Published on August 18, 2020 by Asha Rakesh Maniar and Rekha Narasimhan

The COVID-19 pandemic continues to cripple global economies. Businesses are impacted and the fear of an economic slowdown looms large across sectors. Investor sentiment remains fragile as uncertainty prevails and the path to recovery appears blurred. The unprecedented nature of the pandemic has increased pressure on regulators to preserve the interests of investors and maintain the integrity of financial markets. With the pandemic having surfaced in Asia and the revival of its economy remaining volatile, we summarise below key regulatory and compliance changes introduced by certain regulators in the region.

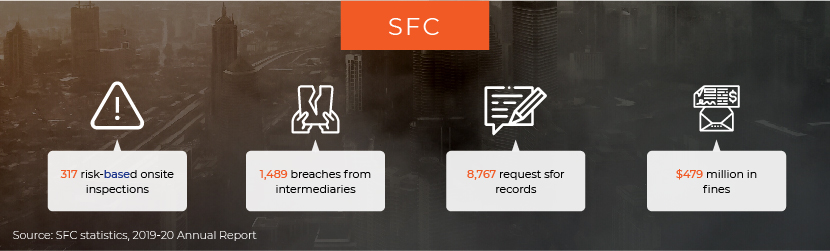

Securities and Futures Commission (SFC):

The Hong Kong regulator, the Securities and Futures Commission (SFC), is actively taking measures to respond to the unprecedented effect of the pandemic on Hong Kong’s capital markets. The response extends across brokers, asset managers and other market intermediaries it supervises, includings listed companies and the Stock Exchange of Hong Kong Limited (SEHK).

Top executives at the SFC say that the COVID-19 pandemic has led to extreme levels of market volatility globally as well as major operational challenges associated with special work arrangements and other emergency measures across the financial industry. In response, the SFC has been flexible in its approach to help the markets function optimally and to safeguard investor interest.

Extended guidelines and support offered: The SFC has made significant effort to provide guidance to brokers for recording client orders when they are out of office, extensions to timeframe for submitting regulatory documents and more flexibility on licensing matters. In response to the current potential pro-cyclical effects, the SFC has supported all clearing houses in Hong Kong by guiding them on how to face the risks arising from the pandemic. The SFC is also closely watching the derivatives markets and short selling data to prevent problems arising from risks to financial stability and systematic risks.

Monetary Authority of Singapore (MAS):

Extension of deadlines: The Monetary Authority of Singapore (MAS) has decided to defer implementation of regulatory reforms such as Basel III to ease the operational burden on financial institutions. It believes that although these reforms are necessary to improve the banking system in the longer term, they can be delayed for another year so the institutions could weather these challenging times.

Suspension of onsite inspections and visits: The MAS has suspended all regular onsite inspections and supervisory visits until, as financial institutions are busy managing regular operations amid split shifts and employees working from home. The regulator plans to instead focus its supervisory reviews on how the institutions are adhering to government guidelines on preventing infection.

Risk management: The MAS has advised financial institutions of the need for heightened cyber security and the increase in risk of fraudulent transactions. It expects these institutions to be prepared for such enhanced risks and to continue serving customers while ensuring adequate flow of credit in the economy.

Securities and Exchange Board of India (SEBI):

Online KYC documentation: The SEBI has decided to allow financial institutions to make use of electronic signatures and online apps to facilitate online KYC for doing business, to adhere to government advisory on COVID-19 prevention. Financial institutions can now request investors to submit their KYC documents online.

Extended timelines: The SEBI has also released a circular to relax the compliance requirements pertaining to mutual funds. Mutual funds in India will now have more time to comply with the new risk management framework for some of their debt schemes.

Amended Insider Trading Regulations: The SEBI has amended the Insider Trading Regulations to make it easier for companies to raise capital from the market amid lockdown. It has changed the insider trading prohibition rule and come up with a new method for pricing preferred stocks. It has also added a new of code of conduct to be followed by corporations and instructed them to maintain a record of all unpublished price information and details of individuals who have access to this information.

Australian Securities and Investments Commission (ASIC):

Increased market supervision: To protect investor interest, the ASIC has stepped up its support across its chain of operations. As noted by the regulator, it has increased market supervision activity extensively to ensure investors are informed and protected against manipulation. Customer education and support activities have gained prominence to protect customers from vulnerable scams, sharp practices and poor investment advice.

Breach and misconduct reporting: The regulator continues to focus on enforcing policies critical for upholding integrity of the financial ecosystem, although it notes that investigations of whistle-blowers’ claims and reports of breach or misconduct may be impacted due to the current crisis. However, its key services remain available to those who rely on them, and the regulator maintains general points of contact for the industry.

Reviving economic activity: The regulator is focused on supporting small businesses and other firms by providing regulatory relief for completing capital raising on time and processing urgent transactions. In addition To protect the interests of participants in the financial services industry and help them meet legal obligations to maintain the necessary records and documentation, the regulator continues to offer supervision of activities that may pose financial or credit risk, despite its staff working remotely.

Importance of business continuity plans and cyber security: The body recommends that organisations and individuals increase their awareness of and protection against cyber threats. The Australian Cyber Security Centre (ACSC) encourages organisations to invest in remote access technologies and guides individuals on ensuring the security of portable devices (laptops/tablets/mobile phones) and strongly recommends the use of multi-factor authentication and other industry best practices to avoid being vulnerable to cyberattack. The agency also notes the need for increased awareness of phishing and identifying socially engineered messages. To help individuals and organizations, the ACSC has also published a threat update, designed to raise awareness of increasing COVID-19-themed malicious cyber activity. The ASIC is now more vigilant about addressing predatory practices, scams and fraud.

Australian Prudential Regulation Authority (APRA):

The APRA, the country’s financial system regulator responsible for overseeing banks, credit unions, building societies, general insurance and reinsurance companies and other regulated institutions, now recognises the need for heightened supervision.

Focus on financial resilience: For the current year, the regulator is focused on maintaining financial resilience through increased emphasis on recovery, resolution planning and stress testing. It has a range of governance, culture, remuneration and accountability (GCRA) reviews of institutions it conducts through deep dives and entity self-assessment to drive greater accountability.

Financial risk management: To protect the financial interests of superannuation fund members, the regulator encourages underperforming fund houses either to improve member outcome or exit the industry. The APRA has also decided not to issue further licences until the current situation stabilises.

Online threats and cyber security: It also closely assesses the ability of institutions to deal with a wide array of risks, including emerging and accelerating online risks, and risks related to cyber security and climate change.

Recent regulatory incidents:

Major cyber security breaches amid the pandemic: https://in.reuters.com/article/us-twitter-cyber/twitter-silences-some-top-accounts-after-internal-systems-hacked-idINKCN24G32Q

MAS fines an international trust for poor control against over money laundering and terrorism financing: https://www.businesstimes.com.sg/banking-finance/mas-fines-asiaciti-trust-s11m-over-money-laundering-breaches

ASIC reveals fraud charges against an individual relating to the transfer of more than USD12m to the Palmer United Party (PUP) via two companies – Media Circus Network and Cosmo Developments: ttps://www.abc.net.au/news/2020-07-17/asic-clive-palmer-charges-alleged-fraud-palmer-united-party/12467070

Sources:

https://asic.gov.au/about-asic/

Tags:

What's your view?

About the Authors

Asha Rakesh Maniar has 7+ years of experience in compliance and has been associated with Acuity Knowledge Partners for about a year. Prior to joining Acuity Knowledge Partners she worked as a senior analyst with Goldman Sachs – PWM and Forensic compliance. At Acuity Knowledge Partners she is part of the corporate and forensic compliance team where she monitors electronic communication and performs trading surveillance for a client. Asha holds a MBA degree from the ICFAI Business School Hyderabad.

Rekha Narasimhan has over 14 years of industry experience in the area of Risk and Compliance. Her expertise spans across Anti Money Laundering compliance and Electronic Communication Surveillance. She is associated with Acuity for the last six years. Prior to joining Acuity, she was associated with Goldman Sachs and HCL Capital Market Services. She holds a Master’s degree in Business Administration, specializing in finance. At Acuity Knowledge Partners, she is part of Corporate and Forensic Compliance team and specializes in Electronic Communication Surveillance and Code Of Ethics.

Comments

17-Aug-2020 05:51:20 am

Very informative ??

Like the way we think?

Next time we post something new, we'll send it to your inbox