Published on July 15, 2022 by Anish Aggarwal

The social distancing regulations implemented amid the COVID-19 outbreak, combined with higher mobile and internet penetration, have given a boost to digital banking around the world. During 2021, US banks and financial institutions closed a net 2,927 and 4,000 branches, respectively. Does this indicate that the decade old prediction that traditional brick-and-mortar banking would become defunct is turning into reality?

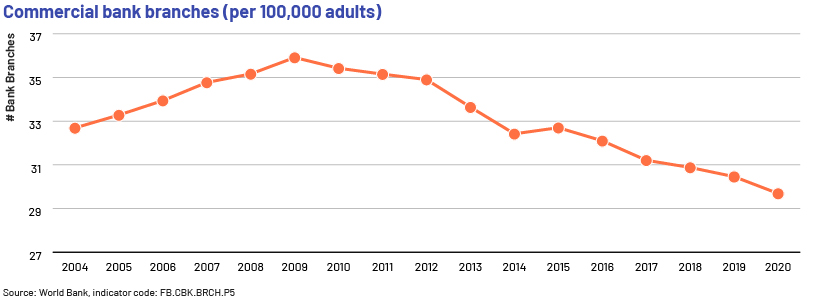

Let us take a look at World Bank data on the number of bank branches in the US per 100K adults. The number has seen a persistent decline over the 10 years from 2010 to 2020. This may be attributed primarily to the fact that, by 2010, more than 80% of the world’s population had access to mobile phones.

Some of the obvious benefits of digitisation of banking include better outreach, reduced turnaround time and the ability to pass on benefits realised from cheaper cost of operations to customers – for instance, the deployment of chatbots itself is expected to save the banking industry USD7.3bn by 2023.

In addition, digitisation offers some lesser known benefits as well, such as low set-up costs and customer centric technology and digitisation focus. This has led to the emergence of branchless digital banks and neobanks (also referred to as challenger banks) globally. Neobanks are largely fintechs with online-only banking platforms. Although their operational structure is similar to those of digital banks, they do not have a bank charter and cannot provide as broad a range of services.

Such banks and generate earnings primarily through their banking services, but they also have the option to monetise their in-house digitalisation platforms by selling these as a service. For instance, JPMorgan invests USD12bn annually in technology to fuel a team of 50,000 technologists; in 2018, it began selling access to its trading software Athena, which can be used for pricing, trading, risk management and analytics.

Having said that, digital banks or challenger banks are not flawless and have their own share of challenges. First, the service is hardly personal, and it requires some level of digital expertise. According to Consumer Affairs data, while 8 out of every 10 Americans prefer online banking over visiting a brick-and-mortar establishment, only 12% of people older than 54 use mobile payment services.

Also, almost 56% of US internet banking users could not get their concerns resolved online and were redirected to the physical establishment (Source: Lightico). Another key factor is that electronic payments and remote banking are prone to criminal abuse in case of security flaws, as the technology is still relatively young.

In addition, such banks mostly depend on third-party service providers for point-of-sale services such as cash transactions, which may translate into higher costs to customers, including fees for using the ATM networks of other banks.

After almost 150 years of existence, Goldman Sachs launched Marcus, the digital banking and consumer lending platform that has become a force to be reckoned. Within 5 years of its launch in 2016, total deposits of Marcus touched $100bn in 2021. More recently, its customer base increased to more than 13 million in Q1’22 from 10 million in Q4’21. Marcus has created a new segment in Goldman Sachs and evolved it into a more consumer facing brand.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) has nearly two decades of experience in helping 400+ banks and financial institutions transform their operating models and cost structures. Within our Lending Services vertical, we launched retail lending support services in September 2021.

Our retail lending solutions help banks optimise their retail banking value chain across origination, processing, underwriting, closing and post-closing activities. We support all retail lending channels, including consumer mortgage, credit cards, personal loans and auto loans. Our loan support officers standardise and streamline the end-to-end loan approval, underwriting and servicing processes, aided by tech-enabled platforms, and help identify red flags in loan applications, such as high credit card utilisation, late payments or lack of credit history.

Sources

https://www.thesoftwarereport.com/jpmorgan-offers-its-trading-platform-as-a-saas-platform/

https://www.jpmorganchase.com/news-stories/tech-investment-could-disrupt-banking

Forbes India - Banking 2021: Without Branches Or Borders

Branchless Banking: Evolution, Challenges and Potential [2022] | SDK.finance

Commercial bank branches (per 100,000 adults) | Data (worldbank.org)

How Chime Is Leading the Way in Customer Loyalty | Bain & Company

NPS Financial Services / 27 Banking NPS Scores 2022 (customergauge.com)

Fintech Customer Experience: How To Get a High NPS Score in Fintech [5 Examples] (customergauge.com)

Marcus Has Reached $100 Billion in Deposits | deBanked

What's your view?

About the Author

Anish Aggarwal has over 16 years of experience in working with Investment Banking, Shared Services and Commercial Lending domains.His expertise spans across broad range of services including credit analysis, target screening, valuation, process migration and onshore client-facing roles.At Acuity Knowledge Partners, he leads a portfolio management team for a regional US bank. He has previously led specialized teams supporting Investment Banks and Credit Ratings Agency covering diverse geographies and industries.Anish is a Chartered Accountant and holds a Bachelors in Commerce (Hons).

Like the way we think?

Next time we post something new, we'll send it to your inbox