Published on November 24, 2023 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

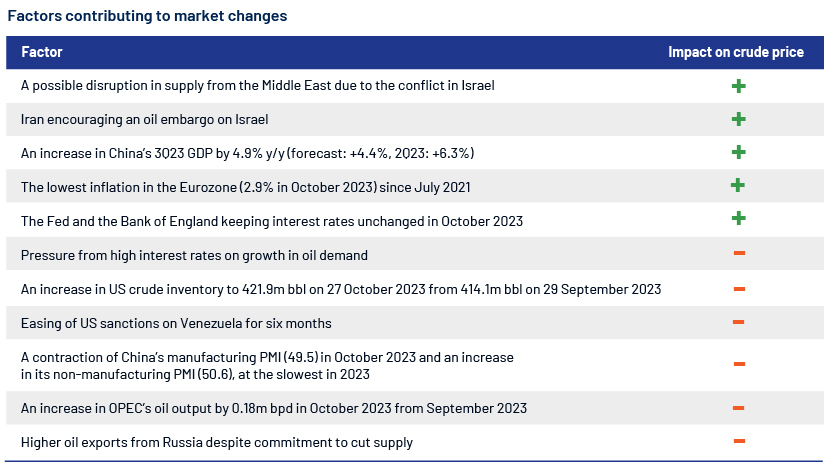

The Brent oil price, which has rallied since July 2023 due to production cuts by OPEC+, failed to continue its momentum in October 2023, declining by 4.3% from September 2023 despite concerns of disruption in supply from the Middle East amid the conflict in Israel. The decline in price followed reports of increased production by OPEC and Russia. Higher interest rates globally and the consistent increase in US stockpiles in October 2023 also pressured growth in oil demand. China, a key importer of crude oil, reported a contraction in its manufacturing PMI in October 2023 after four months of expansion.

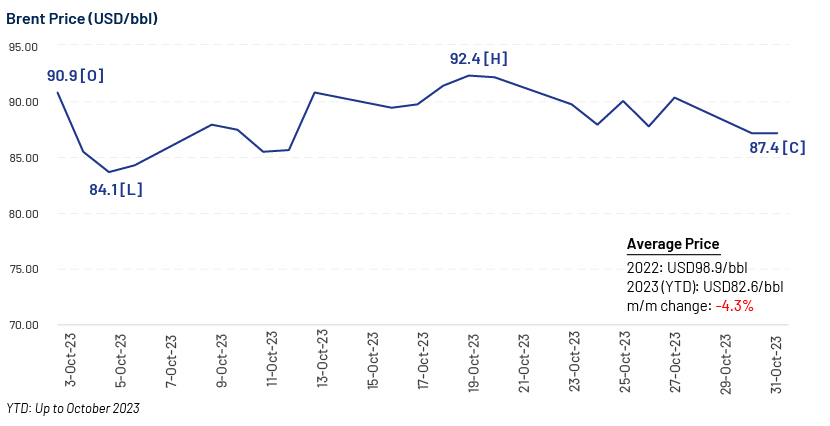

Monthly oil market snapshot – October 2023

Industry analysis for the month

The Brent price eased in October 2023 from the highs in September 2023, and averaged at USD88.6/bbl, 4.3% lower m/m.

The price cooled due to bearish sentiment as higher interest rates globally pressured demand growth, owing to a consistent increase in US stockpiles. Supply concerns due to OPEC+ cuts eased as production increased.

Easing inflation in major economies such as the US and the Eurozone added positivity, whereas China’s macroeconomic data supported the decline.

The main focus was the conflict in Israel, which did not affect physical supply in the market but increased volatility in prices.

Industry updates (key M&A/investments/deals in the month)

-

ExxonMobil announces merger with Pioneer Natural Resources in an all-stock transaction, valued at USD59.5bn

-

Chevron to buy Hess for USD53bn in latest oil mega deal

-

ExxonMobil completes USD4.9bn acquisition of Denbury Inc.

-

Civitas Resources to buy Permian assets for roughly USD2.1bn

-

Berkshire Hathaway expands its stake in Occidental Petroleum

Acuity Knowledge Partners’ view

We believe easing inflation in major economies such as the US and the Eurozone and the conflict in Israel, along with extended cuts by OPEC+ to end-2023, will provide a risk premium to prices in the near term, subject to the Israeli-Palestinian conflict remaining confined to the Levant. However, higher interest rates for longer and uncertainty surrounding China’s growth prospects, the key demand driver, could impact the demand outlook.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts are experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, CNBC, Bloomberg, Reuters, Reuters, Eurostat, FT, ABC, EIA, EIA, Reuters, Bloomberg, Exxon, OP, OP#1, Bloomberg, World Oil, World Oil, WO, WO, WO, WO, WO

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox