Published on July 26, 2024 by Huijuan Luo , Yue Zhang , Ying Liu and Liguo Xin

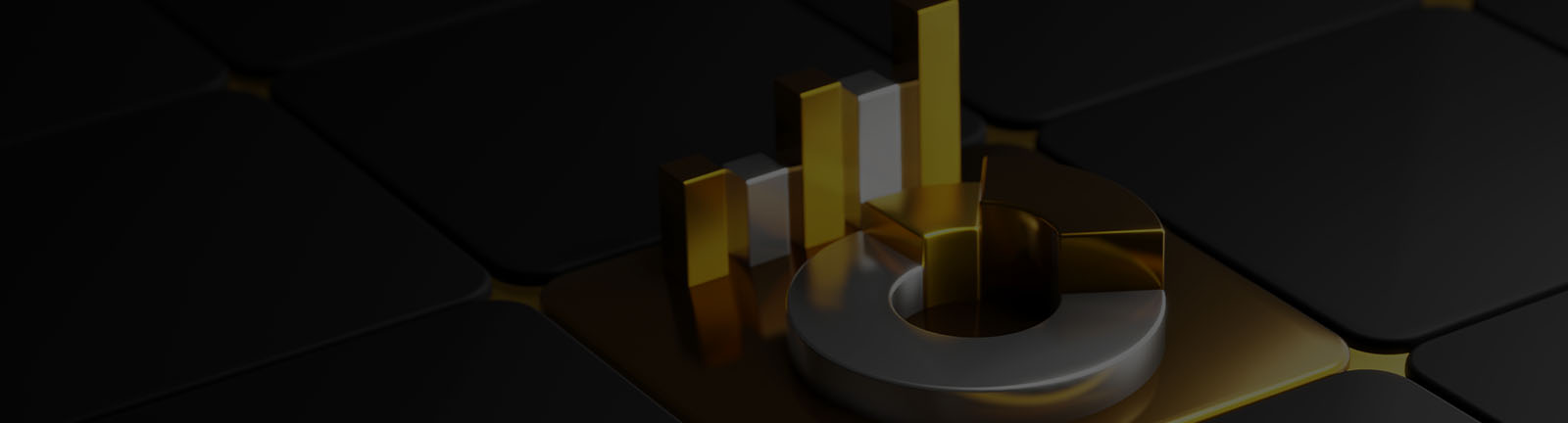

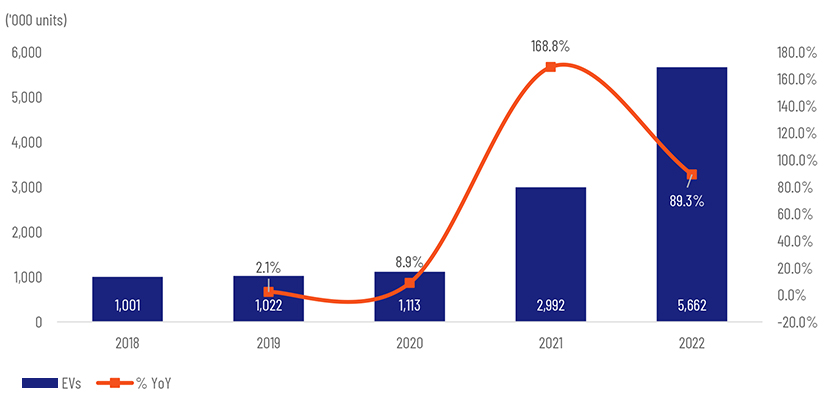

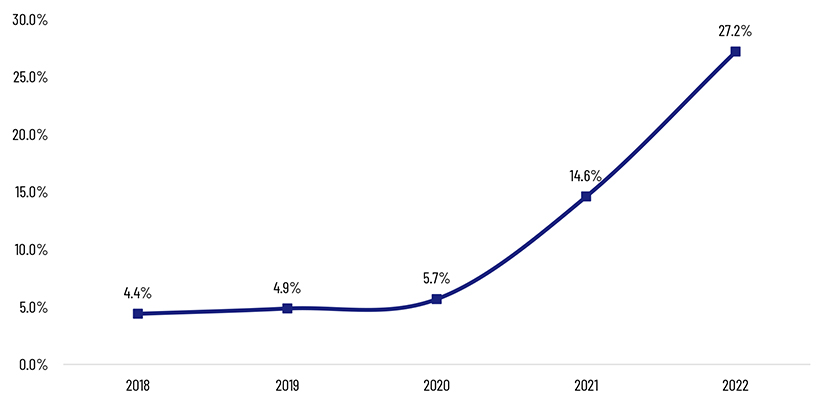

2018-2022 Sales Volume and Penetration Rate: China’s NEV sales have seen rapid growth, from 1.0mn units in 2018 to 5.7mn units in 2022. Thanks to effective market education in the early stage, NEV sales grew at a CAGR of 125% in 2020-2022, outpacing ICE vehicles’ -9% CAGR in the same period. Also, NEV penetration rate rose from 4.4% in 2018 and 5.7% in 2020 to 27.2% in 2022 before touching a record high of 37.8% in October 2023.

Exhibit: China NEV sales volume and YoY growth

Source: CPCA, Acuity Knowledge Partners research

Exhibit: NEV penetration rate in China

Source: CPCA, Acuity Knowledge Partners research

Exhibit: Monthly NEV penetration rate in China

Source: CPCA, Acuity Knowledge Partners research

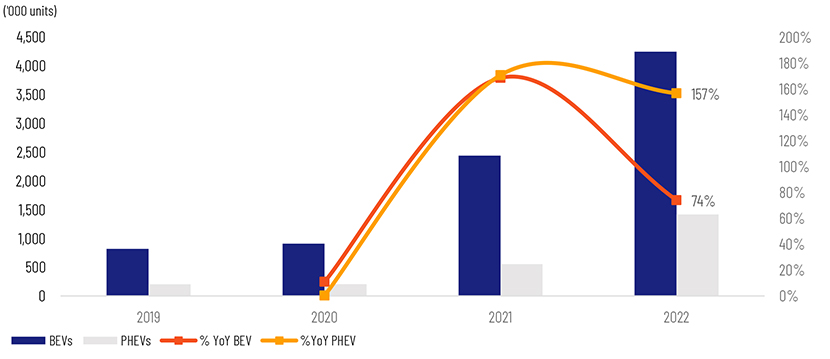

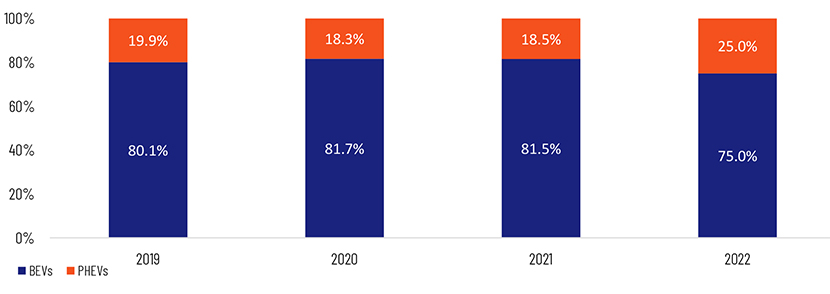

Market Share by Technology Type: The growth trajectory of PHEV and BEV was similar in 2020-2021. In 2022, however, the YoY growth in PHEV sales was higher than that in BEV sales. In 9M23, PHEV sales rose 85.3% YoY (vs BEV’s 18.4% YoY growth).

Exhibit: PHEV growth (91% CAGR in 2019-2022) vs BEV growth (73%)

Source: CPCA, Wind, Acuity Knowledge Partners research

Exhibit: Market share of PHEV/BEV

Source: CPCA, Wind, Acuity Knowledge Partners research

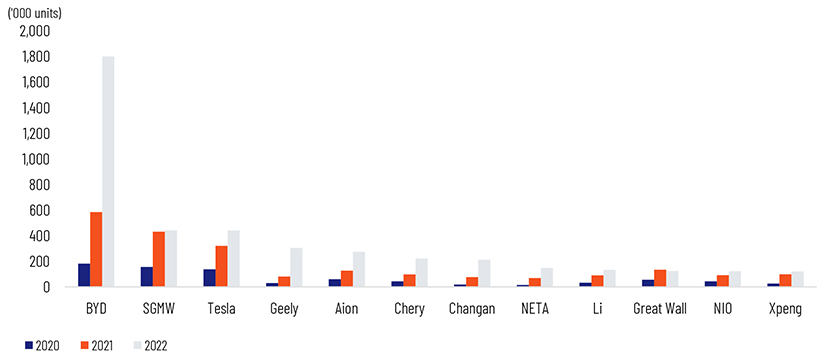

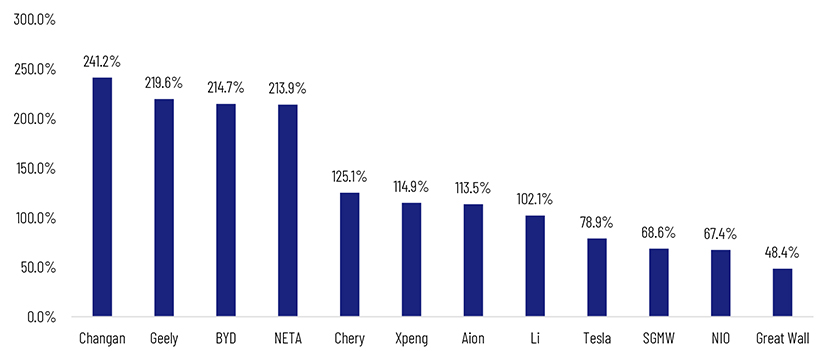

Competitive Landscape

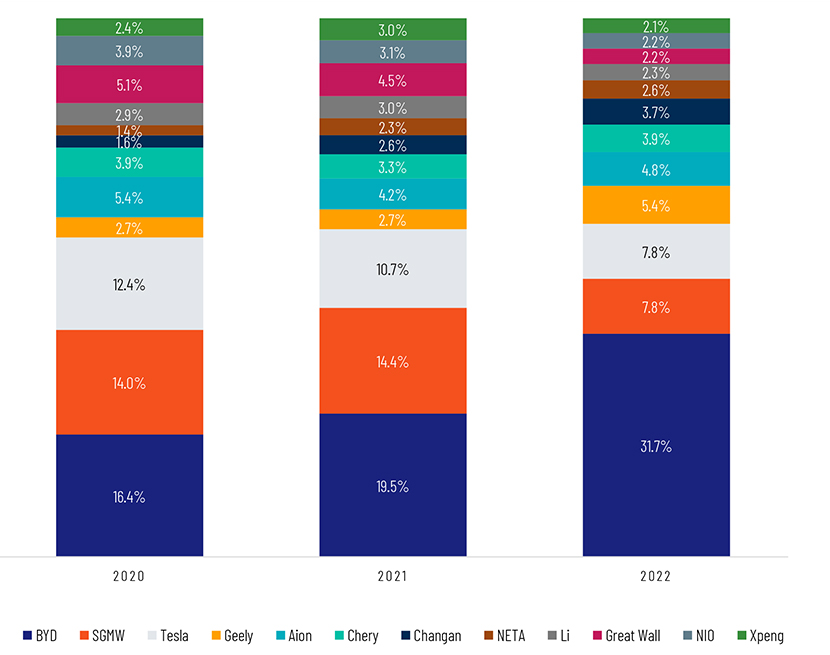

Domestic Competitive Landscape: Domestic EV brands can be categorised into traditional automakers (such as BYD, Geely, GAC Aion, SAIC, Chery and Changan) and new entrants (Tesla, NIO, Li, XPENG, NETA, etc.).

Traditional automakers have an edge in supply chain, technology and channels:

» Supply chain: Given their years of operation, the supply chain of traditional automakers is well entrenched. These automakers have stronger reserves in the upstream and downstream supply chains.

» Technology: Traditional automakers have sufficient capital; hence, they are not constrained by financing shortages, which new entrants normally face.

» Channels: Traditional automobile enterprises have more channels and approaches. They can rely on the channels they have developed in the fuel vehicle market for many years to sell their EVs.

Compared to traditional car companies, the new forces are relatively weak in technology, and their battery cells and chips are entirely outsourced. However, they have a competitive edge in innovation, operational efficiency and focus on customer experience.

Given their advantages in supply chain management and technology, traditional automakers possess superior competitive strengths in terms of product performance and selling price. This superiority is notably significant in the low-end segment. New forces differentiate themselves through innovation and services, focusing on research and development on intelligent driving, as well as customer operations. Their products often target the middle- and high-end markets.

Exhibit: Top 12 brands’ EV retail sales

Source: CPCA, Wind, Acuity Knowledge Partners research

Exhibit: Top 12 brands’ EV retail sales CAGR, 2020-2022

Source: CPCA, Wind, Acuity Knowledge Partners research

Exhibit: Top 12 brands by market share

Source: CPCA, Wind, Acuity Knowledge Partners research

Tags:

What's your view?

About the Authors

Huijuan is an Associate Director in Acuity Beijing’s Investment Research team. She supervises buy-side teams at Acuity Beijing that serve hedge funds, mutual funds, asset management firms and private equity firms in countries and regions such as Hong Kong, Japan, Singapore, Europe and the US. She has 13 years of investment research experience at Acuity, covering China and Japan markets by leveraging her trilingual capabilities and a total of 17 years of working experience. Huijuan holds a master’s degree in Finance from the University of International Business and Economics, China.

Yue is an Assistant Director in Acuity Beijing’s Investment Research team. She has over 10 years of working experience at Acuity including over 5 years in a management role. She supervises Acuity Beijing’s sell-side equity research teams in Mandarin, Japanese and English. Yue previously supported multiple equity research teams at a Europe-based global investment bank, most notably in China’s internet and Japan’s precision machine sectors. She holds a master’s degree in Finance from the University of Sydney, Australia. Yue is an ACCA Affiliate.

Ying is an Associate in Acuity Beijing’s Investment Research team. She has over five years of working experience in investment research, focusing on China’s TMT and industrial sectors. She currently supports a global sell-side equity research client, covering China’s internet sector. Prior to Acuity, she worked as a research analyst with an asset management firm in Hong Kong. Ying holds a master’s degree in Social Work from the Chinese University of Hong Kong. She has passed CFA Level 2.

Liguo is an Associate in Acuity Beijing’s Investment Research team. He currently supports an international sell-side equity research client, covering China’s financials sector. He previously supported equity research teams of multiple top-tier global investment banks, covering Asia’s commodity and China’s EV sectors. He holds a master’s degree in Finance from the University of Iowa (US). Liguo has passed CFA Level 2.

Like the way we think?

Next time we post something new, we'll send it to your inbox