Published on April 8, 2019 by Naveen Katakam

During the financial crisis of 2008, retail investors lost significant amount of money owing to investments that carried risks, due to the investments either being not transparent or lacking information on possible outcomes. In addition, small-time pension holders and retail investors were confused by the complexity of financial instruments. Thus, regulators found a critical need to restore confidence in the global economy, and thereby expand the boundaries of legal oversight to enhance investor protection.

As a result, multiple regulations were wedged into the financial services industry as direct responses to some of the underlying problems. Today, almost every aspect of the industry is overseen by at least one regulatory body, and sometimes by several, forcing financial institutions to spend billions on regulatory infrastructure.

PRIIPs in the game now

One such regulation introduced in early 2018 is Packaged Retail Investments and Insurance Products (PRIIPs), conceptualized following a European Commission (EC) survey. The survey results showed that retail investors often pursue investments without fully understanding the inherent risks and costs and, therefore, incur losses. The PRIIPs regulation aims to increase investor protection and enhance transparency in financial markets. It enables investors to compare the nature, risks, costs, and potential gains and losses of an investment scheme within the scope of the regulation.

New KID on the block

The PRIIPs regulation requires every investment manufacturer and distributor to provide retail investors with a Key Information Document (KID) to reinforce transparency. A KID provides information on costs, risks, and expected future performance associated with an investment.

A Key Information Document (KID) is a mandatory three-page, A4-size, pre-contractual document that must be available to an investor before the sale of the investment product; to be prepared by manufacturers and distributors.

This helps investors understand the critical differences between similar investments, based on common parameters.

& participants

Almost all types of packaged products of a market value of up to EUR10tn – including insurance products, mutual funds, exchange-traded funds, exchange-traded commodities, and structured products – fall under the purview of PRIIPs.

All investments, regardless of their legal form, that satisfy the following criteria are defined as PRIIPs:

-

The amount repayable is subject to fluctuations as a result of the investment’s exposure to one or more underlying assets/derivatives

-

All assets/derivatives are indirectly held by investors

-

The investment is distributed to EU retail investors

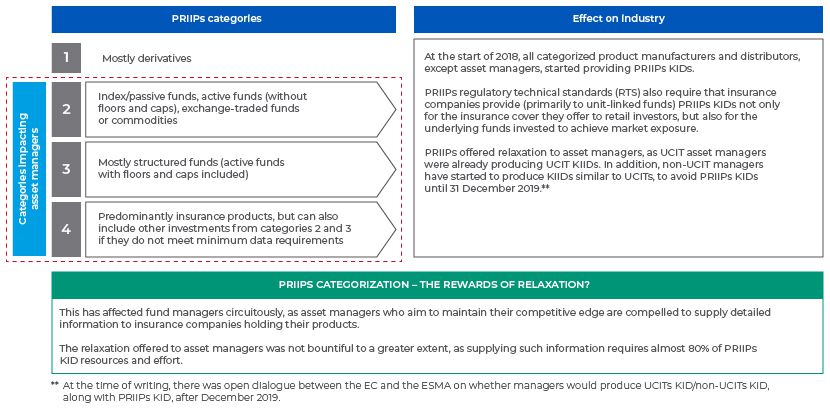

The primary objective of categorizing PRIIPs is to make costs, risks, and performance uniform. Regulation enforces various methodologies to be followed to ensure a standard measure across products, so that they could be compared.

EFAMA and Insurance Europe to the rescue of asset managers and insurance

To avoid confusion and to enhance coordination of data exchange between insurance companies and asset managers, a number of national associations – including the European Fund and Asset Management Association (EFAMA) and Insurance Europe – have recommended templates (EPTs) to outline standards to be followed in presentations and content in the files exchanged.

European PRIIPs Template (EPT): This is a well-recognized standard template to facilitate data exchange between insurance companies and asset managers. It provides sections for risk statistics, performance scenarios, costs, and narratives.

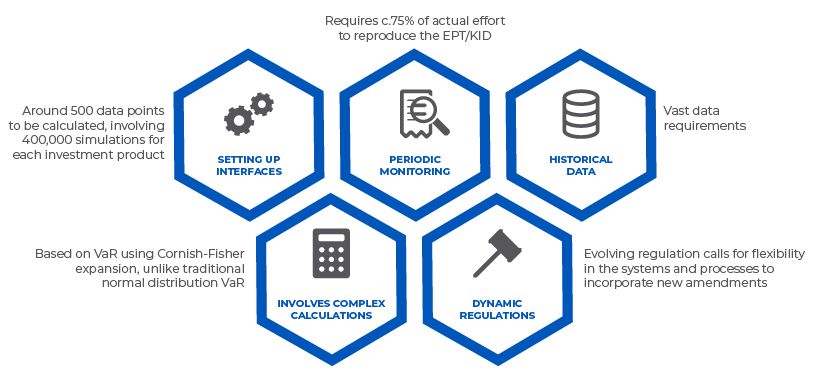

Challenges for asset managers

PRIIPs regulation is one of the most complex of the current regulations that asset managers need to comply with. It also presents new reporting challenges, such as in terms of data quality, for the following reasons:

A frictionless PRIIPs journey with Acuity

At Acuity Knowledge Partners’ Fund Marketing Services, we leverage bespoke technology, experienced personnel, and best practices to offer customized PRIIPs solutions to asset managers. Our subject-matter experts have extensive experience in partnering with asset managers on PRIIPs/UCITS and in ensuring delivery of PRIIPs EPTs/KIDs and UCITS KIDs within deadlines, saving significant time for our clients.

What's your view?

About the Author

Naveen Katakam, CFA, has over 11 years of experience in commentary writing, RFP creation/writing, and regulatory/client reporting. At Acuity Knowledge Partners, he supports fund marketing services for the asset management industry. He holds a Master in Business Administration from Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox