain bottlenecks, regulatory requirements, domestic content incentives, evolving technology landscapes and competing battery chemistries impact battery prices, efficiency in manufacturing and competition.

Early-stage investment by battery and component makers tripled to USD1.4bn over 2021-23, with 60% of the investment in lithium chemistry and 25% in emerging technologies such as metal-hydrogen, redox-flow, solid-state and sodium-ion batteries, compared to USD430m over 2018-20 (75% in lithium-based battery technology).

A. Sodium-ion batteries (SIBs) are more stable, cheaper and durable than lithium-ion batteries but lag in energy density, making them suitable for light-duty vehicles. UK-based Faradion, at the forefront of this technology development, has partnered with Reliance Industries to develop a 2-3GWh factory for battery production using layered oxide cathode and hard carbon anode in India by 2025. Natron Energy (US), HiNa Battery Technology (China), Tiamat Energy (France), Zoolnasm (China) and Cham Battery Technology (China) are also planning to develop giga-factories in the coming years.

B. Solid-state batteries (SSBs) use solid electrolyte to improve shelf life, safety and energy density and have faster charging time than lithium-ion batteries but are costlier. Companies such as Hitachi Zosen, NASA, Factorial Energy and University of Bayreuth are developing different SSB technologies, with some preparing to commercialise production. South Korean company SK On Co. is investing USD352m to mass produce SSBs by 2028.

C. Metal-hydrogen technology uses nickel and hydrogen for energy storage to improve cost-effectiveness, safety and durability in extreme conditions, with lower maintenance requirements. EnerVenue specialises in developing this technology, offering energy-storage vessels using this technology; its EV storage solutions are still in R&D.

D. Redox-flow batteries (RFBs) generate electrical energy through ion transfer in a reduction-oxidation electrochemical process between two liquid chemicals pumped from two tanks past a membrane held between two electrodes. For EV, RFB chemistry can take energy as fast as a combustion engine vehicle but provides a shorter driving range. This technology is yet to be commercialised.

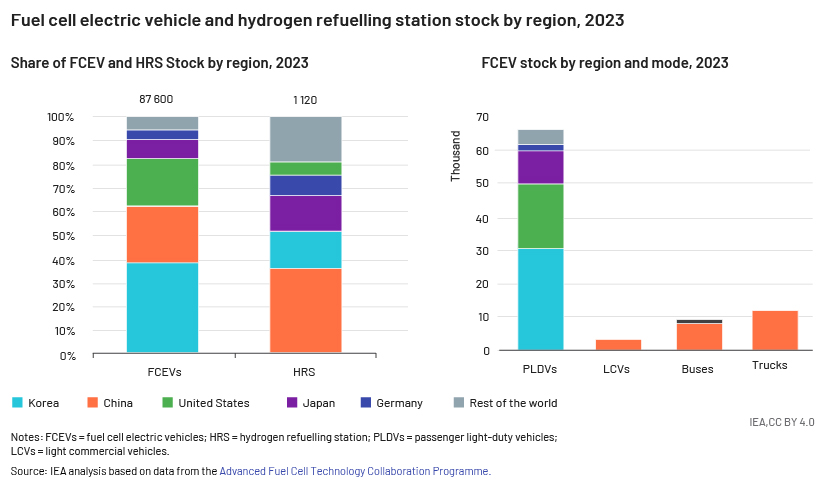

E. Hydrogen-powered vehicles: Green hydrogen produced through electrolysis of water into hydrogen and oxygen using electricity from renewable sources can be commercialised provided efficient storage and a safe transport and distribution network can be developed. R&D is currently focused on reducing the cost of electrolysis. Australia recently pledged USD2bn to support clean hydrogen. The US has also announced tax credits up to USD3/kg for production of low-emission green hydrogen. A number of European countries, such as France and Spain, have also pledged billions of dollars in investment for this technology.

F. Nuclear propulsion: Nuclear propulsion has been in use in military submarines, aircraft carriers, icebreaking ships, experimental aircrafts and missiles for years, but due to safety concerns, size constraints and public perception, research on nuclear-powered EVs for mass consumption is limited.

Developments in electric aircraft: Several small electric vertical take-off and landing (eVTOL) aircraft are currently being flight-tested, with the potential to operate them as air taxis in the near future. Current models include the following:

-

Volocopter Volocity (German 2-seater, 18 rotors, 22 miles flying distance) is expected to launch commercial services by the 2024 Summer Olympics in Paris.

-

US-based Joby Aviation (6 propellers, 4 wing-mounted batteries, 150-mile range, 200 mph top speed) has applied for a commercial air-taxi licence to operate its fleet by 2025. Toyota has invested USD400m in Joby.

-

Other major eVTOL developers such asLilium Jet (UK), Archer Midnight (US), Autoflight Prosperity (Germany+China), Ehang (China) and Vertical Aerospace (UK) are also expected to launch commercial services by 2025.

Varieties of EVs:

-

Battery EV (BEV) is a pure EV with a rechargeable battery. BEVs accounted for 70% of global EV stock in 2023. In France, BEV sales were stronger than PHEV sales in 1Q24.

-

Plug-in hybrid EV (PHEV) has a plug-in point to charge both electric-motor and ICE vehicles. Most of them start with an electric motor but can switch to a gas engine. PHEVs had higher demand than BEV models in China, Germany, the US and the UK in 1Q24.

-

Fuel-cell EV (FCEV) uses fuel cells instead of rechargeable batteries to generate electricity through a reaction between hydrogen and oxygen. They can be refuelled at hydrogen charging stations. FCEV penetration increased by 20% in 2023 to 87,600 units – of which ~50% were cars, ~25% trucks and ~10% buses. Light commercial vehicles were the fastest-growing segment within FCEVs; Korea (40% of FCEVs) was the leading adopter, followed by China and the US (20% each).

Developments in other light-duty EVs: Electric two-wheeler/three-wheeler (2/3W) sales in xx accounted for 13% of global (2/3W) sales in 2023, with penetration the highest in China (30%), followed by India (8%) and other ASEAN countries (3%). However, the overall 2/3W market declined in 2023 mainly due to a 25% drop in China, which continues to command 78% of global 2/3W sales, partially offset by 40% growth in India. In the electric 3W space, India overtook China to become the largest market, with sales increasing by 65% to 580,000 units in 2023.

Government support: The Indonesian government is wooing international companies such as BYD and VinFast to set up manufacturing in the country by limiting the local-content requirement to 40%; it aims to increase production of electric cars to 2m and electric 2/3Ws to 13m by 2030. It has also provided a USD9.8bn package to support battery manufacturing through partnerships with Hyundai, LG Energy Solution and Indonesia Battery Corporation, capitalising on its ample nickel reserves.

Norway, France, Estonia, Finland, Switzerland and the Netherlands have introduced a weight-based purchase tax to encourage sales of lighter vehicles, reducing emissions through lower material content and energy consumption per vehicle.

China, Belgium, Germany, the Netherlands and Spain are encouraging exports of used EVs. In 2022, China exported 70,000 used vehicles while EU exported 120,000 electric cars.

Governments are trying to reduce emissions through zero-emission targets by investing in emission-reduction technologies and electric infrastructure development programmes. The UK government will invest USD250m to deploy electric trucks and develop charging sites. India’s NITI Aayog launched an electric freight corridor for large-scale freight electrification and plying 7,750 electric freight vehicles by 2030. India has also planned USD390m in funding to stock 50,000 electric buses by 2030.

Lithium, nickel and copper assets are being secured by EV battery, component and car makers in partnership with investment banks and local governments in Chile, Australia and other major commodity-producing countries.

Certain governments, such as that in France (USD700m), are also providing grants to construct gigafactories for battery production and launching critical raw material funds.

Contributions towards emissions reduction:

The EU plans to reduce 90% of CO2 emissions by 2040, and the US plans to reduce 60% by 2032. These plans involve 100% zero-emission vehicles by 2035. Global automakers such as Volkswagen, Ampere, Togg, Toyota, Nissan, Suzuki, Subaru, Tata, Hyundai, Kia, SAIC and Geely have, therefore, announced ambitious targets to increase the share of EV sales share to 50% by 2025-31, which would in turn reduce emissions.

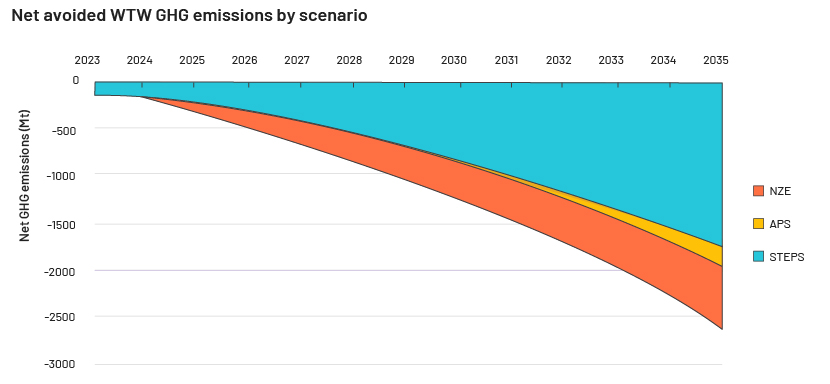

Using EVs instead of ICE vehicles would avoid c.2Gt of CO2-equivaent greenhouse gas emissions in 2035, according to the International Energy Agency’s Stated Policies Scenario (STEPS). Additional emissions could also be avoided by 2023, as projected by the 2050 Net Zero Emission (NZE) scenario and the Announced Pledges Scenario (APS).

Progress in the EV space by leading global automakers:

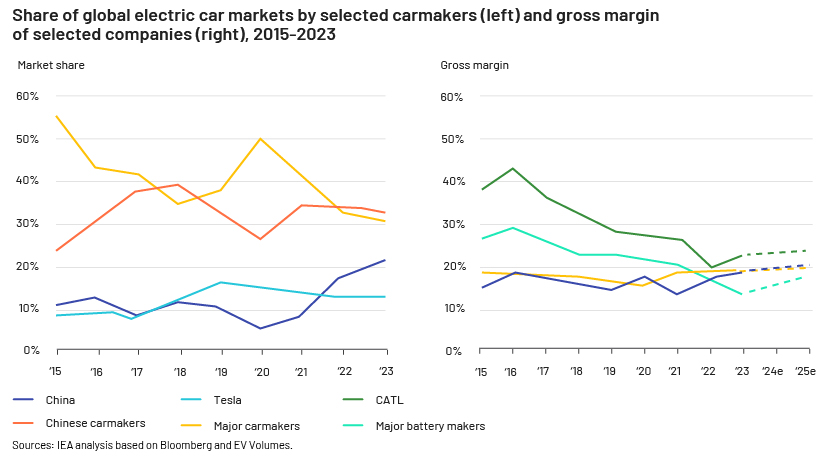

Increased competition in China since 2022 is leading to a sharp decline in EV prices: prices of electric compact cars and SUVs have dropped by 10%, Tesla slashed prices by 6% in 1Q24 for Models 3 and Y while BYD cut model prices by 10-20%. Chinese carmakers have launched a number of new models in the past two years but still fell short of their 2023 sales targets.

In the US, Tesla’s share declined to 45% in 2023from 60% in 2020. Hyundai-Kia surpassed GM and Ford with 8% of FY23 EV sales and will start manufacturing from a Georgia-based plant in 2024 to qualify for benefits from the Inflation Reduction Act.

In Europe, the share of local and Japanese carmakers (Renault, Nissan, Mitsubishi) declined steadily to 60% in 2023 from 80%+ in 2015, although Stellantis and Chinese automakers gained market share (15% each in 2023).

In China, over 80,000+ companies have registered to enter the electromobility sector since 2014, but sales are concentrated in 30 companies, leading to too many loss-making EV makers and oversupply. Despite high import taxes of 27% in the US and 10% in the EU, Chinese carmakers have been able to capture market share there and have even partnered local carmakers such as Ford and GM.

Market shares of major EV players:

Battery capacity in the US is currently led by Tesla, Panasonic, SKI and LG while in China, CATL, BYD and Gotion combined hold c.50% of domestic capacity in a fragmented market.

Among carmakers, competition remains fierce, with steadily declining gross margins since 2016. BYD leads with a 20% share (3m EVs sold in 2023), followed by Tesla with a 15% share of global EV sales in 2023.

Benefits of electric transport:

Electrification of transport promises to reduce greenhouse gas emissions, air pollution, operating costs and reliance on fossil fuels; provide long-term energy security and stable electricity prices compared to volatile oil and gas prices; diversify fuel portfolios; and stimulate economic growth and job creation. However, challenges remain in developing a more cost-effective battery supply chain, improving logistics and shipping to source raw materials for batteries globally and ensuring development of supporting infrastructure such as charging stations, component supplies and battery-swapping facilities.

How Acuity Knowledge Partners can help

The fast-growing EV market presents significant opportunities for investors, current carmakers and new entrants. An ecosystem of mining, raw-material storage, recycling, battery making, R&D of new technologies and charging stations is being developed across the globe to support the manufacture of electric 2-, 3- and 4-wheelers.

We support stakeholders and investors in scouting for investment opportunities in the EV space to develop or promote renewable-energy solutions. For current or new ICE-vehicle and component makers looking to enter the EV space, we prepare detailed business development plans to raise capital from the debt and capital markets for funding their new ventures, and due diligence reports on potential M&A opportunities.

We also provide customised research on emerging trends in the EV space and battery technologies to consultants, corporates and professionals.

Source:

-

https://robbreport.com/motors/aviation/gallery/evtols-certified-two-years

-

https://www.electricvehiclesresearch.com/articles/31036/sodium-ion-insights-industrys-key-queries

What's your view?

About the Author

Jagrut has around 6 years of experience in credit underwriting covering various sectors. He is currently working for a European bank as a credit underwriter. He holds a bachelor's degree in commerce and has cleared the Chartered Accountancy Intermediate course. He is currently pursuing CFA Level 2 course.

Like the way we think?

Next time we post something new, we'll send it to your inbox