Published on September 10, 2024 by Gaurav Sharma and Surbhi Joshi

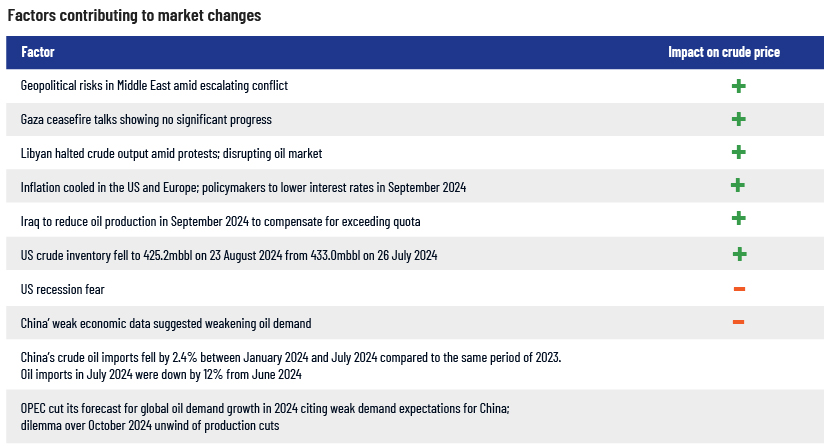

The oil price recorded a 6% m/m decline in August as weak demand from China regained focus amid weak macroeconomic data. The stock market crash due to recessionary fears in the US also added demand uncertainty at the start of the month. On the supply side, the price remained supported by factors such as the escalating crisis in the Middle East, a halt in Libya’s production due to ongoing protests, a decline in oil inventories and the high possibility of policymakers of major economies cutting interest rates in September 2024.

Monthly oil market snapshot – August 2024

Industry analysis for the month

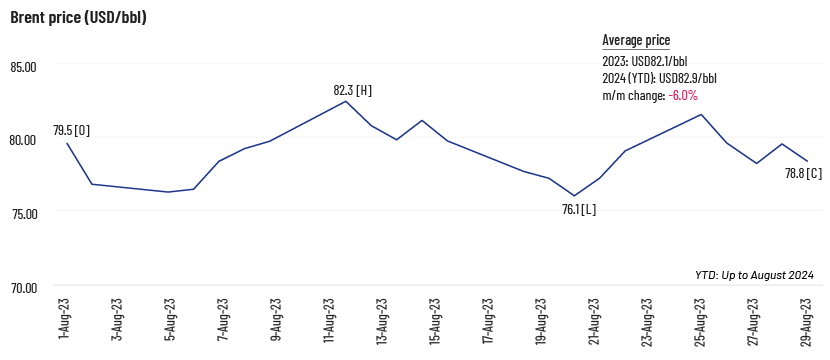

Brent recorded a 6% m/m decline in August, the largest decline since May 2024. It opened at USD79.5/bbl and recorded a high of USD82.3/bbl and a low of USD76.1/bbl before closing at USD78.8/bbl.

The decline in the oil price in early August is attributed mainly to weak demand from China and recessionary fears in the US. However, the escalating geopolitical crisis in the Middle East and Libya announcing force majeure at its major oil fields due to ongoing protests helped the price regain strength mid-month. It lost momentum again towards the end of the month as concerns about China’s weak demand continued to hold market attention.

Industry updates (key M&A/investments/deals in the month)

-

Marathon Oil shareholders approve USD16bn acquisition by Conoco Phillips

-

ONEOK acquires Medallion, EnLink interest for USD5.9bn

-

Exxon seeks to sell conventional Permian assets for USD1bn

-

Equinor plans to invest USD6.6bn annually in Norwegian offshore oil and gas

-

New Zealand to reverse ban on offshore oil and gas exploration

-

Arbitration panel to decide fate of Exxon's claim in USD53bn Chevron-Hess deal

-

Gran Tierra Energy acquires i3 Energy in USD225m deal

-

Guyana anticipates seventh Exxon oil project development plan in early 2025

-

Tourmaline oil dominates Montney shale with USD947m Crew Energy acquisition

-

Crescent Energy, SilverBow Resources form Eagle Ford player following USD2.1bn acquisition closing

Acuity Knowledge Partners’ view

We believe the oil market will remain on the edge, with uncertainty surrounding the geopolitical crisis in Gaza, near-term expectations of interest rate cuts in major economies, OPEC’s plans to unwind production cuts from October 2024 and China’s weak demand.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts is experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, OP, IE, Reuters, Star, EIA, EIA, Edition, Iraqi News, ET, Oil Price, Reuters, Oilprice, Oklahoman, Bloomberg, Oil Price, OP, OP, OP, OP, Trade Winds News

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox