Published on November 15, 2024 by Ankit Agrawal

-

Republican Donald Trump won the 2024 US presidential election (held on 5 November), defeating Kamala Harris 312-226. The Republican Party secured a majority in both houses.

-

Markets viewed this outcome positively, evident in advances across equities, currencies and alternate asset classes, such as bitcoin.

-

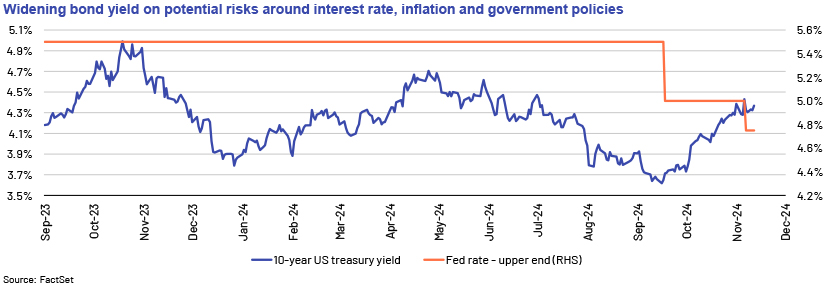

Bond performance was mixed, with Treasuries falling a sharp 20 basis points (bps) , reflecting concerns on tax cuts and a widening fiscal deficit.

-

Emerging markets (EMs) remained volatile on concerns surrounding possible escalation in trade wars and tariff imposition, a notable hallmark of Trump administration policies.

Election overview

The 2024 US presidential election saw the Republican Party’s candidate and former president Donald Trump emerge victorious, winning 312-226 against the Democratic Party’s Kamala Harris. for Trump’s new administration to push through policies on taxes, healthcare and energy. However, even if the Democrats hold onto the House, the president has considerable authority to issue executive orders.

Policy implications

Trump administration policies on trade and tariffs, taxes and regulations, if fully implemented, could have negative consequences for the US economy over the long term:

-

Trade and tariffs: Unlike tax policies, which require congressional approval, trade and tariff policies in the US can often be influenced or implemented through executive order. Trump’s complete trade agenda remains hazy, but his proposal to impose a 60% tariff on Chinese goods and a potential universal 10% tariff could be inflationary and impact consumption. Specifically, these measures could raise inflation by 2.5% and reduce GDP by 0.5% within two years of implementation, according to Bloomberg Economics.

-

Tax cuts: Tax cuts: Trump’s election promises could lead to modifications in the 2017 Tax Cuts and Jobs Act (TCJA) by 2025, potentially affecting individual, corporate and capital gain tax rates. For instance, he plans to lower the corporate income tax rate from 21% to as low as 15%, which could widen the fiscal deficit. Moreover, the changes could significantly impact individual investors, businesses and the government’s fiscal outlook. According to a recent Committee for a Responsible Federal Budget estimate, federal debt could increase USD7.8tn over the next decade because of US economic policies initiated by the Trump administration, not just tax changes.

Market reactions and outlook

Trump’s re-election brings a mix of opportunities and challenges for various asset classes. Pro-business policies are expected to boost equities and certain sectors, but a higher debt burden and potential inflationary pressure could hurt the bond market. These effects underscore the broader implications of Trump administration policies on domestic and global economic dynamics.

| Intraday asset Class performance post Trump’s election | |||

| Asset class | Change | Asset class | Change |

| S&P 500 | +2.5% | NASDAQ | +2.9% |

| Russell 2000 | +5.8% | 10-year US Treasury bond yield | +20bps |

| ICE BofA US Corporate Index Effective Yield | +8bps | ICE BofA US High Yield Index Effective Yield | -1bps |

| ICE BofA Euro Corporate Index Effective Yield | -9bps | ICE BofA Euro High Yield Index Effective Yield | -5bps |

| ICE BofA Emerging Markets Corporate Plus Index Effective Yield | +2bps | ICE BofA High Yield Emerging Markets Corporate Plus Index Effective Yield | +3bps |

| US Dollar Index | +1.8% | Gold | -3.0% |

| Bitcoin | +8.0% | ||

Bonds

-

US government bonds: Trump’s re-election is likely to create a challenging environment for US government bonds, as his economic policies, including tax cuts and increased government spending, are expected to widen the budget deficit. This, together with his plans on trade and tariffs, could stoke inflation. Additionally, increased borrowings and higher inflation expectations are likely to put upward pressure on yields. The benchmark 10-year Treasury yield reached 4.4% intraday – its peak since July 2024 – reflecting investor concerns about potential deterioration in the fiscal profile and inflation expectations.

-

Outlook: slower-than-expected rate cut expectations (interest rate estimated at 3.7% by end-2025, up from earlier expectations of 2.7%, per Fed funds futures), with Treasury yields likely facing headwinds.

-

-

US corporate bonds: Trump’s re-election is likely to have a mixed impact on corporate bonds, including tighter spreads, reflecting optimism about the economic outlook and pro-growth policies, such as tax cuts and deregulation, which would benefit corporate earnings. However, higher borrowing costs, due to expected higher yields and inflation, are a concern.

-

Outlook: Mixed, with potential benefits from economic growth together with possible risks from higher borrowing costs. Energy, real estate and other sectors could benefit from deregulation.

-

-

EM bonds: EM bonds will likely remain volatile given Trump’s foreign policies, specifically trade wars, tariff and a stronger US dollar.

-

Outlook: Neutral, with strong fundamentals and low default rates, coupled with rate outperformance, likely to be offset by mixed commodity outlook and Trump’s foreign policies.

-

Equities

-

US equities: Historically, stocks have tended to rise following a presidential election. This trend has continued, with major US indexes scaling record highs on the anticipation of the fulfilment of election promises ( tax cuts and deregulation among others ) made by Trump.

-

Outlook: Positive in the short term, due to pro-business policies (S&P 500 to rise 5-10% by year-end, as per consensus estimates), and cautious in the long term, due to potential trade conflicts and inflation.

-

-

Global equities: Global markets have reacted positively while adopting a cautious approach, due to potential trade policies. However, equity markets in countries with high export reliance could see sell-offs once Trump starts implementing his tariffs.

-

Outlook: Mixed, with potential gains in developed markets and risks in export-focused economies.

-

Precious metals

The near-term outlook for precious metals remains anaemic as a strengthening dollar makes gold and silver less attractive. However, over the long term, gold provides some protection from the erosion of fiat currency’s purchasing power amid an economic slowdown and sharp deterioration in the US fiscal profile.

-

Outlook: Weak in the short term, but potentially positive in the long term as a hedge against economic instability.

Conclusion

Trump’s re-election presents a complex landscape for markets and asset classes. On one hand, his pro-business policies and deregulation efforts are expected to benefit equities, as these policies could enhance corporate earnings and market valuations. On the other hand, potential trade tensions, especially with China, could introduce significant volatility. Besides, proposed tariffs may accelerate inflation and weigh on US economic growth. Finally, higher interest rates, driven by inflationary pressures, could impact borrowing costs and investment decisions, adding another layer of uncertainty.

Overall, sectors such as energy (including fossil fuel), real estate and banking are likely to benefit from deregulation. Politically, the resolution of the Ukraine-Russia and Israel-Iran conflicts is likely to bolster the global supply chain. However, trade war and potential higher interest rate may have an adverse impact on the economy and asset classes over the medium to long term.

Sources:

-

After Trump win, investors savor 'red sweep' possibilities | Reuters

-

Bond rebound uncertain as Trump plans overshadow Fed rate cuts | Reuters

-

How Donald Trump's victory affects our portfolios - Investors' Chronicle

Tags:

What's your view?

About the Author

Ankit has over 11 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Like the way we think?

Next time we post something new, we'll send it to your inbox