Published on April 5, 2024 by Dinesh Ahuja

Executive summary

Saudi Arabia, historically renowned for its vast oil reserves, is undergoing a significant economic transformation as it implements reforms to reduce its dependence on oil, diversify sources of income and enhance competitiveness. Real GDP contracted by 0.9% y/y in 2023, following strong 8.7% y/y growth in 2022, largely on the back of a significant drop in oil revenue. Oil GDP fell by c.9.2% y/y in 2023 (vs +15.4% in 2022) following voluntary production cuts and lower crude prices. While oil production averaged 9.6mb/d in 2023 vs 10.5mb/d in 2022, average crude oil prices fell sharply, to USD83/bbl in 2023 from USD99/bbl in 2022. On the other hand, non-oil GDP growth held up well at +4.6% y/y in 2023 (vs +5.5% in 2022), largely supported by government reforms and Crown Prince Mohammed bin Salman's “Vision 2030” programme that puts private-sector and non-oil growth at the centre of its development agenda. The Saudi government forecasts GDP growth of 4.4% in 2024 (vs the IMF’s forecast of +2.7%), driven mainly by the non-oil sector, which it expects will grow more than 5% in the medium term.

Vision 2030 – the key driver of non-oil GDP growth

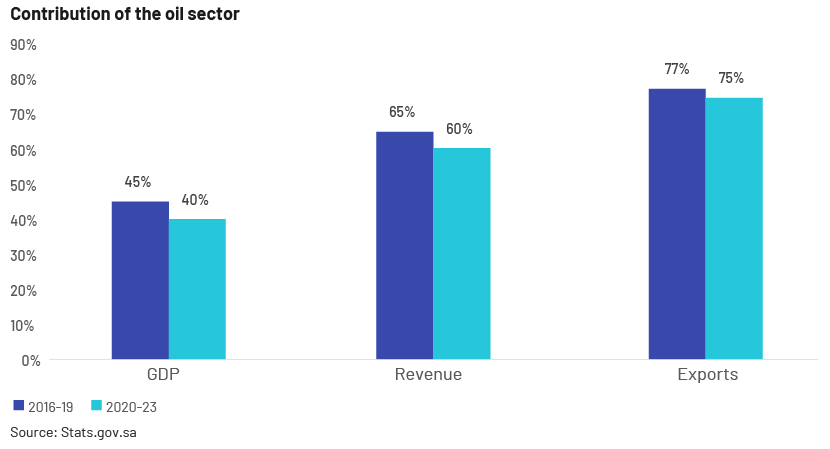

Launched in 2016, with the aim of diversifying the country’s economy away from dependence on oil (which still accounts for 62% of revenue, 77% of exports and 40% of GDP), Vision 2030 is an ambitious national strategy focused on long-term social and economic transformation of the kingdom. The programme encompasses a range of structural reforms based on three key themes: (1) societal: to create a vibrant society with a strong social infrastructure, to provide effective social services to all citizens, (2) economic/financial: to create an environment that supports economic growth and job creation for all Saudi nationals by attracting investments from across the globe and (3) governance: to improve efficiency, accountability and transparency of government entities, instilling greater confidence and trust among foreign investors in the country’s leadership. The table below highlights the key objectives and targets under each theme; these include increasing the share of non-oil government revenue to SAR1tn, raising the share of non-oil exports in non-oil GDP to 50%, lowering the unemployment rate to 7% and improving the household savings ratio to 10%.

| Vision 2030 | |||

| Key objectives | Goals/targets | ||

| Economic | 1.1 | Grow contribution of renewables to national energy mix | Increase the share of non-oil exports in non-oil GDP to 50% from 18.7% |

| 1.2 | Enable financial institutions to support private-sector growth | Increase the private sector's contribution to GDP to 65% from 40% | |

| 1.3 | Attract foreign direct investment (FDI) | Increase FDI contribution to GDP to the international level of 5.7% from 3.8% | |

| 1.4 | Privatise selected government services | Increase SMEs’ contribution to GDP to 35% from 20% | |

| 1.5 | Enhance ease of doing business | Lower the rate of unemployment to 7.0% from 12.3% | |

| 1.6 | Ensure the formation of an advanced capital market | Increase the Public Investment Fund's assets to USD1.86tn from USD159bn | |

| 1.7 | Develop the digital economy | Improve the country's economic position to among the top 15 from 19th | |

| 1.8 | Enhance competitiveness of the energy market | Increase localisation of the oil and gas sector to 75% from 40% | |

| 1.9 | Unlock state-owned assets for the private sector | Increase female participation in the workforce to 30% from 22% | |

| 1.10 | Enable the development of the tourism and retail sectors | Raise Saudi Arabia’s Global Competitive Index ranking to among the top 10 from 25th | |

| Key objectives | Goals/targets | ||

| Societal | 2.1 | Improve value of and ease of access to healthcare services | Increase average life expectancy to 80 years from 74 years |

| 2.2 | Foster values of excellence and discipline | More than double the number of Saudi heritage sites registered with UNESCO | |

| 2.3 | Improve the urban landscape in Saudi cities | Have three Saudi cities recognised among the world’s top 100 cities in terms of quality of life | |

| 2.4 | Improve the effectiveness and efficiency of the welfare system | Raise the country's position in the Social Capital Index to 10 from 26 | |

| 2.5 | Improve the quality of services provided to tourists/visitors | Increase the country's capacity to welcome 30m Umrah visitors annually (from 6.2m) | |

| Key objectives | Goals/targets | ||

| Governance | 3.1 | Maximise revenue from state-owned assets | Raise Saudi Arabia’s ranking on the Government Effectiveness Index to 20th from 80th |

| 3.2 | Maximise revenue from service fees | Improve the country’s ranking on the E-Government Survey Index to among the top 5 from 36th | |

| 3.3 | Increase revenue from fees without taxing citizens' income or wealth | Increase the non-profit sector’s contribution to GDP to 5% from <1% | |

| 3.4 | Enhance performance of government entities | Increase the share of savings of total household income to 10% from 6% | |

| 3.5 | Improve productivity of government employees | Increase non-oil government revenue to >SAR1tn | |

Source: Vision2030.gov.sa

Vision 2030 – key projects: A key component of the programme is the implementation of giga projects that aim not only to generate significant employment opportunities but also to boost trade and tourism in the kingdom. Many of these projects are led by the Public Investment Fund (PIF), which estimates >USD1tn in spending commitments until 2030, of which c.USD90bn has already been spent. Key giga projects currently under construction include the following:

| NEOM | Red Sea Project | Diriyah Gate | Qiddiya | |

| Vision | NEOM is the PIF’s most ambitious venture. The USD500bn development will be spread across the borders of Saudi Arabia, Jordan and Egypt. It encompasses a number of smaller projects, i.e., horizontal city “The Line”, business hub Oxagon, luxury yachting destination Sindalah and mountain resort Trojena, all powered entirely by renewable, clean energy | To develop the Red Sea coastline into a luxury tourist destination. Under this megaproject, the PIF aims to build 8,000 rooms in 50 hotels and 1,000 residences by 2030, across 22 islands and six inland sites | To build a new world-class cultural city in the heart of the nation. The masterplan includes building 38+ hotels and resorts (including properties by big-name brands such as Ritz-Carlton, Park Hyatt and Raffles), 20,000+ residential units, 9 museums, 10+ iconic landmarks, 8+ public parks, 31 mosques, 16 schools and 4 metro stations | An entertainment megaproject to be established in Riyadh. The masterplan includes building family-friendly theme parks, sports arenas suitable for international competitions, academies for sports and the arts, concert and entertainment venues, racetracks for motorsports enthusiasts and outdoor and adventure activities spread across 223km2 of developed area |

| Estimated cost | USD500bn | USD20bn | USD62.2bn | USD40bn |

| Targeted completion | To be completed in phases (2024 to 2030) | First phase (3,000 rooms in 16 hotels) to be completed by end-2024; project completion by 2030 | Completion by 2030 | Completion by 2030 |

| Project contribution | LINE, a subproject of NEOM, to create 380k jobs by 2030 | To create 70k direct, indirect and induced jobs by 2030 | To create 178k direct jobs and attract 50m annual visitors once the project is completed in 2030 | To create 325k direct, indirect and induced jobs by 2030; targets 48m annual visitors |

| Contribution to GDP | Upon completion, LINE (a subproject of NEOM) will contribute USD48bn | USD5.3bn annually from 2030 | NA | USD36bn, once fully operational |

Source: Vision2030.gov.sa

Implementation of these reforms and projects would not only help Saudi Arabia accelerate diversification of its economy at scale beyond oil, but also benefit the country's leisure, tourism and entertainment sectors. The arts and entertainment sector grew at a record 106% y/y in 2023. Another key beneficiary of the Vision 2030 programme would the Saudi banking sector, likely to benefit via the following pillars: (1) a potential capex boom fuelled by a large pipeline of giga projects and investment spending driving demand for corporate loans, (2) a continued increase in household mortgages given the government's target of 70% home ownership by 2030, supporting mortgage lending, (3) growth in SME loans, driven by the government's target of increasing loan penetration to 20% of total loans by 2030 and (4) an increase in unsecured consumer finance, supported by higher levels of employment and an increase in female participation in the workforce, raising consumer credit per capita.

Other reforms

The Saudi government has also been implementing reforms such as the following to boost the private sector’s contribution to GDP and drive growth of the non-oil economy:

-

Regional Headquarters (RHQ) programme: Announced in 2021, this aims to position Saudi Arabia as a major business hub by attracting multinational corporations (MNCs) operating in the MENA region to establish their RHQs in the kingdom. Those that do so will be entitled to tax breaks, a 10-year exemption from “Saudization” requirements and visa benefits for their employees. Furthermore, only those companies with an RHQ in the country would be allowed to bid for government contracts. The government had issued 180 RHQ licences to MNCs as of December 2023, surpassing its target of 160 licences.

-

Shareek programme: Launched in March 2021, this seeks to boost private-sector investment, with the government providing tailored support to help large companies accelerate planned projects and identify new opportunities. Direct financial support (via loans/investment) would also be provided for companies under the programme, when necessary. The government expects to facilitate private-sector investment of SAR5tn until 2030 and increase private-sector contribution to GDP to 65% under the programme.

-

Private Sector Participation Law: Approved in March 2021, this aims to increase private-sector participation in the procurement of infrastructure and the provision of public services, increasing the quality and availability of such infrastructure and services. This would also help reduce government expenditure and encourage foreign direct investment in the country.

Conclusion

Saudi Arabia has in recent years been reducing its reliance on oil in terms of output, revenue and exports following the implementation of Vision 2030 and other programmes. Oil revenue accounted for c.65% of total revenue on average over 2016-19; this declined to c.60% on average in 2020-23. The non-oil economy accounted for c.50% of GDP (USD453bn) in 2023, the highest so far, versus an average of 45% in 2016-19. Non-oil exports accounted for c.21% of total exports on average in 2020-23 versus c.19% on average in 2016-19. This highlights that the country's implementation of key programmes and projects outlined in Vision 2030 has helped not only to diversify its economy away from oil but also to foster development of new sectors, contributing to higher non-oil growth.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific/macroeconomic experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

What's your view?

About the Author

Dinesh Ahuja is an Assistant Director at Acuity Knowledge Partners, having over 15 years of experience working with one of the leading Investment banks in the US. He is skilled in investment research, financial modelling and report writing. His areas of interest are equity and fixed income. Has completed his master’s in finance specialization from Christ University, Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox