Published on August 26, 2024 by Gaurav Sharma and Surbhi Joshi

Oil prices rose in July 2024 by 1.3% m/m after declining for two consecutive months due to supply concerns as a result of geopolitical risks in the Middle East. Strong demand from the US for reasons such as the summer driving season, declining inventories and the likelihood of the Federal Reserve (Fed) cutting interest rates in September 2024 also boosted prices. However, demand concerns from China amid a weak economy and OPEC+ sticking to its policy of unwinding production cuts in September 2024 weakened movement in prices in the latter half of the month.

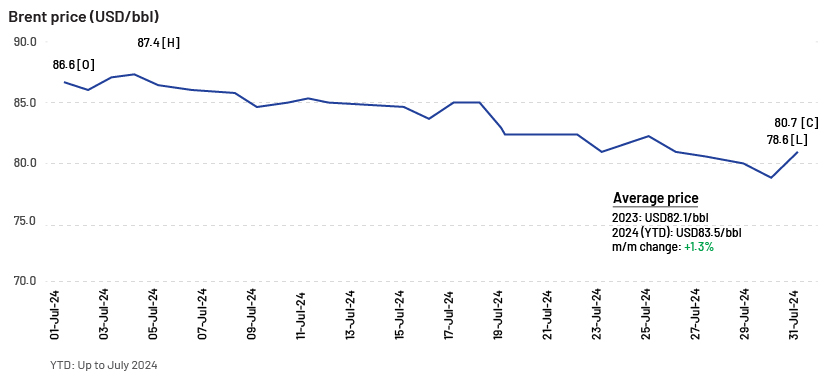

Monthly oil market snapshot – July 2024

Industry analysis for the month

Brent recorded a 1.3% m/m gain in July 2024. It opened at USD86.6/bbl, recorded a high of USD87.4/bbl and a low of USD78.6/bbl and closed at USD80.7/bbl.

Oil prices started the month higher amid escalating conflicts in the Middle East and hope of a Fed interest rate cut in September 2024. However, the limited impact of Hurricane Beryl, weak demand from China and OPEC+ sticking to its policy of unwinding production cuts from September 2024 slowed movement in prices towards the end of the month.

Factors contributing to market changes:

| Factor | Impact on crude price |

| Geopolitical risks in the Middle East amid escalating conflict | + |

| Alberta wildfires threatening 500,000bpd of Canadian oil sands production | + |

| Hope of a Fed interest rate cut in September 2024 | + |

| Strong demand due to the US summer driving season | + |

| US CPI forecast to rise 0.2% m/m in July 2024, after falling 0.1% m/m in June 2024, according to FactSet consensus estimates, indicating a rate cut in the near term | + |

| US crude inventory falling to 433.0m bbl on 26 June 2024, from 448.5m bbl on 28 June 2024 | + |

| OPEC+ expected to unwind output cuts from September 2024 | - |

| Limited impact on supply from Hurricane Beryl in the US | - |

| China's refinery output at a six-month low on weak fuel demand | - |

| Oil consumption in China contracting in May and June 2024 | - |

Industry updates (key M&A/investments/deals in the month)

-

Vital Energy strikes USD1.1bn deal for Permian Basin assets

-

Oxy set to raise USD5bn in debt for CrownRock purchase

-

Post Oak Minerals acquires USD475m in Permian Basin assets

-

Permian Resources to acquire Occidental's West Texas assets for USD817.5m

-

Helmerich & Payne and KCA Deutag form global onshore drilling powerhouse in USD2bn acquisition

-

Nigerian regulator approves USD500m sale of Eni’s onshore oil and gas E&P assets

-

Chappal to acquire TotalEnergies’ stake in oil and gas assets onshore Nigeria for USD860m

-

PETRONAS accelerates development of 12 fields offshore Malaysia with multiple PSC deals

-

ExxonMobil could invest USD15bn in offshore Angola after successful exploration campaigns

-

ExxonMobil, Shell sell North Sea oil and gas assets to Tenaz Energy for USD246m

-

Etu Energias to acquire Galp Energia’s stake in Block 32, Block 14 and Block 14K offshore Angola for USD443m

-

LLOG acquires 41 offshore blocks in deepwater Gulf of Mexico near Blacktip discoveries

-

FTC to delay USD53bn Chevron-Hess deal until after ExxonMobil’s arbitration over assets offshore Guyana

Acuity Knowledge Partners’ view

The oil market collapsed significantly in early August 2024 amid heightened risk of recession in the US and concerns of weak demand from China. We believe that the market will remain on the edge in the near term, adding to questions on OPEC+’s decision to unwind production cuts in September 2024. However, the prolonged geopolitical crisis in the Middle East and Eastern Europe would continue to support the market amid declining global inventories.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts is experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, ET Times, ET, Sprague Energy, Auto, EE, EE, Morning Star, OP, OP#1, WO#1, WO#3, WO#4, WO#5 ,GNW, WO#7

Tags:

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox