Published on June 13, 2024 by Bharti Nagdeo and Anuj Mehta

India’s coalition governments have historically resulted in market volatility in the short term. However, we expect policy continuity to remain intact in the medium to long term, with the focus of the Bharatiya Janata Party (BJP)-led National Domestic Alliance (NDA) on infrastructure spending, manufacturing and investment-led growth. We also expect the new government to adopt certain populist measures to appease its allies.

India’s equity market is set to remain the best asset class as the country gradually transforms with improving infrastructure and rising per capita income. Despite the short-term volatility, the broad-based Indian equity market is likely to register growth in the long term across sectors.

The BJP’s clean sweep in the last two elections

The BJP-led NDA won the 2014 and 2019 elections, with the BJP itself winning a clear majority. In the 2024 elections, while the NDA comfortably cleared the majority mark of 272 seats in the 543-member Lok Sabha (the lower house), the BJP, with 240 seats, fell well short of this for the first time since the 2014 elections. For the first time, the Prime Minister Modi-led BJP, with support of its allies, has formed a new NDA government.

What happened on the 2024 election results day?

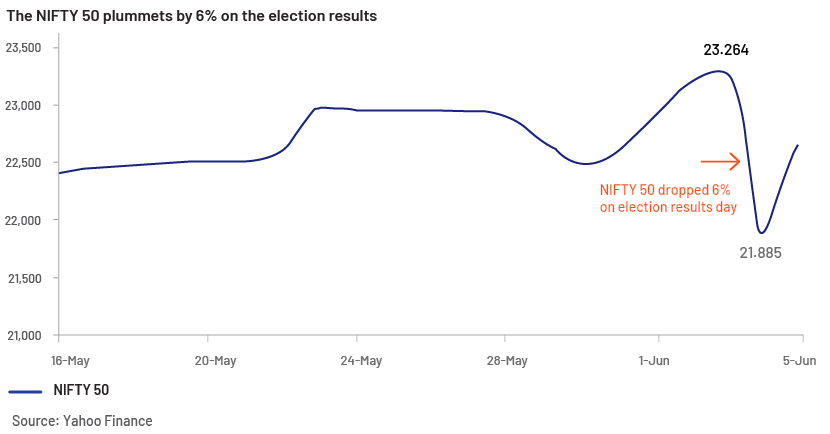

The stock market indices (the Sensex and the NIFTY 50) plummeted on 4 June 2024. Most of the exit polls predicted a big win for the BJP-led NDA, with the NDA securing 350-380 seats and the BJP alone crossing the majority mark.

In contrast, the NDA secured only 293 seats, and the BJP, with 240 seats, failed to secure the majority mark. The disparity between expectations and the reality soured market sentiment and triggered a sell-off by investors.

PSU stocks were the hardest hit amid the market turmoil. The NIFTY CPSE and the PSE dropped 13.3% and 7.4%, respectively. The NIFTY Infrastructure Index plummeted 10.6% while the NIFTY IT (defensive perception) was down only 0.6% on election results day.

How will markets perceive a coalition government?

The NDA has won a historic third term, but the BJP fell short of the majority mark this time, necessitating a coalition government. Although a surprise BJP loss led to market sell-off, we believe this is only a knee-jerk reaction, as coalition governments are not new to India. With coalition governments in the 1990s and early 2000s, India witnessed notable reforms such as Fiscal Responsibility & Budget Management (FRBM), the Right to Food and the Mahatma Gandhi National Rural Employment Guarantee Act (MG-NREGA). Volatility is expected to remain in the short term, but investor focus will likely move back to evaluating the economy and company earnings once the noise around the elections is settled.

| Cumulative returns (in %) | 1999 | 2004 | 2009 | 2014 | 2019 | Average |

| 1 month after election | -1.8% | -9.7% | +27.3% | +2.2% | +1.4% | +3.9% |

| 6 months before elections to 6 months after elections | +37.0% | +25.9% | +94.8% | +42.8% | +15.5% | +43.2% |

| 3 years after elections | -40.5% | +224.3% | +24.6% | +21.1% | +37.9% | +53.5% |

Sensex total return is considered

Source: Bloomberg

The previous two terms of the Modi government aimed to push the Indian economy forward through a policy agenda – investment-led growth, capex, infrastructure creation, manufacturing. We believe this broad agenda and macro stability will not change significantly, as both allies, the Telugu Desam Party (TDP) and the Janata Dal (United) (JDU), will likely support the BJP’s economic agenda.

However, tougher reforms such as land and agriculture reforms and the Uniform Civil Code could be pushed out by the coalition government and certain populist measures adopted. The opposition would also have a stronger influence in Parliament, making it difficult for the government to pass tougher reforms.

Indian valuations are at a premium to emerging-market indices (NIFTY 50 P/E of 21.5x), supported by political stability and the Modi government’s reforms. Now, as the BJP depends on its allies for decision-making and given the rich valuations, we can expect near-term volatility, as risk perception in India has increased.

Industrial and PSU stocks are trading at high valuations and are, therefore, likely to see near-term volatility due to a slowdown in government capex in the short term, as disinvestment/privatisation could be delayed. However, spending on infrastructure capex, manufacturing and defence will likely continue in the long term.

Small- and mid-cap stocks have performed significantly better than large-cap ones over the last year. The NIFTY Midcap 100 Index is up 53.5% and the NIFTY Smallcap 100 Index 61.1% over the last year while the NIFTY 50 is up 22.9%. The strong run-up in small- and mid-cap stocks, coupled with an increase in risk perception, could lead to sell-offs in the near term.

The opposition alliance of the I.N.D.I.A. bloc adopted an election campaign focused on job creation and improving farmers’ income. The new NDA government could opt to take certain populist measures to address rural issues and gain further support. The push for jobs and rural consumption and the resulting improvement in demand sentiment could benefit consumer staples, auto and FMCG companies. A boost to rural consumption could also benefit rural financial lenders.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific/macroeconomic experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

What's your view?

About the Authors

Bharti has around 10 years of experience in equity research, working with both buy-side and sell side clients, spanning across sectors. She has been associated with Acuity Knowledge Partners (Acuity) since May 2022 and currently manages deliverables for a US based hedge fund with an AUM of ~$60bn. Prior to joining Acuity, she worked with a GCC based hedge fund manager covering US and European equities. Bharti holds an MBA (Finance) from University of Mumbai.

Anuj Mehta has around 6 years of experience in equity research. He has been with Acuity Knowledge Partners (Acuity) since April-2024. He currently manages delivery for a buy-side client in the US, supporting them with their research needs, and covering multiple sectors. Prior to joining Acuity, he worked with B&K Securities covering Indian Capital Goods companies. Anuj holds an MBA (Finance) from University of Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox