Published on March 23, 2023 by Oliva Rath

The metaverse appears to be among the most exciting investing themes for the next decade. Within the metaverse, more investments than ever before and other underlying financial transactions are shaping the financial sector. Investors are investing not just in the metaverse, but also in associated markets, which are evolving as a result, as they target complete capital exposure.

The new era of metaverse banking is here as metaverse adoption becomes mainstream for the overall BFSI sector

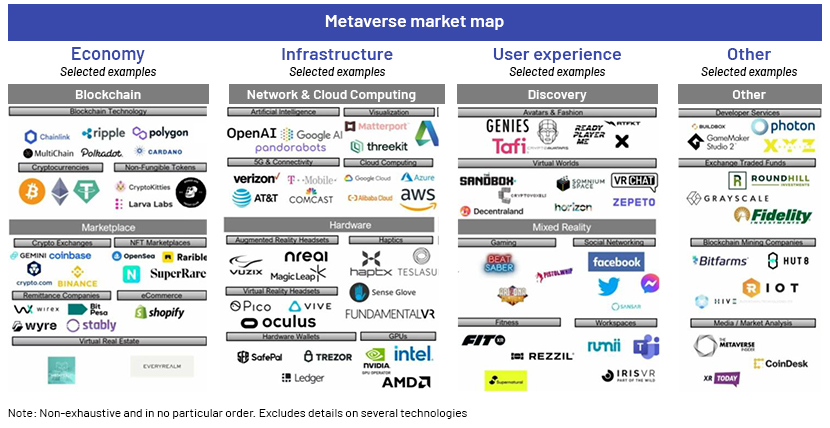

Live entertainment, games and social media dominate metaverse use cases currently, and there exists substantial scope for financial services, too. For instance, PwC’s metaverse offers accounting and taxation services. The banking sector is also preparing its own range of metaverse services. Blockchain technology with a decentralised finance (DeFi) platform can be used on the metaverse, with the option of buying and selling products and services with non-fungible tokens (NFTs) and cryptocurrency.

84% of global banking executives agree that the realisation of Web 3.0 (the internet of the future built on decentralised blockchains) over the next decade will fundamentally change how businesses engage with users online, according to Accenture’s Technology Vision for 2021

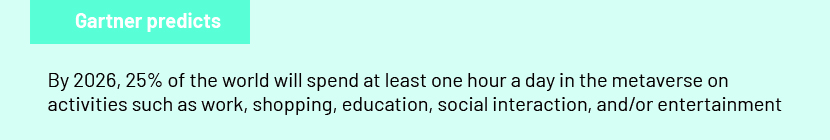

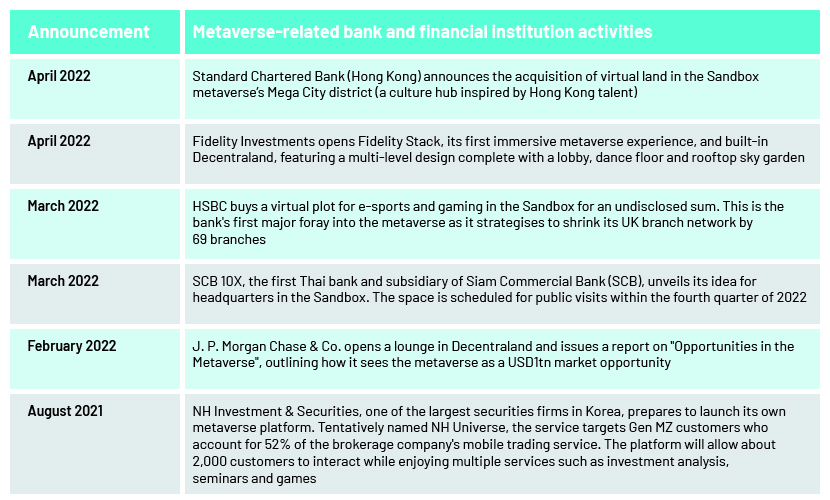

Banks’ and financial institutions’ success in using the metaverse would be determined by their implementation of platforms. Traditional financial institutions are investing in digital “plots of land”, aiming to establish their presence in the virtual world. Financial service companies are likely to initially use the metaverse to interact with customers.

The metaverse will have a profound impact on banking, insurance and capital markets products and services offered by any universal bank, specialised retail, insurance or Takaful company, or corporate/commercial/investment banks. Swiss banks UBS and Julius Baer provide financial advice using viewers and avatars of some of their clients directly in the metaverse. They were the pioneers in providing financial advice through the metaverse.

The metaverse will have a profound impact on banking, insurance and capital markets products and services offered by any universal bank, specialised retail, insurance or Takaful company, or corporate/commercial/investment banks. Swiss banks UBS and Julius Baer provide financial advice using viewers and avatars of some of their clients directly in the metaverse. They were the pioneers in providing financial advice through the metaverse.

Metaverse provides real investment opportunities

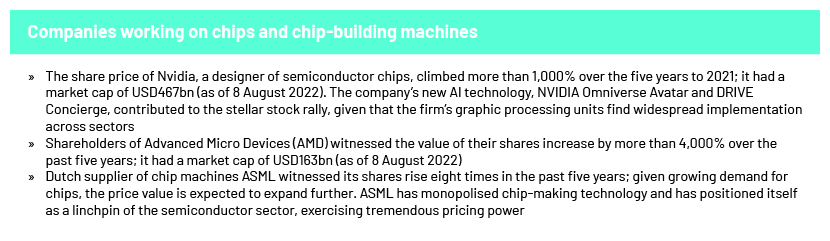

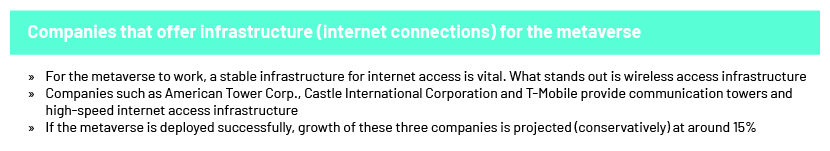

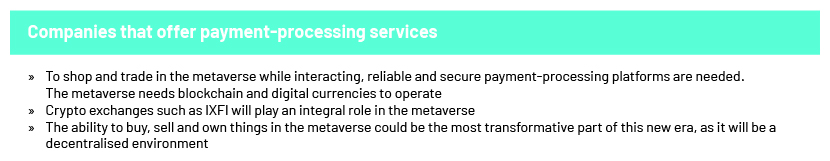

Companies involved in making the metaverse more mainstream collaborate with sectors that have already attracted the attention of investors.

Heightened corporate activity around the metaverse

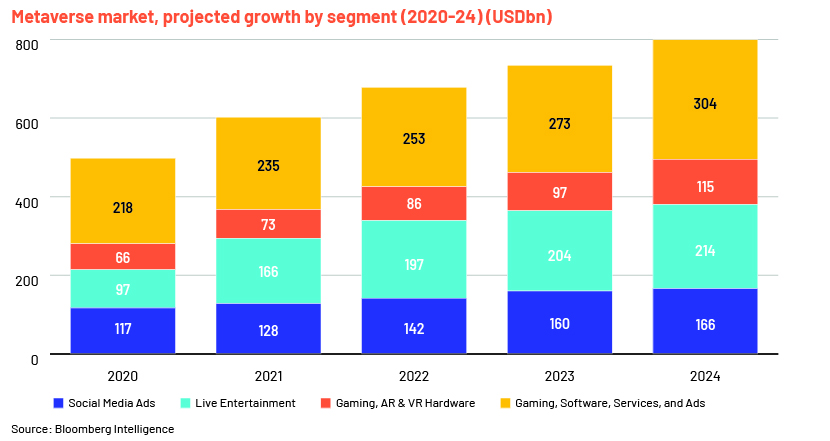

Metaverse projects are flourishing and are the “next big thing”. Some companies are making significant upside speculations, explaining in part the rapid increase in valuation. The metaverse market is forecast to be worth USD800bn by 2024.

Other forecasts have gone further. With potential to generate up to USD5tn in value by 2030, as predicted conservatively by McKinsey, the metaverse is too big for companies to ignore. Citi Bank estimates that the metaverse economy could reach USD8-13tn by 2030, while Goldman Sachs pegs its potential value at USD12.5tn.

“These forecasts may appear very rosy from a particular point of view, but I think there are good reasons to believe in them,” says Nick Rosa, Metaverse Strategy and Extended Reality Lead at Accenture.

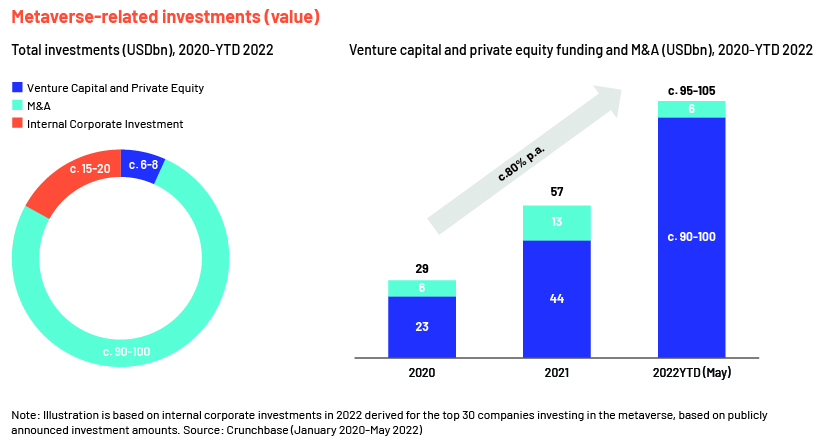

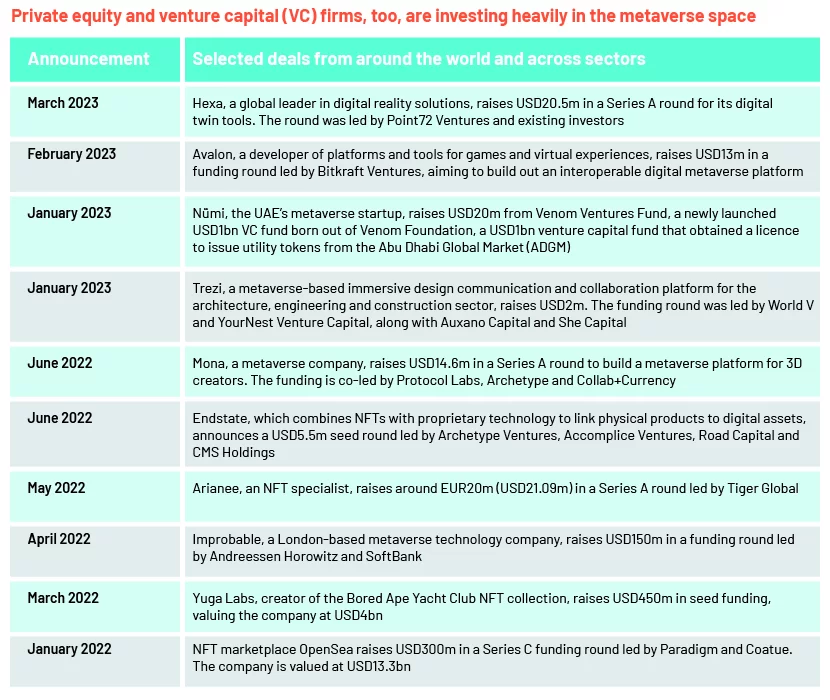

Investment in the metaverse sector is estimated to have more than doubled in the first five months of 2022 versus all of 2021. More than USD120bn in investment flowed into the metaverse in the first five months of 2022.

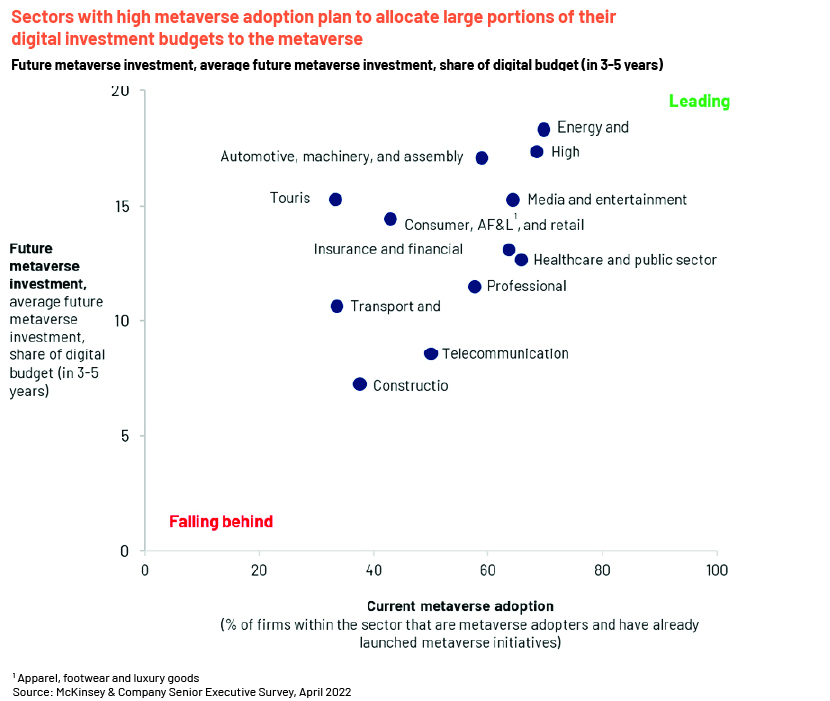

The energy sector plans to dedicate c.18% of its digital investment budgets to the metaverse over the next three to five years; automotive, machinery and assembly (17%), high tech (17%), tourism (15%) and media and entertainment (15%).

The metaverse has a potential USD8.3tn total consumer expenditure total addressable market (TAM) in the US, depending on the level of disruption. The living and working dynamics of millions of people exposed to the immersive digital world have significant potential to be transformative in the future. NFTs are expected to power that ecosystem.

Business opportunities in store, specifically for investment banks

There are obvious advantages of consulting within the metaverse over video calls or live meetings. It offers better client engagement opportunities that can easily translate into business. AR and VR eliminate the barriers of physical distance and allow for simulating a tangible presence.

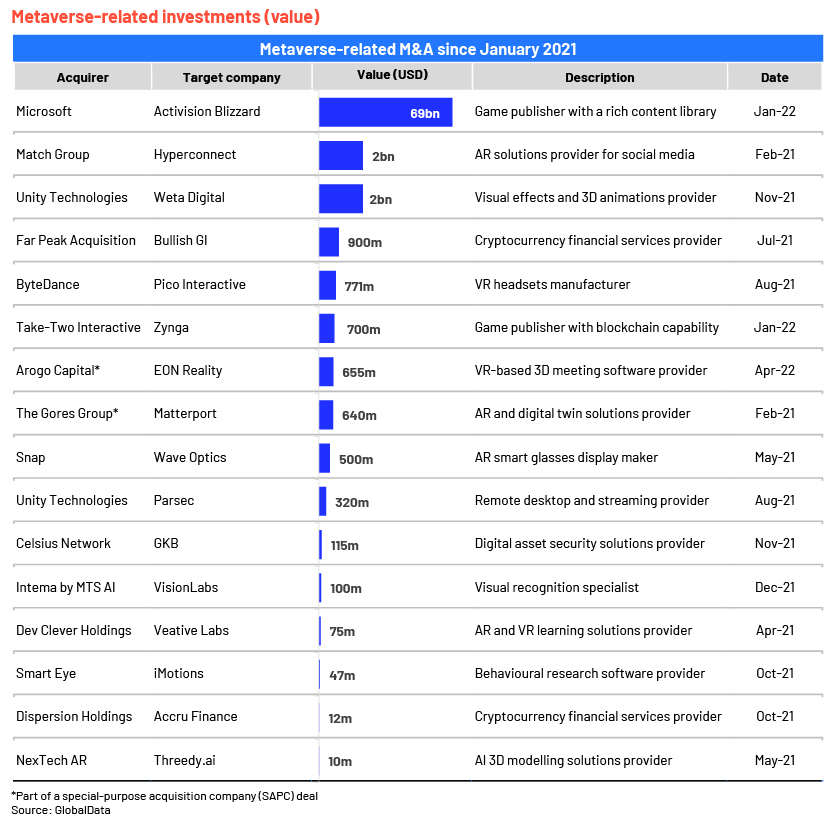

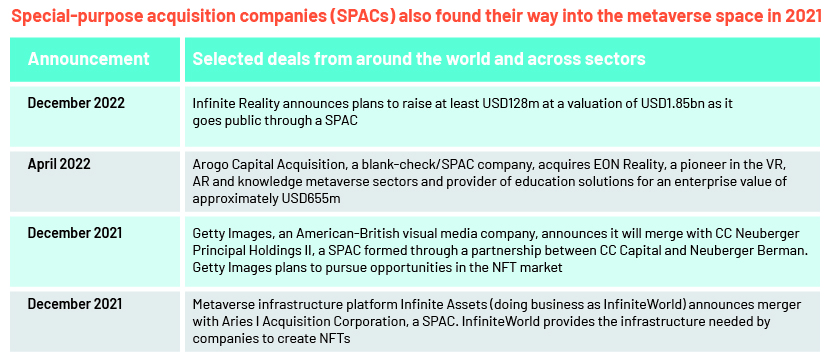

In addition, because the metaverse is still in its early stages, there are significant opportunities for M&A, as big tech firms are eager to snap up smaller innovative companies, especially on a global level. This could translate into more cross-border M&A deals, presenting revenue-generation opportunity for investment banks. The metaverse was among the top themes driving technology, media, and telecom (TMT) M&A activity in 1Q22. The global TMT M&A market saw 39 M&A deals in 1Q22, with deal sizes of more than USD1bn, according to GlobalData. Tech giants are projected to start engaging in billion-dollar M&A to position themselves in the metaverse – the next big step in digital media. There were more than 20 M&A transactions involving targets in the NFT space in 1H22 alone, a record for M&A transactions in this sector. In a nutshell, we see substantial investment banking business opportunities in the metaverse space, especially in the 3D digital content sector, its delivery (involving VR hardware and wearables companies) and the digital infrastructure space.

How Acuity Knowledge Partners can help

We have been providing strategy research support to diverse stakeholders in the technology sector – tech corporates, tech advisory firms and tech-focused investors – for more than two decades. Armed with this strong technology background and experience, we provide support in areas such as technology development, industry intelligence, competitor benchmarking and market sizing for the constantly evolving metaverse market. We also conduct in-depth sector research on metaverse potential and provide insights that can be incorporated into companies’ innovation roadmaps and help make strategic decisions pertaining to deal activity in the metaverse space. A number of industry leaders also leverage our proprietary suite of business excellence tools and offerings to unlock new levers of business growth and unmatched returns on investment.

Sources:

-

Prepare for the metaverse with our ultimate guide | Accenture Banking Blog

-

NVIDIA stock 5-year forecast: Is there room for further growth? (capital.com)

-

AMD Stock Is Up 4,405% Over the Last Five Years: Is It Time to Sell? | InvestorPlace

-

Investments in the Metaverse. Here Are Some Non-Crypto Stocks That… | by IXFI | IXFI | Medium

-

ASML Projected to Have Market Valuation of $500B in 2022 | Coinspeaker

-

Qualcomm Launches $100M Snapdragon Metaverse Fund For XR (themediaverse.com)

-

Metaverse Statistics 2021-2022 – Metaverse Facts, Stats and Data Trends (metaverserra.org)

-

(99+) State of the BFSI Sector Investments in the Metaverse Ecosystem | LinkedIn

-

Into the Metaverse: M&A in the NFT Market in 2022 - Allen & Overy (allenovery.com)

-

Metaverse M&A: Why big business is investing in virtual worlds (techmonitor.ai)

-

Cloud and Metaverse Among Top Themes Driving TMT M&A (globenewswire.com)

-

'Metaverse' becomes new growth engine of financial industry (koreatimes.co.kr)

-

https://www.thefashionlaw.com/web3-market-watch-a-timeline-of-funding-and-ma/

-

https://www.wamda.com/2023/01/uae-metaverse-startup-n%C3%BCmi-raises-20-million-venom-ventures-fund

-

https://economictimes.indiatimes.com/tech/funding/metaverse-based-startup-trezi-raises

What's your view?

About the Author

Oliva joined Acuity Knowledge Partners’ investment banking team in 2020. Well-rounded professional with 12+ years of experience in Investment Banking and Financial Services firms.

She has supported investment bankers on various pitches involving company/industry research, preparation of strategic research reports, pitchbooks, pre-IPO reports and investor PDIEs, competitive landscaping, market sizing & segmentation, case studies, macro-economic studies, and in-depth industry insights.

Extensive exposure in cross-industries primarily including FinTech, Insurance, Asset Management, Oil & Gas, Real Estate, Industrials, and Utilities. She has hands-on experience with prominent databases like Dealogic, Capital IQ, Factiva, FactSet, Pitchbook, and Crunchbase, along with other key industry associations.

Like the way we think?

Next time we post something new, we'll send it to your inbox