Published on March 20, 2023 by Tushar Prabhakar Midge

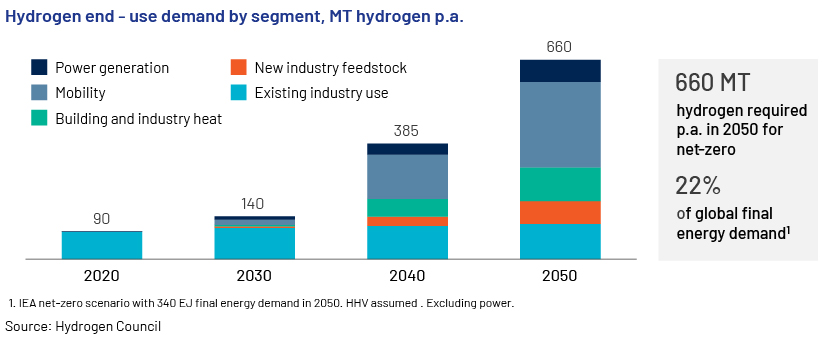

Green hydrogen is getting more traction as the need for decarbonisation and energy security becomes more pronounced. Cost reductions, economies of scale and technological advancements would improve the competitiveness of green hydrogen against traditional fuels. The Hydrogen Council estimates global hydrogen demand to reach 660MT in 2050, which would reduce c.25% of GHG emissions. This leads to a hydrogen production total addressable market (TAM) of c.USD1.3tn, with an estimated price range of USD1-3/kg of hydrogen.

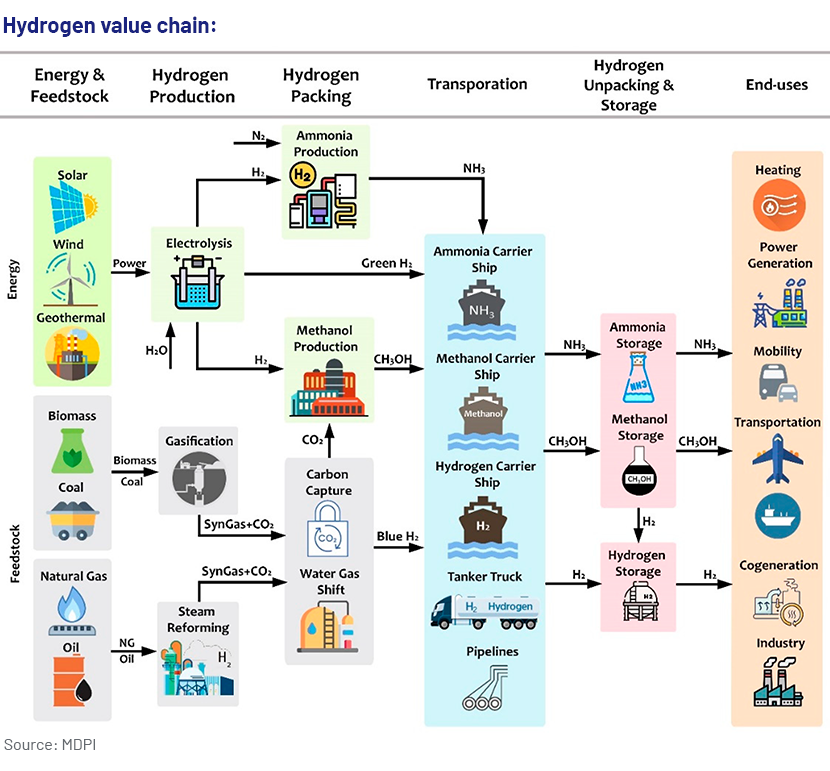

In this blog, we explore the key parts of the green hydrogen value chain.

Production: Green hydrogen is produced by breaking water into hydrogen and oxygen molecules through the process of electrolysis. The two biggest inputs are renewable power and electrolysers.

Renewable electricity prices globally have become economical and are on par with prices of traditional electricity. The share of renewables in the global power mix increased to 28% in 2021 from 20% in 2010, and is expected to increase to 60% by 2030.

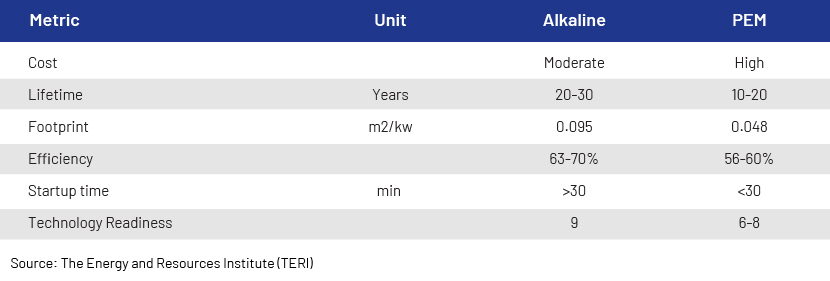

We expect electrolyser prices to decrease in the future due to economies of scale, an improvement in technology and higher efficiencies. Alkaline and proton exchange membrane (PEM) electrolysers are currently used in the electrolysis process. Alkaline electrolyser is a mature technology with years of proven performance. It requires c.50kWh of electricity per kg of hydrogen. The total cost is low compared to PEM electrolysers’. However, alkaline is slow in converting electricity to hydrogen and has lower operational flexibility. PEM electrolyser is a newer technology that produces higher-purity hydrogen. It requires a smaller footprint, delivers hydrogen at higher output pressure and is more flexible with intermittent renewable power. However, PEM requires expensive catalyst components/chemicals, as it works in an acidic environment.

The major electrolyser manufacturers are Nel Hydrogen, ITM Power, Siemens, Thyssenkrupp, Cummins, McPhy, HydrogenPro and Enapter.

Table 1: Electrolyser technologies: Alkaline vs PEM

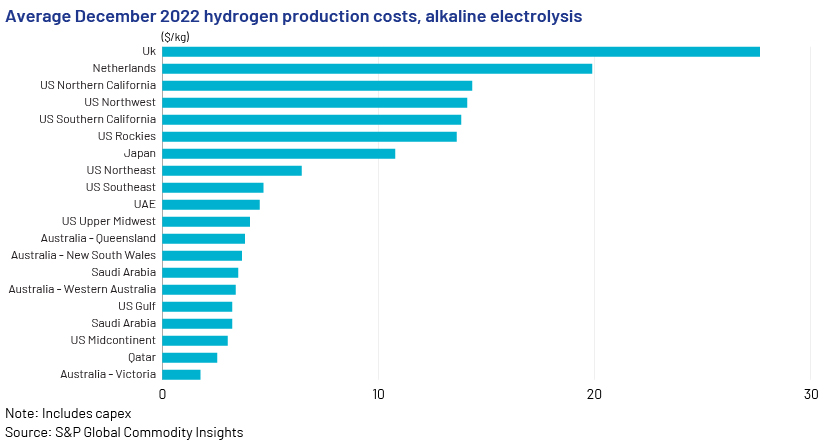

Figure 2: Hydrogen production costs in December 2022

Transport: A number of companies are exploring approaches such as using existing natural gas pipeline infrastructure or converting to methanol or ammonia. Pipelines are the preferred method of transport in regions with high hydrogen demand expected to remain stable for many years. Net-zero emission targets would reduce natural gas consumption over time, making gas networks less useful. The current global gas pipeline network of c.1.2m km could be used to accelerate green hydrogen deployment. Hydrogen could also be blended with the natural gas stream in the near term.

Trucks and ships are two other options. Trucks could be used where pipelines are not feasible or in small end-user sectors such as hydrogen refuelling stations. Countries and companies interested in cross-border hydrogen trade could turn to shipping routes.

Gaseous hydrogen is difficult to transport due to its molecular structure that makes it diffuse and leak easily. While liquid hydrogen provides better efficiency, it leads to transport, storage and cost challenges.

Demand sectors: Hydrogen demand could reach 660MT in 2050, according to the Hydrogen Council, accounting for 22% of global energy demand. Adoption of green hydrogen could create new applications – from power and energy storage to transport. It has the unique ability to decarbonise hard-to-abate sectors such as refining, chemicals and steel.

-

Transport: This sector is expected to be the largest end-use segment, with 285MT of hydrogen demand. Fuel-cell vehicles (FCVs) store hydrogen in their tanks and convert it to electricity through fuel cells.

-

Industry: Hydrogen demand from industries could amount to 180MT in 2050. This sector accounted for 95% of total hydrogen consumption in 2021. Refineries use hydrogen to desulphurise crude oil. Hydrogen is used in the chemical sector to produce a variety of commodity chemicals such as ammonia and methanol.

-

Power: Hydrogen blended with natural gas could be used in power generation. Fuel cells could be used for standalone stationary power-generating plants.

Figure 3: Hydrogen demand by sectors

Conclusion: Green hydrogen is being viewed as a key piece in the decarbonisation puzzle. Economies of scale and technological improvements would improve the economics of green hydrogen vs those of alternatives. Government policy support and corporate net-zero targets would accelerate its adoption.

How Acuity Knowledge Partners can help

Global investment banks and other research firms leverage our experience to rapidly increase internal analyst bandwidth and expand coverage of equities and credit. We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients on a wide range of activities including idea generation, building financial models, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients enjoy a unique, sustainable edge.

Sources:

-

The Hydrogen Council

-

International Energy Agency (IEA)

-

World Nuclear Association

-

The Energy and Resources Institute

-

World Bank

-

Multidisciplinary Digital Publishing Institute (MDPI)

What's your view?

About the Author

Tushar Midge is a part of Investment Research team at Acuity Knowledge Partners. He has around eight years of work experience supporting global sell-side client on Equity Research including building financial models, initiating coverage reports, thematic reports, ad-hoc data research, and earnings review. In his current role, he is covering Oil & Gas sector. Tushar holds an MBA from Department of Management Sciences, Pune University and a B.E. degree in Electronics and Communication Engineering from Pune University.

Like the way we think?

Next time we post something new, we'll send it to your inbox