Published on August 26, 2024 by Nikhil Mange

Net asset value (NAV) lending is a trend that has emerged in the financial sector in recent years. This modern form of lending enables investors to leverage the value of their investment portfolios, especially those structured around NAV. NAV facilities have traditionally been used by debt funds and secondary funds due to their liquidity but are now commonly used by investment funds that invest across asset classes.

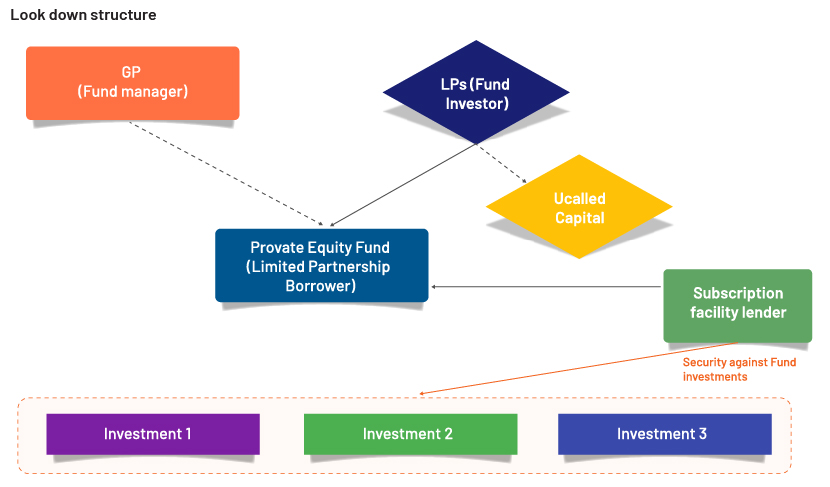

NAV lending typically involves general-partner (GP) financing from private equity funds over a period of time, which creates a need for liquidity. The lender's loan is secured against the underlying assets of the fund's portfolio. Private markets are entering a period of high rates and inflation, prompting a number of GPs and limited partners (LPs) to reconsider their investment strategies and methods for financing them at a time when there is less capital available for new deals, refinancing existing ones and lending to others. In this situation, NAV financing has become a viable option for GPs and LPs to access liquidity without forfeiting an opportunity for gains, particularly for secondary funds of funds that rely on diversified portfolios for steady cash flow.

What is an NAV facility?

NAV financing refers to providing capital to a fund or special-purpose vehicle (SPV) that owns a diversified portfolio of companies. In place of traditional forms of collateral, such as real estate or personal assets, a private equity firm can use liquidity of their investment holdings to access capital. The amount of financing is usually decided based on a percentage of the portfolio's NAV and repaid using cashflow from the portfolio through sale of that company holding.

NAV facilities can be used in a number of situations and particularly when an investor’s unused liabilities are low, or the fund’s investment period has ended, and the fund seeks liquidity for distribution to investors, for further investment or to provide additional liquidity to target companies in difficulty. Term or revolving loan facilities made available by lenders to an investment fund and an SPV held by such a fund are two structures used for NAV financing agreements.

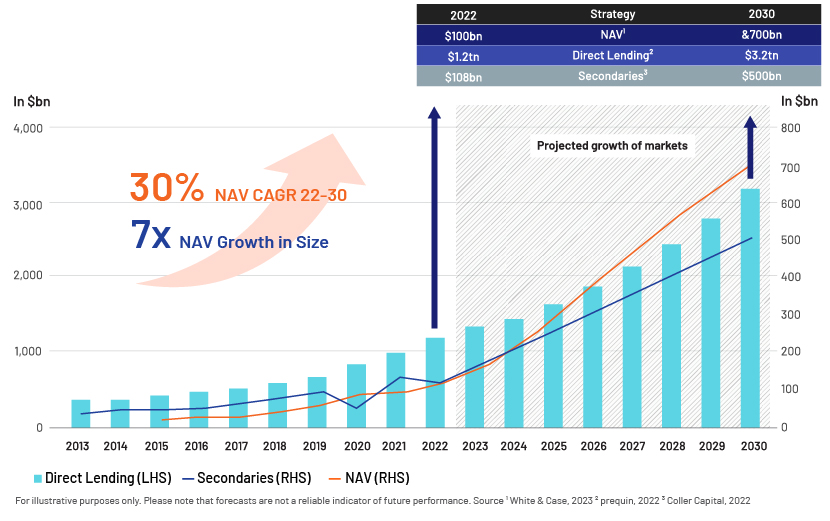

The current USD100bn market is expected to grow to some USD700bn by 2030, according to a report from the Fund Finance Association (FFA).

NAV financing is constantly evolving to meet a wider range of requirements (including use cases, instruments and structures) and is being adopted by more and more users. Due to the varying definitions of an NAV financing market, it is challenging to determine the exact size of the market at present and in the future. However, several sources indicate that the NAV financing market is currently worth USD80-100bn and that this could reach USD700bn by 2030 – a 7x increase in market size and a 30% CAGR over eight years. This is significant and faster than the growth of other asset classes such as direct loans or secondary asset classes. Comparing growth of this market with that of the subscription market (downstream) yields similar forecasts for growth in NAV financing. Independent private equity firm Rede Partners reported in May 2023 that take-up of NAV financing by private equity funds could rise to 90%, similar to the take-up of underwriting lines by private equity funds over the past decade.

Market growth and adoption

-

Increasing demand for NAV facilities: NAV lending has increased in popularity because of increasing demand for liquidity solutions that support investors' financial objectives and protect their investment positions. Demand for NAV lending services has increased as investors realise the value of having access to funds while maintaining their investment portfolios.

The market for NAV tools is growing. Workflow activity has grown by 30-50% annually in recent years, according to Chronograph.pe, surpassing USD35bn in the first nine months of 2023 alone. This growth has been driven by increased private equity endowments and demand for financing solutions. The market is expected to double in size by 2026, driven by continued growth of private equity endowments.

-

Rise of NAV lenders: With the increasing popularity of NAV lending, a range of financial institutions and specialised lending platforms have emerged to cater to investor needs. They offer bespoke lending services that include attractive interest rates and terms, and hassle-free loan processes.

Benefits of NAV lending

-

Enhanced liquidity: Investors can increase the value of their investment portfolios with NAV lending since it gives them access to additional liquidity without having to liquidate securities or change their investment strategy. It is also more convenient for LPs with financing requirements within one to three years.

-

Flexibility in capital allocation: NAV lending enables investors to use borrowed funds for purposes such as financing new investments, managing cashflow, covering personal expenses or capitalising on market opportunities. This enables them to improve capital allocation and potentially enhance overall return on investment.

-

Lower borrowing costs: NAV lending may offer competitive interest rates compared with those of traditional forms of lending. Lenders consider the lower risks afforded by access to collateral, resulting in lower borrowing costs for investors.

Considerations and risks

-

Portfolio performance: While NAV lending provides liquidity, investors should carefully evaluate the potential impact on their investment performance. It could expose them to market volatility and associated risks, and indirectly, it could affect the overall returns and value of their holdings that serve as collateral.

-

Loan-to-value (LTV) ratios and margin calls: Lenders typically evaluate the LTV ratio based on factors such as asset type, liquidity and risk profile. As the lender considers certain LTV requirements and potential margin calls, the borrower may require more collateral as security or repayment if the value of the portfolio declines significantly.

-

Collateral management and custody: Effective collateral management and custody arrangements are crucial in NAV lending. During the loan tenure, there should be a proper monitoring, reporting and verification framework in place to protect holdings.

Conclusion

The rise of NAV lending has completely changed how investors manage their financial demands and access liquidity. This innovative lending strategy offers improved liquidity, flexible capital allocation and lower borrowing costs. Investors should carefully assess the advantages, dangers and terms related to these lending agreements as NAV lending continues to gain popularity, so they can make decisions in line with their investment goals and risk tolerance.

How Acuity Knowledge Partners can help

Our Commercial Lending teams provide offshore support to banks by helping in the prudent underwriting of loans to financial institutions group (FIG), large corporate, mid-corporate and SME customers. Our credit managers offer granular insight at the macro level and help banks’ credit risk teams find potential risks in lending. Our team of experts has a good understanding of the global banking sector and lending trends; we currently support several large global banks in loan appraisal and portfolio monitoring.

Sources:

-

NAV facilities: A strategic tool | Loyens & Loeff (loyensloeff.com)

-

NAV Facilities Gain Momentum Among Alternatives Funds | Business Wire

-

NAV Financing: A Terrific Tool for Savvy Fund Sponsors | Insights | Ropes & Gray LLP

-

The Inevitable Rise of NAV Financing | Insights | Ropes & Gray LLP (ropesgray.com)

-

Pemberton-NAV-Financing-Thought-Leadership_vF.pdf (pembertonam.com)

Tags:

What's your view?

About the Author

Nikhil Mange has over 7 years of experience in Equity research (Financial modelling) and commercial lending. At Acuity Knowledge Partners, he supports a leading corporate bank’s fund finance desk in quantitative and qualitative analysis of assets for NAV based lending. Nikhil holds an MBA in Finance from University of Mumbai, Maharashtra

Like the way we think?

Next time we post something new, we'll send it to your inbox