Published on January 10, 2025 by Virina Mogre and Aarti Madan

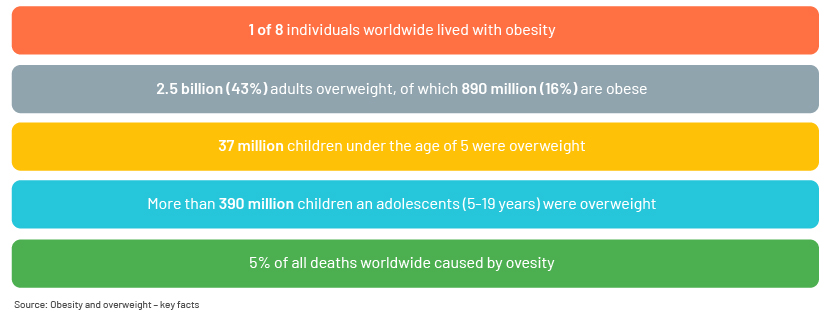

Obesity is a pervasive global health challenge that transcends borders, impacting millions, with profound consequences to their wellbeing and quality of life. In 2022, one in eight people globally were obese, according to WHO, with obesity causing c.5% of deaths. Adult obesity has doubled, and childhood obesity has increased eightfold in 40 years. Experts believe that by 2035, over half of the population above five years of age could be obese. Owing to the growing prevalence of obesity and awareness of the need for weight loss, the obesity-management industry is expected to reach new heights.

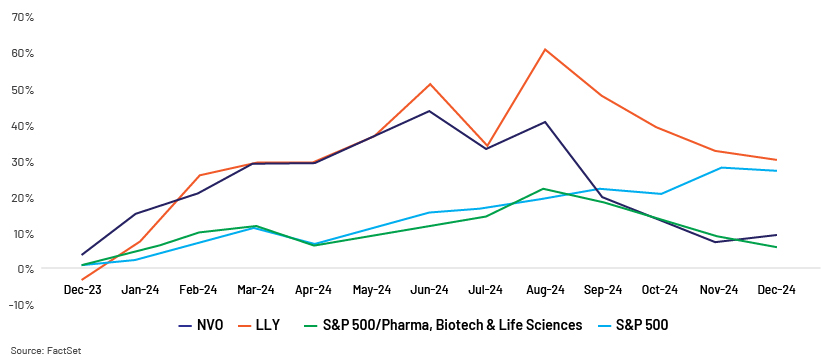

Early movers Eli Lilly and Novo Nordisk have seen their value grow by more than 50% in the past one year, according to Bloomberg, surpassing the S&P 500 and growth of the broader healthcare sector. This growth has been driven by successful clinical breakthroughs in a class of obesity and dietary drugs. Their success has increased interest in the space and investment by both small and large players.

Key growth drivers

Increasing prevalence of obesity

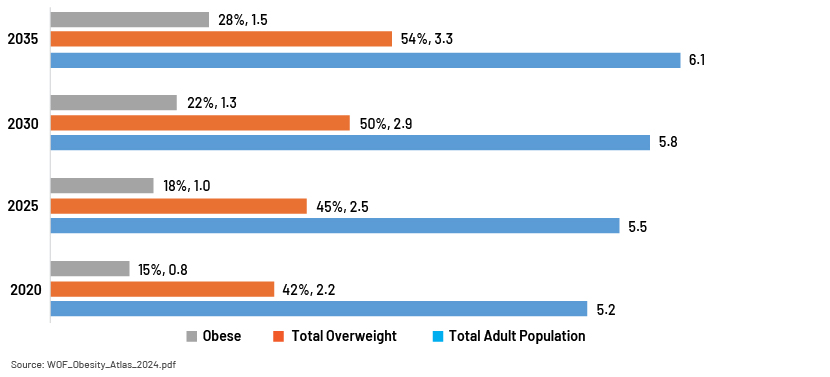

The prevalence of obesity is steadily increasing. The number of adults with a high BMI count could reach alarming levels by 2035, according to World Obesity Atlas 2024.

-

Total overweight: Approximately 3.3bn adults

-

Obese: Around 1.2bn adults

Evolving treatment landscape

Evolving treatment landscape

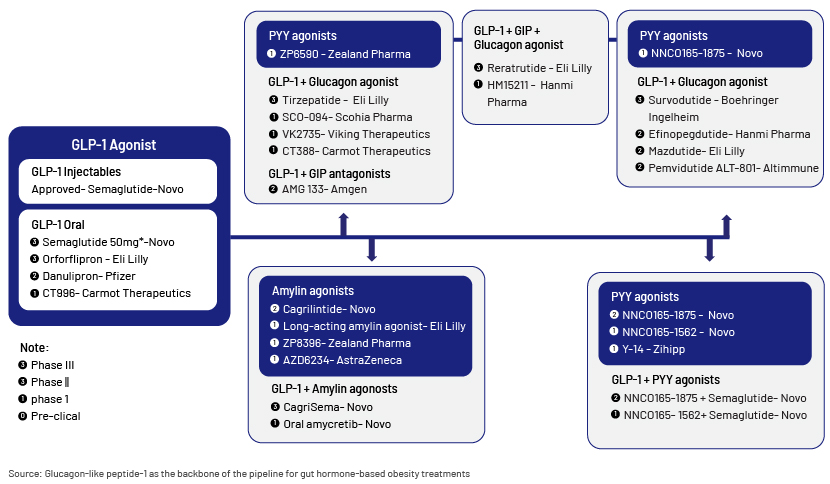

The treatment of obesity has evolved with increased demand, improved understanding of weight-regulation mechanisms and the role of the gut-brain axis in appetite. This has led to the development of safe and effective entero-pancreatic hormone-based treatments for obesity such as Glucagon-like peptide-1 (GLP-1) receptor agonists – Semaglutide, and a dual GLP-1/GIP RA Tirzepatide. However, only some drugs have demonstrated a beneficial efficacy and safety profile in recent decades.

Currently Approved/Used Anti-Obesity Medicines

| Drug | Company | Molecular target | Rx Label |

| Zepbound (Tirzepatide) | Eli Lilly and Company | GIP receptor and GLP-1 receptor agonist | Approved- Nov 2023 |

| Wegovy (Semaglutide subcutaneus) | Novo Nordisk Inc. | GLP-1 receptor agonist | Approved- Jun 2021 |

| Rybelsus (Semaglutide oral) | Novo Nordisk Inc. | GLP-1 receptor agonist | Off- Label |

| Saxenda (Liraglutide) | Novo Nordisk Inc. | GLP-1 receptor agonist | Approved- Dec 2014 |

| Trulicity (Dulaglutide) | Eli Lilly and Company | GLP-1 receptor agonist | Off- Label |

| Jardiance (Empagliflozin) | Boehringer Ingelheim and Eli Lilly and Co. | SGLT2 inhibitor | Off- Label |

| Farxiga (Dapagliflozin) | AstraZeneca and Bristol -Myers Squibb Co. | SGLT2 inhibitor | Off- Label |

| Contrave (Bupropion and naltrexone) | Currax Pharmaceuticals | NDR inhibitor + Opiate antagonist | Approved- Sep 2014 |

| Qsymia (Phentermine and topiramate) | Vivus, Inc. | Sympathomimetic amine anorectic plus anticonvulsant | Approved- Jul 2012 |

| Belviq (Lorcaserin Hydrochloride) | Eisai Co., Ltd. | 5-hydroxytryptamine receptor 2C | Approved |

| Xenical (Orlistat) | Roche Holding | Reversible inhibition of gastric and pancreatic lipases | Approved- April 1999 |

| Meridia (Sibutramine) | Knoll Pharmaceutical | NE and 5-HT inhibitor | Approved |

| Didrex (Benzphetamine) | Pfizer Inc. | Multiple; Synaptic vesicular amine transporter | Approved |

| Suprenza (phentermine hydrochloride) | Akrimax Pharmaceuticals, LLC | Multiple; Incl. Sodium-dependent noradrenaline transporter | Approved |

| Glucophage (Metformin) | Bristol-Myers Squibb Co. | Multiple; including AMP | Off- Label |

| Desoxyn (Methamphetamine) | AbbVie Ltd. | Synaptic vesicular amine transporter | Off- Label |

Note : Gray highlight indicates withdrawal or discontinuation from the U.S. market

Source: Obesity and its comorbidities, current treatment options

GLP-1 drugs currently in use, although effective (15-25% average weight loss), are injectable, and potential patients are reluctant to use them. To address this, oral GLP-1s are being developed to improve convenience and acceptance. There is also a large pipeline of entero-pancreatic hormone-based therapies that aim to enhance GLP-1 receptor efficacy and mechanism:

Future approaches may even include anti-obesity vaccines and gene therapy to target genetic and epigenetic determinants of obesity.

An ever-expanding targeted addressable market

The popularity of new-age weight-loss drugs is surging due to better understanding of diseases, positive results and the rapid rise of their exposure via social media. Analysts predict a market expansion in the next decade, with anti-obesity medicines (AOMs) driving performance.

Intriguing insights:

-

Bloomberg valued the size of the AOM market at USD2.5bn in 2022, spearheaded by big-pharma giants: Novo Nordisk and Eli Lilly. It is expected to grow exponentially over the next 10 years.

-

Evaluate Pharma expects the obesity therapy market to scale up to USD66bn by 2030, with the overall market for GLP-1 therapies in the USD100-130bn range. This is due to the promising results of GLP-1 drugs against obesity and their multi-pronged benefits in reducing risk of heart, liver and kidney disease.

Harnessing challenges as catalysts for growth

Price: Current costs of FDA-approved AOMs range from USD1,000 to USD1,300 out-of-pocket for a month. Considering the prolonged use of these medicines, the price point is notably steep.

New drugs such as Orforglipron and Retatrutide being developed by Eli Lilly are expected to be more affordable and effective than drugs currently available. Eli Lilly has also launched a new vial version of Zepbound for c.50% the price of its original injectable pen to be available through the direct-to-consumer platform to patients who opt for self-pay outside of insurance.

Insurance: Insurance coverage of obesity treatments remains inconsistent and mixed. Medicare currently does not cover AOMs when prescribed solely for weight-loss purposes. Many insurers and employers see weight-loss as a cosmetic need rather than a medical necessity.

Stigma: The stigma surrounding patients who seek obesity treatments remains a significant challenge. 34% of patients visiting weight-loss clinics do not return after their first visit, according to an article published in the International Journal of Obesity. The stigma is reduced through increased recognition and acceptance of obesity as a disease, heightened global engagement, awareness initiatives by organisations such as UNICEF and WHO, and new medical advancements.

Coping with high demand and supply-chain issues: The spike in demand for weight-loss medications is outpacing supply. Comprehensive data regarding the extent of these shortages remains limited. While supply shortages may have constrained immediate growth, the industry’s pipeline has swiftly expanded, introducing novel treatment options.

Key players

The weight-loss drug market has been a two-horse race thus far, with Novo Nordisk and Eli Lilly capturing all of Wall Street’s interest. Novo Nordisk holds first-mover advantage, but there is growing interest and participation of other pharma companies wanting to disrupt and take advantage of this lucrative space.

Analysts expect Novo Nordisk to shed some of its >50% market share, according to Evaluate Pharma, with Eli Lilly and new entrants such as Amgen and Pfizer gaining share.

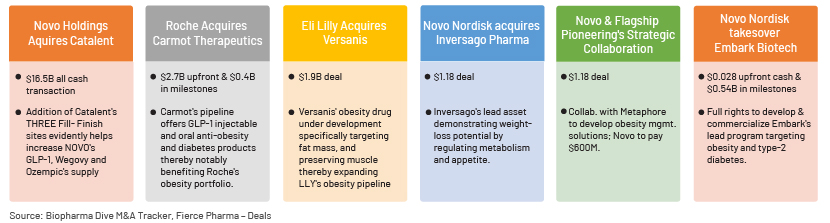

Recent M&A and deals

With the GLP-1 market proving to be highly lucrative, new biotech firms would seek to enter the drug race. Naturally, with a class so potentially large, a large number of biotech firms across the market-cap range are expected to participate. Even capturing a small share of such a large market could be very lucrative for some companies, and these efforts may lead to attractive partnering opportunities.

Increased activity of obesity pipeline buyouts and deals indicates soaring demand and the scope of this market. Highlighted below are some recent key collaborations:

Pfizer and Flagship Pioneering recently settled on the first target for their billion-dollar, multiprogramme collaboration. Pfizer will work with ProFound Therapeutics to develop new obesity drugs.

Conclusion

We think the obesity market has a long way to go and it’s really not too late.

With increasing prevalence of disease and growing demand for effective treatment, there is a substantial need that cannot be fully addressed by medicines already approved. It is still challenging to find treatment that shows meaningful weight reduction of more than 20%. Thus, drugmakers are focusing on innovative drugs that in addition to weight loss would bring other health benefits, such as lowering cardiovascular disease risk and obstructive sleep apnea.

Owing to the influx of new treatments, we expect better patient management, coupled with increasing awareness, better pricing and insurance coverage, which will likely be key contributors to market growth.

Additionally, with a large number of pharmaceutical companies trying to enter the growing obesity market through in-house R&D or acquisition, the AOM GLP-1 drug market appears extremely lucrative; it is estimated to reach USD100bn within a decade, as mentioned above.

How Acuity Knowledge Partners can help

We conduct in-depth research tailored to specific sectors and countries that helps clients navigate complex markets and sectors. A number of research firms and global investment banks leverage our expertise to increase internal analyst bandwidth. We have dedicated teams of analysts to support clients on a wide range of activities – idea generation, building financial models, financial analysis, mergers and acquisitions consulting services, thematic research and sector coverage. We explore the latest developments in a number of sectors, analysing the impacts and helping clients stay ahead. Each output is customised based on client requirements and made available for their exclusive use.

Sources:

-

Obesity and its comorbidities, current treatment options and future perspectives: Challenging bariatric surgery? –ScienceDirect

-

Biotech M&A has plateaued. Track the deals that are happening here. | BioPharma Dive

-

Company PR and SEC filings

What's your view?

About the Authors

Virina Mogre has seven years of work experience, five of which are in equity research. She has been working at Acuity Knowledge Partners (Acuity) for almost two years, leveraging her skills to support a leading US sell-side client covering the biotech sector. Prior to joining Acuity, she worked for a global financial services and analytics company, gaining experience covering SME biotech stocks. Virina has passed two levels of chartered accountancy examinations with the Institute of Chartered Accountants of India (ICAI) and holds a master's degree in Commerce from University of Pune.

Aarti Madan has more than nine years of overall work experience, with over six years in equity research and financial modelling. She has been with Acuity Knowledge Partners (Acuity) for 2.5 years, supporting a US sell-side client focusing on the biotech sector. Before joining Acuity, she worked with a Japan-based start-up covering Japan’s pharma and biotech sector. Aarti has completed her M.Com and holds a company secretary qualification from the Institute of Company Secretaries of India (ICSI).

Like the way we think?

Next time we post something new, we'll send it to your inbox