Published on March 6, 2018 by Mohit Mittal

Sell-side investment banks are currently facing substantial cost pressure due to the introduction of MiFID II regulations, reduced research budgets and commissions, and the popularity of passive funds. While other cost-saving measures (such as offshoring and rationalizing coverage) already contribute, automation seems to be occupying the top spot in research managers’ to-do lists for 2018. The introduction of MiFID II, in particular, has been the major trigger for this urgency.

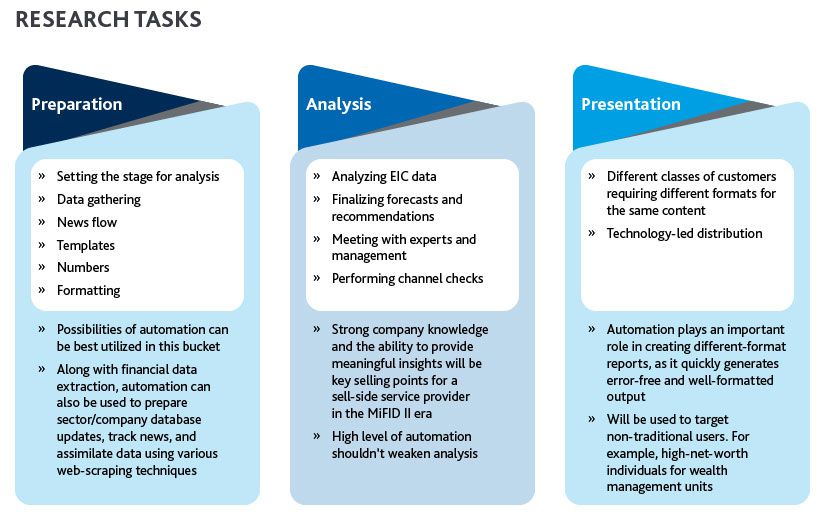

The easiest way to initiate automation is by automating the extraction of basic financial information from company and SEC filings. However, automation has other uses within the three major research tasks, as defined below.

Given the increasing sensitivity of analysis and recommendations, automation should not be viewed merely as a cost-saving exercise, but also as an integral part of the research process. For instance, in the case of automated financial data gathering, the value is not in providing an Excel data dump, but in offering intelligent data that works within an analyst’s framework and aids directly in analysis. To gain long-term success in research automation, in addition to having a robust underlying framework, the tool needs to be

Customizable: An umbrella solution should not be imposed on analysts, as each analyst will have different requirements. Data should flow the way an analyst wants it to, and output should be customized accordingly.

Flexible: Investment research is highly dynamic. Companies’ reporting styles, line items, and accounting policies may change, and the tool should be flexible enough to easily accommodate such changes.

Easily usable: Automation is meant to save analysts’ time. This means that the user-friendly tool should also limit the number of times analysts need to interact with the tool technology team. If required, analysts should be able to make minor changes to the tool themselves.

Value-enhancing: The tool should ideally help analysts to add more companies to the coverage list and enable deeper research, and to differentiate the products and effectively monetized them. Analysts should therefore be up-to-date with technological changes, as automation is here to stay.

At Acuity Knowledge Partners, we provide automation tools under our flagship platform Business Excellence and Automation Tools (BEAT). We began developing our automation tools years ago, in coordination with research analysts, to ease and improve their work. Automation activities are now centralized with a focus on improving the overall research process.

It is still early to conclude that we have reached the true potential of automation in research, but the key lies in recognizing automation as a part of the integrated research process, rather than using it merely as a cost-saving exercise.

What's your view?

About the Author

Mohit leads Acuity Knowledge Partners’ (Acuity’s) Investment Research business unit, responsible for serving over 120 global clients including sell-side research houses, asset managers, hedge funds and private wealth managers. He leads a team of nearly 800 research professionals across India, Sri Lanka, China and Costa Rica.

Mohit started as an Analyst covering the financial sector. He was subsequently promoted to Supervisor and then Manager, leading several research client teams. He also worked in the Beijing office for two years, managing the firm’s China-based research delivery teams. Before joining Acuity Knowledge Partners, he has worked with Sutherland Global Services.

Mohit champions inclusion at workplace for all, irrespective of..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox