Published on March 26, 2024 by Saswata Mohanty and Akshata N. Upadhyaya

M&A activity: possible recovery in 2024

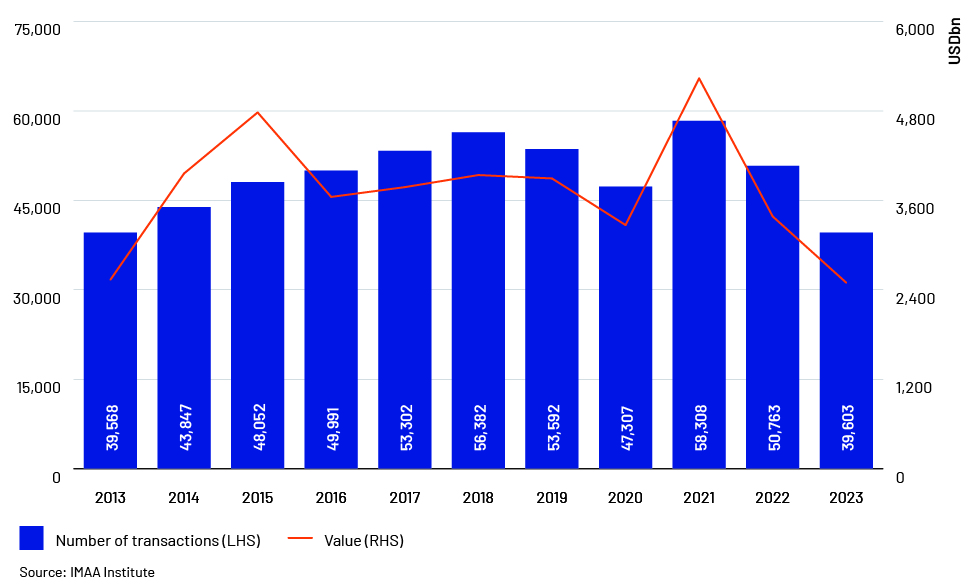

M&A activity has been low since 2013, and market volatility and geopolitical unrest have made IB firms change their outlook and M&A strategies. The number of global M&A transactions in 2023 was almost 25% less than in 2022. High levels of dry powder with financial sponsors and the narrowing price gap between buyers and sellers will likely drive M&A transactions in 2024. To remain competitive, companies need to understand and adapt to the changing environment.

Recovery of M&A activity

Global M&A was expected to start gaining momentum in 2H 2023 but failed to do so. The slight recovery in volumes in M&A in the US, however, heightened expectations of a sustained recovery in 2024. Market volatility, combined with an uncertain economic outlook, geopolitical unrest and rising interest rates, has compelled companies to adopt different M&A strategies to remain competitive.

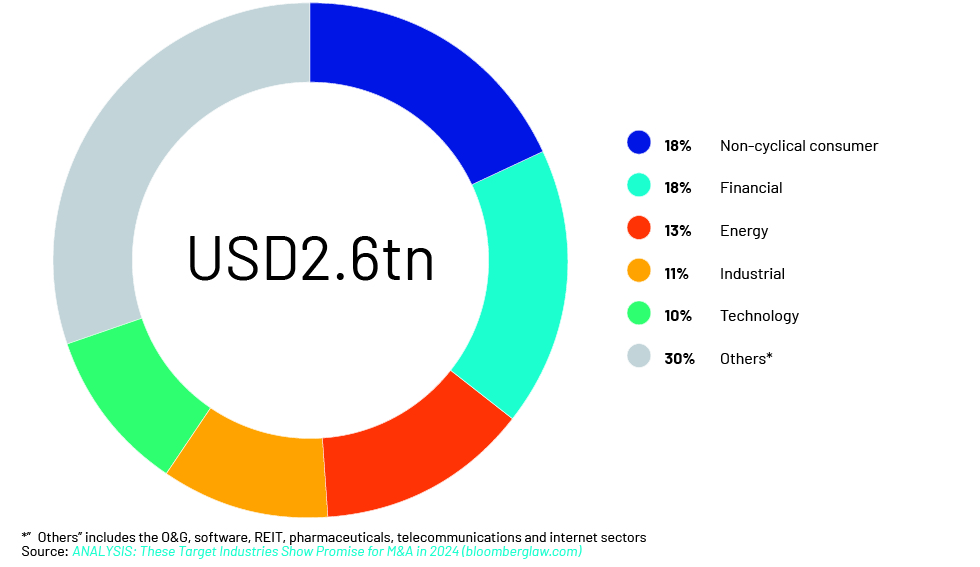

Some dealmakers have capitalised on the current unstable situation by negotiating and pursuing M&A discussions that would not have been possible a few years ago. Global M&A volume in 2023 was the lowest in the last 10 years. M&A deals totalled USD2,495bn in 2023, almost 26% lower than the USD3,384bn in 2022.

In terms of number of transactions, North America accounted for the most (43%), followed Europe (35%) and other regions (22%).

M&A activity is set to gain momentum in 2024, driven mainly by the following:

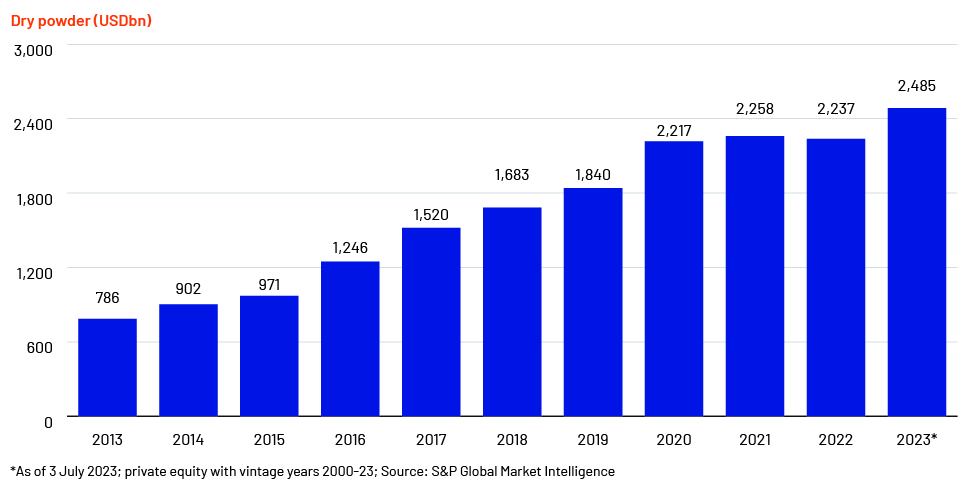

High levels of dry powder with financial sponsors: Approximately USD2.5tn of dry powder was available in the market as of July 2023. It is imperative that fund managers invest this money in the market, despite market conditions.

Narrowing of price difference between buyers and sellers: The wide price gap between buyers and sellers was another reason for the staggered deals in 2023. The price gap is expected to narrow as sellers and buyers accept the new normal and as rising interest rates, inflation and financing costs gradually stabilise.

A recovery of M&A activity in 2024 is inevitable

Increasing focus on small to mid-size deals: Companies are looking at small to mid-size transactions, keeping in mind current market conditions and high interest rates.

Small deals are not that affected by market volatility, and conducting a series of small transactions would help a firm in its transformation journey

As regulatory restrictions such as those relating to competition increase, IB firms would look for small deals more than large ones

Small deals enable meeting the strategic requirement of enhancing growth at less regulatory scrutiny

Shift in activity by sector: Despite declining M&A activity, 2023 saw some sectors bucking the trend. The top five sectors in 2023 through 31 October were as follows:

Many other target sector groups (such as TMT, healthcare and pharma, followed by industrial, power, utilities and infrastructure, and financial services) grew in 2023; their deal volumes are set to increase in 2024.

We expect technology companies to capitalise on lower valuations and enter deals to accelerate business synergies. Financial sponsors have also shown interest in AI/ machine-learning (ML) technology due to increasing demand for digital transformation.

The healthcare sector has capital reserves that can be used for strategic deals. We expect medtech and healthcare analytics companies to also attract investor interest. Advancements in drug development and the continued need for innovative treatment/medical solutions should drive consolidation and M&A activity in the pharma sector.

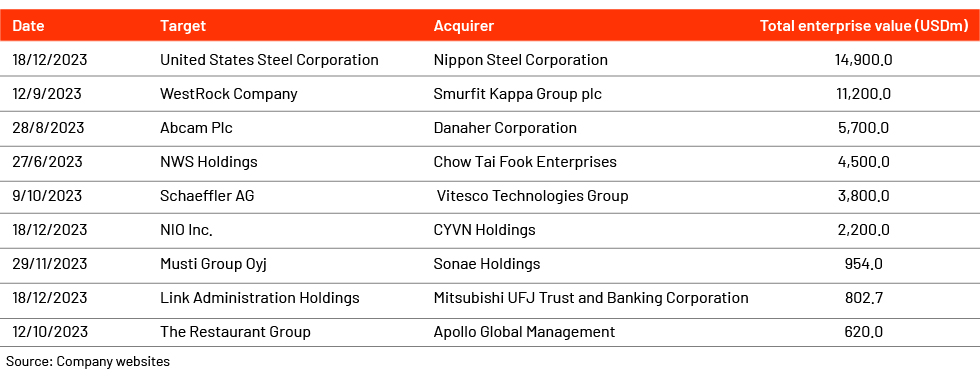

Increasing cross-border transactions: Heightened geopolitical tensions had dampened cross-border transactions, but companies are now seeking growth and diversification to reduce the risk of a volatile economy. Investors are choosing local strategic partnerships to mitigate the challenges from domestic regulations. However, despite such challenges, companies are strategically pursuing M&A to expand globally, as shown below.

Technological advancement driving the market: Digitalisation has been a key trend for many years and will likely continue in 2024. Corporates across sectors are realising the importance of technology, and breakthroughs in the field are prompting them to look for avenues to drive innovation to enhance operations. The market for digital transformation-led services is growing and is estimated to grow at a 13% CAGR from 2020 to 2025. Tailwinds include operational efficiency, support functions, digitalisation and increased importance of business strategies aligned with technology, providing increasing opportunities for investors.

With companies pursuing different growth strategies, mid-market deals are likely to increase, driving growth and transformation. Deal volume declined by almost 15% in 2023, although to levels higher than the pre-pandemic level. All companies and investors are now looking to maintain their strategy of adapting to the current situation and capitalising on the dynamics of large M&A opportunities in 2024.

What's your view?

About the Authors

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Akshata is a Delivery Lead at Acuity Knowledge Partners, completing a decade of experience since joining the company as a fresh graduate. Akshata is an integral member of a mid-market U.S. Investment Bank’s team based in Bangalore. Throughout her tenure, she has adeptly navigated through various roles, supporting a diverse range of sectors and product teams. She actively engages with onshore bankers and supports across the value chain, from deal origination to execution, for various live pitches. Alongside the service delivery, Akshata takes an active role in delivering training to enhance team competencies and mentoring

Like the way we think?

Next time we post something new, we'll send it to your inbox