Published on March 8, 2024 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

Oil prices kept rising in February 2024 as geopolitical risks continued to impact the market. Israel’s rejection of Hamas’s offers of a ceasefire, increasing freight rates and voyage time due to Houthi attacks in the Red Sea area and the drone attack on a Russian refinery caused supply concerns. A tight product market caused by heavy refinery maintenance in the US amid Russia’s ban on oil exports resulted in a shortage in diesel supply in Europe, supporting prices in the month. Demand-side fundamentals in the US were not strong as increased inflation delayed rate cuts and crude storage rose significantly due to refinery maintenance and outages. However, the situation in China was positive, due to a decline in the CPI in January 2024, a boom in travel demand due to the Lunar New Year holiday and the biggest-ever cut in the key mortgage rate to avert a property-market crisis.

Monthly oil-market snapshot – February 2024

Industry analysis for the month

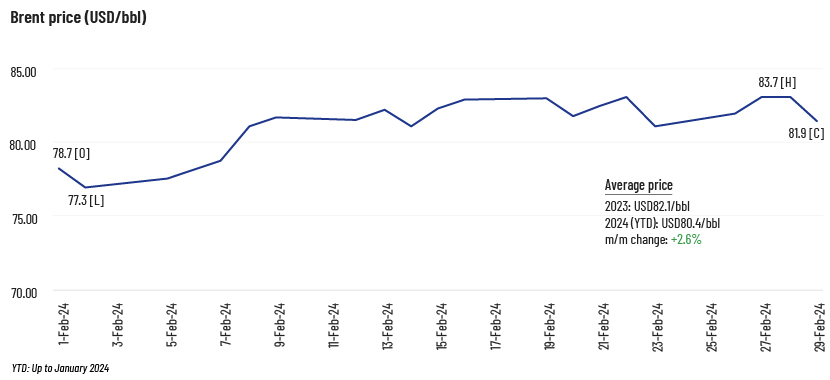

Concerns of supply disruption due to the geopolitical crisis in the Middle East and Ukraine continued to support Brent in February 2024; it recorded a 2.6% m/m gain, as in January 2024.

The price opened at USD78.7/bbl, reached a high of USD83.7/bbl, fell to a low of USD77.3/bbl and closed at USD81.9/bbl.

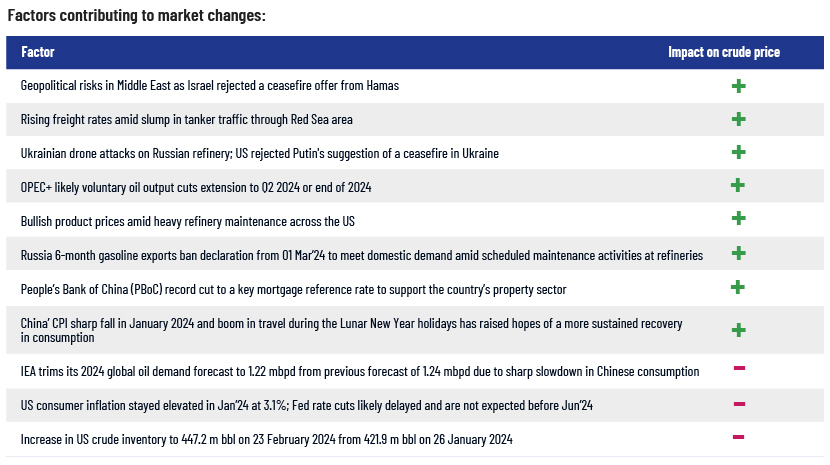

Rejections of ceasefire offers in the Hamas-Israel and Russia-Ukraine wars, rising freight rates amid disruptions in the Red Sea area, drone attacks on Russian refineries, the possibility of OPEC+’s cuts being extended, the oil-product shortage due to refinery maintenance and hope of China’s demand increasing pushed prices higher.

Demand-side factors were weak as the IEA lowered its 2024 demand growth forecast, US crude inventories rose significantly amid refinery maintenance and outages and the Fed delayed interest rate cuts due to high inflation.

Industry updates (key M&A/investments/deals in the month)

-

Chevron’s USD53bn deal for Hess in jeopardy on possible Exxon challenge

-

Occidental explores USD20bn sale of Western Midstream Partners

-

Diamondback Energy agrees to purchase Endeavor Energy for USD26bn in cash and stock, becoming the third-largest oil producer in the Permian Basin

-

Chord Energy and Enerplus agree to USD11bn merger, creating a premier Williston Basin-focused exploration and production company

-

Occidental’s USD12bn acquisition of Permian producer CrownRock delayed as regulator seeks more information

-

ExxonMobil weighs USD1bn sale of Argentine shale assets

-

Vista Energy eyes ExxonMobil shale acquisition in Argentina’s prolific Vaca Muerta region

-

VAALCO Energy joins ExxonMobil, Chevron offshore West Africa with USD66.5m Svenska Petroleum Exploration acquisition

-

Saudi Ministry of Energy orders Aramco to maintain oil production at 12mbpd, halting any expansion plans

-

Petrobras to invest USD100bn in offshore oil production

-

Woodside and Santos plan significant oil and gas exploration expansion activities to address energy shortages and unlock new reserves

-

EOG Resources to invest USD4.2bn in drilling, exploration operations in 2024

-

Chesapeake Energy to reduce gas drilling rigs and completion activity to address oversupply and boost short-cycle productive capacity

-

Oman officially inaugurates USD8.5bn 230,000bpd Duqm Refinery Project

Acuity Knowledge Partners’ view

We expect the prolonged geopolitical crisis in the Middle East and Eastern Europe to continue to impact the oil price. Market movements in the near term are likely to depend largely on factors such as OPEC+’s production levels, increasing maritime fuel demand as ships take longer routes amid the Middle East crisis, the health of China’s economy and the Fed’s decision to cut interest rates.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts are experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, CNBC, Live mint, Reuters, Reuters, BOE, CNBC, Reuters, Bloomberg, Arab News, , Central Banking, Reuters, EIA, EIA, We Forum, BNN Bloomberg, CNN, WSJ, OP, OP#1, OP#2, Reuters, OP#3, OP#4, OP#5, OP#6, OP#7, World Oil,WO#3

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox