Published on January 21, 2025 by Kiran Jagannath

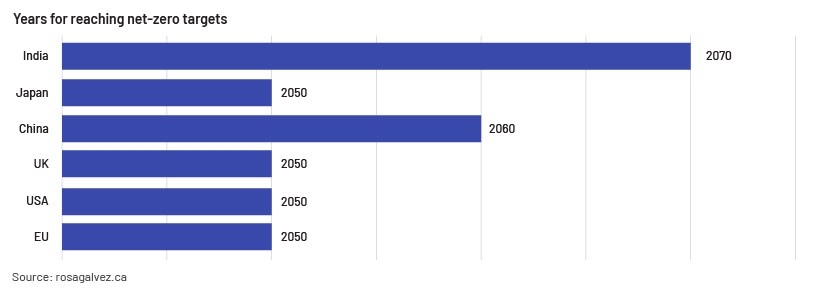

Nuclear power is making a comeback as many countries plan for long-term energy security amid inflated fossil fuel prices, growing power consumption and net-zero transition targets. This nuclear power comeback is driven by its low carbon emissions and high generation stability, presenting itself as an ideal candidate to substitute coal as a base load power supply.Asia Pacific in particular, which was retreating in terms of nuclear adoption after the Fukushima nuclear plant disaster, is leading in nuclear ambition, with the largest number of new reactor builds. Notably, Chinese nuclear regulators have approved the construction of 16 new nuclear reactors, translating into c.RMB231bn of capex commitment. Japan and Korea have reversed their decade-long strategy to phase out nuclear power, with Korea even resuming construction of projects and considering the buildout of new nuclear plants.

Why nuclear fuel?

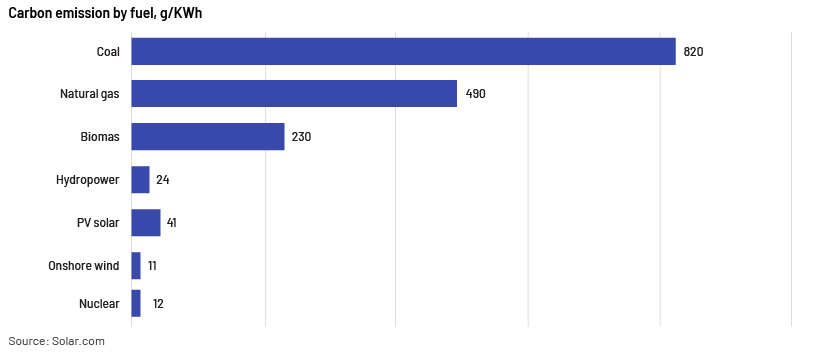

Nuclear power is an energy source with stable output (unlike wind and solar that depend on climatic conditions) and no carbon emissions, making it an ideal candidate to replace fossil fuels. Nuclear power can also help countries with energy security, as they can stockpile uranium as a strategic reserve to secure energy supply, something they cannot do with fossil fuels. So far, countries have been slow in nuclear adoption due to safety issues, high construction costs and difficulties in disposing of radioactive waste.

Key drivers of nuclear fuel demand

1. Decarbonisation targets: Nuclear fuel has a zero-emission quality and is playing a larger role in addressing climate change. Nuclear becomes the top energy source of choice for its superior stability versus other renewables’, which are heavily impacted by natural conditions. Several countries have decided to use nuclear technology to achieve their net-zero emission goals. Asia Pacific will likely be the key driver of demand growth, as it depends heavily on fossil fuels (which account for 60-80% of current power generation).

2. Increasing demand for power from data centres:

2. Increasing demand for power from data centres:

The International Energy Agency (IEA) reports that data centres consumed 460TWh of power in 2022; this could rise to more than 1,000TWh by 2026E.

Goldman Sachs estimates that data centres’ power demand will grow 160% by 2030E. Data centres around the world currently consume 1-2% of global power, but this percentage will likely rise to 3-4% by the end of the decade. Rapid incorporation of artificial intelligence (AI) into software programming by a number of sectors has accelerated data centres’ demand for electricity. Processing a ChatGPT query needs, on average, nearly 10 times as much electricity as a Google search, translating into almost 10TWh of additional electricity a year. While a normal data centre needs 32MW of power flowing into the building, an AI data centre requires 80MW.

Moreover, data centres’ demand for electricity does not fluctuate during the day in the same way as demand from residences or many other businesses. Data centres usually require a consistent and steady supply of electricity at all hours. Likewise, nuclear power plants operate continuously and are the best suited to power data centres. Traditional nuclear reactors are large in size and expensive to build, so adoption of this capacity presented challenges. With the advent of small modular reactors (SMRs), nuclear-powered data centres are expected to become a reality. SMRs have emerged as a potential pathway to a data centre’s nuclear options, with their zero emissions (versus gas turbines), output stability (versus wind/solar farms) and deployment flexibility (versus traditional nuclear power plants). Mass commercialisation of such reactors is expected within the next five years.

Many data-centre companies have announced plans to power their data centres with nuclear power, either through reviving legacy plants or developing emerging technology.

| Company | Nuclear-adoption plans |

| Microsoft | Signed 20-year PPA to purchase power from the Three Mile Island nuclear plant, set to re-open in 2028E after the deal. |

| CEO mentioned SMRs as a potential option to power data centres. | |

| Amazon | Acquired a 960MW data centre powered by Susquehanna, the sixth-largest US NPP. |

| Oracle | Plans to build a gigawatt-scale data centre powered by three SMRs. |

Source: Google News

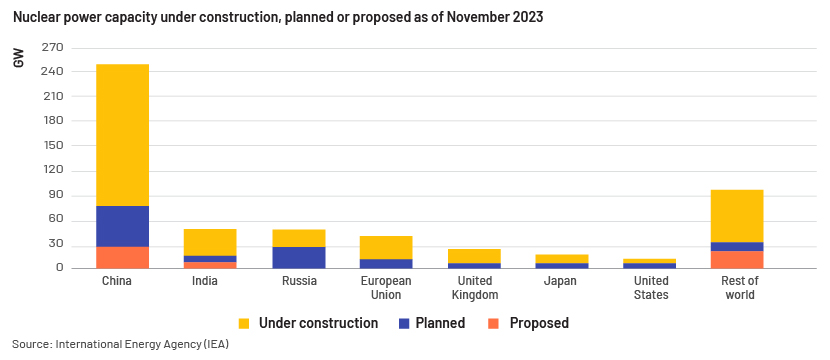

Asia is leading the building of nuclear power capacity

A number of countries announced expanding nuclear power as the centre of their strategies to reach climate policy objectives in 2022 and 2023, sparking a significant revival of global interest in nuclear energy. The IEA’s updated “Net Zero Roadmap” shows that use of nuclear energy should more than double by 2050E, complementing deployment of renewable energy and easing the pressure on critical mineral supply.

Major countries with nuclear programmes in Asia (China, India, Japan and Korea) depend heavily on fossil fuels, with fossil fuels accounting for 60- 80% of their current power generation.

An additional 29GW of new nuclear capacity is expected to come online globally from 2024 to 2026E, with more than half of this in China and India.

Asia’s share of global nuclear generation is expected to reach 30% in 2026E. Based on reactors under construction with completion expected until 2026E, Asia is set to surpass North America as the region with the largest installed capacity. China continues to lead in global nuclear capacity additions, with more than 250GW currently under construction. China and India accounted for >50% of nuclear reactors under construction globally in September 2024, according to the World Nuclear Association (WNA).

Major roadblocks to faster adoption of traditional nuclear power generation

Governments face a number of challenges in operationalising nuclear reactors. The major challenges are as follows:

-

The time lag between planning and operation (due to the number of regulations). The planning-to-operation (PTO) time of all nuclear plants ever built has been 10-19 years or more (versus 2-5 years for wind or solar).

-

Building and maintaining nuclear reactors is more expensive than building and maintaining solar or wind installations. The levelised cost of energy (LCOE) for a new nuclear plant is estimated at USD151/MWh. This compares with USD43/MWh for onshore wind and USD41/MWh for solar.

-

Weapons proliferation risks are high. Non-nuclear countries could choose to enrich uranium to create weapons-grade uranium to be used in nuclear weapons.

-

Meltdown risks are high. To date, 1.5% of all nuclear power plants ever built have melted down to some degree. Meltdowns have been either catastrophic or otherwise damaging.

-

Disposal of nuclear waste takes many years and incurs cost. Nuclear waste after use needs be stored for at least 200,000 years (far beyond the lifetime of reactors). In the US alone, about USD500m is spent yearly to protect about 100 civilian nuclear power plants from nuclear waste.

SMRs are the real game-changers and the solution to many of these roadblocks

Given the long lead times in traditional nuclear power generators and high construction costs, government focus has shifted to SMRs. These have been operational for almost 70 years now in submarines, aircraft carriers and ice breakers, but land-based SMRs have also been developed in recent years to generate electricity. These are significant problem solvers.

They use simple, proven technology and are safer than the current nuclear power stations. They can be manufactured in factories and then rapidly erected on-site. “Modular” refers to the design principle of breaking down a system into small, independent and interchangeable components, or “modules”, that can easily be combined, modified or replaced without affecting the rest of the system. This flexibility means they are scalable. It aids manufacture, transport and installation while reducing construction time and costs.

SMRs do not occupy much land, so they have little impact on the landscape. A 440MW SMR would produce about 3.5TWh of electricity per year – enough for 1.2m homes, or to provide power to North East Wales. This would require about 25 acres of land. A solar farm would need 13,000 acres for the same output; a wind farm 32,000 acres. Three 440MW SMRs would be enough for London, which has around 3.6m homes.

Key beneficiaries along the nuclear value chain

Nuclear energy generation is forecast to reach an all-time high in 2025E, according to the IEA. It estimates that global nuclear energy generation will be 10% higher in 2026E than in 2023. A number of companies along the nuclear value chain are likely to benefit from this renaissance of nuclear technology – nuclear utilities, uranium miners, nuclear reactor manufacturers, nuclear fuel cycle companies and nuclear engineering and construction companies.

Uranium miners: Current demand for uranium stands at 200m pounds per annum, while mining output totals only 140m pounds, indicating a supply deficit. We expect uranium miners to benefit from the increase in demand. There are large producers such as Cameco (CCO CN) and Paladin Energy (PDN AU). Investors can also gain exposure via large-cap companies such as Rio Tinto (RIO LN), but these are not pure plays. There are mine developers too, such as NexGen Energy (NXE CN) whose Rook 1 project should be producing 30m pounds of uranium a year by 2030E, almost enough to solve the uranium supply deficit single-handedly.

Nuclear-reactor manufacturers: Both Rolls-Royce (RR LN) and Fluor Corp. (FLR US) have been real winners. Rolls-Royce has built seven generations of SMRs for use in nuclear submarines and, with its modern designs for SMRs, has been winning contracts globally. Rolls-Royce is not a pure SMR play; it has placed its SMR business as a separate entity (Rolls-Royce SMR), and this could be spun out and listed at some stage. Fluor’s nuclear segment includes new builds, nuclear operations and management, and nuclear power plant support services. Fluor also has a 51% ownership stake in SMR company NuScale Power Corporation (SMR US).

SMR US develops and commercialises SMRs for nuclear-power generation, aiming to provide a “safe, flexible and scalable nuclear-energy solution”. BWX Technologies (BWXT US) manufactures nuclear reactor components, systems fuel and other critical parts for the nuclear power industry.

In Asia Pacific, Mitsubishi Heavy Industries (MHI JP) and Doosan Enerbility (034020 KR) are SMR-exposed equipment makers. MHI is developing innovative and advanced reactors and helping restart existing reactors. It has also been concentrating on developing next-generation light-water reactors and compact reactors. Doosan Enerbility has entered into a strategic partnership with US-based NuScale Power to target US and global markets.

Nuclear utilities: Among US companies, Constellation Energy (CEG US) is the largest owner of nuclear plants in the US that are not rate-regulated. Among European companies, UK-based Centrica (CAN LN) has a 20% stake in Électricité de France's UK nuclear plants. Endesa ELE (EDF FP) is an integrated utility operating in power production, distribution and supply in the Iberian Peninsula. Its nuclear plants account for 40% of its total electricity output. Électricité de France is currently building four new nuclear reactors in France and in the UK. The stock was delisted in June 2023, but the company has remained active in bond markets.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners support global portfolio managers by leveraging our sector-specific experience. Along sector-specific themes, we help investment firms with idea generation, competitive landscape analysis on emerging trends (such as AI, digitalisation, ADAS and AVs) and analysis of investment opportunities through comprehensive research and sector coverage support.

Sources:

-

https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand

-

https://www.oneearth.org/the-7-reasons-why-nuclear-energy-is-not-the-answer-to-solve-climate-change/

-

https://moneyweek.com/investments/energy-stocks/how-to-invest-in-nuclear-power

-

https://www.solar.com/learn/what-is-the-carbon-footprint-of-solar-panels/

Tags:

What's your view?

About the Author

A post graduate in Management (Finance) with nearly 15 years of total work experience in equity research including 8 years in Acuity Knowledge Partners.Well-versed in financial modeling, financial analysis, valuation, writing reports/investment thesis, thematic research (Global M&A and Spinoff Study), special situation analysis (Spinoffs) and portfolio management.

Like the way we think?

Next time we post something new, we'll send it to your inbox