Published on May 18, 2023 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

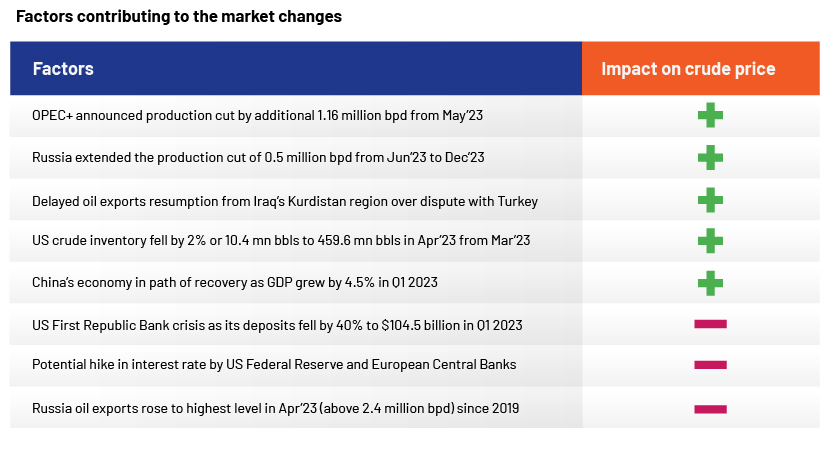

Oil prices started the Apr’23 month on a higher note as OPEC+ announced additional production cut of 1.16 million bbls starting May 2023, however, the prices lost momentum towards the end of month as recession concerns mounted due to potential interest rate hikes by major Central Banks to curb inflation and as the US’ First Republic Bank created panic by announcing 40% decline in its deposits. LNG markers remained under-pressure throughout the month as Japan Korea Marker (JKM) declined on account of weak demand, healthy gas inventories and availability of spot LNG supply in the NE Asian market while UK’s National Balancing Point (NBP) declined with high LNG cargo arrivals in Europe and prevailing outage at Njord and Troll fields in Norway.

Monthly Oil Market Snapshot – Apr 2023

Industry Analysis for the month

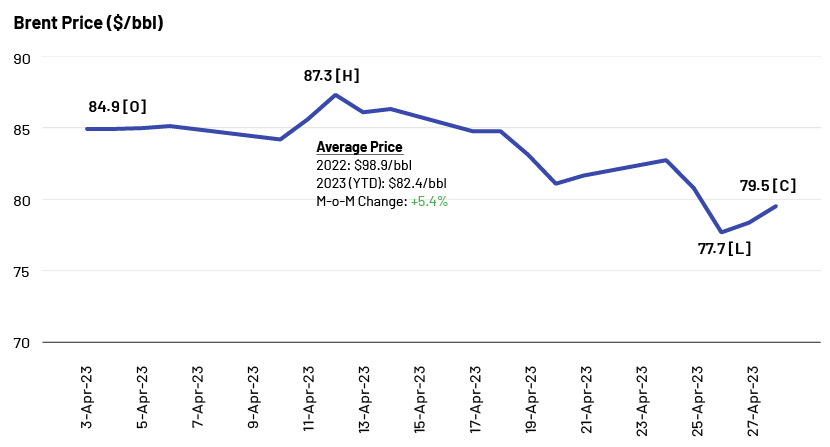

OPEC+ announcement of additional production cut by 1.16 million bbl from May’23 led to the rally in Brent prices during start of Apr’23 as the prices surged to $87s/bbl, highest since Jan’23. However, towards the end of month, the prices cooled and fell by 11.0% from its peak to lows of $77.7/bbl amid another banking crisis in the US and growing recession concerns.

The prices closed the month with a decline of ~8.9% at $79.5/bbl compared to its peak price and fell by ~6.3% compared to the opening price

Industry updates (Key M&A/Investments/Deals in the month)

-

Suncor to buy TotalEnergies Canadian operations for $4.1 billion.

-

Ovintiv to acquire Permian basin assets for $4.3 billion.

-

Exxon Mobil Corp is in preliminary talks with Pioneer Natural Resources Co for its acquisition.

-

OPEC+ announced further oil output cuts of around 1.16 million barrels per day.

-

BP starts oil production in its first oil platform, Argos in the Gulf of Mexico since Deepwater Horizon disaster.

Acuity’s view:

We believe that macroeconomic concerns would continue to create pressure in the oil market, until inflation in major economies like US and Europe gets controlled and China contributes significantly to oil demand growth. OPEC+ production cut will create supply tightness if demand picks up, till then market would remain balanced as resilient Russian supply continues to find market for its oil.

Source(s): Investing, Reuters, Nasdaq, Reuters, Reuters , BP , OP, Reuters, Bloomberg, China, CNBC , Bloomberg , Bloomberg , Zawya , Reuters

Monthly Gas & LNG Market Snapshot – Apr 2023

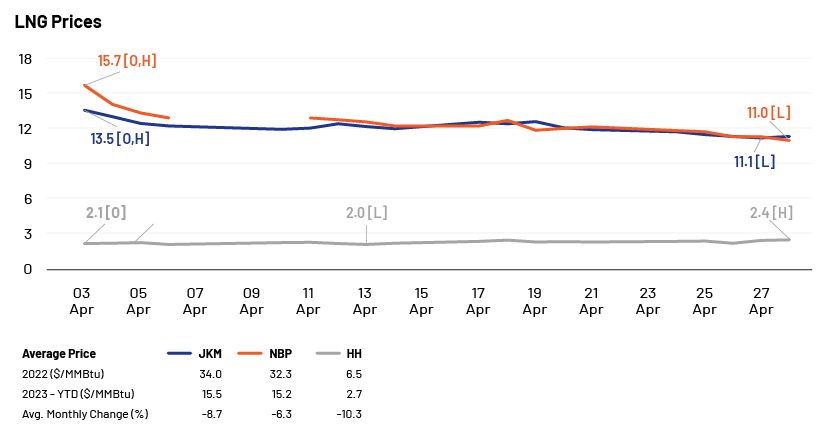

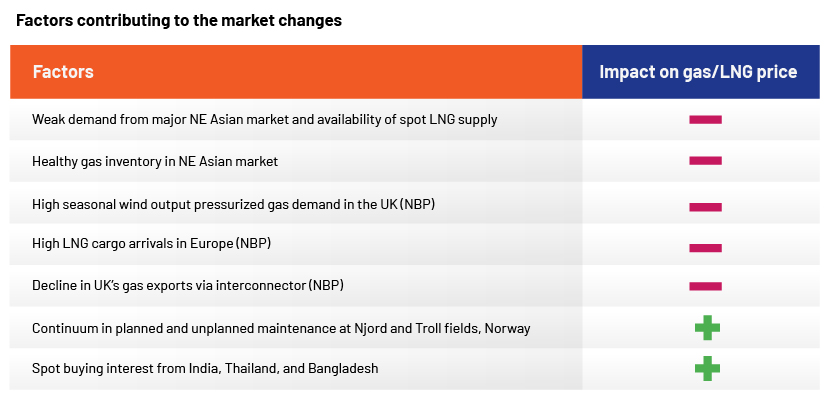

LNG markers during Apr’23 remained under-pressure as the NBP and JKM prices declined by 43% and 20% respectively. UK’s National Balancing Point (NBP) declined sharply from high-$15.00s/MMBtu to low-$11.00s/MMBtu, ending at $10.95/MMBtu on month’s close while Japan Korea Marker (JKM) prices started high at $13.00s/MMBtu and stayed range-bound at $11.00-12.00s/MMBtu levels throughout Apr’23, reaching 21-month low (since Jun’21).

Whereas, US gas benchmark, Henry Hub (HH), reversed the Mar’23 downtrend in Apr’23 and ended 15% higher at $2.40s/MMBtu level.

Industry updates (Key M&A/Investments/Deals in the month)

-

Biden admin greenlights LNG exports from Alaska LNG project

-

Tellurian seeks Japan and India investments in Driftwood LNG project

-

Russia approves Novatek’s purchase of Shell’s stake in Sakhalin-2 gas project

-

BP to take highest stakes in Woodside’s USD 30 billion Browse gas project

-

Iraq agrees to 30% stake in TotalEnergies USD 27 billion Iraq energy project

-

Delfin Midstream inks 20 years 0.60 MMTPA LNG SPA deal with UK's Hartree Partners

-

Petronas inks LNG SPA deal with PetroChina, details undisclosed

-

Venture Global and JERA signs 20 years 1 MMTPA LNG supply deal from its CP2 LNG project.

Acuity’s view:

We believe that LNG demand in Europe will continue to build in short term with temperature expected to remain below normal in May’23 and commissioning of new FSRUs in the region, however, LNG demand in Asia is likely to remain constrained on account of high fuel switching and slower economic growth in China market along with healthy gas inventory in Japan.

Source(s): Investing, CME Group, ICE, LNG Prime, LNG Prime, Reuters, Asia-Nikkei, Market Screener, Bloomberg, SMH, Gas Processing News

How Acuity Knowledge Partners can help

We have a large pool of oil and gas experts experienced in providing strategic support across the value chain. Over the years, we have partnered with leading energy companies and have closely worked with their strategy, business development, market intelligence and M&A teams in providing necessary information and analysis, thus helping them achieve their business objective.

Acuity also offers its expertise in power, renewables, metal and mining, environmental social and governance (ESG) and sustainability space.

https://www.acuitykp.com/solutions/energy-and-utilities/

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox