Published on September 22, 2023 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

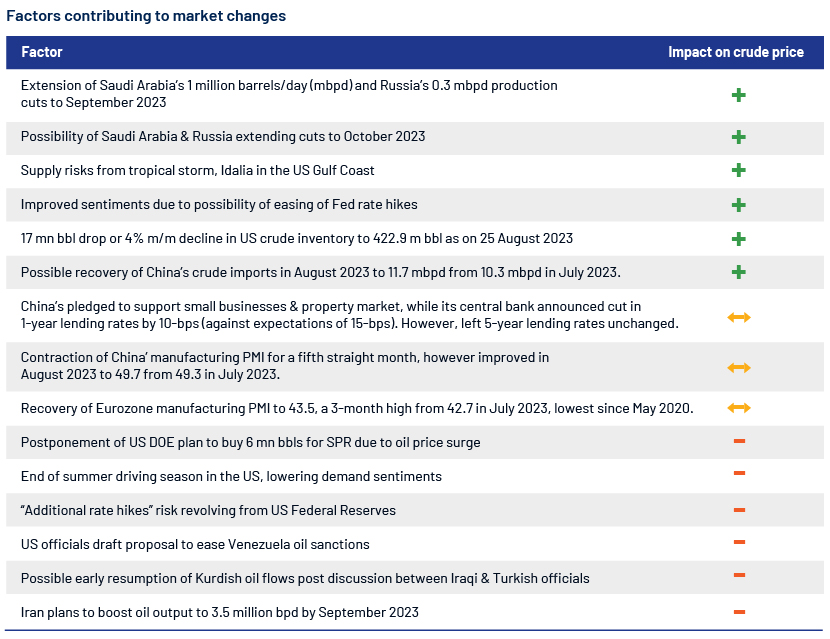

The average oil prices in August 2023 rose to USD85.1/bbl from July 2023 average price of USD80.16/bbl as Saudi Arabia and Russia extended oil output cuts to September 2023. The focus was back on China’s oil demand growth with a rise in refinery throughput and recovery in crude imports for August 2023, despite markets’ anxiety on weak macro-economic indicators. Cooling inflation in the US and record decline in its crude inventory also contributed.

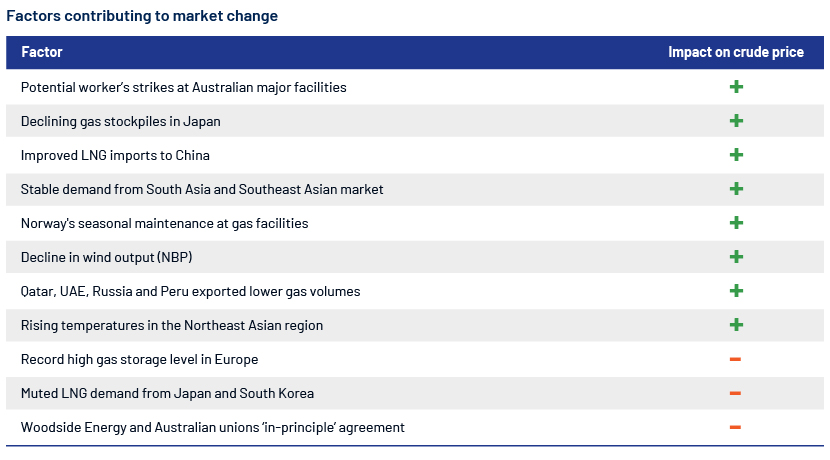

LNG price indices rose in August 2023 after a decline in July 2023. Japan Korea Marker (JKM) improved on fear of potential workers’ strike in Western Australia’s LNG export facilities, consistently growing Chinese demand for LNG, active buying in South Asian markets and declining gas stockpiles in Japan, lowest since last year. The UK’s National Balancing Point (NBP) also rose amid seasonal maintenance in Norwegian gas fields, and decline in wind power generation, which more than offset the record high gas storage levels in Europe.

Monthly oil market snapshot – August 2023

Industry analysis for the month

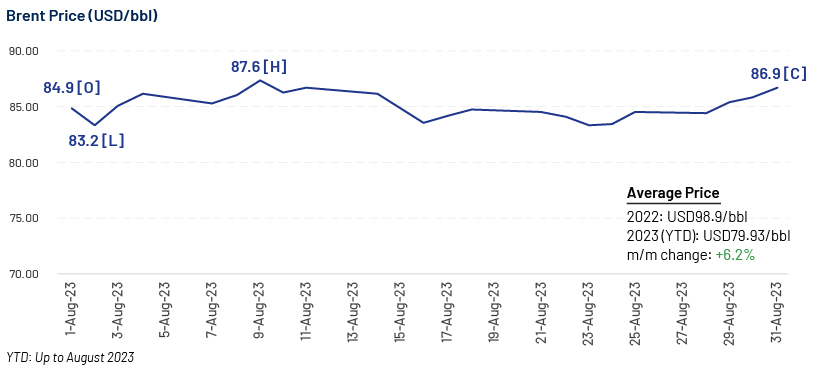

Brent price averaged USD85.1/bbl in August 2023. The price touched a high of USD87.6/bbl and a low of USD83.2/bbl, showing a fluctuation of 4.9%.

Production cut extension from Saudi Arabia and Russia to September 2023 amid slowing inflation in the US and massive decline in country’s crude inventories kept prices higher by 6.2% m/m.

The oil market’s focus was on also on ‘China’ after sluggish import numbers in July 2023. However, the country’s crude imports bounced back, as per Reuters, despite weak macroeconomic indicators as refinery throughput increased significantly to cater domestic demand and exports.

Industry updates (key M&A/investments/deals over the month)

-

India and the UAE close their first oil deal in the INR.

-

Equinor considers exit from Azerbaijan, the sale to include the biggest oil project in the Caspian country, the Azeri-Chirag-Guneshli field.

-

Exxon, Hess, and CNOOC to launch the sixth offshore oil project in Guyana on an investment of USD12.93.

-

Iran to bring 67 new oil and gas projects worth USD15 bn online by March 2023.

-

Energy Transfer LP to acquire Crestwood Equity Partners in a USD 7bn deal.

-

Kimbell Royalty Partners signs USD455m deal to buy oil and gas assets.

-

Chevron completes the acquisition of PDC Energy.

-

Permian Resources signed a deal to buy Earthstone Energy for USD4.5bn to create a USD14bn premier producer in the Delaware basin in the Permian.

Acuity Knowledge Partners’ view

As OPEC+ Saudi Arabia and Russia extended cuts to end of 2023, we believe supply tightness in combination with declining inventories will support prices higher. Further, slowing inflation in the US and strong oil demand growth in China so far in 2023 adds to bullish sentiments. The downside risk involves positive supply growth expectations from the US, Iran, and Venezuela which might balance OPEC+ cuts in the near-term and market’s revolving concerns around macro-economic factors, specially from China.

Monthly gas and LNG market snapshot – August 2023

Industry analysis for the month

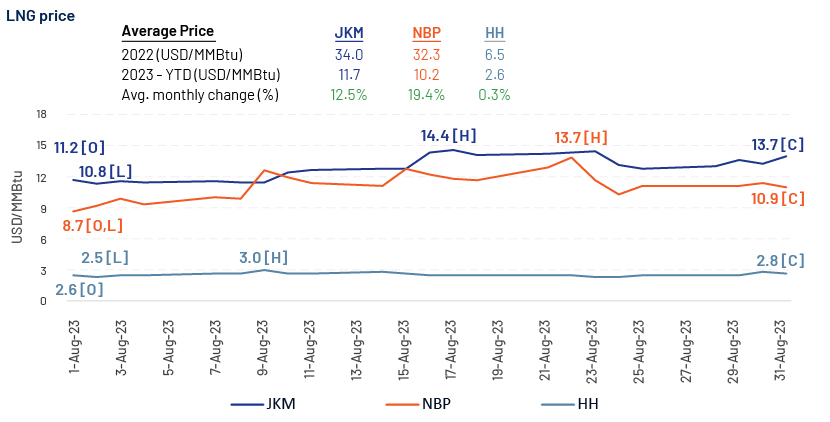

After a dip in global gas and LNG prices in July 2023, LNG markets rebounded in August 2023, with NBP and JKM prices increasing 12.5% and 19.4% m/m, respectively. During the month, UK NBP rose by USD2.2/MMBtu from the August 2023 opening price and the month’s low of USD8.7/MMBtu to close at USD10.9/MMBtu. Also, JKM price opened at USD11.2/MMBtu, near the month’s low price and rose during the month, closing at USD13.7/MMBtu.

US gas benchmark Henry Hub (HH) started the month at USD2.6/MMBtu before increasing 8.1% to close at USD2.8/MMBtu at month-end.

Industry updates (key M&A/investments/deals over the month)

Industry updates (key M&A/investments/deals over the month)

-

BP and OMV inked a long-term LNG supply agreement for 1 MTPA spanning a 10-year period from 2026.

-

ConocoPhillips signed 20-year 2.2 MMTPA of LNG SPA with Mexico Pacific.

-

Oman LNG signed a binding four-year LNG supply deal with SEFE for the delivery of 0.4 MMTPA of LNG starting from 2026.

-

Oman LNG signed two binding term-sheet agreements to supply 0.80 MTPA of LNG to Shell's subsidiary and 0.75 MTPA of LNG to OQ Trading.

-

Woodside and LNG Japan signed SPA for 12 LNG cargoes per year for 10 years starting 2026.

-

ADNOC inked its first major global upstream gas deal with 30% equity stake purchase in Azeri Absheron gas field.

-

TotalEnergies and INPEX acquire stake in Australia’s AC-RL7 block with gas fields.

-

BP likely to double investments to about USD3.5 bn over 2024-2026 in Egypt’s natural gas sector.

-

Australia's Woodside Energy to sell 10% stake in Scarborough to LNG Japan for USD500m.

-

Energy Transfer to buy Crestwood for USD7.1bn in the latest US pipeline deal.

-

Temasek weighs USD2bn Pavilion Energy asset sale.

Acuity Knowledge Partners’ view

We believe clarity on the direction of LNG prices would rely on the outcome of deal between Chevron and workers at its facilities in Australia. The facilities accounts for nearly 5% of global LNG capacity and any supply disruption due to strike could push prices higher. The prices should also get support from continuum of Chinese LNG demand growth and recent decline in Japanese gas stockpiles due to surge in gas power generation. On the contrary, the global prices will remain under pressure if Australian unions and Chevron resolve the ongoing dispute by 07 September 2023, alongside factors such as high gas stockpiles in Europe and US.

How Acuity Knowledge Partners can help

We have a large pool of oil and gas experts experienced in providing strategic support across the value chain. Over the years, we have partnered with leading energy companies, closely working with their strategy, business development, market intelligence and M&A teams to provide them the necessary information and analysis to help them achieve their business objectives.

Acuity also offers its expertise in power; renewables; metals and mining; ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources

Investing, CME Group, ICE, Offshore Energy, PGJ Online, , Times of Oman, Market Screener, Energy Connects, Market Screener, Financial Times, The Star, Inpex, Zawya, Reuters, Oil Price, , Oil Price, AA Energy, Reuters, Reuters, CNBC, Trading Economics, Reuters, EIA, Reuters, Iraqi News, Reuters, EIA, EIA#1, Reuters, Oil Price, Reuters, ENI, OP, Oil Price, Natural Energy News, Oil Price, The Globe, Oil Price, Offshore Technology, Chevron, Oil Price, NBC News, Reuters, Reuters

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox