Published on February 16, 2024 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

Brent oil price recorded m/m gain in January 2024 after declining for three consecutive months as market priced in fears of supply disruptions from heightened shipping risks in the Red Sea following US/UK-led air strikes on Houthi rebels, along with other supply risks such as the closure of the Libyan field and production suspension in the US because of freezing weather. Demand growth in China continued to be uncertain amid economic stimulus measures, contraction in January 2024 PMI and liquidation of property giant Evergrande.

Monthly oil market snapshot – January 2024

Industry analysis for the month

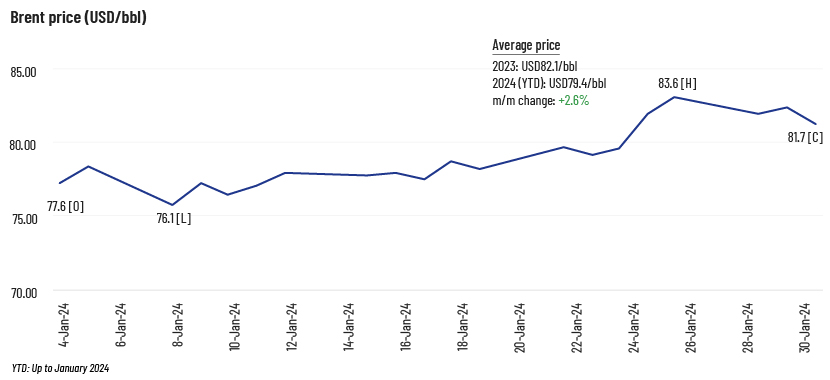

Heightened supply risk from escalating geopolitical conflicts, especially the tensions in the Red Sea following US/UK-led air strikes on Houthi positions, pushed Brent price higher in January 2024 (+2.6% m/m gain – the first monthly rise after three successive months of decline).

Price opened at USD77.6/bbl, touched an intra-month high of USD83.6/bbl and an intra-month low of USD76.1/bbl before closing at USD81.7/bbl.

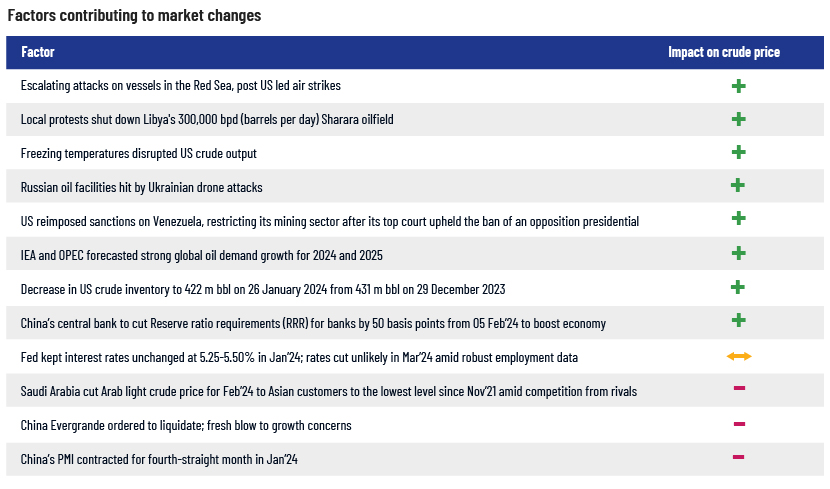

Other supply risks emanated from protests against Libya’s closure of a major oil field, US production suspension owing to freezing temperatures and drone attacks on Russian oil facilities, among others.

Demand fundamentals were uncertain, with upside support from a decline in US crude inventory, the IEA’s and OPEC’s positive demand forecasts and China’s decreasing reserve ratio requirements (RRR). On the other hand, Saudi oil price cuts, uncertainty in the timeline for rate cuts, China’s PMI contraction in January 2024 and liquidation of property giant Evergrande added to downside risks.

Market drivers

Industry updates (key M&A/investments/deals in the month)

-

Russia and Iran finalise a 20-year deal, which includes defence and energy (first right of extraction in the Iranian section of the Caspian Sea).

-

China wins a major contract from Iraq to develop the supergiant Nahr bin Umar oil and gas field.

-

Equinor sells off Azerbaijan oil assets.

-

Saudi Aramco is expected to soon finalise contractors to build part of the onshore infrastructure for Safaniya expansion – the world’s biggest offshore oilfield.

-

Saudi Aramco looks to secure more downstream oil deals in Asia, especially China and India.

-

Shell divests the Nigerian onshore oil business for USD2.4bn.

-

Prairie Operating Co. acquires exploration and production assets in the DJ Basin for USD94.5mn.

-

Chesapeake Energy and Southwestern Energy form a leading US natural gas company in a USD7.4bn merger.

-

QatarEnergy plans to increase production from its largest oil field with USD6bn contract packages.

-

TotalEnergies seeks to acquire OMV’s Malaysian natural gas assets for USD903mn.

-

Talos Energy intends to increase US Gulf of Mexico oil production following the USD1.3bn QuarterNorth Energy acquisition.

-

APA acquires Callon Petroleum in a USD4.5bn Permian deal.

-

Civitas Resources closes the USD2bn acquisition of Vencer Energy’s assets in the Midland Basin.

-

W&T Offshore plans to ramp up oil and gas production with USD72mn US Gulf of Mexico acquisitions.

-

Evolution Petroleum announces USD43.5mn acquisition of non-operated oil and gas assets from Red Sky Resources IV, LLC and Coriolis Energy Partners I, LLC.

-

Karoon concludes USD720mn acquisition of stakes in US oil and gas fields.

-

Harbour Energy agrees to a USD11.2bn deal for Wintershall Dea assets.

Acuity Knowledge Partners’ view

The escalating war risk premium in the Middle East amid the Israel-Gaza conflict and maritime disruptions in the Red Sea, China’s economic health, OPEC’s strategic moves and interest rate movements globally are key factors to watch in the oil market.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts are experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, ET, Reuters, Market Screener, Energy Connect, Reuters, Reuters, WSJ, CNBC, Livemint, BS, Reuters, Aljazeera, Investing, FY, EIA, EIA#1, OP, OP#2, OP#3, OP, OP, Worldoil,WO#3, OP, , WO, FY, oedigital, Chemeng

Tags:

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox