Published on August 25, 2023 by Dolly Sharma and Richa Prakash

Introduction

Customer onboarding or account opening refers to the process by which individuals or businesses establish a new account or relationship with a financial institution or service provider. This relationship could be for purposes such as maintaining a bank account, brokerage account, credit card account or any other type of financial account or obtaining consultancy services. This is a crucial process for a bank or financial institution, as it sets the stage for a successful and long-lasting business relationship. It is the initial interaction with a customer, during which you lay the foundation for trust, communication and collaboration. A slow or inefficient onboarding process could lead to customer frustration and even loss of potential business opportunities. To ensure a smooth and efficient customer onboarding experience, businesses must leverage the right tools and techniques.

The traditional onboarding methods can be time-consuming, cumbersome and prone to error. Technology has emerged as a game changer in the realm of customer onboarding in recent years. Leveraging advanced digital tools and platforms, businesses can streamline and enhance the onboarding experience for both customers and themselves.

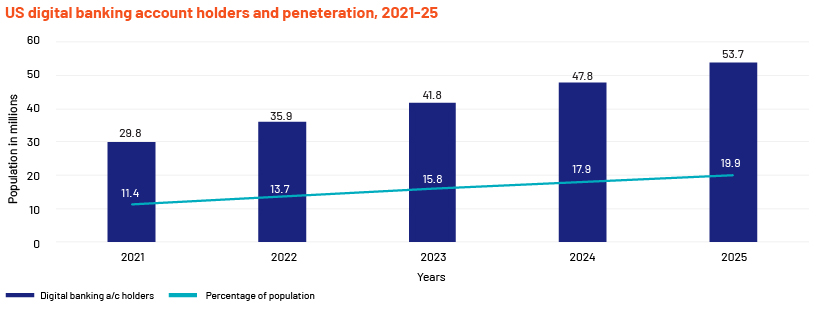

According to a Visa survey, 49% of digital customers need banks that offer only digital services. This has had a direct effect on the fintech market, where the ecosystem has increased 23% a year since 2016, according to Finnovista. The ranks of digital-only bank account holders are expected to swell to 53.7m in 2025 from 41.8m this year, according to Insider Intelligence forecasts.

Source: https://www.insiderintelligence.com/content/us-digital-only-banking-revolution

In this blog, we explore the transformative role of technology in customer onboarding and its numerous benefits. We also explore the strategies and technologies that can maximise efficiency of the customer onboarding process.

Opening an account digitally is a game changer, as it opens the way for customer convenience and facilitates smooth flow of information at every step of the onboarding process.

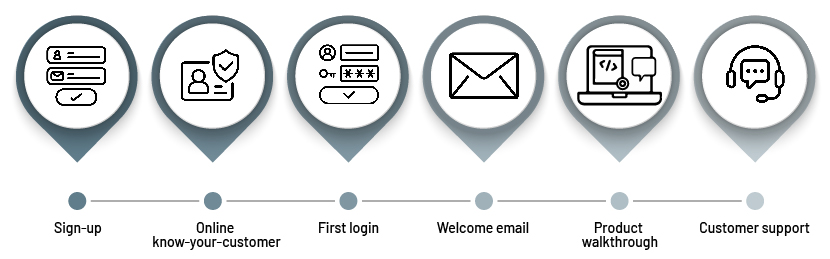

Onboarding process:

The onboarding process is one of the most important stages of the customer lifecycle – it sets the tone for the customer relationship. It is a process that spans the entire journey – from initial sign-up to product activation and use. It is the process through which long-lasting customer relationships are built. A good onboarding process helps not only with customer activation, but also with customer retention.

-

Sign-up – To onboard a customer to the institution’s server, the first step is the customer requesting to open an account based on their specific requirements and eligibility. The customer fills in an online form, providing all details required, such as personal and employment details.

-

Online know-your-customer (KYC) – This process can be aided by an online real-time video KYC process or completed via a kiosk or virtual meeting platform put up by the institution.

-

First login – At this stage, the customer is guided on setting up the initial login credentials to start using the product. This can be done via a guided tutorial shared with the customer, detailing each step of the setup process.

-

Welcome email – After the signing-up is completed, a welcome email needs to be sent to the new customer. This should contain a quick reference guide on the other products and services offered by the institution that the customer could also benefit from.

-

Product walkthrough – This details the steps to be taken to set up the services requested and complete the key tasks specific to a product.

-

Customer support – Facility for human interaction should be made available for enquiries and query resolution; this increases customer satisfaction, essential to maintaining a long-term relationship.

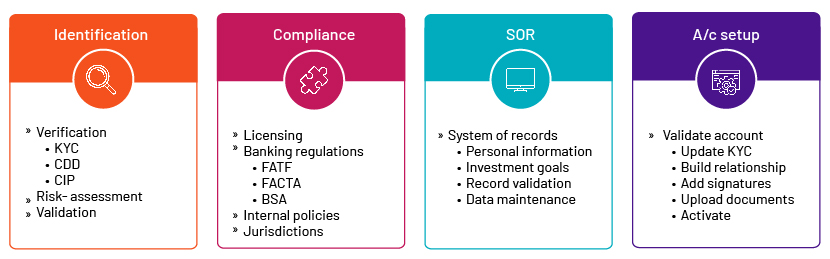

Pillars of account opening:

-

Identification: Financial institutions now require strict verification and validation of a customer's identity. Customers need to submit identification documents such as passports, driving licences and national ID cards so the KYC process can be conducted smoothly.

-

Compliance: The process needs to comply with rules and regulations of the government and relevant authorities. This process is complete when relevant legislation, laws and regulations and the institution’s internal policies are complied with.

-

Registering data: The institution must capture and record accurate customer data, including personal information and investment goals. This data register also holds verification confirmations and keeps data up to date.

-

Establishing the account: All the necessary documentation is validated, after which the account is created and the customer starts using it. Monitoring the health of the account is vital; this includes transaction monitoring and keeping KYC checks up to date.

Checks for opening accounts:

The Customer Identification Program (CIP) is a mandatory requirement under the Bank Secrecy Act (BSA) and PATRIOT Act enforced by the Financial Crimes Enforcement Network (FinCEN) in the US. The CIP is designed to prevent money laundering, terrorist financing and other financial crime by ensuring financial institutions know the true identity of their customers.

The primary goal of the CIP is to establish the identity of individuals or entities opening new accounts at financial institutions. This includes banks, credit unions, brokerages and other types of financial service providers. CIP regulations apply to accounts such as checking accounts, savings accounts, credit card accounts and loans. The following need to be checked under a CIP:

-

Customer name

-

Social security number (SSN)/tax identification number (TIN)

-

Physical address

-

Date of birth

-

KYC check

-

Articles of incorporation (for non-individuals)

Additional checks in line with US regulations

Complying with bank regulations is vital; they are put in place by regulatory authorities to maintain the stability and integrity of the financial system, protect customers, prevent financial crime and ensure fair practice within the banking sector. The following are key regulations banks and financial institutions need to adhere to:

-

USA PATRIOT Act (Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism) – This comprises a list of all those engaged in malpractice or fraudulent activity. It aims to deter and punish terrorist acts in the US.

-

Bank Secrecy Act – Also known as the Currency and Foreign Transactions Reporting Act, this is a US law that requires financial institutionsto assist US government agencies in detecting and preventing money laundering. It is also referred to as an anti-money laundering (AML) law. The act aims to develop customer due diligence plans to detect suspicious transactions and risk of money laundering. Financial institutions are required to report all cash transactions exceeding a threshold of USD10k; these are considered to be suspicious transactions, and the money trail is analysed – where the transaction took place, who conducted the transaction and who the ultimate beneficiary is.

-

Fair and Accurate Credit Transactions Act (FACTA) – This is a US federal law aimed at enhancing customer protections particularly in relation to identity theft. Under this law, creditors and financial institutions are required to implement “red flags” to detect and prevent identity theft. An example is issuers of debit and credit cards taking steps to validate changes to a customer’s address.

-

Know your customer (KYC) – Bankers and advisors are required to identify their customers, beneficial owners of the business and the nature of business.

Documents required:

-

Government-issued ID card

-

Driver’s licence

-

Social security number

-

Birth certificate

-

Passport

Practices to follow for digital account opening:

Digital bank accounts have become increasingly popular due to their convenience and accessibility. To ensure a smooth and secure digital account opening process, ease of use, security and customer satisfaction, banks should implement the following best practices:

-

User-friendly interface – Make it easy to find the Open an Account button on the homepage.

-

Provide clear instructions for opening a digital account – Each step in the onboarding process should be transparent. Reasons for requesting personal and professional information and where these details will be used should be made clear to the customer, and written agreement by the customer should be obtained. This enhances communication and trust. To achieve this, personalised support and assistance should be provided during the onboarding process by online support customer service representatives able to converse in multiple languages.

-

Mobile optimisation – Ensure that the account opening platform is fully optimised for mobile devices. This includes responsive design, easy navigation and compatibility with different screen sizes.

-

Real-time support and regular updates – Provide real-time customer support through chatbots, live chat or phone helplines during the account opening process. This helps customers resolve queries or issues promptly, enhancing their overall experience. Regular updates and notifications should be provided during and after the onboarding process, keeping customers informed about the progress and whether additional steps are required. This would reduce customer anxiety.

-

Display a personalised product list – Avoid providing all details of all products on offer; instead, list only those products and services that the user can use and in response to their needs. These could be ascertained using the customer details acquired during the KYC process, or a short questionnaire could be designed on the size of business, consumption habits, etc., to gauge the best offers for a particular customer.

-

Speedy KYC process – To reduce the time taken for this process and stay competitive, run KYC checks within the platform by synchronising with third parties. This helps build customer relationships, as customers would not need to travel physically to complete the KYC process offline. Acceptable tweaks include the following:

-

Online customer verification through facial recognition software

-

Scanning self-attested documents such as ID cards and driver’s licences

-

Running a checking system from third-party service providers such as Credit Bureau Report or conducting advanced KYC

-

-

Clear communication – Although customers want better digital processes, this does not mean they want all human interaction eliminated. KYC and AML service providers have elevated their requirements by bringing more fine-tuned systems to the market and making the job of customer service representatives easier, helping them focus on meeting customer requirements.

-

E-signatures – This refers to signing documents electronically, eliminating the need for physical signatures and making the process more convenient for the customer. The user-friendly platforms developed are accessible via mobile phones or laptops. This is also environmentally friendly.

Integrated technologies

:Integrated technologies have significantly transformed the account opening process, making it more streamlined, cost-effective and efficient. This has resulted in faster processing times and reduced human error. The following are some of the ways in which integrated technologies have changed the process:

-

Online account opening: Customers previously had to go to a financial centre to open an account, and this involved a lot of paperwork. Such problems have now been solved, with accounts being opened digitally from the comfort of their homes through online portals. Customers can upload the necessary identification documents and provide the required information. The institution would verify customer identity and data through online tools.Banks also offer customers a “mobile-first” banking experience, providing the opportunity for seamless digital and human interaction.

-

-

Digital signatures: Electronic signatures are now accepted as a valid form of approval for opening accounts. This speeds up the process significantly and eliminates the need for customers to visit a bank physically.

-

Document collection and data validation: Cloud-based applications and tools can read uploaded documents and extracts and verify information of customers and signatories. This makes the process faster and more accurate, reducing the costs of account opening.

-

-

Integrated technologies are transforming the account opening process into a more seamless and efficient experience. They also enhance compliance and reduce associated costs.

Overcoming challenges:

Digital account onboarding, while offering numerous benefits, comes with its fair share of challenges. Overcoming these challenges is critical to providing a seamless and secure onboarding experience. Key challenges include the following:

-

-

-

In-person verification and lots of paperwork – Ensuring the authenticity of applicants is a significant challenge in the digital space. Implementing robust identity-verification measures, such as biometrics and document verification, is essential to prevent identity theft and fraudulent account opening. Adopting an online real-time video KYC process could be helpful. An institution may also set up a virtual meeting platform or kiosk to facilitate the process. Demand for account opening has been increasing since the start of the pandemic, and banks have come up with online platforms for doing so. They also offer customers a “mobile-first” banking experience as more and more customers turn to mobile devices to conduct banking transactions.

-

Shifts in the digital customer experience – A number of customers adopted digital channels for opening accounts amid the pandemic and are comfortable with the processes as they enjoy customer-focused banking experiences. Banks must design user-friendly interfaces and provide real-time support to guide customers through the onboarding journey.

-

Fraud prevention – Digital account onboarding is susceptible to fraud attempts, such as account takeover and synthetic identity fraud. Banks must implement sophisticated fraud-prevention measures to protect customer accounts. They could enhance a system’s security tools by implementing advanced applications such as biometrics, DocuSign, RMS, cloud-based applications and run Qualifier that help check customer identity.

-

Data security and privacy – With the increasing prevalence of cyber threats, safeguarding customer data is paramount. Banks must invest in state-of-the-art encryption and security protocols to protect sensitive information during and after the onboarding process.

-

Cross-border onboarding – For international customers, banks must address legal and regulatory complexities associated with cross-border onboarding, including varying compliance requirements in different jurisdictions.

-

Document management – Handling and managing digital documents can be cumbersome. Banks must ensure proper storage and retrieval of customer documents while maintaining data security.

-

Technology integration – Digital account onboarding often involves integrating technologies such as biometrics, electronic signatures and data verification tools. Ensuring seamless integration and smooth functioning of these technologies could be a technical challenge.

-

Integration with legacy systems – For traditional banks transitioning to digital onboarding, integrating digital processes with existing legacy systems could be a challenge, requiring careful planning and execution.

-

Ongoing monitoring and reporting – After onboarding, banks must continue to monitor customer accounts for suspicious activities and report unusual transactions to the regulatory authorities. This ongoing monitoring could be resource-intensive.

-

Overall customer experience – Customers are often dissatisfied due to a lack of follow-up. Technology could be used to showcase features and promotions associated with their new account.

-

-

Addressing these challenges requires a combination of technological innovation, robust security measures and a customer-centric approach. By addressing them, banks could deliver a seamless and secure digital onboarding experience that fosters customer satisfaction and trust.

How Acuity Knowledge Partners can help

We have experience in this sector and are dedicated to delivering the highest-quality services, coupled with enhanced customer offerings, to foster organisational growth. We adhere strictly to industry regulations and guidelines to safeguard customer data.

The following are benefits we offer:

-

-

-

Specialised knowledge

-

Subject-matter expertise

-

Resource management including hiring, training and retaining staff

-

Access to an additional pool of resources in areas of financial analytics, valuation and advisory services

-

-

-

-

Cost savings

-

Well-equipped technology partners

-

Risk management and compliance:

-

Uncompromised security

-

100% data confidentiality

-

-

Robust process structure and governance

-

Timely delivery of projects with strict adherence to deadlines

-

Daily, weekly, monthly, quarterly and yearly reporting to customers

-

Tailor-made process restructuring for improved efficiency and process simplification

-

Easy project management and stakeholder communication

-

-

Competitive edge due to our global presence

-

-

Sources:

-

-

https://blog.totango.com/the-top-five-customer-onboarding-challenges-and-how-to-solve-them-fc/

-

https://www.temenos.com/news/2021/11/12/digital-banking-made-human-bridging-the-emotional-divide/

-

Digital Banking: Why and How Should You Perfect Opening Digital Accounts? | Blog SYDLE

-

https://www.finnovista.com/wp-content/uploads/2020/05/ FR-Mexico-2020.pdf

-

What's your view?

About the Authors

Dolly Sharma is a seasoned professional with more than 7 years of experience specializing in Client Onboarding and Account Opening. With a wealth of experience, she excels in guiding clients through seamless onboarding processes and ensuring compliance with industry standards. Her adeptness in understanding regulatory requirements and leveraging technology to optimize workflows showcases her commitment to efficiency and excellence. Dolly Sharma is a dedicated SME in delivering top-tier client experiences in KYC and onboarding. Holds MBA degree from Amity University Noida, and BBA from MDU University

Richa has pursued B.Tech(IT) from Bharati Vidyapeeth, Pune and MBA(Finance) from Institute of Marketing and Management, Delhi. She is a CDCS certified with around 11 years of rich experience in international trade finance, customer service & relationship management. She has a rich experience of various trade process and platforms migrations along with several process automations in trade finance operations.

Like the way we think?

Next time we post something new, we'll send it to your inbox